Back testing strategies

Forums › ProRealTime English forum › ProOrder support › Back testing strategies

- This topic has 103 replies, 5 voices, and was last updated 5 years ago by

Vonasi.

-

-

06/30/2018 at 7:47 AM #7488406/30/2018 at 8:25 AM #74886

Wouldn’t doing 100k bars straight away cut straight to the point and show you the results that work best over the collective 100k bars without doing each sample size?

Yes I guess it might, but I am impatient and don’t want to sit there doing nothing while 100k bars runs and then find it is shite anyway as the strategy is flawed / does not work.

If I do something else while the 100k bars are running then I get focused on that task and forget where I am with the coding etc. Maybe reading a book is best or an article on Auto-Trading?

100k bars can take ages to run at peak times, but weekends are good / can be fast?

06/30/2018 at 8:41 AM #74888There must be another reason apart from wasting time. You would waste time anyway doing 10, 25, 50 and 100k back tests. So why not go straight to 100k bars?

Also I found as I stated in an earlier post that if i back test 10k bars on nasdaq I have long and shorts and if I do 100k bars only long trades are profitable over the time frame.

06/30/2018 at 8:45 AM #74889Or by doing the small increments leading up to the 100k bars test we are making sure we have not curve fit and optimized too much and our strategy is robust enough to stand the tests of time?

No you could just as easily kid yourself and over-fit a strategy by doing the small increments.

When Walk Forward Testing if the value of variables are wildly different for the different OOS periods then you know your strategy probably won’t produce consistent results.

You could of course restrict the values in the optimiser to a small range either side of your optimum for the main BT period (original 10k bars) and if the results over 100k bars during WF are similar for each OOS period then you may have a winner??

Notice I qualify all my statements with probably, may be, it could be … etc?? Well this is intentional because coding a strategy and then going Live is never going to be a black & white scenario, there is never going to be ONE right answer or one correct way to do it. For one thing we are all different, look at me I want almost instant results on short TF’s, others are happy to wait for days / weeks even for a trade never mind a profit! 🙂

Then at the end of all our hard work we launch our System into a changed Market from our Test period and it is downhill / no profit all the way?

Look how many Systems on here were built around / had emphasis on / were optimised over the Bull run in Indices (DAX / DOW in particular) and now they are way underperforming the results gained during endless analysis and Bactesting?

So try and get into the mindset that there is no black and white correct answer, there is no ONE way to do all this? This is what makes it all both an endless challenge and soooo frustrating at the same time and makes me often think … why bother, I’d be better off getting on with the rest of my life!? However, I keep coming back to it, but with subtle changes to my Modus Operandii that makes it all more palatible to my personality etc.

Hope all that is a bit of food for thought!? 🙂 Now I’m off to my other big time consumer … building!

06/30/2018 at 8:55 AM #74892So why not go straight to 100k bars?

Do you not find BT 100k bars so slow that you can’t stand it?? I am similar with folks who talk real slow, I kinda nod off in between words!!?? 🙂

Also I found as I stated in an earlier post that if i back test 10k bars on nasdaq I have long and shorts and if I do 100k bars only long trades are profitable over the time frame.

Yeah that’s due to your strategy being ineffective on shorts or the range of values you are using are not effective on shorts or maybe your whole strategy is simply riding the rising equity curve anyway.

You do not post equity curves so we can’t comment to help you, but if your equity curves are near enough just following the ups and downs of (for example NASDAQ) then you may as well just buy and hold, open a beer and enjoy life?? 🙂

06/30/2018 at 9:01 AM #74894As I want to be an active trader and not an investor I need to develop a strategy that can make profits regularly and not in a months time when for all I know the direction can change.

How long do you typically stay in a trade for?

06/30/2018 at 9:21 AM #74897Look how many Systems on here were built around / had emphasis on / were optimised over the Bull run in Indices (DAX / DOW in particular) and now they are way underperforming the results gained during endless analysis and Bactesting?

Which is another reason why I now avoid shorter time frame strategies. There is just not enough back data to test properly on.

