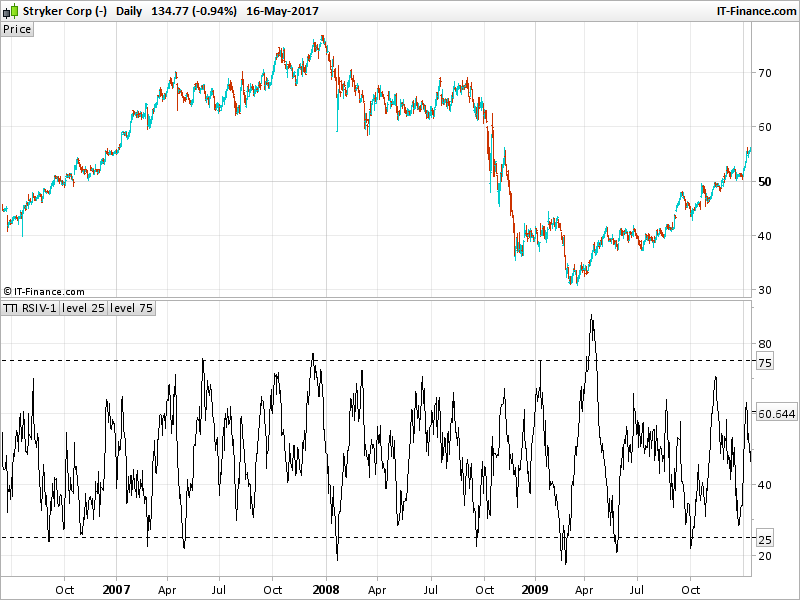

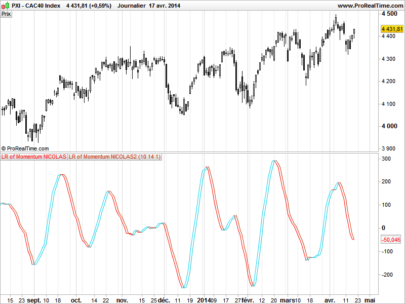

The classic Relative Strength Indicator as created by J. Welles Wilder Jr. is based on sound logic, and was a groundbreaking technical tool in its day. When it was introduced in 1978, computational hardware was not widespread, and it is thus reflective of that limitation. In those days, the trader could not just flip the computer on switch and crank out a hundred million operations per second whenever she felt like it. The original RSI is calculated with an exponential moving average of the increases and decreases for updays and downdays, respectively. The TTI RSIV-1 version computes a simple product of the two, using multiplication. The process of multiplication emphasizes larger movements more decidedly, thus magnifying volatility. It is because of this change that the threshold triggers should to be changed to 25 and 75.

The RSIV-1 is able to adapt quickly to the change in trading direction and thus give back-to-back long and short signals. The primary reason that RSIV-1 can adapt quickly is due to the nature of the linear regression it uses. Linear regression can adapt to direction changes relatively fast.

Description from author of the indicator: Kirk Northington

Indicator translated from TradeStation programming language by a request on the Italian forum.

|

1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 |

//PRC_TTI RSIV-1 | indicator //17.05.2017 //Nicolas @ www.prorealcode.com //Sharing ProRealTime knowledge //translated from TradeStation code //---settings //pds1=30 //pds2=40 //---end of settings x1 = close-LinearRegression[pds2](close) x2= (x1 > x1[1]) if x1>x1[1] then x3=x1-x1[1] else x3=0 endif x4 = x1<x1[1] if x1<x1[1] then x5=x1[1]-x1 else x5=0 endif x6 = summation[pds1](x3)*summation[pds1](x2) x7 = summation[pds1](x5)*summation[pds1](x4) x8 = 100-(100/(1+(x6/x7))) return x8 as "TTI RSIV-1", 25 style(dottedline) as "level 25", 75 style(dottedline) as "level 75" |

Share this

No information on this site is investment advice or a solicitation to buy or sell any financial instrument. Past performance is not indicative of future results. Trading may expose you to risk of loss greater than your deposits and is only suitable for experienced investors who have sufficient financial means to bear such risk.

ProRealTime ITF files and other attachments :PRC is also on YouTube, subscribe to our channel for exclusive content and tutorials