1) Introduction

The ZigZag indicator is a classic tool to filter out minor price fluctuations and highlight major swing points. The version presented here, ZigZag and SR, goes one step further by combining the swing structure with automatic support and resistance levels, as well as labels for trend classification.

This makes it particularly useful for traders who want a clean, structural view of price action without being distracted by noise.

2) What does “ZigZag and SR” add?

While a standard ZigZag only connects pivot highs and lows, this enhanced version introduces:

- Dynamic support and resistance levels (green/red dotted lines).

- Automatic trend labeling: Higher High (HH), Higher Low (HL), Lower High (LH), Lower Low (LL).

- Customizable visualization: the user can enable or disable the ZigZag lines, support/resistance, and labels.

- ATR-based positioning of labels to avoid overlap with price bars.

These features provide an intuitive chart overlay that helps traders quickly assess trend direction and key zones of interest.

3) How it works (step by step)

a) Pivot detection

The algorithm scans for pivot highs (highest[prd](high)) and pivot lows (lowest[prd](low)) over a user-defined lookback period (prd).

b) Direction of movement

Once a pivot is identified, the indicator determines the direction of the swing:

- Uptrend segment (

dir = 1) when a pivot high is confirmed. - Downtrend segment (

dir = -1) when a pivot low is confirmed.

A variable tracks changes of direction (dirchanged) to ensure the ZigZag only updates when a genuine swing reversal occurs.

c) ZigZag construction with arrays

Arrays ($zigzag, $zigzagidx, $dir) are used to store pivot levels, their bar indices, and direction.

When a new pivot is confirmed:

- If the trend has changed, a new segment is added.

- If the trend continues, the last segment is updated to extend to the new extreme.

This ensures the indicator always reflects the most relevant market swings.

d) Dynamic support and resistance

For every confirmed pivot, the indicator projects horizontal dotted lines forward in time:

- Green for support (pivot low).

- Red for resistance (pivot high).

These lines dynamically extend until a new structure point invalidates them.

e) HH, HL, LH, LL classification

Based on the relative position of new pivots compared to previous ones, the code labels swings as:

- HH (Higher High) or HL (Higher Low) in uptrends.

- LH (Lower High) or LL (Lower Low) in downtrends.

To avoid clutter, labels are shifted up or down using ATR(14) as a margin.

f) Efficient rendering with islastbarupdate

To optimize performance, the drawing routines are executed only when the last bar updates, preventing unnecessary redrawing across all candles.

4) Parameters and recommended settings

prd(default = 15): Defines the sensitivity of pivot detection.- Higher values → fewer swings, only major moves.

- Lower values → more swings, captures smaller fluctuations.

showSR(default = 1): Enables or disables the support/resistance dotted lines.showLabels(default = 1): Toggles the HH/HL/LH/LL labels.showZZ(default = 1): Toggles the ZigZag connecting lines.

These options give full flexibility: the user can display only the ZigZag, only support/resistance, or the complete setup.

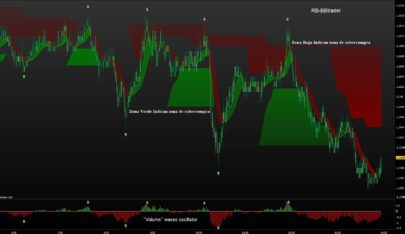

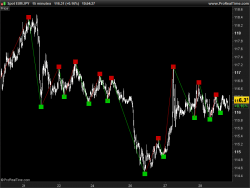

5) Reading the chart: practical cases

- Trending markets: The sequence of HH-HL or LL-LH clearly shows the dominant direction. Support and resistance levels confirm continuation or possible breakout points.

- Range-bound markets: The ZigZag alternates between highs and lows of similar magnitude, highlighting horizontal zones of equilibrium.

- Breakouts: When a support or resistance dotted line is breached, traders can quickly spot the transition to a new structural phase.

This makes the tool adaptable for both trend-following strategies and mean-reversion setups.

6) Limitations and best practices

- Repainting nature: As with all ZigZag indicators, the latest swing may repaint until a pivot is fully confirmed. This is not a bug but a characteristic of ZigZag logic.

