Anyone using ProOrder multi timeframe with IG in live?

Forums › ProRealTime English forum › ProOrder support › Anyone using ProOrder multi timeframe with IG in live?

- This topic has 20 replies, 7 voices, and was last updated 5 years ago by

Vonasi.

-

-

08/22/2018 at 12:22 PM #78774

Hi

Is anyone using the multi timeframe ProOrder feature live with IG?

I just tried a backtest and it’s not enabled in LIVE by default hence my question of other people experiences. I have emailed IG to get it enabled but more interested in how people are finding it?

Thanks

Rob

08/22/2018 at 1:15 PM #78788I have five strategies that contain MTF on forward demo test but so far only one has opened a position and unfortunately failed to close it. This may be nothing to do with MTF and maybe something to do with the recent IG demo server crash. I will wait for IG/PRT to let me know.

The down side to MTF is that it can just add extra filters that mean that trades may be higher quality but you get less quantity. Great in real life but not so good for testing confidence. I like longer time frame trading so it could take me quite a while to fully test out the benefits of MTF. Maybe others who like the cut and thrust of minute and second trading have different experiences.

08/22/2018 at 1:44 PM #78796The down side to MTF is that it can just add extra filters that mean that trades may be higher quality but you get less quantity.

This is only your point of view. I know many discretionary traders that use MTF analysis to trigger their orders, this is what their strategies rely on, they don’t mind having less trades because this is how their strategies were built.

The good point of MTF is to now have the capabilities to interact with orders between 2 candlesticks. Orders management are now at a big step further than they were until now! No more waiting for a daily candlestick to Close to move a stoploss to breakeven or to take a partial profit! 😉

1 user thanked author for this post.

08/22/2018 at 2:41 PM #78804I’m looking forward to testing the MTF because I can check the same condition in more than one timeframe.

My real problem with ProOrder has always been having to wait for a candle to close that meets the condition before opening the trade.

08/22/2018 at 3:35 PM #78806This is only your point of view. I know many discretionary traders that use MTF analysis to trigger their orders, this is what their strategies rely on, they don’t mind having less trades because this is how their strategies were built.

I was referring to the fact that for testing having less trades is not desirable. I could write a strategy that places one trade in all of history. It would be a good trade but would I want to run that strategy live with real money having only ever seen it open one trade – I think not!

Also now we have MTF it brings with it all the disadvantages of only testing on the small data samples that we get when we shift to a faster time frame chart.

Of course better quality trades are the result that we want from MTF but we now have to prove them on a smaller data sample and with most likely less trades produced from that data sample for us to analyse. Forward testing over long periods will be the only way to build confidence in a MTF strategy based on a fast default time frame.

MTF is a major step forward for PRT but there are some prices to pay when it comes to testing when we use it.

