I use it exclusively for the DAX, and timeframes of 1 and 5 minutes, although I suppose in longer times also work.

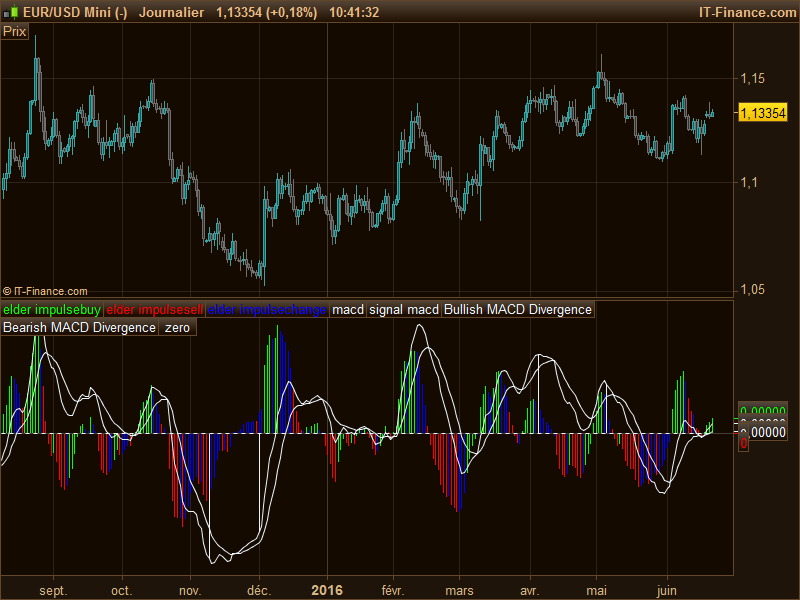

About the MACD I do not think there’s much to explain. I do not use it as the sole indicator, of course, but it is a good complement to detect differences, and it also helps the automatic detector thereof. When the histogram rises, albeit negative, it’s time for long, but I repeat that it is not the indicator that entry. What is interesting are the bars with colors: according to the Elder Impulse System, if the bar is blue, is indifferent, although it may help seeing the previous trend. If the bar is red, it prohibits long and recommends short, and if the bar is green, prohibits short and long recommended. I hope to see two or three green candles in a row to go long or short red. The Elder Impulse System is a combination of momentum and trend. The ideal for long time is when the histogram rises, the candle is green just above zero and there is a divergence above. Ditto for short, but in reverse. Should confirm the differences visually. Naturally, the higher will be the histogram bars, the more the price goes up. If you are long and bar turns red, it is out.

I know it’s very simple, but as I practiced with this indicator (along with others), works for me.

MACD divergences are also spotted in this indicator (white histograms in the screenshot).

The first 3 variables must be rendered as histogram, along with the divergences variables too.

|

1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 32 33 34 35 36 37 38 39 40 41 42 43 44 45 46 47 48 49 50 51 52 53 54 55 56 57 58 59 60 61 62 63 64 65 66 67 68 69 70 71 72 73 74 75 76 77 78 79 80 81 82 83 84 85 86 87 88 89 90 91 92 93 94 95 96 97 98 99 100 101 102 103 104 105 106 107 108 109 110 111 112 |

