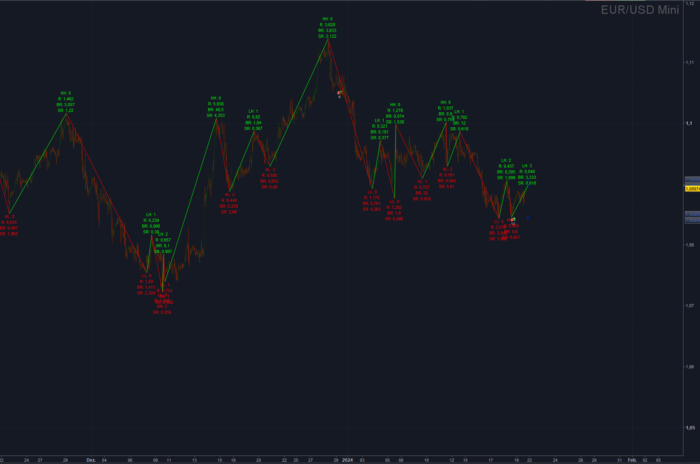

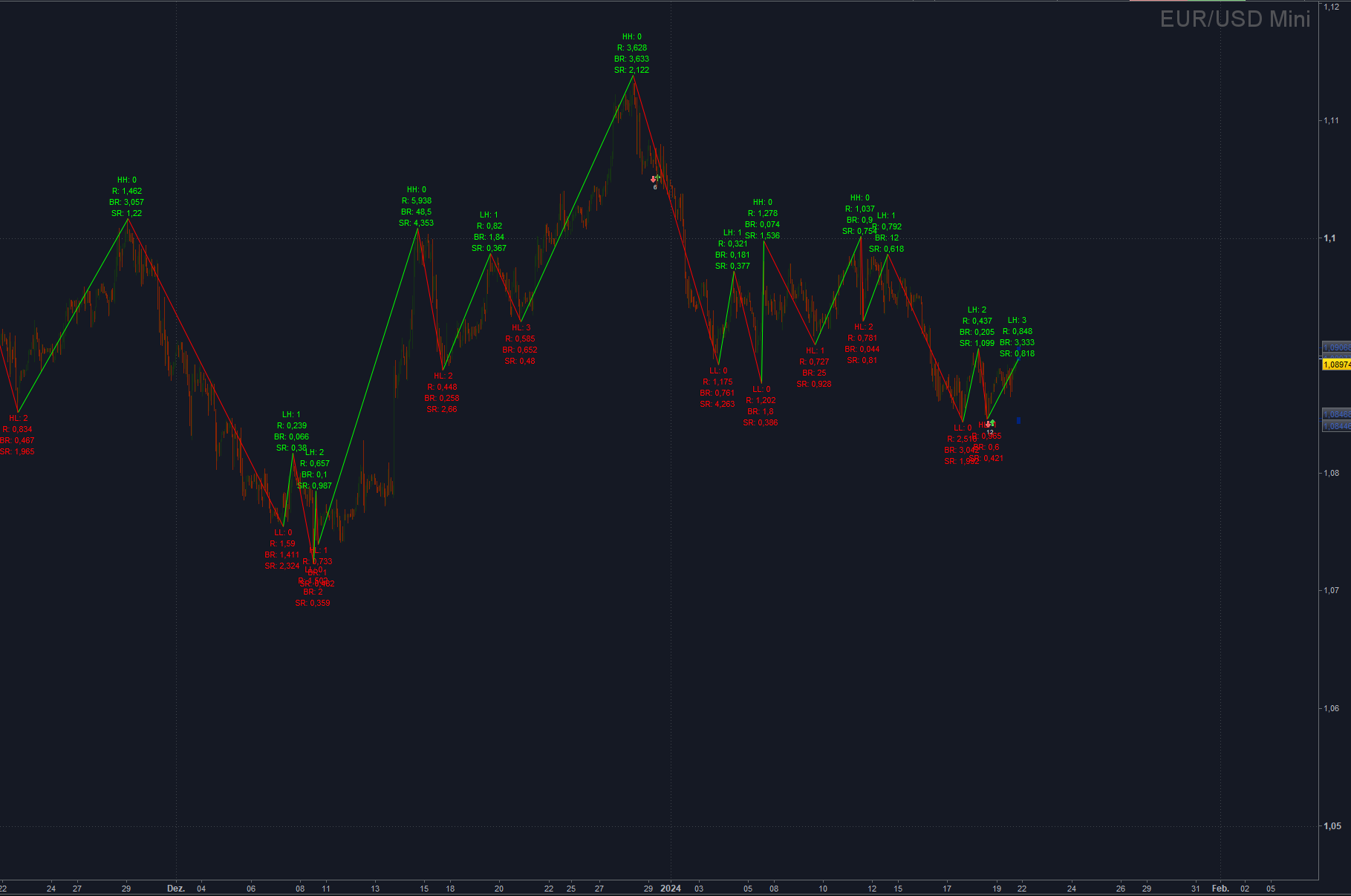

ZigZag base indicator

Calculation is done on High and Lows. A high point is identified, if the highest bar is the current bar. A low point is identified, if the lowest bar is the current bar.

This can be base of any kind of zigzag based indicator.

All zigzag points and his values are stored to a set of arrays.

It will count LH Lower Highs and HL Higher Lows, if HH OR LL occured then LH or HL counter is 0.

It can be used for 1-2-3 pattern or any other pattern algos.

It will also save some ratio value ratio, rizeratio, Barratio.

– Ratio : current move against lasmove 1 = 100% retracement 0.5 = 50% retracement

– Barratio : current move bar length against lasmove bar length

– Sizeration current move against last move of the same direction.

Paramters:

AllowDouble = Allow New High or Low points at the same bar

AllowOverflow = Force a new High or Low Point, if no new high or low point was found after cLength

CheckUpOrDownCandle = New high or low points are only allowed if Candle is up for highs or is down for lows

It return the last 4 zigzag point at the last barindex. Maybe usefull, when will use it for a breakout strategy. If you don’t want this, then replace the “return” line with a simple “return.

