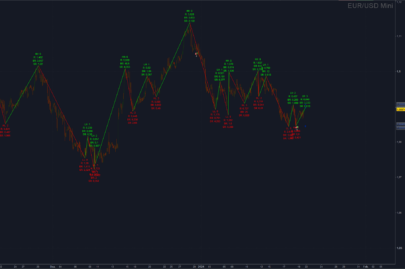

Code for the zigzag indicator with the use of array.

I compared it with the platform indicator, and the results are almost identical in both pips and percentage modes.

With the “Type” variable it is possible to switch the functioning between “Points” and “Percentage” (Note: in the case of ZZ in %, I used the Day Close of the previous day as a basis for calculation to give stability to the reference; using the ” close” with very low % values, sometimes the recalculation gives rise to graphical artifacts)

The “Segments” variable decides how many pairs of up/down segments to display on the graph.

|

1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 32 33 34 35 36 37 38 39 40 41 42 43 44 45 46 47 48 49 50 51 52 53 54 55 56 57 58 59 60 61 62 63 64 65 66 67 68 69 70 71 72 73 74 75 |

//17/12/2022 - T.F. - ZigZag code with Array //Sharing ProRealCode DEFPARAM DRAWONLASTBARONLY=TRUE //Variables: //Points=20 //Pips //Perc=0.25 //% //Type=0 //0=pips; 1=perc //Segments=10 //n. segments up/dw to show PI=max(0,(Segments-1)) //points top/low back to store VarY=CustomClose //close,tpicalprice, etc //inizializzo primo punto come TOP once LastPoint = 1 once $TX[0] = barindex once $TY[0] = VarY //Tipo ZZ in Punti o Percentuale If Type=0 then //ZZ in pips DeltaY=max(2*pipsize,Points*pipsize) elsif Type=1 then //ZZ in % DeltaY=max(0.001,Perc/100*Dclose(1)*pipsize) //Dclose used as ref. endif //ZZ in fase 1 if LastPoint=1 then //lastpoint was a top if VarY>$TY[0] then //update last top and stay in LastPoint=1 $TY[0]=VarY $TX[0]=barindex elsif VarY<=($TY[0]-DeltaY) then //first point in low for i=PI downto 0 do //shift memory previous points $LX[i+1]=$LX[i] $LY[i+1]=$LY[i] next $LY[0]=VarY //store new low and change lastpoint $LX[0]=barindex LastPoint=-1 endif endif //ZZ in fase -1 if LastPoint=-1 then //lastpoint was a low if VarY<$LY[0] then //update last low and stay in LastPoint=-1 $LY[0]=VarY $LX[0]=barindex elsif VarY>=($LY[0]+DeltaY) then //first point in top for i=PI downto 0 do //shift memory previous points $TX[i+1]=$TX[i] $TY[i+1]=$TY[i] next $TY[0]=VarY //store new top and change lastpoint $TX[0]=barindex LastPoint=1 endif endif //---GRAPH--- If LastPoint=1 then drawsegment (barindex,VarY,$TX[0],$TY[0]) style (dottedline,2) COLOURED (0,0,200) //segment in progress for i=0 to PI do //final segments drawsegment ($TX[i],$TY[i],$LX[i],$LY[i]) style (line,2) COLOURED (0,0,200) drawsegment ($LX[i],$LY[i],$TX[i+1],$TY[i+1]) style (line,2) COLOURED (0,0,200) next endif If LastPoint=-1 then drawsegment (barindex,VarY,$LX[0],$LY[0]) style (dottedline,2) COLOURED (0,0,200) //segment in progress for i=0 to PI do //final segments drawsegment ($LX[i],$LY[i],$TX[i],$TY[i]) style (line,2) COLOURED (0,0,200) drawsegment ($TX[i],$TY[i],$LX[i+1],$LY[i+1]) style (line,2) COLOURED (0,0,200) next endif return |

Share this

No information on this site is investment advice or a solicitation to buy or sell any financial instrument. Past performance is not indicative of future results. Trading may expose you to risk of loss greater than your deposits and is only suitable for experienced investors who have sufficient financial means to bear such risk.

