█ Overview

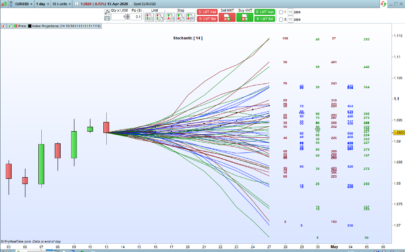

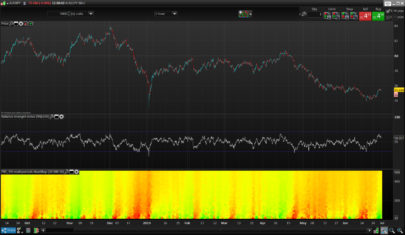

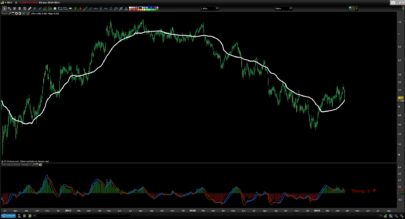

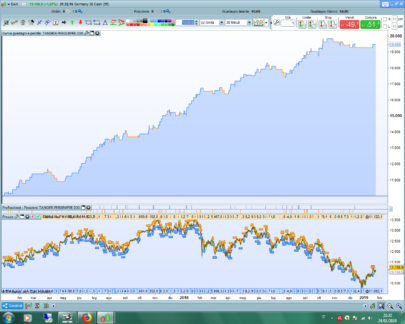

The MACD & RSI Overlay (Expo) trading indicator is a technical analysis tool that combines two popular indicators, the Relative Strength Index (RSI ) and the Moving Average Convergence Divergence (MACD ), and overlays them onto the price chart. The indicator oscillates relative to price, so it plots the RSI and MACD around price while still displaying the same insights as the regular MACD and RSI indicators. This feature gives traders a unique perspective, allowing them to see the relationship between price, momentum, and trend in a single chart.

This indicator is a valuable addition to any trader’s technical analysis toolkit, whether they are a beginner or an experienced trader.

█ MACD

█ RSI

The RSI comes with overbought and oversold areas, which can be set by the trader.

█ MACD & RSI

█ Trend Feature

What sets the MACD & RSI Overlay indicator apart is its ability to factor in the underlying trend. This feature makes the indicator more useful than ever before, as traders can use it to filter trades in the direction of the trend. By considering the underlying trend, traders can gain valuable insights into market trends.

..

█ Benefits

One of the primary benefits of having the MACD and RSI plotted directly on the price chart is that it provides a more intuitive understanding of the relationship between price, momentum, and trend. Traders can quickly identify the direction of the trend by observing the price movement relative to the MACD and RSI lines. In addition, by having these indicators plotted on the chart, traders can quickly identify potential buy and sell signals and develop new trading strategies.

█ How to use

One of the most popular strategies is to use the MACD & RSI Overlay indicator to look for crossings. A crossing occurs when the MACD and RSI lines cross over each other or when they cross over the signal line. These crossings can signal potential trend reversals and momentum shifts. For example, if the MACD line crosses over the signal line from below, it could indicate a bullish signal, while a cross from above could indicate a bearish signal.

—————–

Disclaimer

The information contained in my Scripts/Indicators/Ideas/Algos/Systems does not constitute financial advice or a solicitation to buy or sell any securities of any type. I will not accept liability for any loss or damage, including without limitation any loss of profit, which may arise directly or indirectly from the use of or reliance on such information.

All investments involve risk, and the past performance of a security, industry, sector, market, financial product, trading strategy, backtest, or individual’s trading does not guarantee future results or returns. Investors are fully responsible for any investment decisions they make. Such decisions should be based solely on an evaluation of their financial circumstances, investment objectives, risk tolerance, and liquidity needs.

My Scripts/Indicators/Ideas/Algos/Systems are only for educational purposes!

Share this

No information on this site is investment advice or a solicitation to buy or sell any financial instrument. Past performance is not indicative of future results. Trading may expose you to risk of loss greater than your deposits and is only suitable for experienced investors who have sufficient financial means to bear such risk.

ProRealTime ITF files and other attachments :PRC is also on YouTube, subscribe to our channel for exclusive content and tutorials

Very nice job !

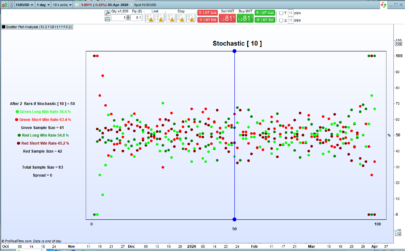

Is it possible to do the opposite because what interests me is to have the price curve on a stochastic indicator.

THANKS.

Sincerely.

Hi Matriciel, how can we do this, because stochastic is limited between 0 and 100 but price can be higher ? Thank you

Dear zeiiermantrading,

I really like your approach combining adaptive averages with MACD in addition with fast RSI and scaling factors. This allows you to find very good entry points.

However, I wonder, if you could help me to understand your ama, MACD and RSI calculation. It does not seem to be equal with the official formulas, e.g. like AMA = AdaptiveAverage[Period,FastPeriod,Slowperiod](close).

Would you be so kind to share your ideas with your approach to calculate e.g. “imacd” or “pma”?

Thanks in advance,

Michael