Code:

|

1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 32 33 34 35 36 37 38 39 40 41 42 43 44 45 46 47 48 49 50 51 52 53 54 55 56 57 58 59 60 61 62 63 64 65 66 67 68 69 70 71 72 73 74 75 76 77 78 79 80 81 82 83 84 85 86 87 88 89 90 91 92 93 94 95 96 97 98 99 100 101 102 103 104 105 106 107 108 109 110 111 112 113 114 115 116 117 118 119 120 121 122 123 124 125 126 127 128 129 130 131 132 133 134 135 136 137 138 139 140 141 142 143 144 145 146 147 148 149 150 151 152 153 154 155 156 157 158 159 160 161 162 163 164 165 166 167 168 169 170 171 172 173 174 175 176 177 178 179 180 181 182 183 184 185 186 187 188 189 190 191 192 193 194 195 196 197 198 199 200 201 202 203 204 205 206 207 208 209 210 211 212 213 214 215 216 217 218 219 220 221 222 223 224 225 226 227 228 229 230 231 232 233 234 235 236 237 238 239 240 241 242 243 244 245 246 247 248 249 250 251 252 253 254 255 256 257 258 259 260 261 262 263 264 265 266 267 268 269 270 271 272 273 274 275 276 277 278 279 280 281 282 283 284 285 286 287 288 289 290 291 292 293 294 295 296 297 298 299 300 301 302 303 304 305 306 307 308 309 310 311 312 313 314 315 316 317 318 319 320 321 322 323 324 325 326 327 328 329 330 331 332 333 334 335 |

