If you have followed the thread found here: https://www.prorealcode.com/topic/profitable-strategy-that-work-on-any-market/

You will be aware that I have placed a challenge to the forum to create a universal market neutral strategy. In other words a strategy that can be adapted to any market without ANY optimization. Below is my attempt at exactly this. I have opted to add a trading time filter as all markets have their sweet spot.

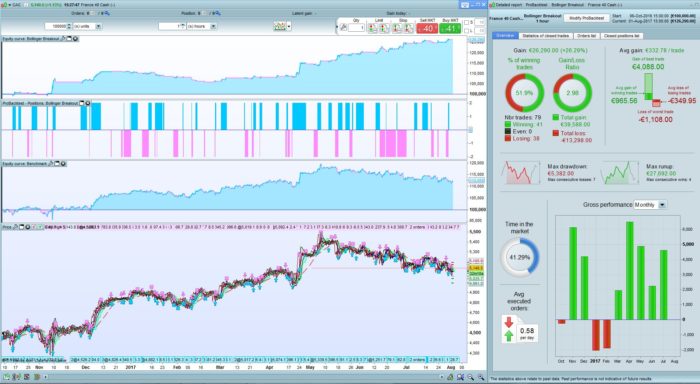

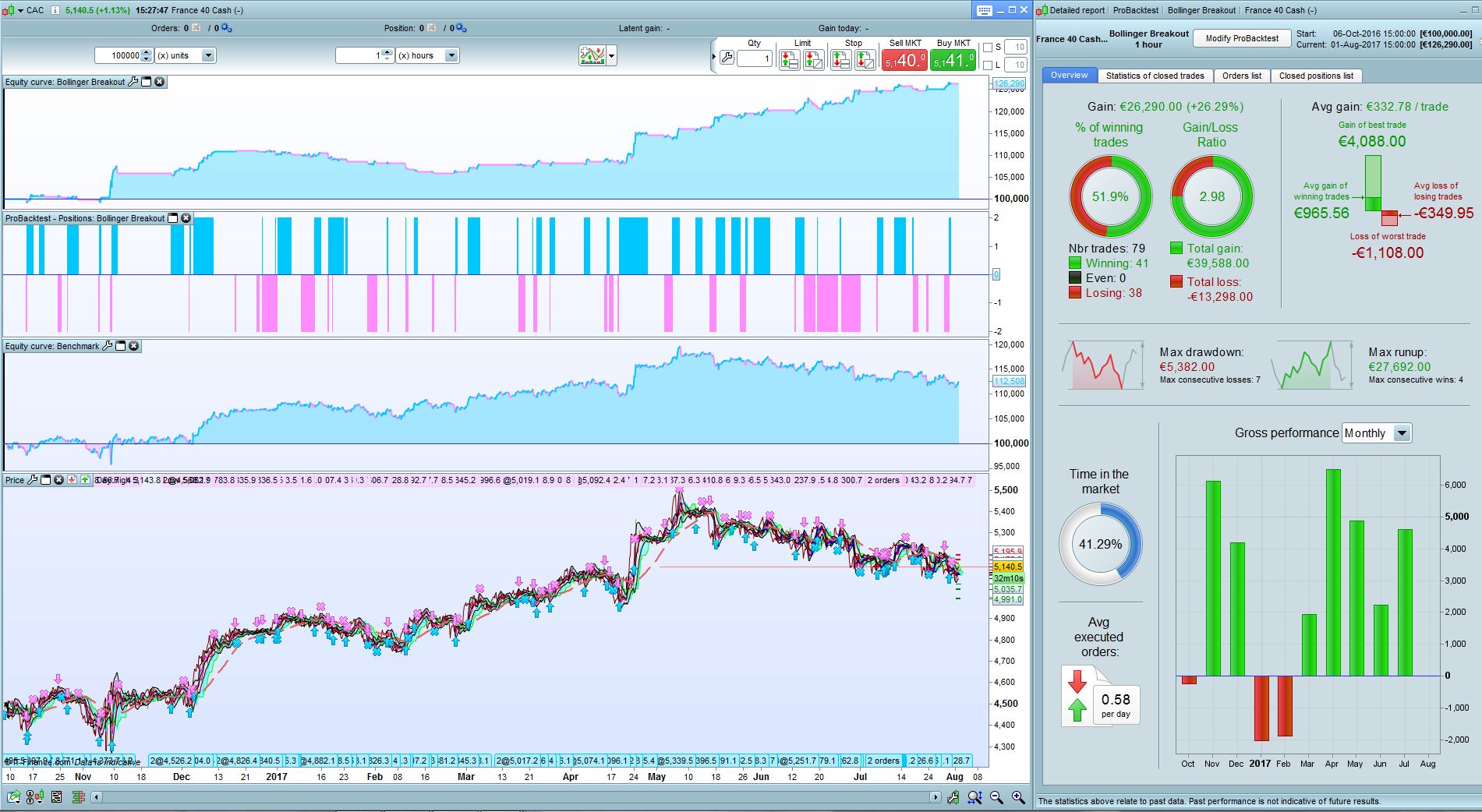

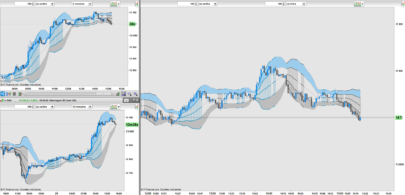

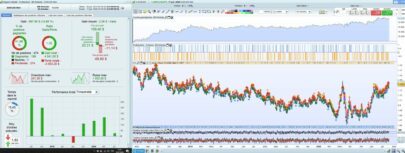

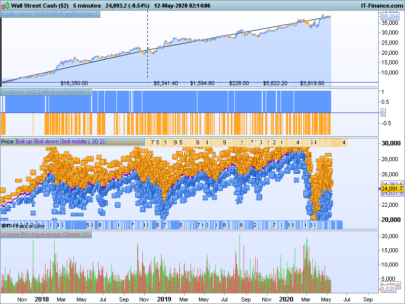

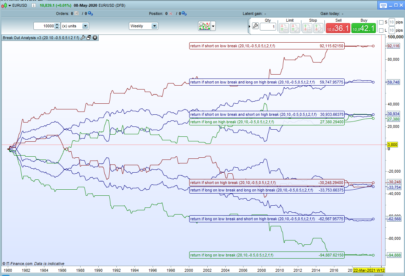

No variables have to be optimized for this strategy to work other than the trading time and spread. Attached is 2 screenshots of the same code executed on 2 different markets (same 1Hr timeframe but different spreads) where in both instances the code has significantly outperformed Buy and Hold. Spread on CAC40 set to 3 and spread on ZAF40 set to 20.

Note that this strategy was not meant to be a jaw dropper in terms of performance but rather a proof of concept that a single strategy can be applied to different markets with positive results. Obviously optimizing this strategy to individual markets will yield better results but that was never the idea. Hopefully the whole ProRealCode community can benefit from this (and even improve on it).

|

1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 32 33 34 35 36 37 38 39 40 41 42 43 44 45 46 47 48 49 50 51 52 53 54 55 56 57 58 59 60 61 62 63 64 65 66 67 68 |

