Back testing strategies

Forums › ProRealTime English forum › ProOrder support › Back testing strategies

- This topic has 103 replies, 5 voices, and was last updated 5 years ago by

Vonasi.

-

-

06/22/2018 at 12:19 PM #74067

then ur stop loss 50 pips might need to increase

Which is why I now would never run a strategy with a fixed number stop loss or fixed number take profit. In fact I rarely use either in any form in a strategy anyway!

Thats interesting, what kind of stop loss do u use then? U dont have any emergency stop loss?

What if a flash crash happens and it exits with 700 pip loss? Like its not exactly something that happens everyday, but it can happen. Wouldnt u want a emergency fixed stop loss at lets just randomly say 300 pips?

I only use fixed but i have seen the flaws of that since day 1 for sure. But i could never get myself to run something without a stop loss i think.. I just wouldnt feel safe, with the insane leverage that im using (normal CFD contracts)

If u google for horror stories with CFD trading for Average Joe theres plenty to read about. That has definitly left a mark on me. Also what kind of strategies are those? (with no fixed stop) Trend following, mean reversion, swing trading, something else?

Edit: im mostly a long only swingtrader or trend follower on 15m – 30m- 1h timeframes, so i feel like using a 300 pip stop loss / no stop loss would be “wrong” because either ive filtered out this great trade that should swing up NOW, or ive missed it and i should probably just get out and wait for my next shot.

06/22/2018 at 12:21 PM #7406806/22/2018 at 12:24 PM #74070I have noticed a lot of the systems on here trade 15 and 30 mins tf on index funds the dax wall street etc . Are these systems operational 24 hrs a day or just during market hours?

Again, there is no right or wrong.

I have 1 system that trades only between 09-17 on the dax.

Several of my systems do NOT trade between 22-02..

some of my systems are 24h a day.

Test, optimize, check it and test it again to find out what ur systems like the most.

06/22/2018 at 12:36 PM #74074Thats interesting, what kind of stop loss do u use then? U dont have any emergency stop loss?

I prefer an exit based on an indicator or price action rather than a line drawn in the sand that the market does not really care about. If you read my other thread about the testing of the SP500 strategy then you will see that I do like to check what the probability of my exit conditions not being met for a very long time are and then maybe use a time based exit if a trade has just been going on too long.

As for emergency stops….. I used to use them until the last big fall in the DAX where I took a £800 loss and then watched price almost immediately go back to where it came from! Usually when markets fall rapidly they bounce back almost as rapidly these days with all the algo trading going on out there.

06/22/2018 at 12:43 PM #74076As for emergency stops….. I used to use them until the last big fall in the DAX where I took a £800 loss and then watched price almost immediately go back to where it came from! Usually when markets fall rapidly they bounce back almost as rapidly these days with all the algo trading going on out there.

Yea cus thats one of the major flaws of a fixed stop loss, ur ALWAYS gonna sell on a big dip lol, just to watch price bounce right up again 9/10 times, but my fear is that 1/10 times where price just keeps on dropping. Imagine if the Dax trade where u lost 800 wouldnt bounce up and u had no stop and suddenly ur looking at -1500 instead.

I guess if u got the cash it dosnt rly matter but for me that could become devasting for my account

06/22/2018 at 2:34 PM #74096I guess if u got the cash it dosnt rly matter but for me that could become devasting for my account

This game is all about risk and reward. You reduce your risk and you reduce your reward.

If you look at the major indices huge drops like you describe are a rarity and becoming rarer % for % and if you look to the right of any major dip on a major index the price has always returned to higher than before the crash. You just have to have the balls and the cash to grit your teeth and ride it out and all will be fine in the end – but a better alternative is to sense when risky times are ahead and stay out of the market at these times. A major long term trend filter would do better in my mind than relying on an emergency stop. No two market plummets are the same so how do you decide where to set one anyway – but if a market has been going down for three months in a row then that is a major signal that something is not right in the world. Others I guess might call it a good value time to buy – back to risk and reward again I guess!

06/22/2018 at 8:42 PM #74131the move up has already happened for the past say 10 candles and u actually want to short or whatever rather then go long.

I agree, price often corrects after about 10 candles (8 to 12 ish, no set rule but about that many) so you may then get a 60 to 75% retrace. So don’t be afraid to try a short in your strategy with an exit at the 62% difference between candle 1 and candle 10 in the upward trend.

Also check out this site if u want a tiny bit more in-depth look at different indicators: https://www.metastock.com/customer/resources/taaz/?p=14

Thanks for above Jebus, looks a good concise A to Z source of reference. Hope I dont forget to read it! 🙂

06/22/2018 at 8:48 PM #74133agree, price often corrects after about 10 candles (8 to 12 ish, no set rule but about that many)

That all depends on your time frame and chosen market. Ten weeks down in a row on a major index would be an all time record for most markets and wouldn’t provide many trades if you were waiting for that!

06/22/2018 at 9:32 PM #74135Ten weeks down in a row on a major index would be an all time record for most markets

I wasn’t thinking of 10-ish red / green bars in a row, there almost always is some minor ups / downs mixed in.

Hey, but I bet if there were 10 weeks all red bars then there would be a correction / Fib retrace to follow very soon after??

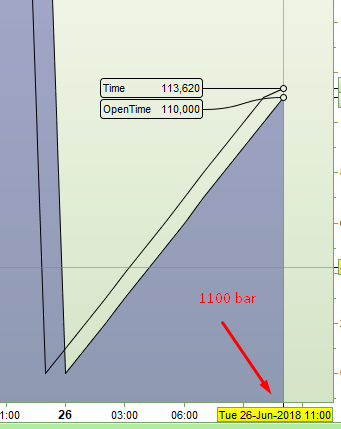

06/23/2018 at 7:53 AM #7415306/23/2018 at 8:48 AM #7415406/26/2018 at 11:21 AM #7440306/26/2018 at 11:29 AM #744041234maxbars = 7if onmarket and barindex - tradeindex >= maxbars thensell at marketendif12345678starttime = 080000endtime = 130000timeok = opentime >= starttime and opentime <= endtimeif timeok and (your conditions) thenbuy 1 contract at marketendifEdit: There was a typo in my post so I have corrected it now.

06/26/2018 at 11:34 AM #7440506/26/2018 at 11:39 AM #74406 -

AuthorPosts

Find exclusive trading pro-tools on