ProRealTime ITF files and other attachments :PRC is also on YouTube, subscribe to our channel for exclusive content and tutorials

Hi, thanks for this code.

I implemented it successfully, however, I don’t see an indicator.

I mean: the zigzag line is drawn, but I cannot translate this line into an indicator or variable that can be used in a strategy.

Suppose we call this zigzagline “zigzag” then we can test the following pattern:

if zigzag[2]<zigzag[1] and zigzag[0]<zigzag[1] then

there is a (local) top that delivers a short signal,

and so on

Regards, Jerke vd Geest

The Netherlands

The coordinates of the zigzag points are stored in the arrays $TX,$TY (for tops) and $LX,$LY (for lows). The last point is stored in index 0, the previous point in index 1 and so on…

But the version I posted above had some problems which were fixed by Roberto (many thanks!), see link to discussion for the modification needed:

https://www.prorealcode.com/topic/zigzag-test-code-indicator/

For use in something like a “1-2-3 J.Ross” strategy, I suggest you to use version 1 that I posted later in the discussion, which draws the zigazag the traditional way, without using arrays , only for the last segments:

the coordinates of the last point are in the variables TX0, TY0 (top) LX0/LY0 (low), and the previous ones in TX1/TY1, LX1/LY1, TX2/TY2, LX2/LY2, etc.

With this version, a simple 1-2-3 strategy can be, for example, entering short when:

lastpoint=-1 (=price in descending phase), TY1>TY0 (=point 3<point 1 by Ross) and Close crosses under LY1 (=breakout point 2 by Ross) – [mirroring for long entering]

I'm also working on it 😉

//20/12/2022 – T.F. – V1: Codice ZigZag Versione v1: eliminati gli array e gestito con variabili fisse

//Sharing on ProRealCode

DEFPARAM DRAWONLASTBARONLY=TRUE

//Variabili:

//Punti=20 //Pips

//Percentuale=0.25 //%

//Tipo=0 //0=pips; 1=perc

VarY=CustomClose //close,tpicalprice, etc

//inizializzo primo punto come TOP

once LastPoint = 1

once TX0 = barindex

once TY0 = VarY

//Tipo ZZ in Punti o Percentuale

If Tipo=0 then //ZZ in punti

DeltaY=Punti*pipsize

elsif tipo=1 then //ZZ in %

DeltaY=Percentuale/100*Dclose(1)//usato Dclose come rif. per stabilità del valore

endif

//ZZ in fase 1

if LastPoint=1 then //ultimo punto era un massimo

if VarY>=TY0 then // aggiorno il punto di max e rimango in LastPoint=1

TY0=VarY

TX0=barindex

endif

if VarY<=TY0-DeltaY then //primo punto definitivo low

rem for i=PI downto 0 do //shift memoria punti precedenti

LX4=LX3

LY4=LY3

LX3=LX2

LY3=LY2

LX2=LX1

LY2=LY1

LX1=LX0

LY1=LY0

LY0=VarY

LX0=barindex

LastPoint=-1

endif

endif

//ZZ in fase -1

if LastPoint=-1 then //ultimo punto era un minimo

if VarY<=LY0 then // aggiorno il punto di min e rimango in LastPoint=-1

LY0=VarY

LX0=barindex

endif

if VarY>=LY0+DeltaY then //primo punto definitivo top

TX4=TX3

TY4=TY3

TX3=TX2

TY3=TY2

TX2=TX1

TY2=TY1

TX1=TX0

TY1=TY0

TY0=VarY

TX0=barindex

LastPoint=1

endif

endif

//—GRAFICA—

If lastpoint=1 then

drawsegment (barindex,close,TX0,TY0) style (dottedline,2) COLOURED (0,0,200) //segmento in progress

drawsegment (TX0,TY0,LX0,LY0) style (line,2) COLOURED (0,0,200) //segmenti definitivi

drawsegment (LX0,LY0,TX1,TY1) style (line,2) COLOURED (0,0,200)

