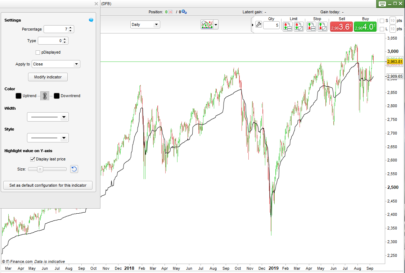

In this complete system Jim Berg uses the volatility indicator 2 times the ATR 10 periods by default, for the entry signal as well as the trailing stop.

He also uses it to produce a takeprofit line on the chart (the small violet points) to indicate when prices have moved up suddenly. This can be a signal to take profits before a possible pullback to more normal price movements. The system is set up for long trades only.

|

1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 32 33 34 35 36 |

//PRC_ATR Volatility Jim Berg | indicator //23.03.2020 //Nicolas @ www.prorealcode.com //Sharing ProRealTime knowledge // --- settings ATRmult = 2 //ATR multiplier // --- end of settings // ATR trailing stop line iATR = averagetruerange[10] vel1 = Close - ATRmult*iATR temp = 0 for j = 0 to 14 do temp = Max(temp,vel1[j]) next vel = temp // velocity points if Close> lowest[20](low) + ATRmult*iATR then trend = 1 vel3 = average[13,1](high) + ATRmult*iATR endif if Close < highest[20](high) - ATRmult*iATR then trend = -1 vel3 = average[13,1](low) - ATRmult*iATR endif if trend = 1 then drawcandle(open,high,low,close) coloured(0,255,0) else drawcandle(open,high,low,close) coloured(255,0,0) endif return vel style(line) as "Trailing stop ATR" , vel3 coloured(238,130,238) style(point,3) as "Velocity points" |

Share this

No information on this site is investment advice or a solicitation to buy or sell any financial instrument. Past performance is not indicative of future results. Trading may expose you to risk of loss greater than your deposits and is only suitable for experienced investors who have sufficient financial means to bear such risk.

ProRealTime ITF files and other attachments :PRC is also on YouTube, subscribe to our channel for exclusive content and tutorials

Bjr, j ai lu effectivement que le système était long only, mais je crois qu on peut aussi l utiliser a l inverse, je pense l avoir lu sur une autre page ou l on donnait le codage pour différentes plateformes

En tout cas encore merci

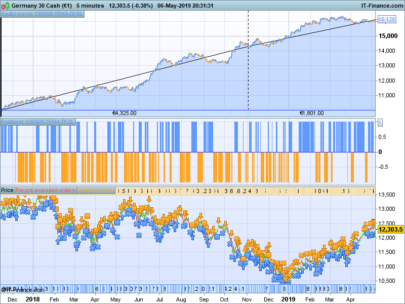

bonsoir Nicolas est il possible de voir cet indicateur évoluer dans un TF bas pour une aide a la décison sur le scalping? merci.

bonjour nicolas! j’aimerais pouvoir changer les couleurs des chandelier directement depuis la fenêtre de paramètre de l’indicateur au lieux d’entrée a chaque fois dans le code pouvez vous m’aider svp, j’ai essayer de le faire moi même mais je n’est pas réussi, merci d’avance

remplacer les valeurs de coloured(0,255,0) par coloured(r,g,b) et ajouter ces noms de variables dans les paramètres de l’indicateur.

merci Nicolas!

Merci Nicolas pour ce set-up que je ne connaissais pas ! J’ai tenté de reprendre le code pour en faire un backtest mais j’aurais besoin d’une correction ! J’obtiens de beaux gains mais un taux de réussite faible (<50%), est-ce normal ?

ATRmult = 2 //ATR multiplier

iATR = averagetruerange[10]

ATR2 = ATRmult*iATR

IN = close > lowest[20](low) + ATR2

OUT = close < highest[20](high) – ATR2

TP = Average[13,1](high) + ATR2

//ATR Stop suiveur

ST = Close – ATR2

temp = 0

for j = 0 to 14 do

temp = Max(temp,ST[j])

next

STsuiveur = temp

// — Conditions

If not longonmarket and IN then

buy 1000 cash roundeddown at market

//buy 1 shares at market

set target profit TP

set stop loss STsuiveur

endif

If LongOnMarket AND OUT THEN

SELL AT MARKET

ENDIF