One year after

Forums › ProRealTime English forum › ProOrder support › One year after

- This topic has 80 replies, 18 voices, and was last updated 5 years ago by

Nicolas.

-

-

03/31/2018 at 1:58 PM #6686803/31/2018 at 2:24 PM #6686903/31/2018 at 3:12 PM #66872

So that ‘USDJPY 3candles and reversal strategy with ADX and VOL filter’ strategy looks quite promising and has worked similar OOS to IS. The gain/loss ratio has dropped a little but the win rate is very similar. Time in market has increased a bit.

Drawdown is pretty massive for a short time frame strategy both IS and OOS – so it may be one only for those with quite deep pockets!

04/02/2018 at 2:03 PM #66924Thanks Francesco for the repost of the code on USD/JPY, unfortunatly it still doesn’t work on my platform, and no solution have been found if I read the thread… It would be great if someone had a new idea of the cause of the problem. No position opens, and when I reduce the ATR to 0.1, it takes only one position, but loose all the capital at this first position…

04/02/2018 at 2:13 PM #66925Hello,

Since a few month, I’m running live a strategy developed initially by ALE and edited by CKW:

https://www.prorealcode.com/topic/fractal-breakout-intraday-strategy-eurusd-1h/page/16/

Not a lot of trades recently, but working well.

Attached the live results on my real account

04/02/2018 at 3:28 PM #66930Since a few month, I’m running live a strategy developed initially by ALE and edited by CKW: https://www.prorealcode.com/topic/fractal-breakout-intraday-strategy-eurusd-1h/page/16/

Thanks for posting that @stefou102 – not quite a year after but the results over seven months look promising 🙂

As always with strategies that place just a few trades it is quite slow to get forward testing results and so difficult to build absolute confidence in the strategy. One to keep watching though.

It would be interesting to compare your results with the backtest results when the strategy was first posted.

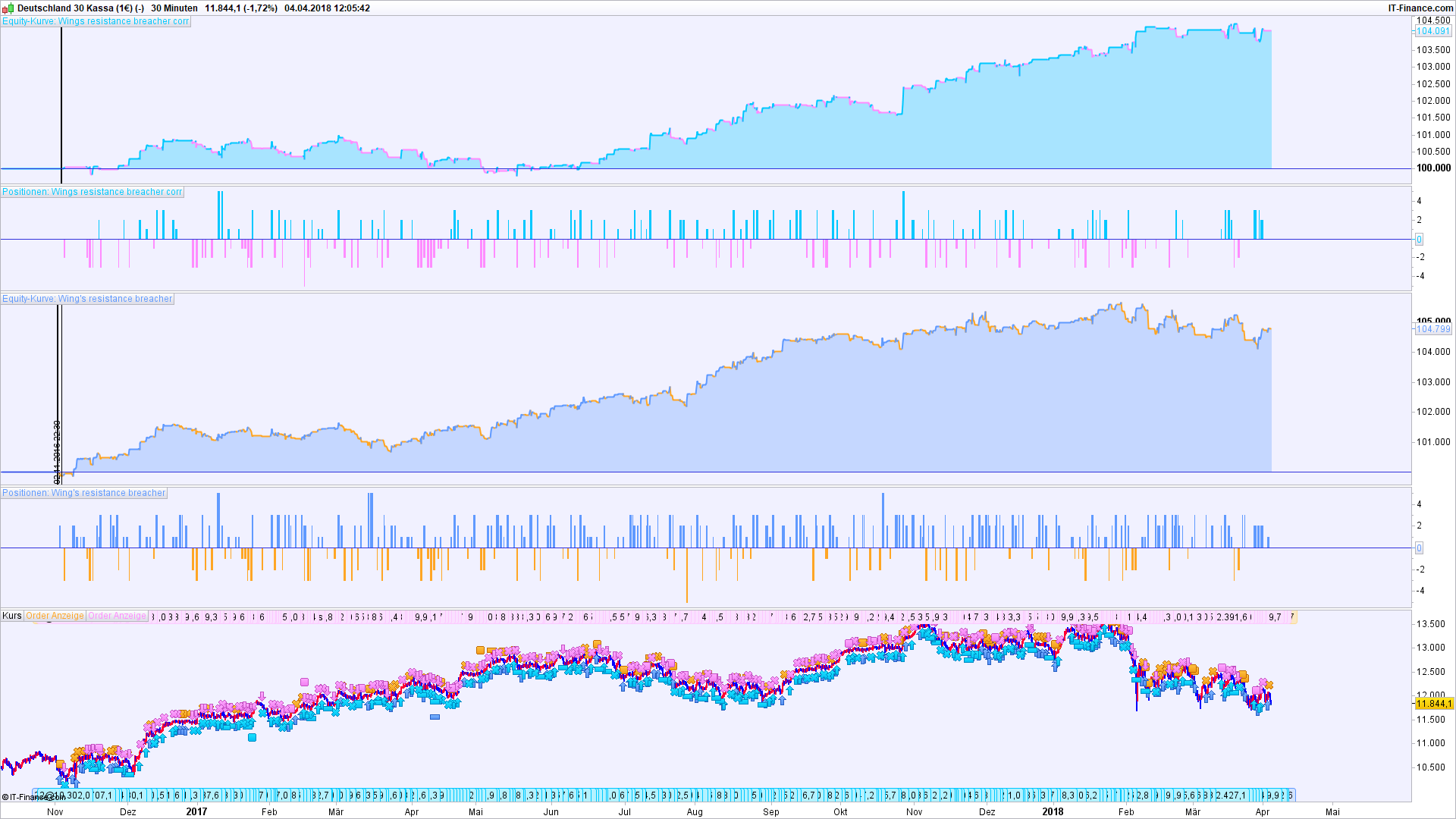

04/02/2018 at 4:19 PM #6693304/02/2018 at 5:10 PM #66937Wing’s resistance breacher has been quite good since November 2016.

