@Paul

My system with my MM end with many position but this means that the system earns and the combination of DD and necessary margin allows those size. I will not get to those sizes because if the system goes well I will change the instrument…I hope to arrive to use a cash with a 10$ a point.

@Paul

Thanks for sharing the system.

you must have a setting wrong

Had to be something simple so I tried various … seems the minimum position size on Demo Backtest Spread Bet platform is now 0.5 on DJI.

I changed below (line 23 to 25) and the Algo sprang into life! 🙂

if normal then

positionsize = 0.5 //0.2

endif

Paul

PaulParticipant

Master

normally there is a be/ts atr or %, pt for profits. I found Market Resilence EUR | Graph Indicator and created exit criteria for long & short.

It let’s profits run more. In the pic there’s besides that only a stoploss. Default settings as it was published. It’s done quick & got to check it some more. But it does look interesting! Still a high dd though.

On the other hand, if you turn off be/ts/pt then results jump even higher but then time in market is almost 100%.

here’s a comparison.

Thanks @Paul

I count more than 10 variables in the code = big overfitting and a big distribution in results.

For me it can’t work on OOS.

Just my opinion …

Thx Paul, it looks great. In direct comparison to your last backtest, you have significantly fewer trades and a little bit worse rate. But a better profit, and

the losing rades have not increased. Thats good.

Paul

PaulParticipant

Master

@zilliq I know and I’am a bit sceptical too. But it’s too good not to look at it. The vectorial dax always had many factors and in fact i’ve trying to reduce them but not successfully and instead I added now more 🙂

Here’s the code i’am experimenting with. It can be paste at the bottom. If used I would suggest to turn off the atr trailing stop & breakeven, but use the trailing stop preferably at 1%.

Maybe it’s crap or maybe not (completely). I just was curious about the impact of a rough idea.

//MR

once mr=1

if mr then

starttime = 0 // 08h00 Pré Market EU (Cac, Dax, Footsie, ect...)

endtime = 044500 // 09h00 Ouverture session européenne

if intradaybarindex = 0 then

hh = 0

ll = 0

endif

if time >= starttime and time <= endtime then

if high > hh then

hh = high

endif

if low < ll or ll = 0 then

ll = low

endif

endif

fib38 = hh

fib0 = ll

fibobull200 = (fib38-fib0)*5.236+fib0

fibobull162 = (fib38-fib0)*4.236+fib0

fibobull124 = (fib38-fib0)*3.236+fib0

fibobull100 = (fib38-fib0)*1.618+fib38

fibobull76 = (fib38-fib0)+fib38

fibobull62 = (fib38-fib0)*1.618+fib0

fibobear62 = (fib0-fib38)*.618+fib0

fibobear76 = (fib0-fib38)+fib0

fibobear100 = (fib0-fib38)*1.618+fib0

fibobear124 = (fib0-fib38)*2.236+fib0

fibobear162 = (fib0-fib38)*3.236+fib0

fibobear200 = (fib0-fib38)*4.236+fib0

fibobull200=fibobull200

fibobull162=fibobull162

fibobull124=fibobull124

fibobull100=fibobull100

fibobull76=fibobull76

fibobull62=fibobull62

fibobear62=fibobear62

fibobear76=fibobear76

fibobear100=fibobear100

fibobear124=fibobear124

fibobear162=fibobear162

fibobear200=fibobear200

//graphonprice fibobull62

//graphonprice hh

if not onmarket or ((longonmarket and shortonmarket[1]) or (longonmarket[1] and shortonmarket)) then

flag1=0

flag2=0

flag3=0

flag4=0

flag5=0

flag6=0

flag7=0

flag8=0

flag9=0

flag10=0

flag11=0

flag12=0

endif

if time>=044500 then

if longonmarket then

if close crosses over fibobull62 then

flag1=1

endif

if flag1=1 then

if close crosses under (ll+fibobull62)/2 then

sell at market

endif

endif

if close crosses over fibobull76 then

flag2=1

endif

if flag2=1 then

if close crosses under (hh+fibobull76)/2 then

sell at market

endif

endif

if close crosses over fibobull100 then

flag3=1

endif

if flag3=1 then

if close crosses under (fibobull62+fibobull100)/2 then

sell at market

endif

endif

if close crosses over fibobull124 then

flag4=1

endif

if flag4=1 then

if close crosses under (fibobull76+fibobull124)/2 then

sell at market

endif

endif

if close crosses over fibobull162 then

flag5=1

endif

if flag5=1 then

if close crosses under (fibobull100+fibobull162)/2 then

sell at market

endif

endif

if close crosses over fibobull200 then

flag6=1

endif

if flag6=1 then

if close crosses under (fibobull124+fibobull200)/2 then

sell at market

endif

endif

endif

if shortonmarket then

if close crosses under fibobear62 then

flag7=1

endif

if flag7=1 then

if close crosses over (hh+fibobear62)/2 then

exitshort at market

endif

endif

if close crosses under fibobear76 then

flag8=1

endif

if flag8=1 then

if close crosses over (ll+fibobear76)/2 then

exitshort at market

endif

endif

if close crosses under fibobear100 then

flag9=1

endif

if flag9=1 then

if close crosses over (fibobear62+fibobear100)/2 then

exitshort at market

endif

endif

if close crosses under fibobear124 then

flag10=1

endif

if flag10=1 then

if close crosses over (fibobear76+fibobear124)/2 then

exitshort at market

endif

endif

if close crosses under fibobear162 then

flag11=1

endif

if flag11=1 then

if close crosses over (fibobear100+fibobear162)/2 then

exitshort at market

endif

endif

if close crosses under fibobear200 then

flag12=1

endif

if flag12=1 then

if close crosses over (fibobear124+fibobear200)/2 then

exitshort at market

endif

endif

endif

endif

endif

It looks, that the code is not complete.

Paul

PaulParticipant

Master

volpiemanuele, i’ve included your money management, so it can be compared mm from nonetheless. Not on 200k bars, but on a much smaller timeframe in a backtest or live. Thanks for sharing.

Also included above test code. Interesting to see it compared to ts 1% on / off.

Paul

PaulParticipant

Master

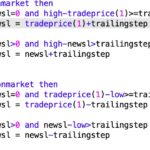

I spotted a small minor mistake in the % trailing stop. It should be as in the pic. (switched high/low for long & short).

Although i’am not a fan of breakeven, it has some use. If trailingstop is used 1%. Perhaps use a breakeven of 0.5% to get out if the market turns, at -1%, -0.5% or i.e. 0%.

thanked this post

Paul

PaulParticipant

Master

above is just a preference. But what’s used makes a bit of a difference.

Anyway here’s the indicator where the extra code is based on. It the strategy it uses different times then de indicator.

Great performance, you are the best😉 Is it possible to have .itf for testing? Thanks a lot.

Nasdaq optimized 200k…can you improve it further ?

@Paul Can you share itf file for DAX ?

Thnaks

Paul

PaulParticipant

Master

Sharing is easy but it takes time to find something good. It nice to see another market popup. Thanks volpiemanuele

In my case I focussed from the start between 8-22h.