Back testing strategies

Forums › ProRealTime English forum › ProOrder support › Back testing strategies

- This topic has 103 replies, 5 voices, and was last updated 5 years ago by

Vonasi.

-

-

06/22/2018 at 9:13 AM #74015

I dont like strategies that have red years, i can accept a bad year here and there, thats not as profitable as the other years, but overall i want ish similar profit every year in my algos. You just need to filter out all the crap..

Some people run algos depending on other things. Like if they mean that the market is in a trending market they will use only trend following strategies and when its choppy theyll switch to maybe mean reverting strategies.

personally i think that is flawed cus if u start to “think that the market is so and so” u should be able to say WHY you think it is like it is, and then u should be able to code that reason into ur system.

So i believe more in the systems that can be turned on and just keep running as long as its not overfit and starts to fail.When you say its hard, yes it is. When u say that u struggle, so does everyone else. U just gotta keep on keeping on.

Edit: i can live with a red year in say 2008 that was horrible for long only algos.

Edit2: Some strategies can look good in multiple similar markets, other strategies will look only good in 1 market, and crap in the others. There is no “right or wrong” here, but its alot easier to say “this is a robust system” if it works in 10/10 similar markets. If it only works in 1 market then it might be overfit for that 1 market. If it “works” in similar markets then that means it dosnt rly matter what data ur watching, it captures trends/swings/momentum anyways..

06/22/2018 at 9:21 AM #7401706/22/2018 at 9:40 AM #74025You mentioned you dont like strategies that have red years – do you mean individual strategies?

Yea i mean individual strategies. And again this is no “right or wrong” its just how i like to run my algos/strategies/systems..

I wouldnt like very much to see a strategy just loose trade after trade and overall going into a loss over 12 months. Thats probably a strategy i would stop after just 4-8 months or smthn depending on how and what it is.

As ive said in my noob-posts: A strategy can loose 1 year and be ur most profitable strategy the next year. But 12 months and ur overall red? nah i dont like that. That too me feels like that “if the market would turn bad” but not just for 12 mnths but this time for 24 months, ur gonna keep running a strategy that might just bleed money until “the market turns good” again.. i would rather run a strategy that works regardless if the markets are “good/bad/volatile/slow/fast” etc..

again, this is just me. Some ppl would never run a 40% winrate trend following strategy even if it shows ever year as a green year, cus they just dont wanna loose 6/10 trades.. even if 1 good trade might make up for all those 6 trades! Cus it makes u feel uneasy when running it.. Ur strategy and backtest has to match ur personality.. meaning if u want 80% winrate, if u wanna see 8 winners and 2 loosers in the bigger pic, then dont run 25% winrate strategies that ur gonna turn off as soon as u hit a 10 loss streak, which is gonna happen sooner or later.

if ur comfy with seeing 5-10 loosers, then making the big bucks roll in as soon as market turns further up and a huge trend comes, then sure, run that then. ..

Try to think about:

Why do i wanna trade? Is to make a living trading? Is it to make some side-money? Is it cus its just for fun and u dont rly care about the money-part of it?

If your trading to make a living, and u wanna be able to live from doing this then u need to set up a timeframe of YEARS. U cant just quit ur job in 2 months cus u have 2 algos that “look great” in backtest. U need to trade them for months and months to make money and see that its robust etc. Also this mindset might make u impatient and could make every loss feel 10x worse because u feel like ur failing ur big dream and goal in life which is to trade for a living.

if your trading cus u wanna make side-money ur gonna feel less stress when going into drawdowns and reaching ur goal might take 6 months or 6 years and it dosnt rly matter as long as ur making a little bit extra on the side.

If ur trading for the fun of it and making strategies is fun and a cool thing to master, then ur just gonna have fun with it and experience the joy of making something good, the research that comes with it, reading books and podcasts etc. Going into drawdowns wont make u stressed, it would rather peak ur interest: Why am i loosing 6 in a row here? what kind of filter could i use to increase my winrate and “miss out” of these false signals?

06/22/2018 at 9:51 AM #74032Ok so my goal is every strategy should have green years of profit and it doesn’t mean consistently say 10k per year. It could be 10, 3, 8, 1, 5k per year and if I add up all these yearly profits across all my argos that is the total profit per annum?

06/22/2018 at 10:18 AM #74039I mean i cant define ur goals, u gotta define them urself, what would u be comfy running and what wouldnt u be comfy running.

I like for every year to be green + every year be ISH similar to each other. Meaning if u got year 1-3 with 500-900€ profits, then year 4-5 has 4K€ profits, then its back to 500-900€ thats a big red flag for my part. That would indicate (i would say, dosnt mean its right or wrong) that the strategy is very good if the markets are juuuust right. but as soon as markets isnt “right” then ur gonna see small small profits over 12 months or so.