- Choosing

prdwisely:- Use larger values on higher timeframes to capture meaningful structure.

- Use smaller values on intraday charts for short-term swing recognition.

- Timeframe sensitivity: The indicator adapts to any timeframe but behaves best when aligned with your trading horizon.

By understanding these nuances, traders can avoid common pitfalls and integrate the tool effectively into their workflow.

7) Code

|

1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 32 33 34 35 36 37 38 39 40 41 42 43 44 45 46 47 48 49 50 51 52 53 54 55 56 57 58 59 60 61 62 63 64 65 66 67 68 69 70 71 72 73 74 75 76 77 78 79 80 81 82 83 84 85 86 87 88 89 90 91 92 93 94 95 96 97 98 99 100 101 102 103 104 105 106 107 108 109 110 111 112 113 114 |

//------------------------------------// //PRC_ZigZag and SR //version = 0 //03.12.2024 //Iván González @ www.prorealcode.com //Sharing ProRealTime knowledge //------------------------------------// // Inputs //------------------------------------// prd=15 showSR=1 //Show Support and Resistance//Boolean// 0 means false 1 means True showLabels=1 //Boolean// 0 means false 1 means True showZZ=1 //Boolean// 0 means false 1 means True atr=averagetruerange[14](close) //------------------------------------// // Calculate Pivot High and Low //------------------------------------// ph = high=highest[prd](high) pl = low=lowest[prd](low) //------------------------------------// // Calculate Direction //------------------------------------// if ph and pl=0 then dir=1 elsif pl and ph=0 then dir=-1 else dir=dir endif dirchanged=dir<>dir[1] //------------------------------------// // Calculate ZizZag levels and x //------------------------------------// if ph or pl then if dirchanged then if dir=1 then $zigzag[t+1]=highest[prd](high) $zigzagidx[t+1]=barindex $dir[t+1]=1 t=t+1 elsif dir=-1 then $zigzag[t+1]=lowest[prd](low) $zigzagidx[t+1]=barindex $dir[t+1]=-1 t=t+1 endif else if dir=1 and highest[prd](high)> $zigzag[t] then $zigzag[t]=highest[prd](high) $zigzagidx[t]=barindex elsif dir=-1 and lowest[prd](low)< $zigzag[t] then $zigzag[t]=lowest[prd](low) $zigzagidx[t]=barindex endif endif endif //------------------------------------// // Draw ZigZag and Levels //------------------------------------// $zigzag[0]=undefined $zigzagidx[0]=undefined if islastbarupdate then if showZZ then //Last ZigZag drawsegment($zigzagidx[max(0,t-1)],$zigzag[max(0,t-1)],$zigzagidx[t],$zigzag[t]) endif if showSR and $dir[t]=1 then drawsegment($zigzagidx[t],$zigzag[t],barindex,$zigzag[t])style(dottedline,3)coloured("green") drawsegment($zigzagidx[max(0,t-1)],$zigzag[max(0,t-1)],barindex,$zigzag[max(0,t-1)])style(dottedline,3)coloured("red") if $zigzag[t]<$zigzag[t-2] then drawtext("HL",$zigzagidx[t],$zigzag[t]+0.5*atr)coloured("green") else drawtext("HH",$zigzagidx[t],$zigzag[t]+0.5*atr)coloured("green") endif elsif showSR and $dir[t]=-1 then drawsegment($zigzagidx[t],$zigzag[t],barindex,$zigzag[t])style(dottedline,3)coloured("red") drawsegment($zigzagidx[max(0,t-1)],$zigzag[max(0,t-1)],barindex,$zigzag[max(0,t-1)])style(dottedline,3)coloured("green") if $zigzag[t]<$zigzag[t-2] then drawtext("LL",$zigzagidx[t],$zigzag[t]-0.5*atr)coloured("red") else drawtext("LH",$zigzagidx[t],$zigzag[t]-0.5*atr)coloured("red") endif endif if showLabels then drawpoint($zigzagidx[max(0,t-1)],$zigzag[max(0,t-1)],2)coloured("blue",100) drawpoint($zigzagidx[t],$zigzag[t],2)coloured("blue",100) endif //Draw all ZigZag for i=t-1 downto 3 do if showZZ then drawsegment($zigzagidx[max(0,i-1)],$zigzag[max(0,i-1)],$zigzagidx[i],$zigzag[i]) endif if showSR and $dir[i]=1 then drawsegment($zigzagidx[i],$zigzag[i],$zigzagidx[i+1],$zigzag[i])style(dottedline,3)coloured("green") drawsegment($zigzagidx[max(0,i-1)],$zigzag[max(0,i-1)],$zigzagidx[i],$zigzag[max(0,i-1)])style(dottedline,3)coloured("red") elsif showSR and $dir[i]=-1 then drawsegment($zigzagidx[i],$zigzag[i],$zigzagidx[i+1],$zigzag[i])style(dottedline,3)coloured("red") drawsegment($zigzagidx[max(0,i-1)],$zigzag[max(0,i-1)],$zigzagidx[i],$zigzag[max(0,i-1)])style(dottedline,3)coloured("green") endif if showLabels and $dir[i]=-1 and $zigzag[i]>$zigzag[i-2] then drawtext("LH",$zigzagidx[i],$zigzag[i]-0.5*atr)coloured("red") elsif showLabels and $dir[i]=-1 and $zigzag[i]<=$zigzag[i-2] then drawtext("LL",$zigzagidx[i],$zigzag[i]-0.5*atr)coloured("red") elsif showLabels and $dir[i]=1 and $zigzag[i]>$zigzag[i-2] then drawtext("HH",$zigzagidx[i],$zigzag[i]+0.5*atr)coloured("green") elsif showLabels and $dir[i]=1 and $zigzag[i]<=$zigzag[i-2] then drawtext("HL",$zigzagidx[i],$zigzag[i]+0.5*atr)coloured("green") endif next endif //------------------------------------// return |

