@ Elsborgtrading

In the last 25 years I’ve seen so much that I don’t believe everything. But the Pathfinder is exceptional.

Mark

MarkParticipant

Senior

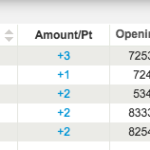

I have attached the trades currently open in DEMO for Jan2 period, doesn’t look too great 🙁

this is mine….We have to be patient… Light is straight away 🙂

Hi Guys,

Pathfinder swing isn’t fast money. As mentioned the algo is a “bottom fisher” and needs a correction and make money by accumulating cheap positions and sell when the correction is over. For crude I didn’t get a signal and the cotton trade ensures a positiv balance over all positions.

Best, Reiner

yes, we need to be patient 🙂

For crude, i have a position opened too on demo at 00.00 (see picture);

thanks Reiner !

For me, crude tried to open from 23.00 on Sunday, and then opened on Monday 00.00.

Best regards, David

And now at 1am HS swing opened long live.

Cotton position was closed at 7482 with gain of 1.100$

Hi Guys,

you will find enclose all infos concerning Pathfinder Swing idea with all swing trades so far.

Best, Reiner

Hi Reiner,

same position but on Coton NY (contrat 1€)= + 237€ with a 10k account starting.

Is it a good instrument? Thanks

Reiner,

i see it’s ok wth the same performance (+3%). Thanks

Hello Everyone, (specially Reiner)

Thank you very much for all your work.

I would like to start to operate this system but I need to understand clearly the process.

At the beginning of every month (or half month) we choose the best assets to apply the systems based on the monthly past results. Isn’t it?

In the end, the number of trades for each asset and each system is reduced. Is there maybe a little bit of curvefitting?

The system we applied is in daily timeframe, Then..Is the system for the DAX 4h-V6 also a good system?

Thank you very much in advance,

I will start in February 🙂

Best regards

Hola ivillalonga and welcome,

The first post of this topic described the idea. Based on the Pathfinder daily system you’ll find at the first post the best setups for the next period. The robots can run in demo or in life and you can trade whatever fits to your portfolio (cfd, future, ETF, DFB). I personally use it for my ETF accounts but I’ll trade not every signal. Be careful because the status is still experimental und I backtested not all scenarios.

DAX 4H V6 is another system. Please check the related topic for details.

Cheers, Reiner

H Guys,

I have improved the underlying Pathfinder daily algo a little bit. The results are very promising and gain is almost double but unfortunately the max drawdown is also a little bit higher. I have added an additional long position (cross over DHigh(2)). Please find details below.

I tried to find a way to reduce it without losing the exceptional performance but I’m not really happy with it. Maybe one of you have a good idea. I’ve attached the DAX version to play around.

dailyHigh = DHigh(1)

dailyLow = DLow(1)

previousDailyHigh = DHigh(2)

// long position conditions

l1 = signalline CROSSES OVER dailyHigh

l2 = signalline CROSSES OVER previousDailyHigh

// exit position conditions

s1 = signalline CROSSES UNDER dailyLow

// long entry with order cumulation

IF (l1 AND f2) OR (l2 AND f2) THEN

Thanks, Reiner

Hi Reiner. It’s not that I forgotten about trying to implement the CFTA code in Pathfinder- I’m just not happy about the result. For the moment I’m stuck because the code will limit the Gain, and DD will be bigger. But I have the framework for it. I can try and post it in the other post for 4H Pathfinder if you want? perhaps you or someone else have an idea for what to do.