Expert Services

ProRealCode - Trading & Coding with ProRealTime™

ProRealCode - Trading & Coding with ProRealTime™

No recent search

How to Add Options Probabilities

- Forums

- ProRealTime English Forum

- General Trading: Market Analysis & Manual Trading

- How to Add Options Probabilities

-

AuthorPosts

-

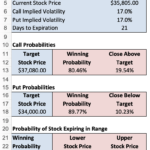

Hi there, I was hoping a math expert here could tell me if it’s possible to add two probabilities when the probabilities are dependent? I assume they are from the way the Black Scholes option formula prices Calls and Puts, — where the value of the Call option (its premium) will go up (if the market rises and volatility changes) whilst the value of the Put option will go down)?

What I have downloaded is an Excel Options probability calculator — pls see screenshot and Excel attachment. I don’t or can’t get the last table to do anything and don’t think it works?

The Dow Jones price ranges (option Strikes) represent going short to open a Call (bearish, with the higher Strike, Dow 37,080) and going short to open a Put (bullish, with the lower Strike, Dow 34,000).

The Short Strangle’s strategy objective is for the Dow to stay within the higher and lower Strike ranges (think of a dog with a vet cone around its head but in reverse!) and for the options to expire worthless (so you can close the trade out and buy the options back for less or zero and profit in the difference between the total premiums for the short Call and Put and the final contract (or earlier) option buy (closing) price.

So is it possible (or wise) to add the two event probabilities and get a final total probability, which I think the last table in the Excel calculator was supposed to produce?

Cheers, for any thoughts or input,

Best,

BardThe probability that the price will end up above the current share price of $35,805.00 is 50%.

The probability that the price will end up below the current share price of $35,805.00 is 50%

The probability that the price will remain below $ 37,080 is 80.46%

The probability that the price will stay above $ 34,000 is 89.77%

The combined probability is then: 0.5 * 0.8046 + 0.5 * 0.8977 = 0.85115 (85.115 %)

Buy Call (Long Call) = Bullish

Sell Call (Short Call) = Bearish

Buy Put (Long Put) = Bearish

Sell Put (Short Put) = Bullish

The maximum profit with a short strangle is fixed, namely the yield of the premiums of the short call and short put.

The maximum loss (risk) is in principle unlimited.

The probability that the price will remain between 34000 and 37080 before the expiration date is here: 85%

Hi JS,

Thanks for taking the time to take a look at this and for your explanations. I have been reading how probabilities are multiplied not added for dependent events? https://www.investopedia.com/terms/a/additionruleforprobabilities.asp

Also I was reading a Seeking Alpha article about Strangles:

https://seekingalpha.com/article/4356459-what-to-watch-out-for-in-high-probability-strategiesand they wrote:-

“Theoretically speaking a 1 SD (std dev) short strangle with 45 days to expiration should have a probability of success of 68% (100 – 2 x 16%).”I guess the real question is how to mathematically define any Strangle trading range in terms of the probability distribution so that it gives 1, 2 and 3 Standard Deviations probabilities?

Can a re-working of the Black Scholes formula provide that?

https://www.investopedia.com/terms/b/blackscholes.asp

PeterSt thanked this postSome points on Standard Deviations and the Probability Distribution: “Standard deviation measures certain outcomes relative to the average outcome. Here are how probabilities associated with certain multiples of standard deviations: One standard deviation encompasses approximately 68.2% of outcomes in a distribution of occurrences.Two does it for 95.4% and Three does 99.7%

For example, if a £100 stock is trading with a 20% IV (implied volatility), the standard deviation ranges are:

– One standard deviation – £80 to £120 – Two standard deviations – £60 to £140 – Three standard deviations – £40 to £160

So what is the chances of that £100 stock staying between £80 and £120? 68.2% So what is the chances of that £100 stock staying between £60 and £140? 95.4%”

https://unofficed.com/topic/risk-metrics-of-option-strangle/

It is complicated because there are three cases:- The price ends below OR above the current index price. The price can never end up both above and below the current index price at the same time, so this is a mutually exclusive event (you can add up the probabilities).

- The price ends below the current index price AND it drops to a certain limit, so this is a case where the events depend on each other (dependent events, here you have to multiply the probabilities with each other)

- The price ends above the current index price AND it rises to a certain limit, so this is also a case where the events depend on each other (the price must rise AND the price must rise to a certain limit). So again a dependent event where you have to multiply the probabilities with each other.