Share this

No information on this site is investment advice or a solicitation to buy or sell any financial instrument. Past performance is not indicative of future results. Trading may expose you to risk of loss greater than your deposits and is only suitable for experienced investors who have sufficient financial means to bear such risk.

ProRealTime ITF files and other attachments :PRC is also on YouTube, subscribe to our channel for exclusive content and tutorials

Excelente Iván!

En mi modesta opinión de como entiendo este complicado mundo del trading, este indicador que has publicado es muy bueno para poder entrar en impulsos o correcciones y si se pudiera mejorar puliendo o reforzando sería casi perfecto, dejando claro que no existe el indicador perfecto, gracias por tus trabajos.

Me alegro que sea útil el indicador. Pulir/reforzar, eso ya lo dejo para vosotros 🙂

Hello, really nice and working (nearly) perfectly well. Quick questions about the code . What means “zigzagidx”. I understand zigzag but not with IDX. Same question for T . what is the value behind T. I also have 1 question about your code line 90 for i=t-1 downto 3 do, you are introducing a looping function but why value 3?

Hi, thanks!

1) zigzagidx is the array that stores the bar index (barindex) of each detected pivot. It allows us to know exactly where (in time) the pivot occurred, so we can draw the segments correctly on the chart.

2) t is simply a counter. Every time a new ZigZag point (HH, HL, LH or LL) is detected, t is incremented by 1 and used as the index to store the ZigZag values and their positions in the arrays:

3) As for the for i = t-1 downto 3 do, we use 3 as the minimum value because the code compares current values to i-2 (for example: $zigzag[i] > $zigzag[i-2]). To avoid accessing a negative or undefined index, we stop the loop at 3.

Thanks a lot ..

was it converted as a trading strategy?

no it wasn’t

could be interesting to do so as visually it works well ….

Hi ivan, still working on your indicator. Is there a way (as i’m not a coder) to integrate in your code , a formula allowing to show on graph ( as a kind of timestamp on 1st bar) , when the pivot started (LL/LH/HH/HL) ……… thanks for your help