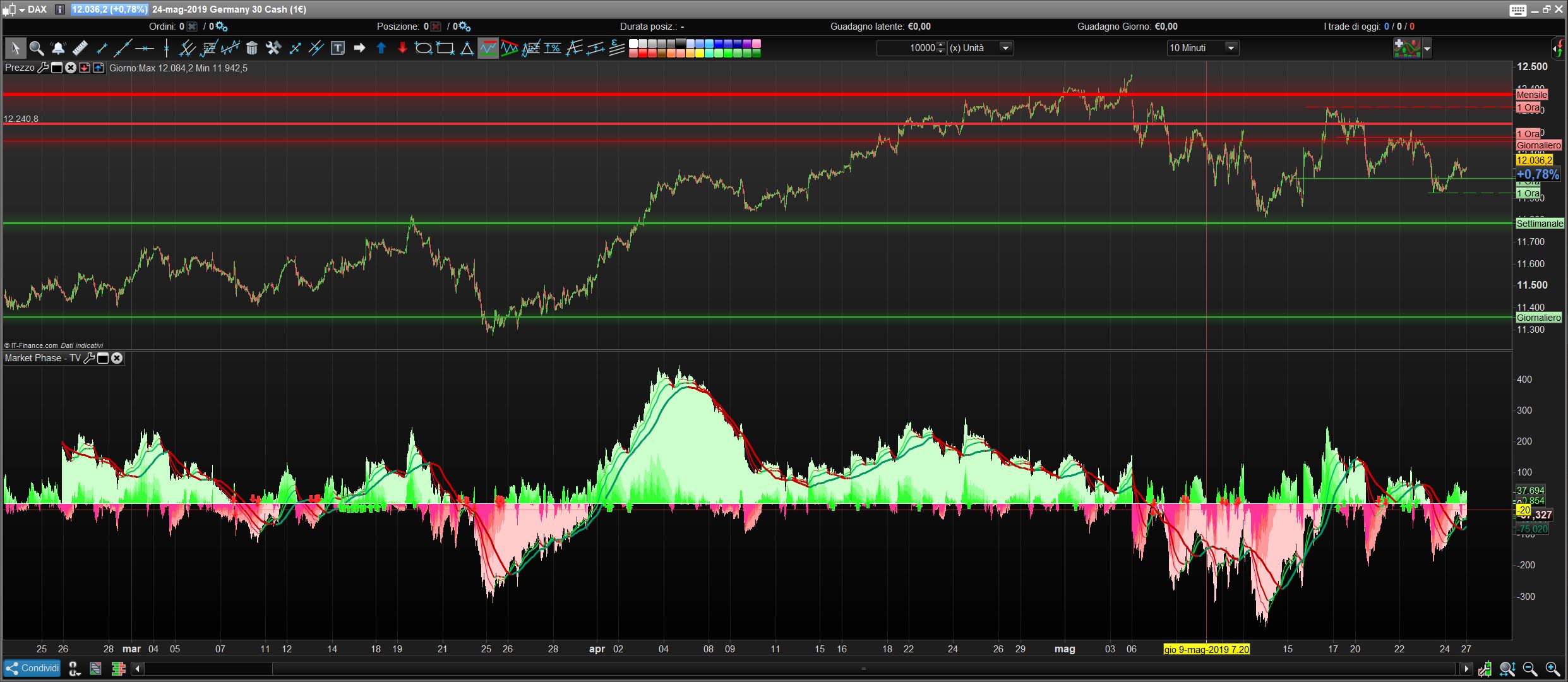

Inspired by a script seen on TradingView, I translated and adapted this indicator.

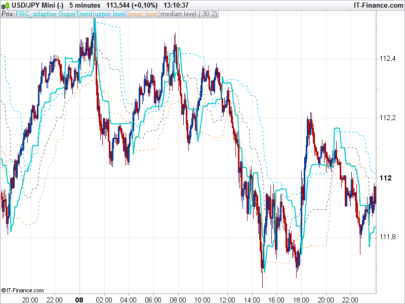

It shows the relation of price against different period moving averages.

The arrows indicates possible retracements in a general trend direction, so they can be used as entry point.

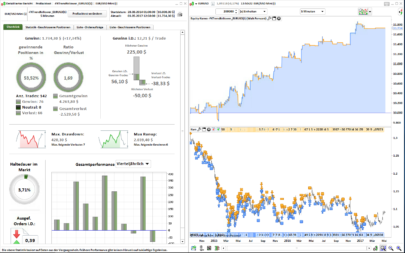

No ground breaking math here, but I am finding very useful and some algo based on it is giving good results in demo live.

