One year after

Forums › ProRealTime English forum › ProOrder support › One year after

- This topic has 80 replies, 18 voices, and was last updated 5 years ago by

Nicolas.

-

-

04/04/2018 at 11:34 AM #6712404/04/2018 at 11:45 AM #6712704/04/2018 at 11:45 AM #67128

I optimized nothing, I just took out the logical error.

No optimizing in hindsight here, please ! It is like sitting in the casino and telling yourself : If I had known the ball would have hit the fence here and a second later there, I could have known I should have placed everything on 17.

04/04/2018 at 11:47 AM #67129@verdi55 on the Charts you posted, isn’t the difference 104,799 – 104,091 = 708 (not 1500+ as you say?)

I just ran the corrected version starting on November 1st, 2017, and the result is + 1593€, then.

04/04/2018 at 11:53 AM #67130@verdi55 on the Charts you posted, isn’t the difference 104,799 – 104,091 = 708 (not 1503+ as you say?) Ah my mistake you are stating in euros, mine is in £’s.

You Englishmen on your splendid island… 😉

1 user thanked author for this post.

04/04/2018 at 11:55 AM #67131GraHal wrote: @verdi55 on the Charts you posted, isn’t the difference 104,799 – 104,091 = 708 (not 1593+ as you say?)

I was reading the above values direct off your charts that you posted. anyway no biggie thanks for telling us about your tweak.

Probably my mistake with me diving in and out too quick and making comments while watching my trades etc?