U can see from my post here what i run both live and in demo: https://www.prorealcode.com/topic/lets-compare-some-notes/

I like to look at the quarters to see how “even” they are. i dont like many low quarters and a few big ones, i would rather that it would be as even as possible.

so when i optimize something i dont always (hardly ever) go for the “top optimized results”, i would rather go through 10-30 of the top results and pick the one set of optimized variables that gives me an as even as possible result when it comes to profit pr year/quarter. And thats just my thinking that it would be more robust if it gives even results back “every year”. Dosnt mean its right or wrong, but logically this is what makes sense to me and thats what i would like to run.

Edit: About correlation of algos and how u want them to be collective profitable every year: Think about it as this, u open an IG account for 1 algo only, and u place 5K€ or whatever on that account and u run that 1 strategy. U want that to be profitable every year.

if u do the same but with 10 strategies u want them all to be profitable every year. Some might have a red quarter here and there, but all in all u should be able to run each system u have on a seperate IG account with XX € on the account and it shuld be profitable.

In other words when i make algos i dont think too much about what i already have made and what might be correlated to what. That being said correlation is KEY and if u can make 2 systems that are not correlated at all u would be golden as long as they both keep being profitable in the long run.

06/22/2018 at 10:29 AM #7404206/22/2018 at 10:36 AM #74044Every year be similar profits do you mean all your strategies cumulative or each individual strategy?

Each individual strategy. I dont want 1 strategy that makes 200 this year and 5000 next year then 250 the year after that

i would much rather want to see all those 3 years make 1200~€ each year.

Edit: Numbers are just random examples..

Edit2: added a photo of 1 of my systems to show more clearly what i mean

06/22/2018 at 11:10 AM #7405006/22/2018 at 11:30 AM #74053I saw that pic and your other strategies pictures. Dam good returns. Want to ask what indicators your using but am sure you will ignore me

Congrats anyway. Must feel good.

All my algos are made in different ways. Some indicators that i use/have used are: Chande momentum, RSI, price rate of change, supertrend, custom indicators from this forum, bollinger bands, moving averages on f example RSI or chande or price rate of change etc. +++ The possibilities are endless, if u cant seem to get an indicator “to work” ur probably using it the wrong way.

Very few of my systems use stuff like “rsi crosses over rsi 77” or smthn super spesific value like that, but i also do have similar rules in some systems.

And u just want to filter out alot of the shit markets as good as u can. Like lets say u wanna go Long only trend follower, a simple filter like “Close > MA200” will filter out alot of bad / shitty markets that u dont wanna take trades in. Or for example u can use say take a RSI14 and add 2 moving averages on that and say MA 5 > MA 30 on the RSI, meaning the RSIis “trending” upwards.

In other words filter out all the good momentum u wanna be “in”, and find a trigger/entry inside all that good momentum that lets u take trades.

Also u can check out simple shit like: Close > yesterdays low/open/close/high etc. Or even Close > open could help u filter out some of ur shitty trades.

Edit: Yes it “feels good” but mostly, for my part, it feels good cus i looked at a problem, and i came up with a set of rules that might “solve my problem”. I look at this like sort of an IQ test, or something similar. Like there are patterns that can observed and then u just gotta capture them as good as u can using whatever u can. And i have made 1000+ strategies and lets say 50 / 1000 have gone into demo, out of those 50 i currently run 8 live and got roughly 5-10 still in demo. The rest have turned out to be overfit shit systems that i have discarded.

Edit2: U will get there too if u keep this up. Work on systems every day and try something new. Try to go away from ALL the indicators that uve previously used and just try new shit using new indicators. Things that makes sense to u.

Also check out this site if u want a tiny bit more in-depth look at different indicators: https://www.metastock.com/customer/resources/taaz/?p=14

On the right side u can choose different indicators and read a short little txt about how why and where

06/22/2018 at 11:43 AM #74054i would much rather want to see all those 3 years make 1200~€ each year.

The only thing that I would add to this is that if a strategy is based on an index and on candle price action or a percentage exit then it is likely that each year the returns will get bigger. A candle with a range of 0.0001% of price when price is 1000 is much smaller than the same 0.0001% when price is 10000. An exit of 2% above close on a price of 1000 is much smaller than the same 2% on a price of 10000.

Candle range will generally increase as price does and so your return per trade is likely to also increase so level yearly returns in this situation would mean that the effectiveness of the strategy is actually lessening.

