Hi all,

This morning, one of you sent me an email, asking me to code a screener.

It applies on H4 timeframe, on stocks, indexes, ETF.

Here is the email and the screener…

Hello.

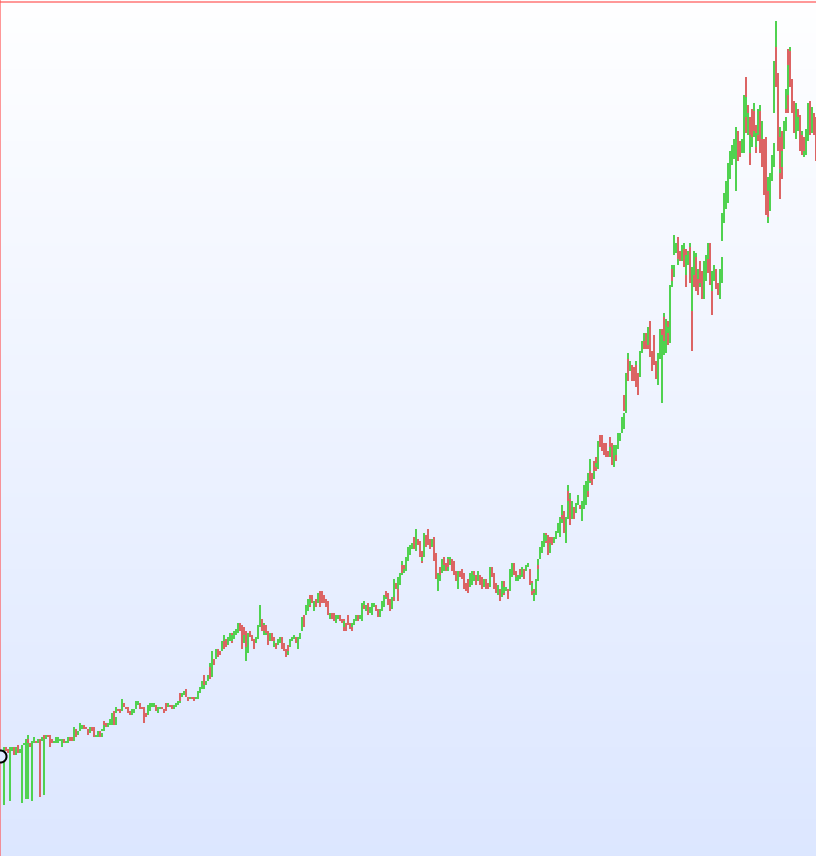

After analysis of several charts

M He was allowed to consist of a recurrent comportment during the etf and indices On the frame time 4 hours. The upward change is supported quad he gathered the following conditions. I appreciate if you can detail me a screener developer who could The MET:

#Frame Time 4 hours

# During the above or just exceed 30 EXP MM

# MS uptrend

MME # 30 above MS 150

# RSI just crossed 50 time in 3 frames precedent

# MACD Zero has inferior races and both come from the bullish cross has

Thank you d advance

Sincerely yours

(in French)

Bonjour.

Apres analyse de plusieurs charts

Il m a été permission de consistent un comportment recurrent des cours des etf et indices Sur le frame time 4heures . Le changement haussier est soutenu quad il reuni Les conditions suivantes . Je detail reconnaissant si vous pouvez me developer un screener qui put Les reuni:

#Frame time 4heures

# cours au dessus ou viens de depasser MM EXP 30

# MME de tendance haussier

# MME 30 dessus de MME 150

# RSI vient de franchir Les 50 dans 3 frames time precedent

# MACD inferior a Zero et Les deux courses viennent de se croiser a la haussier

Merci d advance

Bien a vous

|

1 2 3 4 5 6 7 8 9 10 11 12 13 14 |

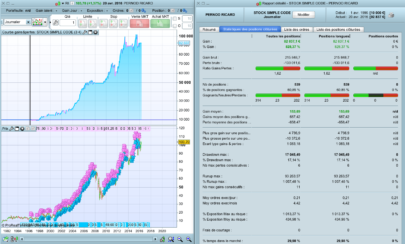

// PASSAGE HAUSSIER // TIMEFRAME H4 Timeframe(4 hours) c1 = close crosses over ExponentialAverage[30](close) or close[1] crosses over ExponentialAverage[30](close) or close[2] crosses over ExponentialAverage[30](close) c2 = ExponentialAverage[30](close) > ExponentialAverage[30](close[1]) c3 = ExponentialAverage[30](close) > ExponentialAverage[150](close) RSI14 = RSI[14] c4 = RSI14 crosses over 50 or RSI14[1] crosses over 50 or RSI14[2] crosses over 50 iMACD = MACD[12,26,9] c5 = (iMACD > 0 and iMACD[1] < 0) or (iMACD[1] > 0 and iMACD[2] < 0) or (iMACD[2] > 0 and iMACD[3] < 0) SCREENER[c1 and c2 and c3 and c4 and c5] |

Share this

No information on this site is investment advice or a solicitation to buy or sell any financial instrument. Past performance is not indicative of future results. Trading may expose you to risk of loss greater than your deposits and is only suitable for experienced investors who have sufficient financial means to bear such risk.

ProRealTime ITF files and other attachments :PRC is also on YouTube, subscribe to our channel for exclusive content and tutorials

Hi Doctrading,

Is it possible to flip this to a “going bearish” by simply switching the code direction?

Julio

Hello,

Yes, you can do it very simply…

Hi doctrading

i am the one who sent you the email

first thanks for the code . It really work quite.

I try it with a frame time daily and I discover it also work, still one question, Is it possible To add volume as filter in this code ? Can you do it ?

best regards