// ZigZag base indicator // This can be base of any kind of zigzag based indicator // all zigzag points and his values are stored to a set of arrays // it will count LH Lower Highs and HL Higher Lows, if HH OR LL occured then LH or HL counter is 0 // this can be used for 1-2-3 pattern // it will also save some ratio value ratio, rizeratio, Barratio // ratio : current move against lasmove 1 = 100% retracement 0.5 = 50% retracement // barratio : current move bar length against lasmove bar length // sizeration current move against last move of the same direction. // AllowDouble = Allow New High or Low points at the same bar // AllowOverflow = Force a new High or Low Point, if no new high or low point was found after cLength // CheckUpOrDownCandle = New high or low points are only allowed if Candle is up for highs or is down for lows // It return the last 4 zigzag point at the last barindex. DEFPARAM DrawOnLastBarOnly = true // ----- settings ----- MaxBars = 1000 ShowLabel = 1 AllowDouble = 0 //Allow New High or Low points at the same bar AllowOverflow = 1 //Force a new High or Low Point, if no new high or low point was found after cLength CheckUpOrDownCandle = 0 //New high or low points are only allowed if Candle is up for highs or is down for lows // -------------------- cLength = Max(1,cLength) if IsLastBarUpdate THEN // Reset Arrays UNSET($pPrice1) UNSET($pBar1) UNSET($pDir1) UNSET($pNumber1) UNSET($pTrend1) UNSET($pSizeRatio) UNSET($pBarRatio) UNSET($pRatio) UNSET($pHighNumber1) UNSET($pLowNumber1) from = MIN(BarIndex ,MaxBars ) for i = from -1 DOWNTO 0 DO //// NEW Code candlepHighBar = highestBars[cLength] (High[i]) candlepLowBar = lowestBars[cLength] (Low[i]) candlepHigh = highest[cLength] (High[i]) candlepLow = lowest[cLength] (Low[i]) if CheckUpOrDownCandle THEN bCandleIsHigh = Open[i] <= Close[i] bCandleIsLow = Open[i] >= Close[i] ELSE bCandleIsHigh = 1 bCandleIsLow = 1 ENDIF pDir = 1 updateLastPivot = 0 newPivot = 0 doublePivot = 0 newBar = barindex[i] distanceFromLastPivot = 0 //var counter = 0 //var lastCounterBar = 0 forceDoublePivot = 0 pIndex1 = LastSet($pBar1) if(pIndex1 >= 0) THEN lastpPrice = $pPrice1[pIndex1] lastpBar = $pBar1[pIndex1] lastpDir = SGN($pDir1[pIndex1]) pDir = SGN($pDir1[pIndex1]) distanceFromLastPivot = newBar - lastpBar ENDIF if(pIndex1 >= 1) THEN llastPrice = $pPrice1[pIndex1-1] llastDir = SGN($pDir1[pIndex1-1]) llastBar = $pBar1[pIndex1-1] forceDoublePivot = (pDir = 1 and candlepLowBar = 0 AND candlepLow < llastPrice AND bCandleIsLow) OR (pDir = -1 and candlepHighBar = 0 AND candlepHigh > llastPrice AND bCandleIsHigh) if NOT AllowDouble then forceDoublePivot = 0 ENDIF ENDIF if AllowOverflow THEN overflow = distanceFromLastPivot >= clength ELSE overflow = 0 ENDIF if ((pDir = 1 and candlepHighBar = 0 ) or (pDir = -1 and candlepLowBar = 0 )) and pIndex1 >1 THEN if pDir = 1 THEN val = candlepHigh ELSE val = candlepLow ENDIF removeOld = val * lastpDir >= lastpPrice * lastpDir if(removeOld) THEN updateLastPivot = 1 newPivot = 1 // Update Pivot ------------------------------------------------------------------------ dir = SGN(pDir) newDir = dir pivotratio = 1 pivotbarRatio = 1 pivotsizeRatio = 1 $pPrice1[pIndex1] = val $pBar1[pIndex1] = newBar $pDir1[pIndex1] = newDir $pSizeRatio[pIndex1] = pivotsizeRatio $pBarRatio[pIndex1] = pivotbarRatio $pRatio[pIndex1] = pivotratio $pHighNumber1[pIndex1] = 1 $pLowNumber1[pIndex1] = 1 // Check Dir AND Ratios dir = SGN($pDir1[pIndex1]) if(pIndex1 >=1) then lastValue = $pPrice1[pIndex1-1] if(pIndex1 >=2) THEN lval = $pPrice1[pIndex1] llastValue = $pPrice1[pIndex1-2] if newDir * lval > newDir * llastValue THEN newDir = 2* newDir if newDir > 0 then $pHighNumber1[pIndex1] = 0 $pLowNumber1[pIndex1] = $pLowNumber1[pIndex1-1] ELSE $pHighNumber1[pIndex1] = $pHighNumber1[pIndex1-1] $pLowNumber1[pIndex1] = 0 endif ELSE newDir = newDir if newDir > 0 then $pHighNumber1[pIndex1] = $pHighNumber1[pIndex1-2] + 1 $pLowNumber1[pIndex1] = $pLowNumber1[pIndex1-1] ELSE $pHighNumber1[pIndex1] = $pHighNumber1[pIndex1-1] $pLowNumber1[pIndex1] = $pLowNumber1[pIndex1-2] + 1 ENDIF ENDIF pivotratio = round(abs(lastValue-lval)/abs(llastValue - lastValue), 3) pivotbarRatio = round(abs($pBar1[pIndex1-1]- newBar)/abs($pBar1[pIndex1-2] - $pBar1[pIndex1-1]), 3) if(pIndex1 >=3) then lllastValue = $pPrice1[pIndex1-3] pivotsizeRatio = round(abs(lastValue-lval)/abs(lllastValue - llastValue), 3) endif ENDIF ENDIF $pDir1[pIndex1] = newDir $pSizeRatio[pIndex1] = pivotsizeRatio $pBarRatio[pIndex1] = pivotbarRatio $pRatio[pIndex1] = pivotratio ENDIF ENDIF if ((pDir = 1 and candlepLowBar = 0 AND bCandleIsLow) or (pDir = -1 and candlepHighBar = 0 AND bCandleIsHigh)) and (newPivot = 0 or forceDoublePivot > 0) THEN if pDir = 1 THEN val = candlepLow ELSE val = candlepHigh ENDIF // NEW PIVOT ------------------------------------------------------------------------------- dir = SGN(pDir) newDir = -1*dir pivotratio = 1 pivotbarRatio = 1 pivotsizeRatio = 1 pIndex1 = pIndex1 + 1 $pPrice1[pIndex1] = val $pBar1[pIndex1] = newBar $pDir1[pIndex1] = newDir $pSizeRatio[pIndex1] = pivotsizeRatio $pBarRatio[pIndex1] = pivotbarRatio $pRatio[pIndex1] = pivotratio $pHighNumber1[pIndex1] = 1 $pLowNumber1[pIndex1] = 1 // Check Dir AND Ratios dir = SGN($pDir1[pIndex1]) if(pIndex1 >=1) then lastValue = $pPrice1[pIndex1-1] if(pIndex1 >=2) THEN lval = $pPrice1[pIndex1] llastValue = $pPrice1[pIndex1-2] if newDir * lval > newDir * llastValue THEN newDir = 2* newDir if newDir > 0 then $pHighNumber1[pIndex1] = 0 $pLowNumber1[pIndex1] = $pLowNumber1[pIndex1-1] ELSE $pHighNumber1[pIndex1] = $pHighNumber1[pIndex1-1] $pLowNumber1[pIndex1] = 0 endif ELSE newDir = newDir if newDir > 0 then $pHighNumber1[pIndex1] = $pHighNumber1[pIndex1-2] + 1 $pLowNumber1[pIndex1] = $pLowNumber1[pIndex1-1] ELSE $pHighNumber1[pIndex1] = $pHighNumber1[pIndex1-1] $pLowNumber1[pIndex1] = $pLowNumber1[pIndex1-2] + 1 ENDIF ENDIF pivotratio = round(abs(lastValue-lval)/abs(llastValue - lastValue), 3) pivotbarRatio = round(abs($pBar1[pIndex1-1]- newBar)/abs($pBar1[pIndex1-2] - $pBar1[pIndex1-1]), 3) if(pIndex1 >=3) then lllastValue = $pPrice1[pIndex1-3] pivotsizeRatio = round(abs(lastValue-lval)/abs(lllastValue - llastValue), 3) endif ENDIF ENDIF $pDir1[pIndex1] = newDir $pSizeRatio[pIndex1] = pivotsizeRatio $pBarRatio[pIndex1] = pivotbarRatio $pRatio[pIndex1] = pivotratio doublePivot = newPivot newPivot = 1 ENDIF if(overflow and newPivot = 0 ) THEN if pDir = 1 THEN ipivot = candlepLow ipivotbar = newBar-candlepLowBar ELSE ipivot = candlepHigh ipivotbar = newBar-candlepHighBar ENDIF // NEW PIVOT ------------------------------------------------------------------------- dir = SGN(pDir) newDir = -1*dir pivotratio = 1 pivotbarRatio = 1 pivotsizeRatio = 1 pIndex1 = pIndex1 + 1 $pPrice1[pIndex1] = ipivot $pBar1[pIndex1] = ipivotbar $pDir1[pIndex1] = newDir $pSizeRatio[pIndex1] = pivotsizeRatio $pBarRatio[pIndex1] = pivotbarRatio $pRatio[pIndex1] = pivotratio $pHighNumber1[pIndex1] = 1 $pLowNumber1[pIndex1] = 1 // Check Dir AND Ratios dir = SGN($pDir1[pIndex1]) if(pIndex1 >=1) then lastValue = $pPrice1[pIndex1-1] if(pIndex1 >=2) THEN lval = $pPrice1[pIndex1] llastValue = $pPrice1[pIndex1-2] if newDir * lval > newDir * llastValue THEN newDir = 2* newDir if newDir > 0 then $pHighNumber1[pIndex1] = 0 $pLowNumber1[pIndex1] = $pLowNumber1[pIndex1-1] ELSE $pHighNumber1[pIndex1] = $pHighNumber1[pIndex1-1] $pLowNumber1[pIndex1] = 0 endif ELSE newDir = newDir if newDir > 0 then $pHighNumber1[pIndex1] = $pHighNumber1[pIndex1-2] + 1 $pLowNumber1[pIndex1] = $pLowNumber1[pIndex1-1] ELSE $pHighNumber1[pIndex1] = $pHighNumber1[pIndex1-1] $pLowNumber1[pIndex1] = $pLowNumber1[pIndex1-2] + 1 ENDIF ENDIF pivotratio = round(abs(lastValue-lval)/abs(llastValue - lastValue), 3) pivotbarRatio = round(abs($pBar1[pIndex1-1]- $pBar1[pIndex1])/abs($pBar1[pIndex1-2] - $pBar1[pIndex1-1]), 3) if(pIndex1 >=3) then lllastValue = $pPrice1[pIndex1-3] pivotsizeRatio = round(abs(lastValue-lval)/abs(lllastValue - llastValue), 3) endif ENDIF ENDIF $pDir1[pIndex1] = newDir $pSizeRatio[pIndex1] = pivotsizeRatio $pBarRatio[pIndex1] = pivotbarRatio $pRatio[pIndex1] = pivotratio newPivot = 1 ENDIF // New Point update point if newPivot THEN // WHAT TODO ? if pIndex1 >= 3 then myPrice = $pPrice1[pIndex1] lmyPrice = $pPrice1[pIndex1-1] llmyPrice = $pPrice1[pIndex1-2] lllmyPrice = $pPrice1[pIndex1-3] ENDIF ENDIF NEXT // draw for x = LastSet($pBar1) DOWNTO 1 DO SizeRatio = $pSizeRatio[x] BarRatio = $pBarRatio[x] Ratio = $pRatio[x] Hnumber = $pHighNumber1[x] Lnumber = $pLowNumber1[x] if ShowLabel THEN if $pDir1[x] = 1 THEN DRAWTEXT("LH: #Hnumber#\nR: #Ratio#\nBR: #BarRatio#\nSR: #SizeRatio#\n\n\n\n ", $pBar1[x], $pPrice1[x]) COLOURED("lime") ELSIF $pDir1[x] = 2 THEN DRAWTEXT("HH: #Hnumber#\nR: #Ratio#\nBR: #BarRatio#\nSR: #SizeRatio#\n\n\n\n ", $pBar1[x], $pPrice1[x]) COLOURED("lime") ELSIF $pDir1[x] = -1 THEN DRAWTEXT("\n\n\n\n HL: #Lnumber#\nR: #Ratio#\nBR: #BarRatio#\nSR: #SizeRatio#", $pBar1[x], $pPrice1[x]) COLOURED("red") ELSIF $pDir1[x] = -2 THEN DRAWTEXT("\n\n\n\n LL: #Lnumber#\nR: #Ratio#\nBR: #BarRatio#\nSR: #SizeRatio#", $pBar1[x], $pPrice1[x]) COLOURED("red") ENDIF ENDIF if $pDir1[x] < 0 THEN DRAWSEGMENT($pBar1[x-1] , $pPrice1[x-1] , $pBar1[x] , $pPrice1[x] ) COLOURED("red") STYLE (LINE,1 ) elsif $pDir1[x] > 0 THEN DRAWSEGMENT($pBar1[x-1] , $pPrice1[x-1] , $pBar1[x] , $pPrice1[x] ) COLOURED("lime") STYLE (LINE,1 ) ELSE DRAWSEGMENT($pBar1[x-1] , $pPrice1[x-1] , $pBar1[x] , $pPrice1[x] ) COLOURED("cyan") STYLE (LINE,1 ) ENDIF NEXT ENDIF if myPrice > llmyPrice AND lmyPrice > lllmyPrice THEN R=0 G=255 B=0 elsif myPrice > llmyPrice AND lmyPrice > lllmyPrice THEN R=255 G=0 B=0 ELSE R=0 G=35 B=125 ENDIF // return last 4 zigzag points RETURN myPrice STYLE (POINT ,5)COLOURED(R,G,B) , lmyPrice STYLE (POINT ,5)COLOURED(R,G,B), llmyPrice STYLE (POINT ,5)COLOURED(R,G,B) ,lllmyPrice STYLE (POINT ,5)COLOURED(R,G,B) // return nothing // RETURN |

