Published in the Technical Analysis of Stocks and Commodities magazine in the May 2004 issue, the inverse fisher transform is an indicator created by John Ehlers. The Inverse Fisher Transform was developed to help traders and investors with their timing decisions to buy and sell securities. It does this by altering the probability distribution function (PDF) of any indicator and makes it appear smoother.

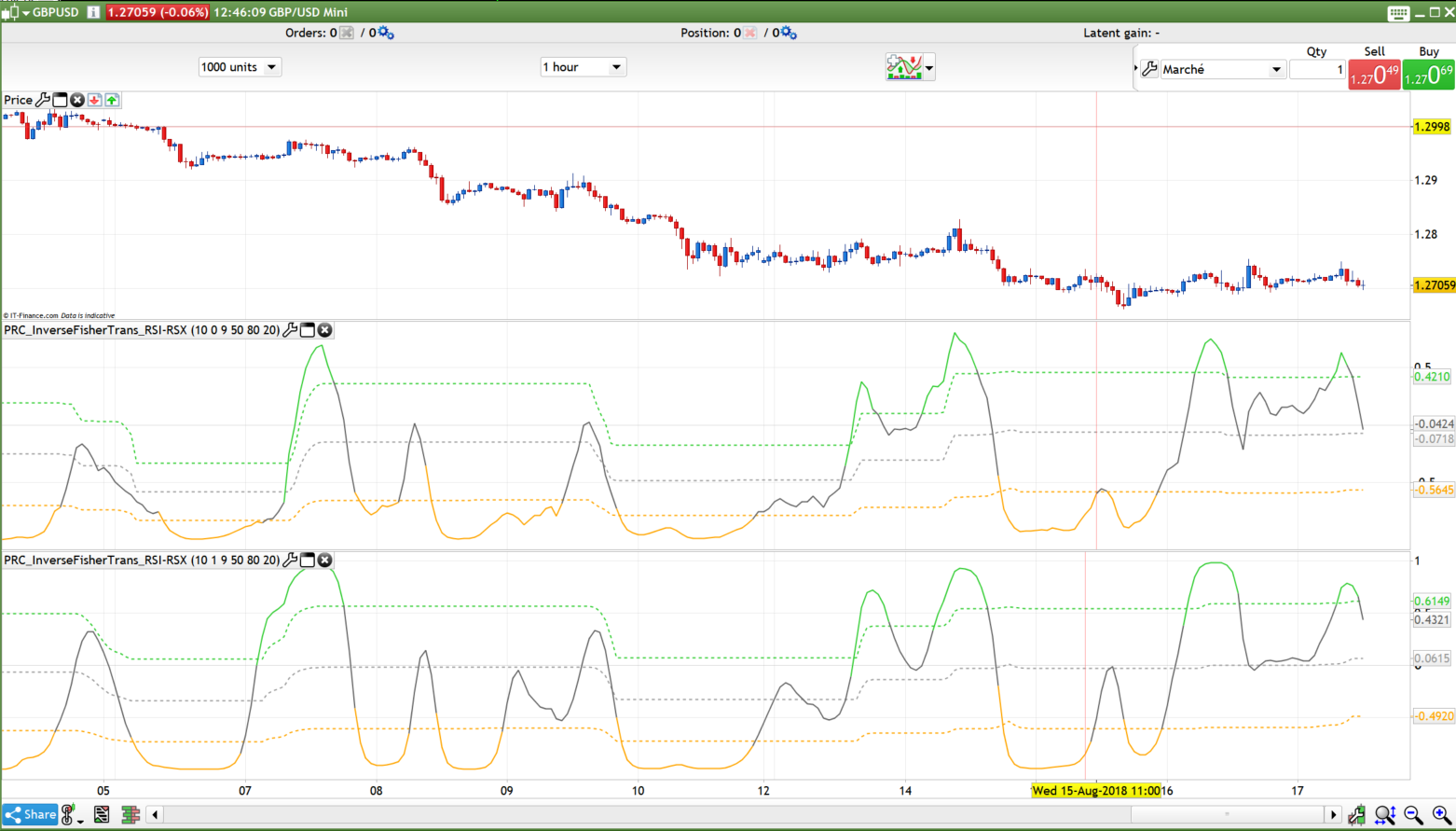

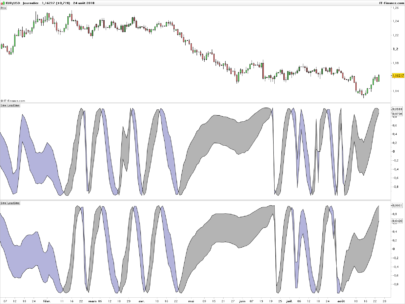

This version include the inverse fisher transform calculation method applied on the RSI (upper oscillator in the screenshot) or the RSX (lower oscillator in the attached picture).