With daily or weekly you get to see how the world has changed over the decades. You can see and prove how the later data is far more relevant than the way back in time data. You can see how bar range has evolved over time and much more. You have bull runs, bear runs and sideways markets to test on. With short time frames you are just looking at the latest bull run or bear run or sideways market and making your strategy fit that then you test it on an OS bit of data which is part of the same bull run, bear run or sideways market. Then you put it live and suddenly it doesn’t work because the market structure of the tomorrow pays no attention to what happened in the last year or month or week or ten seconds and switches from bull run to bear run. So why make it hard for yourself? Learn to embrace slower trading rather than the adrenalin rush of losing on short time frame trading! IMHO

On a separate note to ChrisNYE – I would suggest simplifying your strategies even further. For every strategy you are developing you should just start with a long only or short only strategy. It is far easier to develop and analyse when trading in one direction only. Often shorting has very different characteristics to going long anyway so one variable value does not fit both styles of trading anyway – so you end up trying to write two different strategies in one code – why make it hard for yourself?

06/30/2018 at 9:31 AM #74898Vonasi the majority of people I speak to suggest I trade dailychrts and forget the smaller time frames. My one point of concern for me is I like to know quickly if I have made a profit. I dont want to be in a trade for months. The other issue with trading daily tf is allowing for the large pullbacks to ride the trend. I could not handle seeing a nice profit turnout to a loss or break even with the potential of going to a profit again maybe. Your thoughts,

06/30/2018 at 9:43 AM #74902I like to know quickly if I have made a profit.

Then I would try greyhound racing. Races are over in the blink of an eye and you know whether you have a profit or not very quickly. 🙂

You can trade on daily bars and be in a trade for just hours or a day or a few days. It does not need to be months.

In fact you do not want to be in for months as spread betting/CFD’s are not the right tool for that sort of trading due to the costs. Buy an ETF for that.

06/30/2018 at 9:52 AM #74903The aim of this game is to make money. Whether it be on a 15min of daily tf we all have the same goal. Both strategies have merits and profits. As I am an amateur I guess I have the belief of smaller time frames for quicker profit realization.

06/30/2018 at 9:59 AM #74904As I am an amateur I guess I have the belief of smaller time frames for quicker profit realization.

….or quicker loss realisation! 🙂

06/30/2018 at 1:46 PM #74929If you have a robust system clearly the more often you trade the faster the curve . Ultimately , its not the time frames that dictates profit , its expectancy and the 2 inputs that produce that metric . Short term trading has it benefits dont you worry , Less time in market is less risk . You can be an intraday futures trader and only be in market 10% of the time . Pros and cons

In the words of Howard Bandy

Trade frequently, trade accurately, hold a very short period of time and avoid losses.

06/30/2018 at 1:56 PM #74930If you have a robust system clearly the more often you trade the faster the curve . Ultimately , its not the time frames that dictates profit , its expectancy and the 2 inputs that produce that metric . Short term trading has it benefits dont you worry , Less time in market is less risk . You can be an intraday futures trader and only be in market 10% of the time . Pros and cons

In the words of Howard Bandy

Trade frequently, trade accurately, hold a very short period of time and avoid losses.

I mean who else but an intraday trader can go to sleep each day with no risk in the market . Who else can start trading minutes before cash market open and be done for the day inside 2 hours most days .

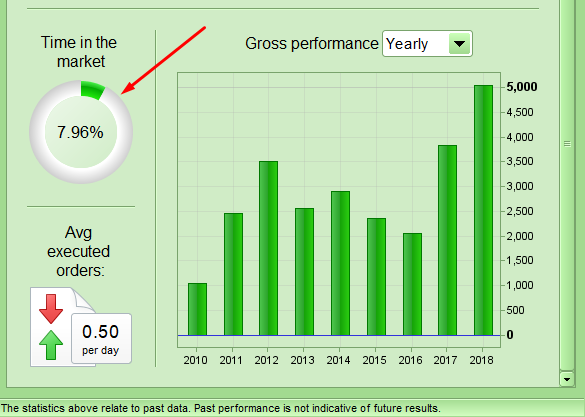

06/30/2018 at 2:01 PM #74931Less time in market is less risk . You can be an intraday futures trader and only be in market 10% of the time

Like this Intraday strategy based on daily charts? Average hold 7H 40min. That and profits will be further improved when MTF is released and closure of some positions does not need to wait until the next days candle.

-

AuthorPosts

Find exclusive trading pro-tools on