/////////////////MACD IMPULSE ELDER//// // variables // pc, fast ma, 12 // pl, slow ma, 26 // ps, signal, 9 // p, exp ma EIS, 18 // set first three and divergences as histograms pc=12 pl=26 ps=9 p=13//periodos EIS aa=exponentialaverage[p](close) cc=MACD[pc,pl,ps](close) if aa > aa[1] and cc>cc[1] Then dd =cc*2 else dd=0 endif if aa<aa[1] and cc < cc[1] then ee=cc*2 else ee=0 endif if ( aa <aa[1] and cc > cc[1]) or (aa>aa[1] and cc<cc[1]) then ff=cc*2 else ff=0 endif REM MACD hh=exponentialaverage[pc](close) - exponentialaverage[pl](close) REM Signal hh1=exponentialaverage[ps](hh) // DIVERGENCES ZeroLag MACD adapted from HK-LISSE RSI divergences code EMAshort1 = exponentialaverage[pc](close) EMAshort2 = exponentialaverage[pc](EMAshort1) DifferenceShort = EMAshort1 - EMAshort2 ZeroLagShort = EMAshort1 + DifferenceShort EMAlong1 = exponentialaverage[pl](close) EMAlong2 = exponentialaverage[pl](EMAlong1) DifferenceLong = EMAlong1 - EMAlong2 ZeroLagLong = EMAlong1 + DifferenceLong ZeroLagMACD = ZeroLagShort - ZeroLagLong signal1=ExponentialAverage[ps](ZEROLAGMACD) signal2=ExponentialAverage[ps](signal1) DIFFERENCE2=signal1-signal2 SignalMACD=signal1+DIFFERENCE2 x = ZeroLagMACD y = SignalMACD // BEARISH DIVERGENCES MACD hi=max(hi,x) hico=max(hico,max(high,high[1])) if x crosses under y then sto2b=sto1b sto1b=hi hi=0 p3b=p1b p2b=max(p1b,hico1) p1b=max(highest[3](high),hico) if p2b=p1b then p2b=max(p3b,p4b) endif hico=0 hico1=0 endif if x<y then p4b=hico1 hico1=max(hico1,high) endif if p1b>p2b and sto1b<sto2b and x crosses under y and x<x[1] then signB= hh//-2 else signB= 0 endif // BULLISH MACD DIVERGENCES lo=min(lo,x) lowco=min(lowco,min(low,low[1])) if x CROSSES OVER y then sto2h=sto1h sto1h=lo lo=100 p3h=p1h p2h=min(p1h,lowco1) p1h=min(lowest[3](low),lowco) if p2h=p1h then p2h=min(p3h,p4h) endif lowco=100000 lowco1=100000 endif if x>y then p4h=lowco1 lowco1=min(lowco1,low) endif if p1h<p2h and sto1h > sto2h and x crosses over y and x>x[1] then signH= hh//2 else signH= 0 endif return dd*pipsize COLOURED(0,255,0) as "elder impulsebuy", ee*pipsize COLOURED(255,0,0) as "elder impulsesell", ff*pipsize coloured(0,0,255) as "elder impulsechange", hh*pipsize as "macd", hh1*pipsize as "signal macd", signH*pipsize as "Bullish MACD Divergence", signB*pipsize as "Bearish MACD Divergence" , 0 as " zero " |

Share this

No information on this site is investment advice or a solicitation to buy or sell any financial instrument. Past performance is not indicative of future results. Trading may expose you to risk of loss greater than your deposits and is only suitable for experienced investors who have sufficient financial means to bear such risk.

ProRealTime ITF files and other attachments :PRC is also on YouTube, subscribe to our channel for exclusive content and tutorials

I HAVE BEEN USING YOUR INDICATOR WITH THE STOCHASTIC .IT IS AMAZING.

THANKYOU

l’indicatore che mi viene fuori senza modificare il codice è diverso dall’immagine che vedo ed è sicuramente sbagliato. Non so come gestire le 4 variabili iniziali messe con //. Cioè pc, pl, ps, p. Come devo usarle nel codice? Putroppo non riesco neanche a mandarvi uno screenshot del mio grafico perché il sistema mi dice che non sono autorizzato a farlo. Attendo qualche suggerimento. Grazie.

Capitan Nemo

Ciao Capitan Nemo.

I would not change these 4 variables, as they are the standard ones for the normal MACD (pc, pl, and ps) and for the Elder Impulse System (p).

But if you really want to change them and play with other values, you have to delete the lines 8 to 11, and put these 4 values in the indicator as variables (Add on the programming window), and then you can put there any value you want.

I also don’t know how to include a photo of the graphic in this comment, but if you send me your mail, I will send you these possibilities.

le variabili poi le ho capite ad una più attenta rilettura, scusami, ma il grafico mi viene tutto diverso. Non ci sono le barre colorate verticali, solo tante curve oscillanti.

Non ho la tua mail, dove la trovo? Grazie. Scrivi a pieropadova@gmail.com.

@ade1 – I can run it with stochastic not to got – tino.viehweg1969@gmail.com

Newbie in prt use, could you give me the best way (condition) for creating a signal directly in the principal bar charts screen

Thanks for this wonderfull job

You should use the forum instead for this question, since it doesn’t have any relation to this post specifically. Thanks.

Sorry

HI and thank you very much for the MACD H Divergence scanner, I was badly lookin for it! Could you code a different version using the normal MACD instead of the MACD LAG? Thanks!

The curves MACD and signal, and the MACD histogram are calculated using the normal MACD (lines 13, 30 and 33 of the code) , not the Zero Lag. The Zero Lag is used only used to calculate the divergences. But the most useful indication of this indicator is the normal MACD combinated with the Elder Impulse system.