Settings explained:

- RsiPeriod: Period of RSI or RSX oscillator

- RsiMethod: 0=RSI 1=RSX

- SmoothPeriod: Smoothing period applied on the oscillator with a linear weighted average

- MinMaxPeriod: period of highest high / lowest low to calculate the dynamic overbough/oversold levels

- LevelUp: percentage of the overbought upper level

- LevelDown: percentage of the oversold lower level

|

1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 32 33 34 35 36 37 38 39 40 41 42 43 44 45 46 47 48 49 50 51 52 53 54 55 56 57 58 59 60 61 62 63 64 65 66 67 68 69 70 71 72 73 74 75 76 77 78 79 80 81 82 83 84 85 86 87 88 89 90 91 92 93 94 95 96 97 98 99 100 101 102 103 104 105 106 107 108 109 110 111 112 113 114 115 116 117 118 119 120 121 122 123 124 125 126 127 128 129 130 131 132 133 134 135 136 137 |

//PRC_InverseFisherTrans_RSI-RSX | indicator //17.08.2018 //Nicolas @ www.prorealcode.com //Sharing ProRealTime knowledge // --- settings RsiPeriod = 10 // RSI period RsiMethod = 1 // Rsi method (0=RSI, 1=RSX) SmoothPeriod = 9 // Smoothing period MinMaxPeriod = 50 // Floating levels period (<= 1 for fixed levels) LevelUp = 80.0 // Up level % LevelDown = 20.0 // Down level % // --- end of settings RsiPrice = customclose // Price if barindex>RsiPeriod then smallRsiValue = 0.0000000000000001 if RsiMethod=0 then //RSI alpha = 1.0/Max(RsiPeriod,1) change = RsiPrice-RsiPrice[1] workRsichange = workRsichange[1] + alpha*( change - workRsichange[1]) workRsichanga = workRsichanga[1] + alpha*(Abs(change) - workRsichanga[1]) iRsi = (50.0*(workRsichange/Max(workRsichanga,smallRsiValue)+1)) else //RSX Len=rsiperiod if (f90 = 0.0) then f90 = 1.0 f0 = 0.0 if (Len-1 >= 5) then f88 = Len-1.0 else f88 = 5.0 endif f8 = 100.0*(rsiprice) f18 = 3.0 / (Len + 2.0) f20 = 1.0 - f18 else if (f88 <= f90) then f90 = f88 + 1 else f90 = f90 + 1 endif f10 = f8 f8 = 100*Close v8 = f8 - f10 f28 = f20 * f28 + f18 * v8 f30 = f18 * f28 + f20 * f30 vC = f28 * 1.5 - f30 * 0.5 f38 = f20 * f38 + f18 * vC f40 = f18 * f38 + f20 * f40 v10 = f38 * 1.5 - f40 * 0.5 f48 = f20 * f48 + f18 * v10 f50 = f18 * f48 + f20 * f50 v14 = f48 * 1.5 - f50 * 0.5 f58 = f20 * f58 + f18 * Abs(v8) f60 = f18 * f58 + f20 * f60 v18 = f58 * 1.5 - f60 * 0.5 f68 = f20 * f68 + f18 * v18 f70 = f18 * f68 + f20 * f70 v1C = f68 * 1.5 - f70 * 0.5 f78 = f20 * f78 + f18 * v1C f80 = f18 * f78 + f20 * f80 v20 = f78 * 1.5 - f80 * 0.5 if ((f88 >= f90) and (f8 <> f10)) then f0 = 1.0 endif if ((f88 = f90) and (f0 = 0.0)) then f90 = 0.0 endif endif if ((f88 < f90) and (v20 > smallRsiValue)) then v4 = (v14 / v20 + 1.0) * 50.0 if (v4 > 100.0) then v4 = 100.0 endif if (v4 < 0.0) then v4 = 0.0 endif else v4 = 50.0 endif irsi=v4 endif //linear weighted moving average sumw = smoothperiod sum = smoothperiod*(0.1*(iRsi-50)) workLwma = (0.1*(iRsi-50)) for k=1 to smoothperiod-1 do weight = smoothperiod-k sumw = sumw + weight sum = sum+(weight*workLwma[k]) next trss = (sum/sumw) //oscillator final cut e = 2.7182818284590452353602874713527 y = exp((2.0*trss)*log(e)) rsii=(y-1.0)/(y+1.0) //levels mmin = rsii mmax = rsii for k=1 to MinMaxPeriod-1 do mmin=min(rsii[k],mmin) mmax=max(rsii[k],mmax) next rrange = mmax-mmin levelupz = mmin+LevelUp * rrange/100 leveldnz = mmin+LevelDown * rrange/100 levelmi = mmin+0.5*rrange //Color r=100 g=100 b=100 if rsii>levelupz then r=50 g=205 b=50 elsif rsii<leveldnz then r=255 g=165 b=0 endif endif return levelupz coloured(50,205,50) style(dottedline,2) as "Level Up", leveldnz coloured(255,165,0) style(dottedline,2) as "Level Down", levelmi coloured(155,155,155) style(dottedline,2) as "mid level", rsii coloured(r,g,b) style(line,2) as "RSI" |