I have created a spreadsheet in Excel with which you can calculate the reliability interval based on:- current rate (S)

- average annual return (m)

- standard deviation (s)

- time between now and the expiration (T – t)

Bard thanked this postDo not include personal information such as email addresses or telephone numbers in your posts. You can post any file here as an attachment, if interested. Thank you 🙂@robertogozzi where do you see any personal data ???It was a reminder of the widely known rule since you wrote “I can send you“. Anything on this forum can be posted to everyone’s benefit, not sent privately.In your case with: S = 35.805 Volatility = 17% (T – t) = 21 The 68% interval is between 34061 and 37548 The 95% interval is between 32318 and 39291 So you can sell a put option with a strike around 34.000 and sell a call option with a strike around 37.500 (68%) Or sell a put option with a strike around 32.300 and sell a call option with a strike around 39.200 (95%)@robertogozzi I know the rules, thank you 🙂Hi @JS, Thank you very much for taking the time to explain the probabilities further, it’s much appreciated! This confirms what I have been reading about and of course there’s no need to expand upon the BS model because the standard deviation formula for calculating the future price is given by: Price x Volatility x Sq Root (21/365) and multiplying this result by 2 or 3 will give the 2 and 3 standard deviation move amounts and probabilities, (pls see post #180611 above). This comment from Quora also gives a little bit more detail about probabilities and option delta values:“The rule of thumb is that the Delta of an option approximates the likelihood that the option will expire in-the-money. Since 2 Standard Deviations is the upper and lower bounds of where the stock will close 95% of the time, in only 2.5% of the cases will the stock be below 2 SDs — so the Delta should be in the range of .975 for a call, or -.025 for a put.

Standard deviation tells us the range of expected future values based on past price history. By definition, 68% of results (in this case, stock prices as of option expiration) will fall within + or – one standard deviation, meaning 32% are expected to fall outside the (+/-) range — 16% above one standard deviation, and 16% below one standard deviation. (btw, I have never seen any research that validates the actual predictive value of standard deviation: I suspect it’s purely theoretical.)

If you expand the +/- range to two standard deviations, by definition 95% of future events are expected to fall within that range, with 2.5% ending above and 2.5% below the range. Therefore, a call option 2 SDs below strike has a 97.5% chance of expiring in-the-money (ITM) — as of the moment the analysis is done, and holding all other factors equal. (The delta will change as market moves the stock price.) The equivalent put option has a 2.5% likelihood of closing ITM. (Three standard deviations predicts the range that 99.7% of future events should fall within — with a Black Swan being the curve-breaker.)

The Delta of an option tells us its sensitivity to moves in the underlying stock price — literally how much the market price of an option can be expected to increase should the stock price increase by $1. (For this reason, puts always have negative deltas, since an increase in the stock price should NEVER cause a put’s value to increase.)

Option deltas are said to approximate the probability that the option will expire in-the-money. An at-the-money call or put has a delta around .5, which means both that it is likely to increase/decrease by 50 cents given a $1 price move — but also that it has a 50% chance of expiring ITM.

Using this logic, a call two SDs below current ATM strike is deeply ITM, and can be expected to have a delta near 1, given that it has a 97.5% probability of expiring ITM. Actual option price moves are subject to market bid/ask/demand, so the exact move will be more or less than $1.

A put at the same strike, 2 SDs below market is far OTM, with a 2.5% likelihood of payout at exp. The put delta is likely around -.02 — an expected 2 cent bump if the stock drops a dollar, though this is debatable given that there may be no open interest at that price point, and the Bid/Ask may be negligible. ie: There is no market action that can demonstrate the specificity of the equation.

A look at some option chains suggests that very close to expiration, the delta is very close to the 2 SD probability, but as expiration gets further away, a 2 SD ITM call will have a delta more in the range of .80 to .90, and puts -.10 to -.20. So much for “Rules of thumb.”

https://www.quora.com/What-is-the-delta-of-a-2-standard-deviation-below-the-strike-price

Naturally markets don’t follow a normal distribution and under account for tail risk Black Swan events. Thanks once again for your help.Hi @Bard, Gladly done, it was a bit of digging into my memory because I have not done anything with options for a while. Long story but also interesting for me to dive in again. Forget the Excel sheet because it is better and easier to use the formula “Price x Volatility x Sq. Root (21/365)”. Cheers JS -

AuthorPosts

- You must be logged in to reply to this topic.

How to Add Options Probabilities

General Trading: Market Analysis & Manual Trading

Summary

This topic contains 51 replies,

has 5 voices, and was last updated by ![]() Nicolas

Nicolas

1 year, 6 months ago.

Topic Details

| Forum: | General Trading: Market Analysis & Manual Trading |

| Language: | English |

| Started: | 10/29/2021 |

| Status: | Active |

| Attachments: | 27 files |

About personal data collected

The information collected on this form is stored in a computer file by ProRealCode to create and access your ProRealCode profile. This data is kept in a secure database for the duration of the member's membership. They will be kept as long as you use our services and will be automatically deleted after 3 years of inactivity. Your personal data is used to create your private profile on ProRealCode. This data is maintained by SAS ProRealCode, 407 rue Freycinet, 59151 Arleux, France. If you subscribe to our newsletters, your email address is provided to our service provider "MailChimp" located in the United States, with whom we have signed a confidentiality agreement. This company is also compliant with the EU/Swiss Privacy Shield, and the GDPR. For any request for correction or deletion concerning your data, you can directly contact the ProRealCode team by email at privacy@prorealcode.com If you would like to lodge a complaint regarding the use of your personal data, you can contact your data protection supervisory authority.