|

1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 32 |

// This indicator shows the relation of price against different period ma's. // When put in daily Timeframe it gives the 1400 Day (= 200 Weekly) and the 200 ,100 an 50 Daily. // Features: // - The lines show the 200,100 and 50 ma in relation to the 1400 ma. // - The arrows indicate possible (retracement) entry points // Coded by AlexF ma50=close-ExponentialAverage[50](close) ma100=close-ExponentialAverage[100](close) ma200=close-Average[200](close) ma1400=close-Average[1400](close) dma50=ma1400-ma50 dma100=ma1400-ma100 dma200=ma1400-ma200 if dma50<dma50[1] and dma100<dma100[1] and dma200<dma200[1] and ma50<0 and ma100<0 and ma200<0 and ma1400<0 then trend=-1 elsif dma50>dma50[1] and dma100>dma100[1] and dma200>dma200[1] and ma50>0 and ma100>0 and ma200>0 and ma1400>0 then trend=1 elsif trend<>1 or trend<>-1 then trend=0 endif if trend=-1 and ma50 crosses under 0 then drawarrowdown(barindex,ma50+5*pipsize)coloured(255,0,0) endif if trend=1 and ma50 crosses over 0 then drawarrowup(barindex,ma50-5*pipsize)coloured(0,255,0) endif return ma1400 as "1400 phase",ma200 as "200 phase", ma100 as "100 phase", ma50 as "50 phase", dma50 as "50", dma100 as "100", dma200 as "200", 0 as "zero" |

Share this

No information on this site is investment advice or a solicitation to buy or sell any financial instrument. Past performance is not indicative of future results. Trading may expose you to risk of loss greater than your deposits and is only suitable for experienced investors who have sufficient financial means to bear such risk.

ProRealTime ITF files and other attachments :PRC is also on YouTube, subscribe to our channel for exclusive content and tutorials

Please, could you tell me how can i to put yours colours on the indicator and how colour the zones.

Thanks and sorry for my english

AlexF, thanks for the market phase indicator; please, you could give an indication of how to set the resulting graph (color zones and line colors) in order to reproduce a visual effect similar to yours. Thanks again

Set the “phases” as histograms with different shades of green and red for above/below zero. Set the other ma values as lines.

Thanks for the post !

Have you tried it with the volume indicator, maybe it gives another good restriction /confirmation for a trading strategy?

At least I will try around with this indicator for a trendfollowing strategy.

KR Jan

I added the (boring) coloring coding to this indicator, see below, so the indicator will immediatly be colored when you add it,

// This indicator shows the relation of price against different period ma’s.

// When put in daily Timeframe it gives the 1400 Day (= 200 Weekly) and the 200 ,100 an 50 Daily.

// Features:

// – The lines show the 200,100 and 50 ma in relation to the 1400 ma.

// – The arrows indicate possible (retracement) entry points

// Coded by AlexF

ma50=close-ExponentialAverage[50](close)

ma100=close-ExponentialAverage[100](close)

ma200=close-Average[200](close)

ma1400=close-Average[1400](close)

dma50=ma1400-ma50

dma100=ma1400-ma100

dma200=ma1400-ma200

if ma50 < 0 then

r = 255

g = 0

b = 0

else

r = 0

g = 128

b = 0

endif

if ma100 < 0 then

r1 = 192

g1 = 0

b1 = 0

else

r1 = 51

g1 = 204

b1 = 51

endif

if ma200 < 0 then

r200 = 255

g200 = 51

b200 = 0

else

r200 = 153

g200 = 255

b200 = 102

endif

if ma1400 < 0 then

r14 = 162

g14 = 43

b14 = 30

else

r14 = 204

g14 = 255

b14 = 153

endif

if dma50 < 0 then

dr = 255

dg = 0

db = 0

else

dr = 0

dg = 128

db = 0

endif

if dma100 < 0 then

dr1 = 192

dg1 = 0

db1 = 0

else

dr1 = 51

dg1 = 204

db1 = 51

endif

if dma200 < 0 then

dr2 = 255

dg2 = 51

db2 = 0

else

dr2 = 153

dg2 = 255

db2 = 102

endif

return ma1400 coloured(r14,g14,b14)style(histogram) as "1400 phase",ma200 coloured(r200,g200,b200)style(histogram) as "200 phase", ma100 coloured(r1,g1,b1)style(histogram) as "100 phase", ma50 coloured(r,g,b)style(histogram) as "50 phase", dma50 coloured(dr,dg,db)style(line,3) as "50", dma100 coloured(dr1,dg1,db1)style(line,3) as "100", dma200 coloured(dr2,dg2,db2)style(line,3) as "200", 0 as "zero"

hello,

thanks, could you post somes algos suggestions to improve, based on this indicator?

Hallo Winnie37,

Not sure about your question,

I will have investigate if I can make a new trading algo for myself based on this indicator. I am a trendfollowing trader, so I hope this indicator can contribute..

yes. “No ground breaking math here, but I am finding very useful and some algo based on it is giving good results in demo live” in description; I investigate too but not very good results for the moment…

Also interesting to know what does not work, which set up you use, saves me investigating ! Do you mind sharing this ?

i just set the proorder like this: buy when 50/100/200 phase >0 and sell when under 0, good backtest but no effective trades in demo…strange thing…Ok to share 🙂