drawsegment (TX1,TY1,LX1,LY1) style (line,2) COLOURED (0,0,200)

drawsegment (LX1,LY1,TX2,TY2) style (line,2) COLOURED (0,0,200)

drawsegment (TX2,TY2,LX2,LY2) style (line,2) COLOURED (0,0,200)

drawsegment (LX2,LY2,TX3,TY3) style (line,2) COLOURED (0,0,200)

drawsegment (TX3,TY3,LX3,LY3) style (line,2) COLOURED (0,0,200)

drawsegment (LX3,LY3,TX4,TY4) style (line,2) COLOURED (0,0,200)

drawsegment (TX4,TY4,LX4,LY4) style (line,2) COLOURED (0,0,200)

endif

If lastpoint=-1 then

drawsegment (barindex,close,LX0,LY0) style (dottedline,2) COLOURED (0,200,0) //segmento in progress

drawsegment (LX0,LY0,TX0,TY0) style (line,2) COLOURED (0,0,200) //segmenti definitivi

drawsegment (TX0,TY0,LX1,LY1) style (line,2) COLOURED (0,0,200)

drawsegment (LX1,LY1,TX1,TY1) style (line,2) COLOURED (0,0,200)

drawsegment (TX1,TY1,LX2,LY2) style (line,2) COLOURED (0,0,200)

drawsegment (LX2,LY2,TX2,TY2) style (line,2) COLOURED (0,0,200)

drawsegment (TX2,TY2,LX3,LY3) style (line,2) COLOURED (0,0,200)

drawsegment (LX3,LY3,TX3,TY3) style (line,2) COLOURED (0,0,200)

drawsegment (TX3,TY3,LX4,LY4) style (line,2) COLOURED (0,0,200)

drawsegment (LX4,LY4,TX4,TY4) style (line,2) COLOURED (0,0,200)

endif

return

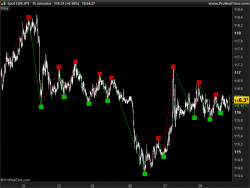

Thanks for this!

My version uses highs and lows and uses 3 * ATR as the minimum difference between points:

DEFPARAM DRAWONLASTBARONLY=TRUE

//Variabili:

Punti=3 * averagetruerange[200] //Pips

Percentuale=0.25 //%

Tipo=0 //0=pips; 1=perc

//VarY=CustomClose //close,tpicalprice, etc

//inizializzo primo punto come TOP

once LastPoint = 1

once TX0 = barindex

once TY0 = close

//Tipo ZZ in Punti o Percentuale

If Tipo=0 then //ZZ in punti

DeltaY=Punti//*pipsize

elsif tipo=1 then //ZZ in %

DeltaY=Percentuale/100*Dclose(1)//usato Dclose come rif. per stabilità del valore

endif

//ZZ in fase 1

if LastPoint=1 then //ultimo punto era un massimo

if high>=TY0 then // aggiorno il punto di max e rimango in LastPoint=1

TY0=high

TX0=barindex

elsif low<=TY0-DeltaY then //primo punto definitivo low

rem for i=PI downto 0 do //shift memoria punti precedenti

LX4=LX3

LY4=LY3

LX3=LX2

LY3=LY2

LX2=LX1

LY2=LY1

LX1=LX0

LY1=LY0

LY0=low

LX0=barindex

LastPoint=-1

endif

endif

//ZZ in fase -1

if LastPoint=-1 then //ultimo punto era un minimo

if low<=LY0 then // aggiorno il punto di min e rimango in LastPoint=-1

LY0=low

LX0=barindex

elsif high>=LY0+DeltaY then //primo punto definitivo top

TX4=TX3

TY4=TY3

TX3=TX2

TY3=TY2

TX2=TX1

TY2=TY1

TX1=TX0

TY1=TY0

TY0=high

TX0=barindex

LastPoint=1

endif

endif

//—GRAFICA—

If lastpoint=1 then

drawsegment (barindex,high,TX0,TY0) style (dottedline,2) COLOURED (0,0,200) //segmento in progress

