Hi guys,

I had time to work a little bit on my trading systems.

I have developed a V2 of the Pathfinder swing template. The following new features are possible now:

- one template for long and short trades

- payout a certain amount of money

- an optional accumulation mode for very bullish or bearish times

The V2 template is backward compatible and can be used in the same way as V1. The new features offer more opportunities and flexibility for the Pathfinder swing robots especially for short trading.

Please find attached some samples for DAX and HANGSENG.

DAX:

- comparison of V1 and V2 for March/April

- short robot for August/September

HANGSENG

Best, Reiner

Hi Guys,

Living in the U.K we’re using pro real time via I.G index. We know that a lot of the swings are based on mini contracts but we are unable to find the appropriate ones through I.G . I presume I.G do not offer mini contracts.

So guys…. Living in the U.K what would be the best way to trade manually for e.g Dax mini ? Hopefully this will help clear it up for others too.. Thanks Reiner for your new post, I’ll be looking into great detail soon.

cheers,

John

wp01

wp01Participant

Master

@John,

IG UK offers the same mini’s as all other countries. In attached link you will find the value after the slash.

https://www.ig.com/uk/indices-cfd-product-details

If you go to your platform to the left you see all the markets. When you scroll down to the bottom you’ll find all the mini’s.

In PRT just give in the code from the picture in the upper left corner.

For specific UK issues (like spread betting) maybe someone from the UK can answer them.

Good luck.

Patrick

here are some explanations for the new Pathfinder swing V2 features:

ONCE maxProfit = 5000 // payout certain amount of money

Pathfinder swing idea based on the concept that the robots accumulate positions in the correction of a potential up trend. This logic means that most of the positions are in loss at the beginning and I have the feeling that this is hard for some of the traders. With the variable maxProfit the position will closed at the next open bar if the profit is above that level. With this little logic the number of profitable trades can be increase but of course it will limit the potential profit as well.

ONCE accumulationModeLong = 0 // 0 - off, 1 - on

ONCE accumulationModeShort = 0 // 0 - off, 1 - on

As mentioned above we expect that based on statistical analysis the price will probably recover after a correction. In V1 the algo cumulates carefully but if we know we are probably in a very bullish or bearish setup we can accumulate more aggressively. I have added two further conditions for cumulation but take care higher positions mean higher drawdowns as well. If the accumulation mode is switched off it works like in V1.

previousDailyHigh = DHigh(2)

previousDailyLow = DLow(2)

//...

// long position conditions

l1 = signalline CROSSES OVER dailyHigh

l2 = signalline CROSSES OVER previousDailyHigh // used only if accumulation mode is active

// short position conditions

s1 = signalline CROSSES UNDER dailyLow

s2 = signalline CROSSES UNDER previousDailyLow // used only if accumulation mode is active

// long entry with order cumulation

IF (l1 AND f2) OR ( accumulationModeLong = 1 AND (l2 AND f2) ) THEN

V2 can used for short trading now. The logic is controlled by the well known saisonal settings -multiplier.

ONCE May1 = -1

ONCE May2 = -1

ONCE June1 = 0

ONCE June2 = -1

// short entry with order cumulation

IF (s1 AND f1) OR ( accumulationModeShort = 1 AND (s2) ) THEN

IF saisonalPatternMultiplier < 0 THEN

IF (COUNTOFPOSITION + (positionSize * ABS(saisonalPatternMultiplier))) <= maxPositionSize THEN

SELLSHORT AT MARKET

ENDIF

ENDIF

// close long position only

IF saisonalPatternMultiplier > 0 THEN

SELL AT MARKET

ENDIF

ENDIF

Depending of the instrument short results are better if the accumulation mode for the long or short side is activated. Please be aware that you can’t trade long and short with the same robot.

Great to have some technical improvements from Reiner. Feels like having a brand-new fishing-rod for the next period. 🙂

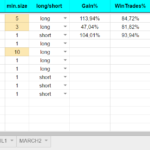

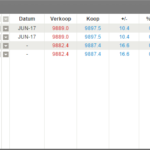

I have updated the dropbox and installed the HS short algo. I also added a long/short column in the comparison sheet.

I am looking forward to use the new V2 algo design for the instruments of MAY2.

About time to think for algos for the next season MAY2.

I have choosen instruments for long algos in the usual way and added some instruments to try out for short algos.

For short algos I have started with non-europe index instruments which have a lot of red zeros ahead from MAY2 (Roadmap). Hope we find a winner like this.

Please have a look at the attachment or comparison .

@Reiner and all: If you have additional remarks please let me know.

I have tried to do something with Gold, both May and June together and separately, but I can’t make it look good.

wp01

wp01Participant

Master

IG added US dollar basket 1 EUR into their platform for who is interested.

Kind regards,

Patrick

wp01

wp01Participant

Master

I’ve tried AEX May2.

Attached the results and the itf. file.

I don’t think it is good enough. Winning trades is 61% and the DD is € 2.200,00.

I created it with the Walkforward tests. What i was wondering while running the tests. Is it useful a walkforward test with “out of sample ” repetition when the code is

just for the first or second part of a month? In other words: when all periods are zero what is the use of a walkforward out of sample test?

Patrick

Now I have tried the rest for May2. I can’t get any good figures without over-optimising. Hopefully someone else can…

@wp01 maybe it is still useful if there is enough trades to base it on? I mean, the market is never exactly the same twice.

Best regards, David

wp01

wp01Participant

Master

One of the two Platinum positions just got stopped out @ 898,50 with a loss of € 622.53.

Patrick

Confirm:

| A2 |

27.04.2017 |

04.05.2017 |

|

|

Platin ($10 Mini) |

1 |

953,00 |

898,50 |

-5,72% |

-622,53 € |

People dont buy jewelery anymore?! :-\

Hi Guys,

Here are the Algos I tried.

Cacoa has not a good result. If somebody finds something better, go for it.