04/04/2018 at 12:24 PM #6713404/04/2018 at 12:43 PM #67140CKW

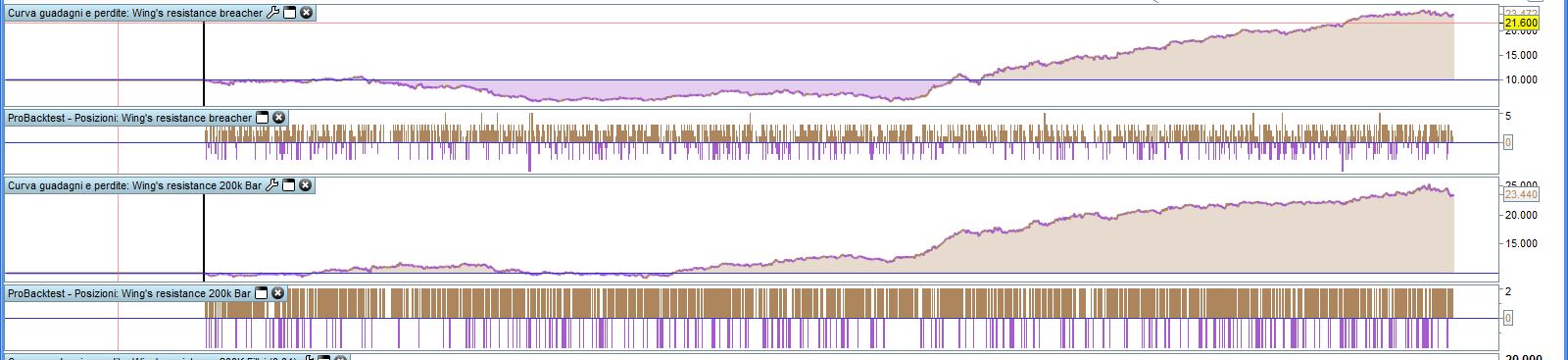

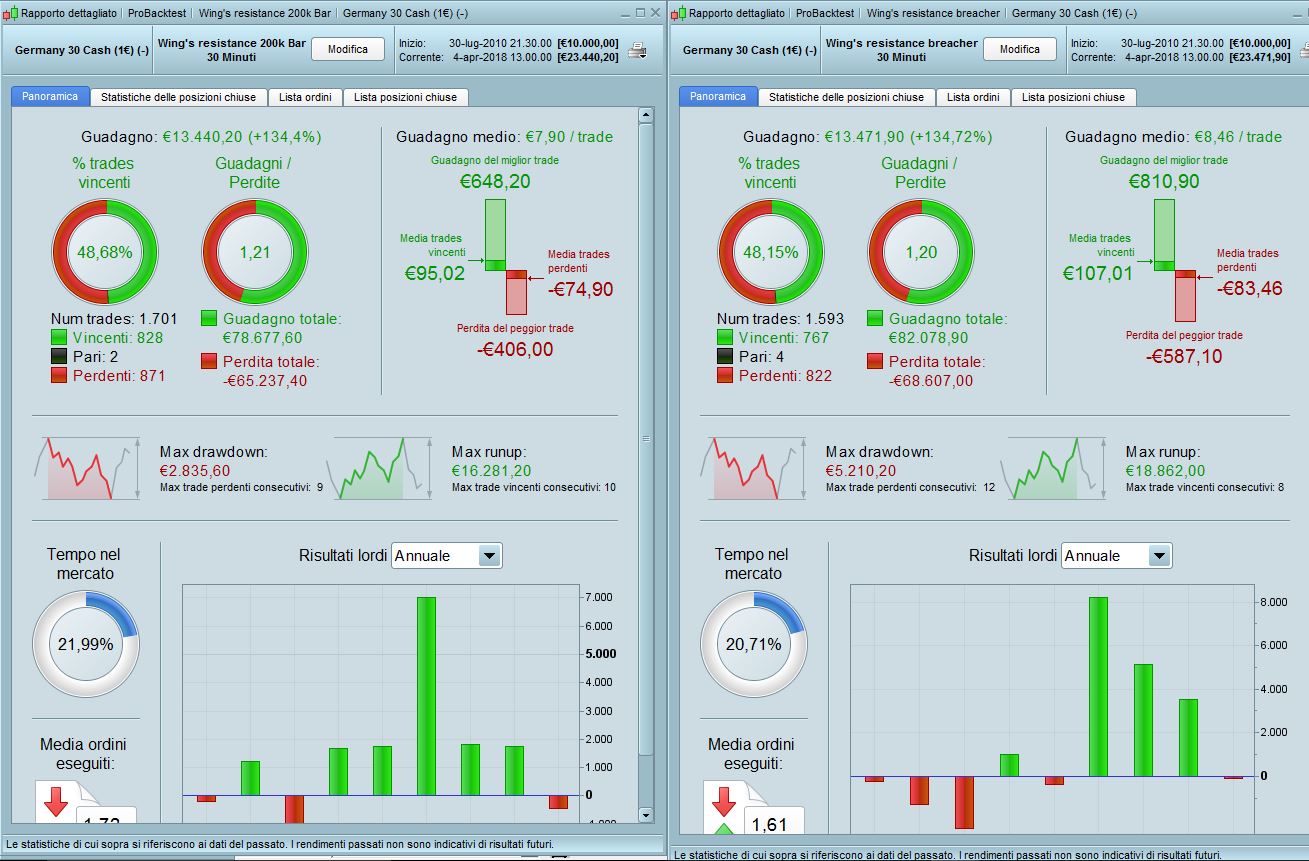

Aloysius was asking here : Which systems have performed well one year after the end of the optimization period ?

Not : Do you have a system that works well over all times and all circumstances ? We all know that there is no such system.

A good system works well under certain circumstances and has only small losses under others. Like your lower curve, I’d say.

And as Vonasi said before : position sizing does not seem to add much in this case. Only the system’s volatility gets higher, then.

04/04/2018 at 12:54 PM #67142@GraHal – I would say we are better to stick on this thread to the original code that has survived one year otherwise we could end up with 200 discussions about 200 different strategies and then another 200 discussions about another 200 optimized/modified versions of them! It would become very confusing or just get taken over by one strategy.

If someone wants to discuss or share an updated version then it would be much better to start another thread about it or add it on to any original thread regarding that particular strategy. Posting a link here to say where the discussion is happening may be helpful to some who are interested.

This thread then just becomes a place to come and look for potentially proven strategies with links to where to find out more about new developments of them. Maybe in a years time the new versions can get posted here as proven working updated versions!

04/04/2018 at 4:05 PM #67152Thanks to all for these contributions. I agree with Verdi and Vonasi about the fact that we should limit our discussion to systems that have succeeded, and not those that could with optimization. Anyway, it is possible to propose some minor adjustments on the existant variables, but creating new modules, like a filter to eliminate bad trades, might lead to over-optimization. For new propositions about these codes, it is possible to reactivate old threads dedicated to them, or it is also possible to create new threads for new ideas coming from this one. Thanks Grahal for the link for the sheet, that should be useful. I will search again for the initial post of Francesco’s strategy.

04/05/2018 at 8:57 PM #67354I hope my conclusions from 151 days ago were correct, I did not think about them once again now.

Anybody have any thoughts or conclusions re the Verdi55 tweak in the post above?

Have you incorporated it in the version you are testing out?

Or is it too much adultery for you from the purist original version? 🙂

Or maybe, like me, you can’t work out what that bit of the code is doing anyway (and lots of the rest of the code?) 🙂

GraHal

PS I do agree re the group decision to keep this Thread ‘purist’ and to post – optimised code and / or suggestions for changes – to the Thread from which the original code was sourced.1 user thanked author for this post.