If you want more information about the divergences, you can see following links:

http://www.prorealcode.com/prorealtime-indicators/divergences-rsx/

http://www.prorealcode.com/prorealtime-indicators/macd-divergences-from-price/

http://hk-lisse.over-blog.com/search/divergences%20macd/

Hi Petrus and thanks for reply. I was indeed talking about the divergence scanner which, as you coded it, it uses the Lagged MACD instead of the plain MACD which is the one used by the divergence scanner coded by Elder for Tradestation.

I already use the Impulse system combined in the Triple Screen for my trading but was looking for a PRT version of the MACD divergence scanner to look for potential/running divergences and that’s why I asked you.

Thanks again

Hi leofib.

As I explained on the text, I did not code this scanner, I only adapted it from the first link, who also adapted it from a code of HK-LISSE (3rd link). But be careful: the divergence indicator works ok, but not on the 100% of the cases. They have to be confirmed visually, on the graph. It should be only used as a warning. And of course, even if the divergence are confirmed, not always are they giving the right information. You can sometimes get a clear bullish divergence, having in the near time a big bullish trend.

Hi Petrus, yes I noticed it sometimes misses a major divergence but I would say it takes about 90% of the MACD H divergences, but a couple of bar later than the same divergence signaled by the plain MACD. It has to be followed “by hand” of course but it would be of great help having this scanner working with the plain MACD just to let it do the gross job. I wonder if you can help with this as I am not good at all in coding. Thanks!

Hi leofib.

To use the normal MACD for the divergences, you only have to change in line 54

x=hh (instead of ZeroLagMACD)-> this is the normal MACD of line 30

and in line 55

y=hh1 (instead of SignalMACD)-> this is the normal Signal of line 33

After that, you have only to eliminate (or write REM or // on the start of the lines) the lines 35 to 53.

That’s all. And I have tested it and it works.

Thnak you Petrus. I adapted your code as you suggested and noticed that by using the normal MACD it misses a great number of divergences which are on the other side correctly detected by the Zerolag MACD version, even if with a couple of bars laters.

In other words, the normal MACD H version is much less precise than the Zerolag Version. Could it be that it requires some other modification?

Thanks for your patience

Exactly leofib!! That’s the reason for using the ZeroLag.

As in many other indicators, if you reduce the number of periods or if you want they faster, it becomes more nervous but they anticipate the information, although you have to pay the price of giving some fake signals. There is no other solution.

If you read the code, even the signal (in both, normal MACD and ZeroLag) are nothing but an exponential average over the MACD or ZeroLag: that means, they smoothed the nervous curve. ZeroLag, as the name tells, will be always faster than the normal MACD and will give signals that the normal MACD cannot see. However, I think that the difference between both are really not so critical.

Thanks Petrus, However I think the problem is not with how fast they are but I suspect your code has been written considering the MACD Lag. I’ll try to explain.

I noticed that your original code (which follows the Zerolag), signals a divergence as soon as the MACD H turns positive (or negative), i.e. when it corss the zero line.

By using the original MACD H, and following Elder’s instruction, you have a divergence when the MACD H TICKS UP (or down) independently on being above or below the (normal) MACD H.

Thus, the problem could be that you have coded your indicator by giving a divergence signal when it crosses the zero line and not when it ticks up or down from a previous bar. I’m not able to verify this by reading your code but what you believe?

Thianks again!

Hi again. The problem is that I did not analyze the code because I did not code it: I simply adapted it from the first link I gave you before.

Ok sorry I missed this part.

Well if you are interested in coding a correct MACD H scanner (by correct I mean a scanner following Elder’s rules) please let me know, provided that you are not already fully aware of what these rules are 🙂

Thanks again Petrus

Hi Leofib,

Did you finally find a screener following Elder MACD-H divergences? If so, could you please share with me? I appreciate your support!!

Thanks for the code, excellent work. I remember Elder suggesting to use this system on the second timeframe higher to the one you use for trading (i.e. if you trade on an hourly timeframe you should get this indicator running out of the weekly charts and use a force index indicator out of the daily one). Since PRT doesn’t allow multi frames yet I suggest to keep the daily timeframe running (like you did) and change the settings as folllow by multiply the current settings by a factor of five:

pc=60 pl=130 ps=20 p=65The graph you obtain represents very well a weekly macd and EMA13 on a daily frame.CheersGabriele

Thanks a lot for the indicator. It is essential in my strategy….

And I have a request if someone can help me with the coding…

For me it would be really helpful if the Histogram would change colors depending on the difference with the previous bar as well.

I mean, if the histogram is blue and the next bar is still blue but with a lower value, then it would be colored in a lighter blue or if it has a higher value in a stronger blue.

I don’t know if it is possible….

Thanks in advance.

Hi Petrus thank you so much for your indicator, very helpful.