Share this

No information on this site is investment advice or a solicitation to buy or sell any financial instrument. Past performance is not indicative of future results. Trading may expose you to risk of loss greater than your deposits and is only suitable for experienced investors who have sufficient financial means to bear such risk.

ProRealTime ITF files and other attachments :PRC is also on YouTube, subscribe to our channel for exclusive content and tutorials

Thanks a lot for this nice contribution to the community! I’m eager to see what’s next! 🙂

Good job. cLength is not defined in the parameters list. So, always equal to 1, which gives very small zigzags.

Thanks for the hint. I think i know now, why this happen. The “settings” block was added by the reviewer. I believe, that it could be difficult to find all parameters directly in the sourcecode.

I will add this block next time directly to the source code.

The correct settings block:

// —– settings —–

MaxBars = 1000

ShowLabel = 1

AllowDouble = 0 //Allow New High or Low points at the same bar

AllowOverflow = 1 //Force a new High or Low Point, if no new high or low point was found after cLength

CheckUpOrDownCandle = 0 //New high or low points are only allowed if Candle is up for highs or is down for lows

cLength = 3 // how many bars lookback to find highs or lows

// ——————–

I think , it would be a nice feature to have the possibilty to declare input parameters inside the source code in the next version:

Like this:

INPUT(“Name”, “Description”, Type(integer, bool…) , Value)

Thank you for sharing your work, both original and very disconcerting. When I went through the code, two things struck me (if I may):

1 – we are closer to a fractal code than a zigzag code. The fractal code determines the new highs and lows based on a minimum bar number (horizontality). The Zigzag code determines that there is a change of direction from a certain vertical movement. This minimum vertical movement to change direction can sometimes be done in 1 bar… This makes the Zigzag code (based on verticality = prices) more responsive and often more consistent, because it is the price that counts.

2 – The code erases everything and redo all the calculations at each new bar, which is incongruous and especially very time-consuming…

Hello LucasBest,

thanks for your comment.

Point 1:

Yes your are right. The Zigzag version is more fractal based. For me a ZZ indicator should show turning points (highs and lows).

So the calculation should be done on candle high and candle low. With “vertical” calculation(percentage) you can see some jumping ZZ points.

Example: If you see serveral Dojis with long shadows, then the high and low of this candle can be in the range of the percentage change, even if the low or high is not lower or higher then the candle before.

Thats why i prefer to indentify ZZ points as higher highs or lower lows.

Point2:

Yes your are right. The goal was to limit the calculation to a specific range of bars. Sometimes i have open a chart with 10k bars. If i would do the calculation over all bars, then the time for calculation would take longer the first time.

I can remove the calculation loop. But i don’t know, how to update this post with the new code.

best regards

Gidien