Share this

No information on this site is investment advice or a solicitation to buy or sell any financial instrument. Past performance is not indicative of future results. Trading may expose you to risk of loss greater than your deposits and is only suitable for experienced investors who have sufficient financial means to bear such risk.

ProRealTime ITF files and other attachments :PRC is also on YouTube, subscribe to our channel for exclusive content and tutorials

Great job and thanks very much for posting this @nicolas.

I’ve backtested both these RSI and the RSX’s 20 period, 20/80 cross overs/unders using the Kase Dev Stop as an Exit on the Daily £/Yen, FTSE and Dow (DJI) (between Aug. 2013 and Sept. 2018) and it appears that although the profits are less with the RSX (versus the RSI) it produces sensible drawdowns in the 25-30% range for the £/Yen and FTSE… but for some reason and despite using all the Dev Stops exits from 1 to 6 std deviations for the Dow, the Dow just isn’t profitable. It’s only ever profitable on the cross over of the mid line using Dev Stop 1.0 but that has a very high drawdown… which got me thinking about the probability of these bigger market moves as I noticed that your Ehler’s Rocket RSI code: https://www.prorealcode.com/prorealtime-indicators/rocketrsi-john-ehlers had scaled/bounded the oscillator’s output between +/-3 standard deviations. Can that be done here?

If 3 std devs is -3/+3 = 0.999 then how would you denote a range output of between -6+6 std devs?

I have looked at trying to modify this code here for the last hour without success, is it possible to do? This way gives us a different perspective to judge how large a specific market move has been and how likely and maybe it’ll give me some insight as to why this indicator works well on the £/Yen and FTSE but not the Dow?

Cheers

Bard

So you want to bound this oscillator with a scale made of std devs but of price? not from the oscillator itself?

Grazie del prezioso contributo Nicolas,

scusa la mia inesperienza, sono alle prime armi e sto imparando.

Volevo farti una domanda sull’argomento e prendo a riferimento l’ “Inverse Fisher Transform applicato al RSI” (pagina 64, probacktest_c1504281788c.pdf).

Ho fatto delle prove “daily” su EUR MXN ma i segnali (ingresso, uscita, long e short) sembrano che vengano ricalcolati a posteriori a seconda della data finale di simulazione.

Non ho quindi dei segnali validi in tempo reale, tipo il sistema ZIG ZAG.

Solo allontanandomi di qualche giorno dal segnale che appare sul grafico quest’ultimo si fissa su una data certa, quando ormai non serve più.

Posso inviare un immagine se non sono stato chiaro.

Grazie ancora della tua cortesia

https://ibb.co/kcT8Xf

To avoid recalculation, you should use the one from this post.

Ok Grazie Nicolas.