drawsegment (TX0,TY0,LX0,LY0) style (line,2) COLOURED (0,0,200) //segmenti definitivi

drawsegment (LX0,LY0,TX1,TY1) style (line,2) COLOURED (0,0,200)

drawsegment (TX1,TY1,LX1,LY1) style (line,2) COLOURED (0,0,200)

drawsegment (LX1,LY1,TX2,TY2) style (line,2) COLOURED (0,0,200)

drawsegment (TX2,TY2,LX2,LY2) style (line,2) COLOURED (0,0,200)

drawsegment (LX2,LY2,TX3,TY3) style (line,2) COLOURED (0,0,200)

drawsegment (TX3,TY3,LX3,LY3) style (line,2) COLOURED (0,0,200)

drawsegment (LX3,LY3,TX4,TY4) style (line,2) COLOURED (0,0,200)

drawsegment (TX4,TY4,LX4,LY4) style (line,2) COLOURED (0,0,200)

endif

If lastpoint=-1 then

drawsegment (barindex,low,LX0,LY0) style (dottedline,2) COLOURED (0,200,0) //segmento in progress

drawsegment (LX0,LY0,TX0,TY0) style (line,2) COLOURED (0,0,200) //segmenti definitivi

drawsegment (TX0,TY0,LX1,LY1) style (line,2) COLOURED (0,0,200)

drawsegment (LX1,LY1,TX1,TY1) style (line,2) COLOURED (0,0,200)

drawsegment (TX1,TY1,LX2,LY2) style (line,2) COLOURED (0,0,200)

drawsegment (LX2,LY2,TX2,TY2) style (line,2) COLOURED (0,0,200)

drawsegment (TX2,TY2,LX3,LY3) style (line,2) COLOURED (0,0,200)

drawsegment (LX3,LY3,TX3,TY3) style (line,2) COLOURED (0,0,200)

drawsegment (TX3,TY3,LX4,LY4) style (line,2) COLOURED (0,0,200)

drawsegment (LX4,LY4,TX4,TY4) style (line,2) COLOURED (0,0,200)

endif

return

A good alternative solution, even I had thought of the variant that uses high and low (probabily better than “Close”)

Another solution that I’m testing (and that seems to work very well when used on timeframe < day) is to use a % of the daily ATR as a parameter for the change of direction: 30% of the daily ATR value ( on 5 days, excluding today) seems to me the best one to follow the market swings on 15M. I use this setup for 1-2-3 strategy

Add at the The code:

time frame (1 day)

Atrd=AverageTrueRange[5](close)[1] //Average Daily max variations, today excluded to avoid recalculations on the ATRD value

time frame (default)

VarY=CustomClose //close,tpicalprice, etc

//initialize first point as TOP

once LastPoint = 1

ounces TX0 = barindex

ounces TY0 = VarY

//Type ZZ in Points or Percentage

If Type=0 then //ZZ in points

DeltaY=Points*pipsize

elsif type=1 then //ZZ in %

DeltaY=Percentage/100*Dclose(1) //used Dclose as ref. for value stability

//newtype=2

elsif type=2 then //ZZ in % on ATR Daily

DeltaY=PercOnATRD/100*Atrd //value in points calculated as % on atrd

endif

did you automate that 1-2-3 strategy? how is that working for you?

Not yet, I’m busy developing other strategies/indicators at the moment, but it’s on my to-do list 🙂

I think it’s not that complicated to make the basic 1-2-3 strategy using this ZigZag code.

As I said, with this version, a simple 1-2-3 strategy can be, for example, entering short when:

lastpoint=-1 (=price in descending phase), TY1>TY0 (=point 3<point 1 by Ross) and Close crosses under LY1 (=breakout point 2 by Ross).

Surely it is more difficult to make it efficient and filter it well to avoid consecutive losses in the lateral phases. Somehow we should take into account the basic trend, and block the strategy in moments of low volatility.

Even the type of money management (such as setting the target and the stop) can completely change the performance.