//Stategy: Universal Bollinger Breakout/Reversal //Author: Juan Jacobs //Market: Neutral //Timeframe: 1Hr but not timeframe dependant DEFPARAM CumulateOrders = False // Cumulating positions deactivated If hour > 0 and hour < 18 then //(CAC: 0-18, ZA: 0-18, DAX: 9-13,OMX: 8-11, US: 8-16, FTSE: 15-22, DOW: 8-22, EUR/USD: 9-23, AUD/USD: 3-17, GBP/USD: 10-23, EUR/GBP: 0-13, USCrude: 17-21, BrentCrude: 16-22, Gold: <2 or >22) possize = 2 Else possize = 0 EndIf If dayofweek >= 5 and hour > 22 Then If longonmarket Then Sell at market ElsIf shortonmarket Then Exitshort at market EndIf EndIf // Conditions to enter long positions Periods = 42 Deviations = 1.618 PRICE = LOG(customclose) alpha = 2/(PERIODS+1) if barindex < PERIODS then EWMA = AVERAGE[3](PRICE) else EWMA = alpha * PRICE + (1-alpha)*EWMA endif error = PRICE - EWMA dev = SQUARE(error) if barindex < PERIODS+1 then var = dev else var = alpha * dev + (1-alpha) * var endif ESD = SQRT(var) BollU = EXP(EWMA + (DEVIATIONS*ESD)) BollL = EXP(EWMA - (DEVIATIONS*ESD)) LongMA = Average[100](close) RS2 = RSI[2](close) ATR = AverageTrueRange[2](close) If close > LongMA and RS2 > 70 and close[1] > BollU and close > BollU and open > open[2] Then Buy possize contract at market ElsIf close > LongMA and RS2 < 50 and close[1] > BollU and close < BollU Then Sellshort possize contract at market EndIf If close < LongMA and RS2 < 40 and close[1] < BollL and close < BollL and open < open[2] Then Sellshort possize contract at market ElsIf close < LongMA and RS2 > 50 and close[1] < BollL and close > BollL Then Buy possize contract at market EndIf If longonmarket and ((close < close[1] - ATR and RS2 < 5)) Then Sell at market ElsIf shortonmarket and ((close > close[1] + ATR and RS2 > 95)) Then Exitshort at market EndIf |

