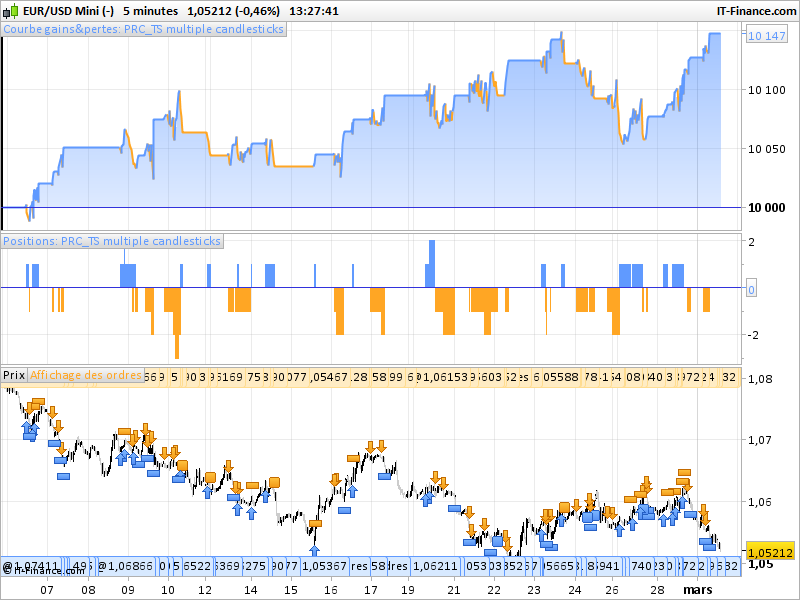

Principle of multi-candle trading strategy:

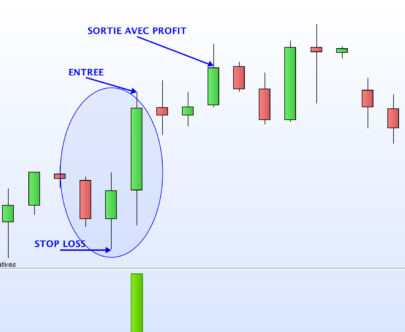

The automated trading strategy expects X consecutive candles having the same direction to open a position.

Example: the chart has just formed 6 consecutive bulbs, and I want that at the opening of the 7th candle, the system automatically opens a trade short (with stop loss and take profit).

Parameters and Options:

- Size of the position: in number of lots.

- Stop loss: to determine how many pips / points of the entry price will be positioned the stop loss of an opened position.

- Take Profit: To determine how many pips / points of the entry price will be positioned the take profit of an open position.

- Number of candles to wait: to determine the number of consecutive candles having the same meaning to wait.

- Trade inverse: true / false, this option allows you to choose whether the opening of the trade will be in the same direction or the reverse of the X consecutive candles.

Example: If the option is set to “False”, the system opens a purchase after X candles bullish. Conversely, if the option is set to “True”, the system then opens a sale after X candles bullish. In other words: on False, the system opens positions in the direction of the movement during formation. On True, the system opens positions against the trend of the movement being formed.

- Trading accumulation: true / false, this option is used to fix whether the system should (or should not) open a new position if the spark plug X + 1 is also in the same direction as the previous X candles. Example: If the option is set to “False”, the system waits at least X candles after opening a new position. If the option is set to “True”, the system can then cumulate new positions directly to each subsequent candlestick.

Example 1 of the multi-candle system:

1/10 2/30 3/60 4/7 5 / True 6 / False This setting causes the system to wait 7 consecutive bullish or bearish candles to open a counter-meaning trade to the 8th candle. If this 8th candle also closes in the same direction as the previous 7 candles, the system does not open a new position at the opening of the 9th candle. * * Having already opened a position, the system waits again 7 consecutive candles From the 8th candle to possibly open a new position (if these candles from 8 to 14 are all in the same direction)

Example 2 of the multi-candle system:

1/10 2/30 3/60 4/3 5 / False 6 / True This setting means that the system expects 3 consecutive bullish or bearish candles to open a trade in the same direction to the 4th candle. If this 4th candle also closes in the same direction as the previous 3 candles, the system opens a new position directly at the opening of the 5th candle.

