wp01

wp01Participant

Master

@Pfeiler,

regarding Soybeans:

The minimum contract size is for the mini 20 and not 0.5 as you say in you Excel sheet.

I think you mixed up Soybeans Meal with the Soybeans, because the Meal version is indead 0,5 contractsize.

I do not get any trades by the way if i change the code to 20. Don’t know what i’m doing wrong.

regards,

Patrick

wp01

wp01Participant

Master

@Pfeiler,

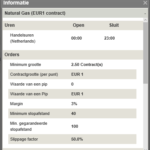

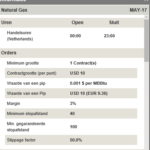

It looks like there is also a mix up with the Natural Gas.

The Natural Gas May future is 1 contract instead of 2,5 and the Nature Gas 1 EUR is 2,5 instead of 1. Just the other way around

as what is in the Excel sheet.

Maybe you can check this if this is also in the German version of IG.

Patrick

Thanks for your remarks guys!

Here is Soybean algo v2 for a minimum contract size 20. A bit risky, but the min. contract size is quite high.

For natural gas I fixed the comparison spreadsheet pnly, because generally I would like to prefer instruments without a time limit. Easier to handle, despite the min contract size.

@maleknf

No rejections for me today.

Best regards, David

wp01

wp01Participant

Master

Hi Pfeiler,

Regarding the US500. In the code you say positionsize 5. For April it says multiply 3, but the maximum positionsizelong=15. As i understand it correctly it can only take one time a position and not

have an accumulation. Did you do that on purpose? Because when i change the maximumcandlelong to 30 the PF improves from 5,64 to 8,24.

Thanks for your reply.

Patrick

Hi Guys,

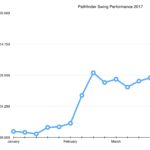

I hope you’re all well. I’m glad to see that still so many of you are interested in the Pathfinder trading ideas. Thank you @pfeiler and the others for your faithful support.

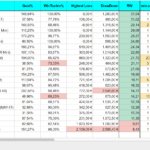

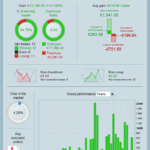

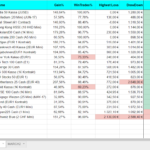

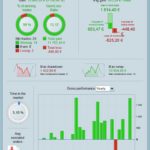

The first quarter is over and I wanted to inform you about the Pathfinder results so far. Please find attached the track record of all Pathfinder systems (seven 4H and all swing versions).

- Pathfinder systems made 75 trades in the first quarter

- the profit of all robots is 10.425 Euro after fees

- highest drawdown related to the account size of 100k was 2.440 Euro

- best robot is Davids 4H version for the Hang Seng with amazing 47k HKD gain

- number of profitable swing trades is currently over 71%

Equity curve is stable and currently at the all time hight. Drawdown seems to be moderate.

The combination of the two Pathfinder approaches (4H breakout and daily buy the correction in an up trend) seems to be a profitable idea so far.

I wish you all good trades.

Best, Reiner

It is great to hear from you, Reiner.

I hope you are ok with it, that I have taken control of PF-Swing and don’t mind that I will continue the idea, for the time being.

Your ideas and your insights are always welcome!

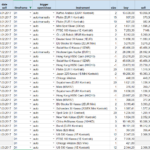

In the attachment you guys can see all my trades with PF Swing in live system so far.

The trades sum up to a year total of 5.137,57 € with a loss of 512,29 € in the month march. The Spot Gold trade really did hurt.

@Patrick: Yes .. you are right. I created a V2 and changed the value to 30.

I have installed successfully all 22 algos for APRIL1 and uploaded a final package “Pathfinder Swing 04 APR1 v04.zip” to dropbox including the changes from the latest remarks (Soybean, US500).

Fishernets are thrown out, lets hope the sea brings us a lot of fish!

Thanks everyone for your contributions. 🙂

wp01

wp01Participant

Master

Hi Pfeiler,

Jimbob already mentioned it in post 30362 but in the code from the STFX EUR Stocks 50 the maximum candle is “0”.

“maxPositionSizeLong = MAX(0, abs(round(maxRisk / (close * stopLossLong / 100) / PointValue) * pipsize)) “

As far as i could see this was not changed in today’s upload.

I think there will not be many trades when this is zero. If you change it to 15 it is less interesting to trade.

Regards,

Patrick

Patrick,

That was my mistake to begin with.

If you set it to 1 instead of 0 the results are the same.

Best regards, David

wp01

wp01Participant

Master

David,

I saw your reply under that post but actually i didn’t understand it.

april1=2, with 1 position. how is it than useful to maxPositionsizeLong=1?

Should it be at least 2 to trigger it and when it is in position it won’t accumulate?

Or do i get it all wrong? Sorry for the misunderstanding.

Thanks.

Patrick

Patrick,

No misunderstanding.

It seems as though the backtest does not take all variables into consideration at all times.

Yes, I screwed this one up. The results are completely different if the maxposition is set to a higher number.

I know it is last minute, but here is an alternative.

wp01

wp01Participant

Master

Thanks David.

I’m not sure but i thought the day candles were a day behind. If this is the case than trades on Monday will be from Friday 31st. And that were the March2 algo’s.

Regards,

Patrick

If of any interest, here is STXE for April1 only.