Share this

No information on this site is investment advice or a solicitation to buy or sell any financial instrument. Past performance is not indicative of future results. Trading may expose you to risk of loss greater than your deposits and is only suitable for experienced investors who have sufficient financial means to bear such risk.

ProRealTime ITF files and other attachments :PRC is also on YouTube, subscribe to our channel for exclusive content and tutorials

Thanks for this interesting concept. I successfully test the strategy on DAX and Bund (same kind of results as your other tests on SAF40 and CAC40), but I’m not able to get relevant backtests on other timeframes than 1 hour, and because you stated that this trading strategy is “non timeframe dependent”, that’s why I’m talking about it. Good job!

I just want to expand a bit on the mechanics of how this strategy should theoretically perform in both ranging and trending markets. The idea is that in a ranging market you would likely see Bollinger reversals between the bands whereas in a trending market you would see a successful Bollinger breakout. This strategy aims to take advantage of both. Then also just to be fair (in answering Nicolas’s question above) although I mentioned the strategy to be timeframe independent, it would more accurate to just call it market neutral. The above set of ‘static’ variables is more suited to a specific timeframe. For lower timeframes such as the 5min chart, a smaller MA such as 50 would likely be ‘more’ suited along with an ATR[1] period. However once configured for an timeframe, it should be compatible between different markets on that timeframe.

@nicolas it would be interesting to see the 200k bar backtests of the CAC40 and SAF40, if you can post them? Would also be interesting to see if another trading time-frame is maybe better suited back then? I also think that maybe we can look into adding a different stop mechanism, maybe something like your trailing stop? The idea is for the PRC COMMUNITY to build onto this to get it to perform even better and more consistently on all markets.

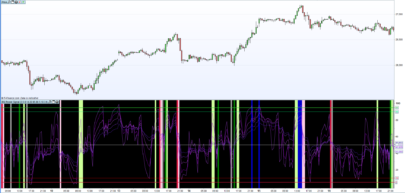

I have made a minor modification to the Exit criteria and the result is looking very promising (check the EUR/USD 1Hr with spread of 0.8) for example.

If longonmarket and ((close[2] > BollU and close[1] > BollU and close BollU and high[1] > BollU and high < BollU)) Then

LE = 1

ElsIf shortonmarket and ((close[2] < BollL and close[1] BollL) or (low[2] < BollL and low[1] BollL)) Then

SE = 1

EndIf

If ((close 95 Then

Sell at market

ElsIf ((close > close[1] + ATR) or (SE = 1)) and RS2 < 5 Then

Exitshort at market

EndIf

For above modification also add to the entry criteria to initialize the values;

‘LE = 0’ below every ‘Buy possize contract at market’

‘SE = 0’ below every ‘Sellshort possize contract at market’

@Nicolas I see it also significantly brings down the drawdown on the CAC40.

Btw why is the Add PRT Code function not working on here? Also cannot attach screenshots, there are some very sexy curves on for instance the EUR/USD that need some showing off.

To follow new developments or get the latest version of this strategy please visit the forum:

https://www.prorealcode.com/topic/profitable-strategy-that-work-on-any-market/

Hello Juan, I wanted to test Universal Strategy via a demo account on PRT but nothing happens, the auto trading is in process but nothing occured after 6 hours, the screen has no orders at all. What could be the problem to your opinion? Cheers.

@juanj wondering if you may help me please. I am looking for a simply strategy to use on the South African Alsi through IG markets, would you be able to discuss this with me? Thanks