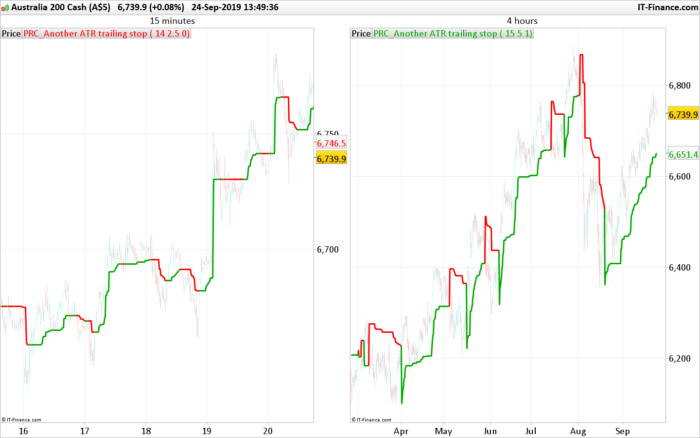

Closely following the price with the Another trailing stop ATR (Average True Range), a based trend following indicator. The idea of this indicator is to closely following the price to get out quickly if the price tends to not move enough to ensure the trend is profitable.

This version uses declining ATR to closely adapt its level to the price. The trailing stop line is following the highest Close (green when it is bullish) or Lowest Close (red when it is bearish) by adding or subtracting the ATR value multiplied with the “mult” setting.

If the ATR (aka price volatility) is ascending, then the trailing stop keep its previous level. When it is declining, the trailing stop level adapt its value according to the current trend:

- Long trend: if the new calculated level is higher than the previous one

- Short trend: if the new calculated level is lower than the previous one

The ATR trailing stop has 2 modes: (“mode” setting)

- mode=0 ; the trend line will keep the same level each time a cross over occur

- mode>0 ; the trend line will take the highest or lowest Close level each time a cross over occur

The chosen mode of the trailing stop line behavior depends of your own trading style, traded instrument and timeframe.

Idea come from this topic in the indicator’s forum: ATR TRAILING STOP

If you have other ideas, nevermind opening a new topic in the forum describing what you have in mind. The community will try to help you achieving your goal!

|

1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 32 33 34 35 36 37 38 39 40 41 42 43 44 45 46 47 48 49 50 51 52 53 54 |

//PRC_Another ATR trailing stop | indicator //24.09.2019 //Nicolas @ www.prorealcode.com //Sharing ProRealTime knowledge // --- settings p=14 //ATR period mult=2 //multiplier mode=1 //trailing stop mode (0=straight line // --- end of settings atr = AverageTrueRange[p](close) * mult once trend=1 if trend=1 then hh=max(hh,close) ll=hh if atr<atr[1] then hhlevel=hh-atr if hhlevel>ts then ts=hhlevel endif endif r=0 g=168 else ll=min(ll,close) hh=ll if atr<atr[1] then lllevel=ll+atr if lllevel<ts then ts=lllevel endif endif r=255 g=0 endif if close crosses over ts then trend=1 if mode>0 then ts=ll endif elsif close crosses under ts then trend=-1 if mode>0 then ts=hh endif endif return ts coloured(r,g,0) style(line,3) |

Share this

No information on this site is investment advice or a solicitation to buy or sell any financial instrument. Past performance is not indicative of future results. Trading may expose you to risk of loss greater than your deposits and is only suitable for experienced investors who have sufficient financial means to bear such risk.

ProRealTime ITF files and other attachments :PRC is also on YouTube, subscribe to our channel for exclusive content and tutorials

I tried this indicator to trail stop. Problem i am facing is that, when there is a trend change, say from bullish to bearish. For example, In a short entry – I get stopped out when price moves back and touches the support line of Bullish Trend. While the purpose of stop is to sell when the BEARISH upper line is crossed (when short in market), positions get stopped out at start of the trend. I think this is unintended consequence. I tried similar another indicator, same thing happens. How would be possible to BUY only when RED line above is crossed in Short Entry and Bottom Green line when Long?

Use the color variables R and G to test if the trend is bullish (R=0) or bearish (R>0).

Where can i find the syntax to test the colour of the line, I am calling the indicator values at the moment, this is my current code,

ts= Call “ATR STOP2”

IF SHORTONMARKET AND close > TS THEN

BUY AT MARKET

ENDIF

I tried few syntax but it gives error. Could you please help?

You should open a new topic to discuss about the strategy and its coding.

Hello Nicolas,

How could plot this indicator over the price series?

Thanks

Dave

Just add it on the price series.

Hello Nicolas,

Can I use high and low price at lines hh=max(hh,close) and ll=min(ll,close) instead of close ? What impact would that make to my tracking?

Thank you.

Ahmed

Yes you can do that, the impact will be that the trailing stop line will be much close to the price.