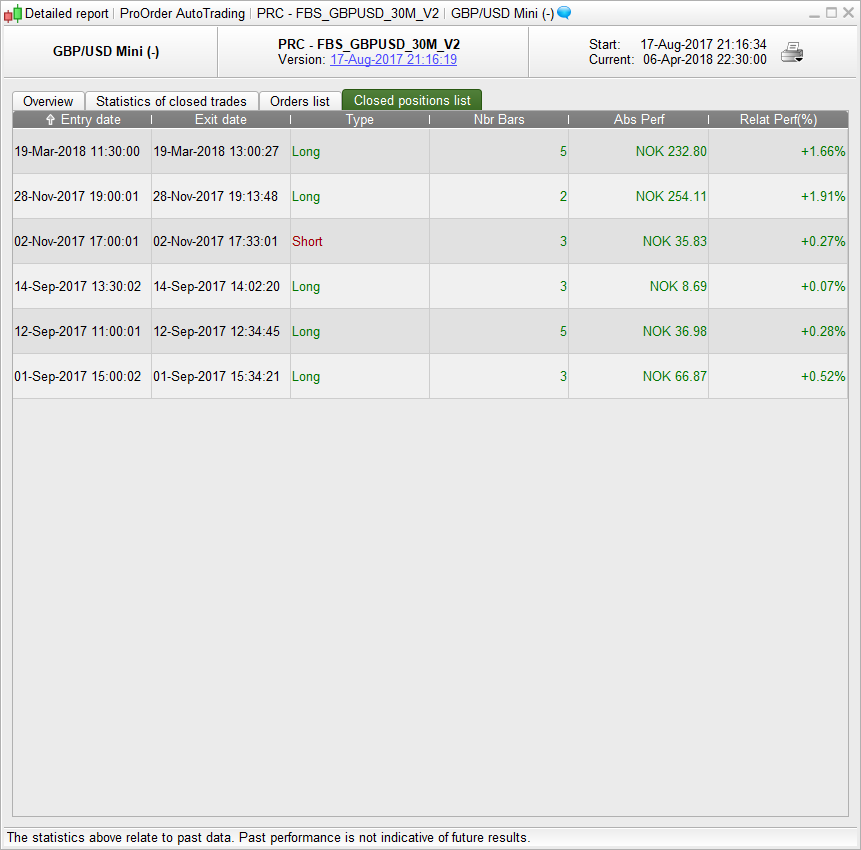

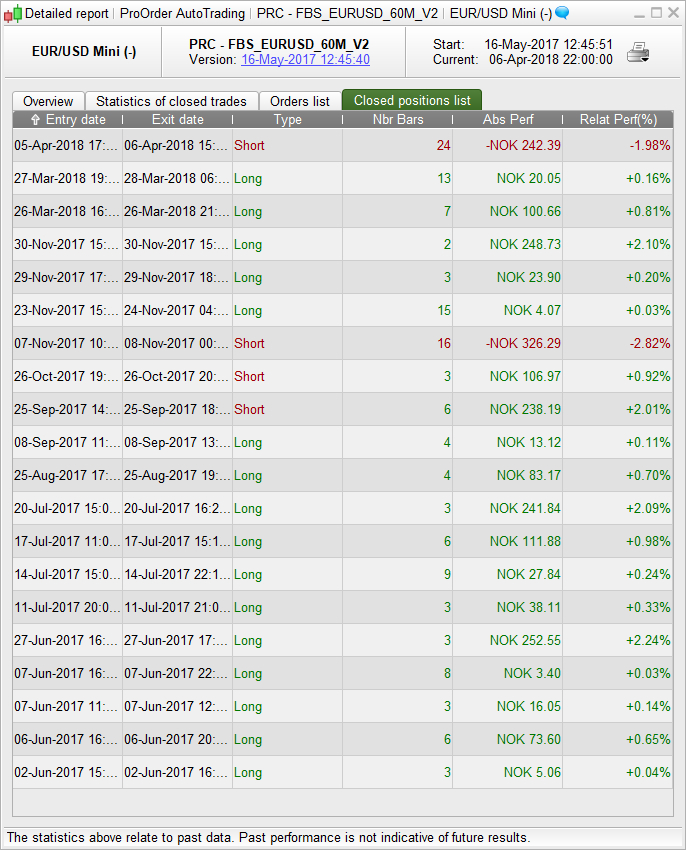

04/05/2018 at 10:19 PM #6737004/06/2018 at 7:31 PM #6747104/07/2018 at 2:31 PM #67503Report of FBS strategy on Eur/usd habe been made, but not yet on GBP/USD, very good too: here are my results for the last 6 months in demo : no loss.

https://www.prorealcode.com/topic/fractal-breakout-intraday-strategy-eurusd-1h/

1 user thanked author for this post.

04/07/2018 at 5:39 PM #67516Report of FBS strategy on Eur/usd habe been made, but not yet on GBP/USD, very good too: here are my results for the last 6 months in demo : no loss. https://www.prorealcode.com/topic/fractal-breakout-intraday-strategy-eurusd-1h/

I have been running a variant of this on M30 live (GBPUSD). I stopped it for a period when exploring Ninjatrader (..), but is back and have started it again.

Also on EURUSD H1. To confirm earlier posts.

1 user thanked author for this post.

-

AuthorPosts

Find exclusive trading pro-tools on