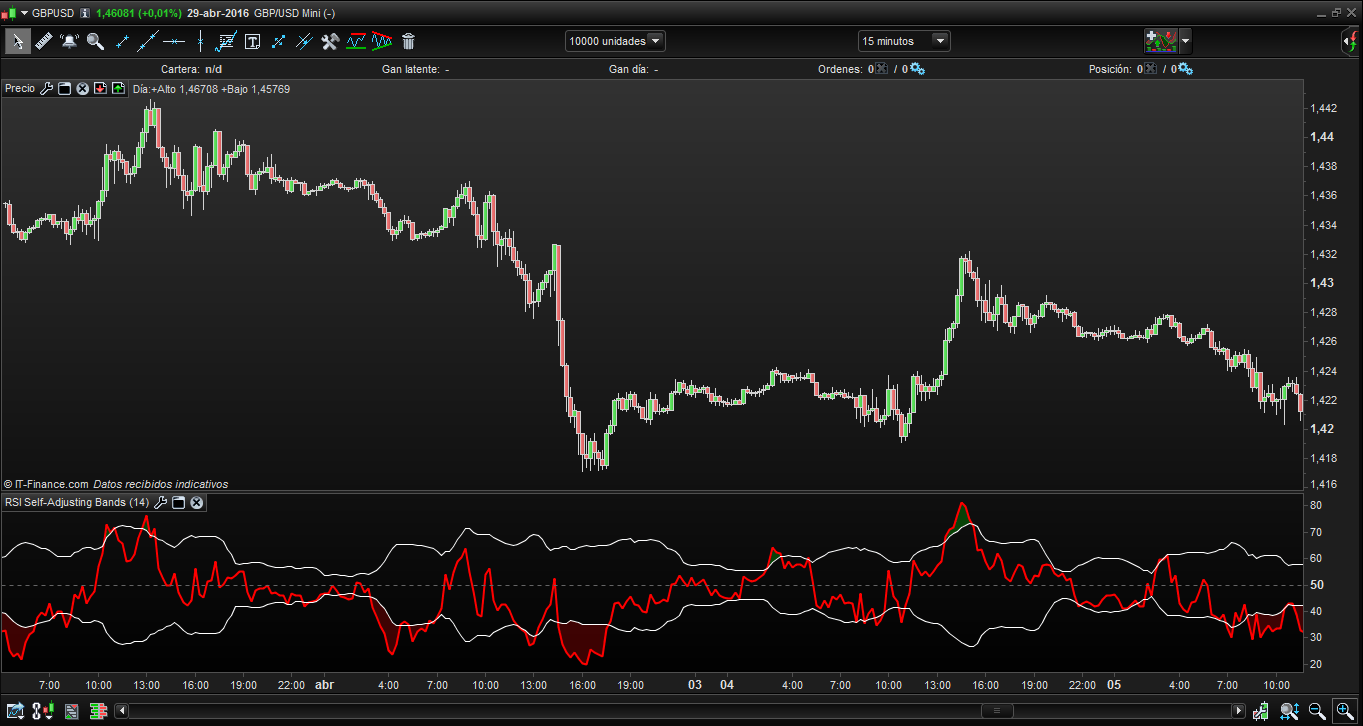

RSI modificado para que las bandas sean ajustables a la volatilidad, es parecido al indicador de Blai5 (RSI Avanzado con BV).

|

1 2 3 4 5 6 7 8 9 10 11 12 13 |

//Rsi con bandas Autoajustables por volatilidad modificada por Josep Bosch rsiplus = RSI[P](close) bsup = 50+ (1.8*STD(rsiplus)) binf = 50 - (1.8*STD(rsiplus)) bmedia = 50 RETURN rsiplus COLOURED(255,0,0) AS"RSI", bsup AS"High Band", binf AS"Low Band", bmedia AS "Center Band" |

Share this

No information on this site is investment advice or a solicitation to buy or sell any financial instrument. Past performance is not indicative of future results. Trading may expose you to risk of loss greater than your deposits and is only suitable for experienced investors who have sufficient financial means to bear such risk.

ProRealTime ITF files and other attachments :PRC is also on YouTube, subscribe to our channel for exclusive content and tutorials

Very nice and contribution much appreciated. Thank you! 🙂

Se puede anadir tambien las bandas 30 y 70 como supravendido / supracomprado//Rsi con bandas Autoajustables por volatilidad modificada por Josep Bosch

rsiplus = RSI[P](close)

bsup = 50+ (1.8*STD(rsiplus))

binf = 50 - (1.8*STD(rsiplus))

bmedia = 50

RETURN rsiplus COLOURED(255,0,0) AS\"RSI\", bsup AS\"High Band\", binf AS\"Low Band\", bmedia AS \"Center Band\" ,30 as \" 30 \" , 70 as \" 70 \"

Pour Nicolas

Ne peux t’on pas ajouter un bouton pour illustrer une suggestion par un graphe de l’indicateur ?

bonne journée

@supertiti, can you translate your code into English version PRT ? I copy and paste your code into new indicator, error the first line.

The bands 30 and 70 can also be added as supra-sold / super-purchased // RSI with volatile self-adjusting bands modified by Josep Bosch

P=14

rsiplus = RSI[P](close)

bsup = 50+ (1.8*STD(rsiplus))

binf = 50 – (1.8*STD(rsiplus))

bmedia = 50

RETURN rsiplus COLOURED(255,0,0) AS”RSI”, bsup AS”High Band”, binf AS”Low Band”, bmedia AS ”Center Band” ,30 as ” 30 ” , 70 as ” 70 ”