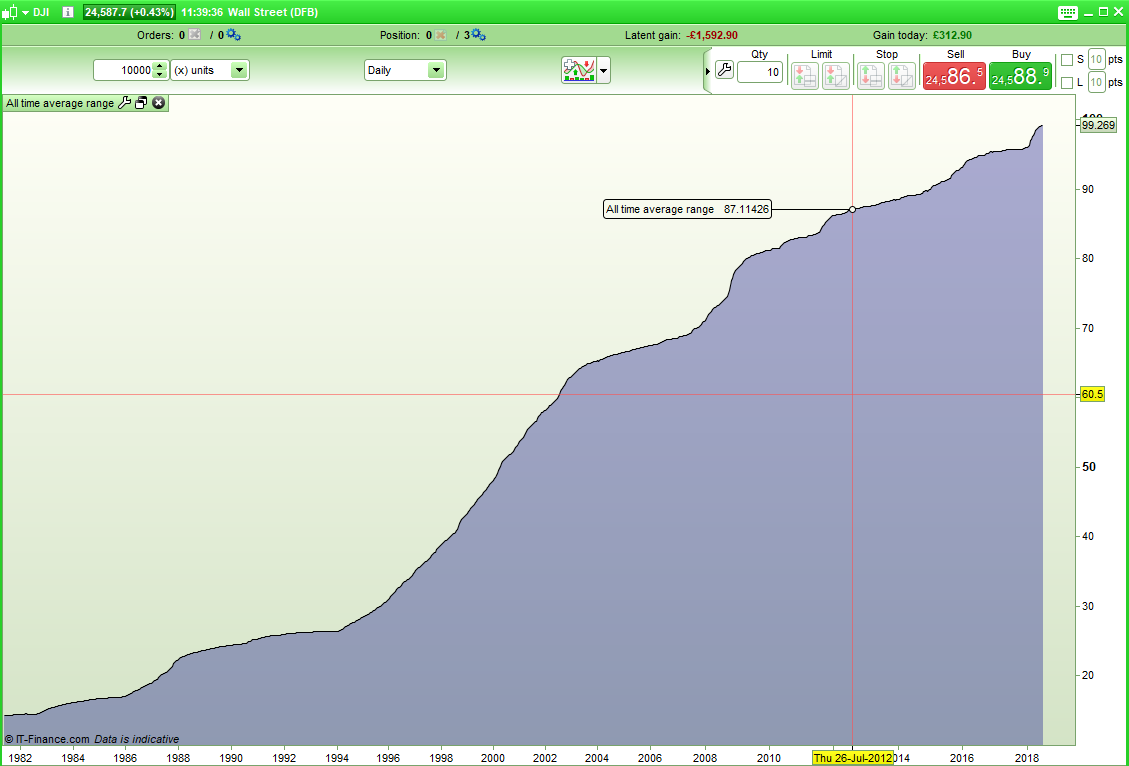

This simple indicator shows what I mean.

123456a = a + rangecount = count + 1b = a /countreturn b…and the all time average range for the DJI:

06/22/2018 at 11:53 AM #7405806/22/2018 at 11:57 AM #7406006/22/2018 at 12:02 PM #74062Agree with vonasi about moving averages…

And yes Vonasi this is true about increase of index should mean increase in ur systems profitability. Of course only if the market keeps behaving as it has. Bigger index also might mean u need to increase ur stop losses, ur targets, maybe even some variables. Thats the “tuning” part of the job. watching and making sure ur strategies is doing what u want them to do. If u see an increase of 5000 points in 1 index, then ur stop loss 50 pips might need to increase roughly with the same % change that tthe index has seen.

But yea that might never happen also depending on what that market is gonna do the next 1-100 years, hehe.

When i say i would rather see 1200€ each year i just mean i would like to se “as even” results as possible. What im trying to say is that i want as little volatility as possible in the EQ curve/results.

Edit: A fun thing to think about is that when a moving average 10 is crossing above say moving average 20, that means price has moved alot the last 10 candles! In other words the “move up” might already be done by the time ur entering, unless its the start of a big fat swing/trend. But usually ull find that most of ur fake signals are crossovers and then price instnatly turns the opposite way! And thats cus as vonasi said, they’re lagging indicators! When crossover happens, the move up has already happened for the past say 10 candles and u actually want to short or whatever rather then go long.

So what u wanna do, if ur gonna use moving averages as say an entry/trigger for entry, then u just wanna try to filter out as much bad signals as possible, so go into chart, look at ur bad trades and jut open indicators that would make sense to you.

Lets say u want MA10 crosses over MA20. U need to filter out all the bad crossovers… maybe close should be above bollingerband up? Maybe RSI should be above 70? Maybe close > yesterdays high?

U just gotta keep testing and trying everything that u can think of.

06/22/2018 at 12:09 PM #74063then ur stop loss 50 pips might need to increase

Which is why I now would never run a strategy with a fixed number stop loss or fixed number take profit. In fact I rarely use either in any form in a strategy anyway!

06/22/2018 at 12:13 PM #74065 -

AuthorPosts

Find exclusive trading pro-tools on