Copyright by HPotter v1.0 09/06/2014

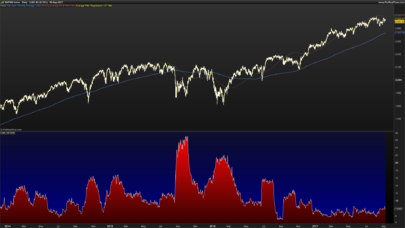

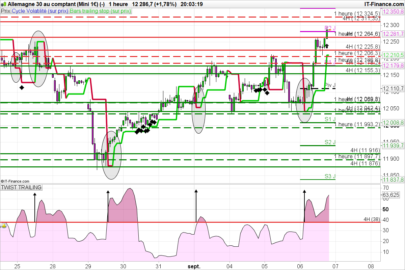

The Klinger Oscillator (KO) was developed by Stephen J. Klinger. Learning from prior research on volume by such well-known technicians as Joseph Granville, Larry Williams, and Marc Chaikin, Mr. Klinger set out to develop a volume-based indicator to help in both short- and long-term analysis.

The KO was developed with two seemingly opposite goals in mind: to be sensitive enough to signal short-term tops and bottoms, yet accurate enough to reflect the long-term flow of money into and out of a security.

The KO is based on the following tenets: Price range (i.e. High – Low) is a measure of movement and volume is the force behind the movement. The sum of High + Low + Close defines a trend. Accumulation occurs when today’s sum is greater than the previous day’s. Conversely, distribution occurs when today’s sum is less than the previous day’s. When the sums are equal, the existing trend is maintained. Volume produces continuous intra-day changes in price reflecting buying and selling pressure.

The KO quantifies the difference between the number of shares being accumulated and distributed each day as “volume force”. A strong, rising volume force should accompany an uptrend and then gradually contract over time during the latter stages of the uptrend and the early stages of the following downtrend. This should be followed by a rising volume force reflecting some accumulation before a bottom develops.

|

1 2 3 4 5 6 7 8 9 10 11 12 13 14 |

hlc3= (high + low + close)/3 if(hlc3>hlc3[1]) THEN xTrend = volume * 100 ELSE xTrend = -volume * 100 ENDIF xFast = exponentialaverage[FastX](xTrend) xSlow = exponentialaverage[SlowX](xTrend) xKvO = xFast-xSlow xTrigger = exponentialaverage[TrigLen](xKvO) RETURN xKvO AS "Klinger oscillator", xTrigger AS "trigger" |

Share this

No information on this site is investment advice or a solicitation to buy or sell any financial instrument. Past performance is not indicative of future results. Trading may expose you to risk of loss greater than your deposits and is only suitable for experienced investors who have sufficient financial means to bear such risk.

ProRealTime ITF files and other attachments :PRC is also on YouTube, subscribe to our channel for exclusive content and tutorials

Syntax Error: vairiables “fastx , slowx, triglen” are undefined….

Because they are external variables and not present in the code. Please download the itf file and import it into your platform, you’ll get rid of this error message.

Whenever I attempt to apply this to a chart, the value is 0, not sure what is wrong.

The Klinger Oscillator needs Volume in order to be calculated. Apply it on an instrument that have Volumes.