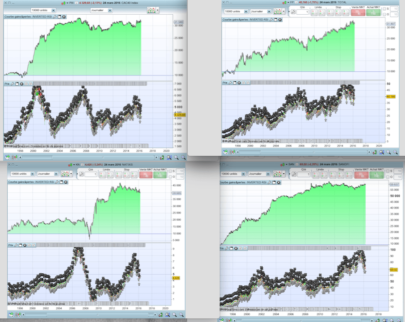

Please set up colors and lines as you prefere or as suggested in the pictures.

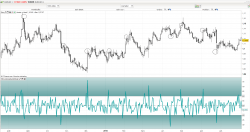

On a weekly chart, the indicator inform you if enter the market next week according to automatic strategy called “A based on 2RSI weekly strategy working on indexes” posted here.

The simulated performances of the automated strategy code, combined with the information of the indicator can support you in the decision if enter the market the next week. If you enter manually, it may be on monday or in a diferent eek day.

|

1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 32 33 34 35 36 37 38 39 40 41 42 43 44 45 46 47 48 49 50 51 52 53 54 55 56 57 58 59 60 61 62 63 64 |

// 10/6e90/94 - Week setup - CONNORS daysForbiddenEntry = OpenDayOfWeek = 0 // IND MM = average[50](close) indicator1 = Average[1](RSI[2](close)) indicator2 = Average[5](close) ONCE posA = 0 ONCE posV = 0 // BUY 1 ca1 = close >MM ca2 = indicator1<=10 ca3 = close<indicator2 IF posA = 0 and ca1 and ca2 and ca3 and not daysForbiddenEntry THEN tradeprice1 = close barencours = barindex posA = 1 ENDIF // BUY 2 IF posA = 1 and barindex - barencours>= 1 THEN IF indicator1<=6 and not daysForbiddenEntry THEN tradeprice2 = close barencours = barindex posA = 2 ENDIF ENDIF // EXIT LONG IF posA>0 and indicator1>70 THEN posA = 0 ENDIF //SHORT 1 cv1 = close <MM cv2 = indicator1>=90 cv3 = close>indicator2 IF posV = 0 and cv1 and cv2 and cv3 and not daysForbiddenEntry THEN tradeprice1 = close barencours = barindex posV = -1 ENDIF // SHORT 2 IF posV = -1 and barindex - barencours>= 1 THEN IF indicator1>=94 and not daysForbiddenEntry THEN tradeprice2 = close barencours = barindex posV = -2 ENDIF ENDIF // EXIT SHORT IF posV<0 and indicator1<30 THEN posV = 0 ENDIF // RETURN return posA as "BUY", posV as "SHORT" |

Share this

No information on this site is investment advice or a solicitation to buy or sell any financial instrument. Past performance is not indicative of future results. Trading may expose you to risk of loss greater than your deposits and is only suitable for experienced investors who have sufficient financial means to bear such risk.

ProRealTime ITF files and other attachments :PRC is also on YouTube, subscribe to our channel for exclusive content and tutorials

merci pour le partage de cet l’indicateur, j’ai rajouté un autre indicateur pour faire une stratégie rentable sans succès, pouvez vous nous donner une stratégie pour le mettre en marche sur prorealtime svp,

Hi, thank you for the this. Is it possible to create a screener from this indicator, so that we can filter those who are in buy/short signal at the moment?

Brs