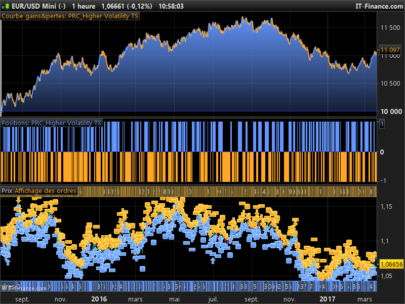

This trading strategy has been coded by a request on the French forum. Please consider that there is no typical settings and it is not dedicated to any instrument or timeframe at all. This strategy is almost like a “sandbox” for studying purpose and to define suitable parameters for your preferred instruments.

|

1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 32 33 34 35 36 37 38 39 40 41 42 43 44 45 46 47 48 49 50 51 52 53 54 55 56 57 58 59 60 61 62 63 64 65 66 67 68 69 70 71 72 73 74 75 76 77 78 |

//PRC_TS multiple candlesticks | indicator //01.03.2017 //Nicolas @ www.prorealcode.com //Sharing ProRealTime knowledge // --- parameters Size = 1 //position size StopLoss = 20 //stoploss in points TakeProfit = 10 //takeprofit in points Xcandlesticks = 6 //consecutive bullish or bearish candlesticks to open a new position InverseTrading = 0 //(0=false ; 1=true) trade in the same direction of the candlesticks pattern or not CumulateOrder = 0 //(0=false ; 1=true) cumulate or not a new trade if the current candlestick is in the same trend as the pattern // ------------ //detecting patterns bearpattern = summation[Xcandlesticks](close<open)=Xcandlesticks bullishpattern = summation[Xcandlesticks](close>open)=Xcandlesticks //first order if not onmarket then if bearpattern then if InverseTrading then BUY Size CONTRACTS AT MARKET else SELLSHORT Size CONTRACT AT MARKET endif lastbar = barindex lastpattern = -1 endif if bullishpattern then if InverseTrading then SELLSHORT Size CONTRACT AT MARKET else BUY Size CONTRACTS AT MARKET endif lastbar = barindex lastpattern = 1 endif endif //cumulate order when a new pattern occurred if onmarket and not CumulateOrder and barindex-lastbar>=Xcandlesticks then if bearpattern then if InverseTrading then BUY Size CONTRACTS AT MARKET else SELLSHORT Size CONTRACT AT MARKET endif lastbar = barindex endif if bullishpattern then if InverseTrading then SELLSHORT Size CONTRACT AT MARKET else BUY Size CONTRACTS AT MARKET endif lastbar = barindex endif endif //cumulate order when a new consecutive candletick happen right after the pattern occurred if onmarket and CumulateOrder and barindex-lastbar=1 then if longonmarket then if (close>open and lastpattern=1) or (close<open and lastpattern=-1) then BUY Size CONTRACTS AT MARKET lastbar = barindex endif endif if shortonmarket then if (close>open and lastpattern=1) or (close<open and lastpattern=-1) then SELLSHORT Size CONTRACT AT MARKET lastbar = barindex endif endif endif SET STOP PLOSS StopLoss SET TARGET PPROFIT TakeProfit |

Share this

No information on this site is investment advice or a solicitation to buy or sell any financial instrument. Past performance is not indicative of future results. Trading may expose you to risk of loss greater than your deposits and is only suitable for experienced investors who have sufficient financial means to bear such risk.

ProRealTime ITF files and other attachments :PRC is also on YouTube, subscribe to our channel for exclusive content and tutorials

Molto bello sui 15m da ottimi risultati !!!

This is just that I was looking for!! Thanks a lot.

I think it’s important to note that the SET STOP pLOSS will not be a combined STOP LOSS if Cumulative = 0. Each trade will have it’s own SET STOP pLOSS StopLoss.

Hello all and thanks for sharing scripts!

