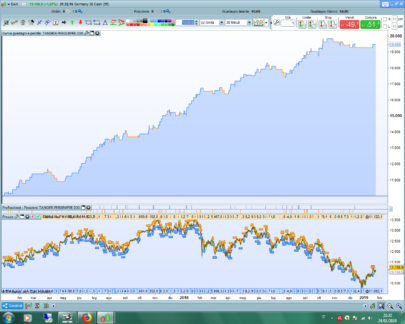

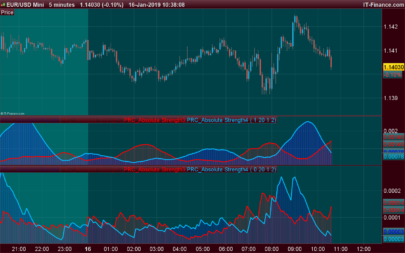

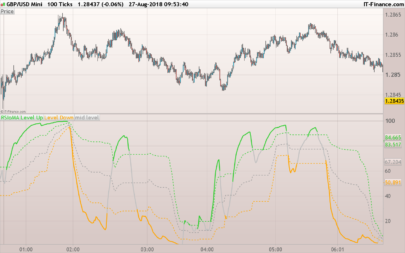

LBR RSI indicator is a 3 periods RSI (Relative Strength Index) of the momentum change (using ROC, Rate Of Change indicator of 1 period).

This pattern uses a one-period rate of change or ‘momentum’ function. This is simply the difference between today’s close and yesterday’s close. I.e., if today’s closing price is 592 and yesterday’s closing price was 596, the difference is -4. A three-period RSI of this one-period change is calculated.

|

1 2 3 |

lbrrsi = rsi[3](roc[1]) return lbrrsi style(line,2), 30 style(dottedline) as "level 30", 70 style(dottedline) as "level 70" |

Share this

No information on this site is investment advice or a solicitation to buy or sell any financial instrument. Past performance is not indicative of future results. Trading may expose you to risk of loss greater than your deposits and is only suitable for experienced investors who have sufficient financial means to bear such risk.

ProRealTime ITF files and other attachments :PRC is also on YouTube, subscribe to our channel for exclusive content and tutorials

Ciao Nicolas scusa se ti scrivo qui, ma sono nuovo e nn riesco a creare un nuovo post, cioè nn so proprio dove scrivere con il cellulare puoi aiutarmi. Grazie

Scusa nn riesco.

If you smooth the signal using a “summation” function, you get a nice “crossing of 0” graph. Summation acts in this case like an “Integral” function.

Try by substituting

lbrrsi = rsi[3](roc[1])

by

lbrrsi = (summation[8](rsi[3](roc[1])))/8

Thanks a lot for your continuous and extremely useful contributions.

Greatly appreciated Nicolas!