https://www.prorealcode.com/prorealtime-trading-strategies/wings-resistance-breacher-dax-30m/

Without position sizing (position size = 1, all the time) , it made about 2300 DAX points since then – not bad at all.

5 users thanked author for this post.

04/03/2018 at 2:17 PM #67031Since a few month, I’m running live a strategy developed initially by ALE and edited by CKW: https://www.prorealcode.com/topic/fractal-breakout-intraday-strategy-eurusd-1h/page/16/

Thanks for posting that @stefou102 – not quite a year after but the results over seven months look promising 🙂

As always with strategies that place just a few trades it is quite slow to get forward testing results and so difficult to build absolute confidence in the strategy. One to keep watching though.

It would be interesting to compare your results with the backtest results when the strategy was first posted.

I am also continue running this since Jul’17, result so far so good.

04/03/2018 at 3:20 PM #67037Wing’s resistance breacher has been quite good since November 2016. https://www.prorealcode.com/prorealtime-trading-strategies/wings-resistance-breacher-dax-30m/ Without position sizing (position size = 1, all the time) , it made about 2300 DAX points since then – not bad at all.

From my quick check of this strategy it does seem that the position sizing adds nothing – in fact the gain/loss ratio is slightly improved without it over my test period

With a simple 70/30 IS/OOS walk forward it appears that the OOS has outperformed the IS which is not usually the case if something is over optimized.

Overall this may be one to watch (without position sizing though I think).

04/04/2018 at 8:41 AM #67094Wing’s resistance breacher has been quite good since November 2016. https://www.prorealcode.com/prorealtime-trading-strategies/wings-resistance-breacher-dax-30m/ Without position sizing (position size = 1, all the time) , it made about 2300 DAX points since then – not bad at all.

Sorry but i’ve, started the strategy on november 2017 and stopped in the end of march, the result are very bad in the last time, so i’ve got an idea this morning, and i am working on a filter, with huge improove of performance, i will post the result asap.

1 user thanked author for this post.

04/04/2018 at 10:46 AM #67115Wing’s resistance breacher has been quite good since November 2016. https://www.prorealcode.com/prorealtime-trading-strategies/wings-resistance-breacher-dax-30m/ Without position sizing (position size = 1, all the time) , it made about 2300 DAX points since then – not bad at all.

Sorry but i’ve, started the strategy on november 2017 and stopped in the end of march, the result are very bad in the last time, so i’ve got an idea this morning, and i am working on a filter, with huge improove of performance, i will post the result asap.

Result since November 1st, 2017 is + 32 Euro, to date.

When you develop a filter, please do not forget to do a walk forward analysis, at best starting in 2010.

04/04/2018 at 10:54 AM #67116I’ve optimised Wings Resistance breacher and set it going Live, but I’m not sure what’s the gig re posting optimsed versions in this Thread?

Nobody seems to want to use my database https://docs.google.com/spreadsheets/d/11zMhXG7oiSgUfMu2JSU1Un2Q0CbP8iWeAJg1HPaArD8/edit?usp=sharing and without a an easy means of identifying versions then this Thread may get filled up with loads of versions and the only way then would be to laboriously read through post after post etc to see what changes had been made? So I haven’t posted my optimised version here.

What you reckon …?

- Stick with the purist original code ONLY?

- Post optimised versions here, but all / any of us populate my database with v1.0, v1.1.

- Raise new Topics with optimised versions?

- Continue as we are with no definite rules?

- Alternative??

Cheers

GraHal04/04/2018 at 10:56 AM #67117Stick with the purist original code ONLY? Post optimised versions here, but all / any of us populate my datab

i would use and have a look on it if you don’t mind, i’ve also optimized for 200k bar, the original is very bad on 200k

04/04/2018 at 11:09 AM #67119When you read my comments from 151 days ago in the original post

https://www.prorealcode.com/prorealtime-trading-strategies/wings-resistance-breacher-dax-30m/

there is a logical mistake in the original system. It favors long over short positions and therefore works better in a bull market.

When you remove the error and set

1234if close<average[yy] or close<exponentialaverage[tt] thenMaBoty=0MaBotzy=999999999endifin lines 125-128 (line numbers of the original post, not of the itf file), the system opens long positions more carefully and therefore works better in a downward trend as we have it now. Of course, this takes profits away of the previous upward trend.

Result since November 1st, 2017 is then + 1593 Euro.

See a comparison of both codes below (upper curve = corrected code). I hope my conclusions from 151 days ago were correct, I did not think about them once again now.

2 users thanked author for this post.

-

AuthorPosts

Find exclusive trading pro-tools on