@Duck74: Did you try this scripts in real market?

Hello.

Great code.!

I’m just so amazed by your guys coding ability (I can’t code to save my life even though I’m in IT – but learning a lot from the masters here and learning myself)Played with this code with various options across various commodities/FX and Indices.Running this now on Gold-mini 1 £ on IG demo account. Looks promising so far.From my back testing looks like this code is runs almost any time frame from 2min right up past 20min timescale.

Thank you.

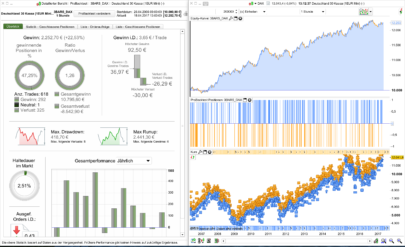

Thank you Nicolas, great code, I have tried with the Bund future, with daily framework and the results look pretty amazing.

//PRC_TS multiple candlesticks | indicator//01.03.2017//Nicolas @ http://www.prorealcode.com//Sharing ProRealTime knowledge// Stops and targets// Stops and targets

// — parametersSize = 100 //position sizeStopLoss = 25 //stoploss in pointsTakeProfit = 60 //takeprofit in pointsXcandlesticks = 5 //consecutive bullish or bearish candlesticks to open a new positionInverseTrading = 1 //(0=false ; 1=true) trade in the same direction of the candlesticks pattern or notCumulateOrder = 0 //(0=false ; 1=true) cumulate or not a new trade if the current candlestick is in the same trend as the pattern// ————

//detecting patternsbearpattern = summation[Xcandlesticks](close<open)=Xcandlesticksbullishpattern = summation[Xcandlesticks](close>open)=Xcandlesticks

//first orderif not onmarket thenif bearpattern thenif InverseTrading thenBUY Size CONTRACTS AT MARKETelseSELLSHORT Size CONTRACT AT MARKETendiflastbar = barindexlastpattern = -1endifif bullishpattern thenif InverseTrading thenSELLSHORT Size CONTRACT AT MARKETelseBUY Size CONTRACTS AT MARKETendiflastbar = barindexlastpattern = 1endifendif

//cumulate order when a new pattern occurredif onmarket and not CumulateOrder and barindex-lastbar>=Xcandlesticks thenif bearpattern thenif InverseTrading thenBUY Size CONTRACTS AT MARKETelseSELLSHORT Size CONTRACT AT MARKETendiflastbar = barindexendifif bullishpattern thenif InverseTrading thenSELLSHORT Size CONTRACT AT MARKETelseBUY Size CONTRACTS AT MARKETendiflastbar = barindexendifendif

//cumulate order when a new consecutive candletick happen right after the pattern occurredif onmarket and CumulateOrder and barindex-lastbar=1 thenif longonmarket thenif (close>open and lastpattern=1) or (close<open and lastpattern=-1) thenBUY Size CONTRACTS AT MARKETlastbar = barindexendifendifif shortonmarket thenif (close>open and lastpattern=1) or (close<open and lastpattern=-1) thenSELLSHORT Size CONTRACT AT MARKETlastbar = barindexendifendifendif

SET STOP pTrailing StopLossSET TARGET PPROFIT TakeProfit

Sorry I must add that it looks great only if we start the backtesting from 2008.

Im not familiar with the forum yet, I cant upload the image of the backtesting for some reason.

Apologies for this

You can’t upload images here, sorry.

Hi, I dont understand, when I do the backtest I get only drawdown and a big loos? Have I missed something?

Hi friends, is there any way to program the system to close the position when you have a longtrade an a bear candel is come ? thank you lg

Hello @Nicolas, thanks for this code! Just what i was looking for.

I’m fairly new to this but do you have any suggestions to implement a code that makes you able to set a certain close of the candlestick? Let’s say i want 4 consecutive bullbars but i want all of them close 60% of the candlestick or higher

Needs custom coding, ask for a mod in a dedicated topic, in the appropriate forum please.