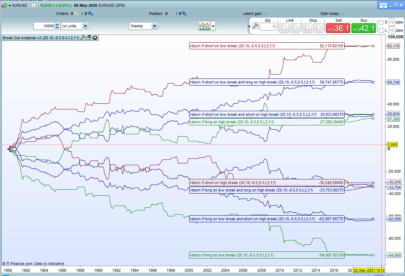

This breakout stocks screener come with my article here : http://www.prorealcode.com/blog/trading/stocks-breakouts-find-easily-proscreener/

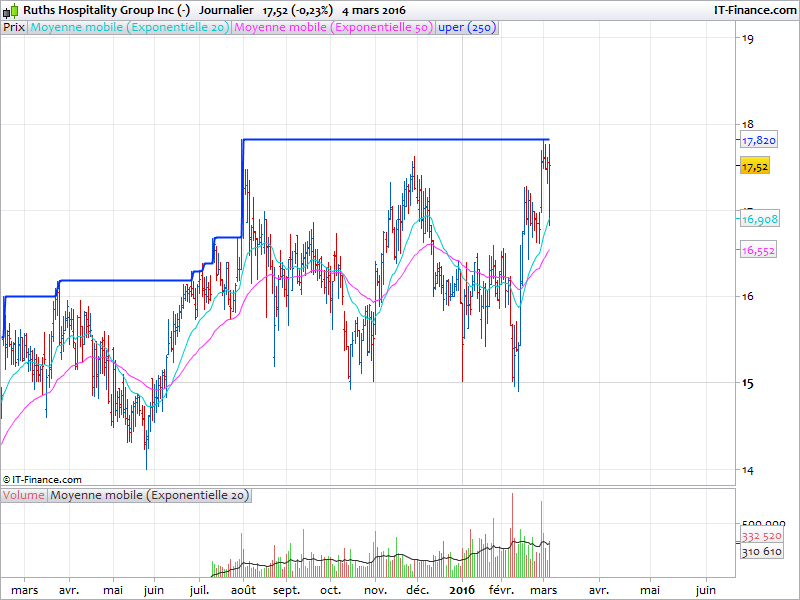

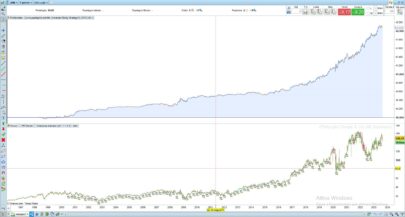

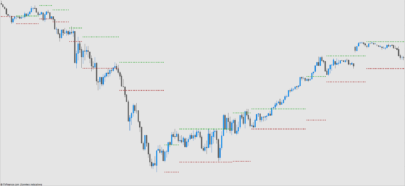

Its purpose is to find the current stocks that may breakthrough their recent 52 week high on a daily timeframe.

|

1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 |

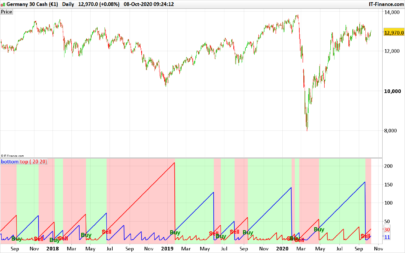

//bullish trend EMA1 = exponentialaverage[20](close) EMA2 = exponentialaverage[50](close) bullish = Close>EMA1 AND Close>EMA2 AND EMA1>EMA2 //near 52 week highest price FiftyTwoWeekHigh = highest[250](high) FivePercentBelow = 1-(Close/FiftyTwoWeekHigh)<5/100 //the recent 52 week high were created at least 3 days ago if FiftyTwoWeekHigh = FiftyTwoWeekHigh[1] AND FiftyTwoWeekHigh = FiftyTwoWeekHigh[2] AND FiftyTwoWeekHigh = FiftyTwoWeekHigh[3] THEN AtLeast3DaysAgo = 1 ELSE AtLeast3DaysAgo = 0 ENDIF AllConditions = bullish AND FivePercentBelow AND AtLeast3DaysAgo = 1 SCREENER [AllConditions] |

Share this

No information on this site is investment advice or a solicitation to buy or sell any financial instrument. Past performance is not indicative of future results. Trading may expose you to risk of loss greater than your deposits and is only suitable for experienced investors who have sufficient financial means to bear such risk.

ProRealTime ITF files and other attachments :PRC is also on YouTube, subscribe to our channel for exclusive content and tutorials

This stock screener has also been re-coded for bearish side to fetch breakdown stocks, as a request on ProScreener support forum, here : http://www.prorealcode.com/topic/breakdown-stocks-fetcher/

Hi, shouldn´t it be or instead of and? if FiftyTwoWeekHigh = FiftyTwoWeekHigh[1] OR FiftyTwoWeekHigh = FiftyTwoWeekHigh[2] OR FiftyTwoWeekHigh = FiftyTwoWeekHigh[3] THEN

Line 4 has a redundant term “Close>EMA2.” is not necessary as EMA2 will always be less than EMA1. So only needs

bullish = EMA1 > EMA2 AND Close > EMA1

Thanks

It a good job !