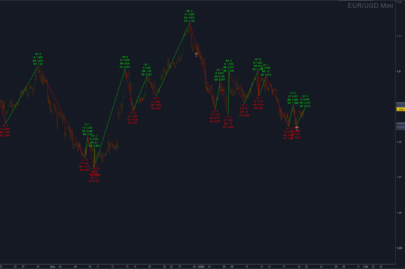

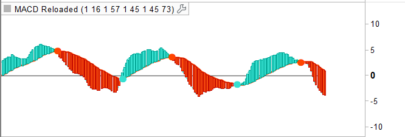

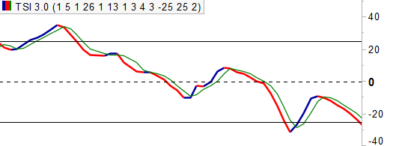

This oscillator is based between the relationship that exist between price and volume. It combines these values to help detect up and down trend.

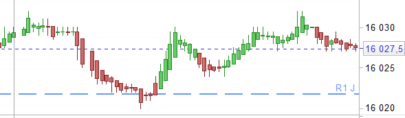

It is devoted to detect short term trades based on standard deviation of recent moves, so bearish signals occurs when oscillator is crossing the lower deviation and bullish movement when oscillator is crossing down the upper deviation.

Parameters :

- period = 8

- cutoff = 1

- devH = 1.5

- devL = 1.3

- stdevper = 100

|

1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 |

haOpen = ((Open[1]+High[1]+Low[1]+Close[1])+(Open[2]+High[2]+Low[2]+Close[2]))/2 haCl = ((Open+High+Low+Close)/4+haOpen+MAX(High,haOpen)+MIN(Low,haOpen))/4 haC = tema[period/1.6](haCl) vav = average[period*5](volume) vave = vav[1] vmax = vave * 2 if(volume<vmax) THEN vc = volume else vc = vmax endif vtr = tema[period](linearregressionslope[period](volume)) if haC>haC[1]*(1+cutoff/1000) AND vtr>=vtr[1] THEN tosum = vc ELSIF haC<haC[1]*(1+cutoff/1000) AND vtr>vtr[1] THEN tosum = -vc ENDIF SVAPO = tema[period](summation[period](tosum)/(vave+1)) hi = devH*STD[stdevper](SVAPO) lo = -devL*STD[stdevper](SVAPO) RETURN SVAPO as "SVAPO", hi as "deviation High", lo as "deviation Low", 0 as "zero ref" |

Share this

No information on this site is investment advice or a solicitation to buy or sell any financial instrument. Past performance is not indicative of future results. Trading may expose you to risk of loss greater than your deposits and is only suitable for experienced investors who have sufficient financial means to bear such risk.

ProRealTime ITF files and other attachments :PRC is also on YouTube, subscribe to our channel for exclusive content and tutorials

Tout fonctionne bien dans cet indicateur? Quelle est la variable “Seuil” dans le code? Pourquoi est il basé sur du Hekin-Ashi?

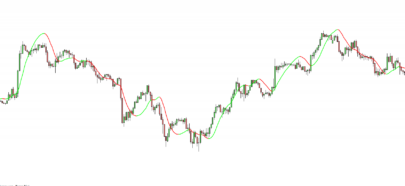

Oui il fonctionne, il faut que l’instrument analysé possède des Volumes. La variable “seuil” = cutoff, est utilisé dans la comparaison du prix (exprimé en Heikin Ashi Close et non en Close pour un effet de lissage).