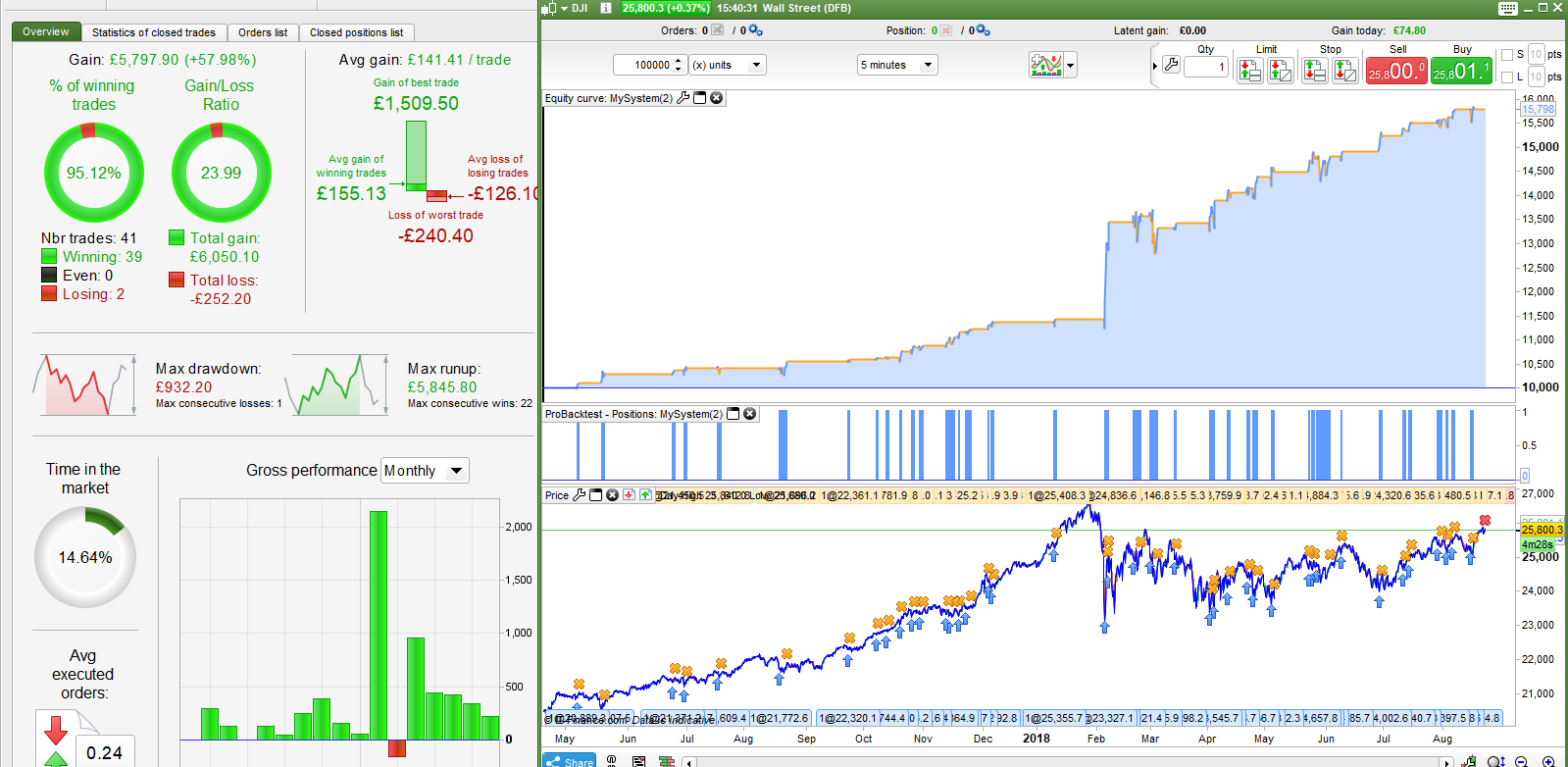

08/22/2018 at 3:49 PM #78807For example here are the back test results from one of my fairly simple MTF strategies traded on a 5 minute time frame. The quality of the trades looks pretty good with a 95% win rate and almost 24 gain/loss ratio and reasonable drawdown compared to profit – but the test period is just the most recent year and a half because of the 5 minute timeframe and it only opened 41 trades so that is not a lot of data or trades to be confident in. It will take years of forward testing just to get enough trades to be confident that it works! Had I been able to see it working this well in a 15 year back test period and seen it open hundreds of trades in that time then confidence to trade it would be much higher.

08/22/2018 at 4:32 PM #78811here are the back test results from one of my fairly simple MTF strategies traded on a 5 minute time frame.

Oh go on show us the code!!!

You don’t even like 5 min TF so you’ll probably never even use it in anger!? 🙂

08/22/2018 at 5:04 PM #78812Oh go on show us the code!!!

Just a combination of RSI[2] over different time frames with one longer term filter to keep it out of the market in major down turns. Exit on RSI[2] levels or on one other condition that I am not telling you as I have already said too much. If I say any more then I may have to kill you!

Go catch your own fish…..

1 user thanked author for this post.

08/23/2018 at 4:55 AM #7882908/23/2018 at 8:19 AM #78834Sounds like a curve fit anyway so no need for that code , we have all built one of them

I’ll let you into a little secret. All of our codes are a curve fit. We only have historical data to base them on and test them on and so everything we do is curve fitting. To not curve fit we have to have never looked at historical data and then just written a code by guessing what we think will happen in the future. Then forward test that and see how we get on. I think you will find that we need to curve fit to the past to have even the slightest chance of knowing what might be going on in the future.

Of course the above code is curve fitted as I used the historical data technique rather than the guess what happens in the future technique. It is however very lightly curve fitted with just three variables (and one of them is for the downturn filter that has not been triggered in the above test) and obviously the choice of time frames used. There are no curve fitted stop loss or take profit levels but I guess you could say that the exit conditions are curve fitted as they are techniques that have worked historically and so far proven profitable in other longer time frame strategies.

It is the level of curve fitting that is important. Light = Good and Heavy = Bad. The code you are classifying as heavily curve fitted without any actual knowledge of is what I would class as light curve fitting. I will not know if my classification of light is too much curve fitting or not until I have forward tested it for a good number of trades. I’ll get back to you on the results of that one in a few years time.

If you have a completely non curve fitted code to share then please do share it – as I’m sure that everyone would be fascinated to see it. Then again if your eyes have ever seen a chart prior to writing it then it will already be lightly curve fitted.

08/23/2018 at 9:04 AM #78835Slightly off topic but it’s an interesting conversation all the same.

I agree with some of what you say but there are conditions that happen every day in every market and have done since those markets were traded electronically. Of course, some of them are false signals but on the whole they are not. It’s how you go about weeding out the false signals and that’s where the MTF could be very useful but I haven’t tested it yet.

Are you willing to divulge anything about your exit conditions?

Thanks

Rob

08/23/2018 at 9:48 AM #78841Slightly off topic but it’s an interesting conversation all the same.

I agree with some of what you say but there are conditions that happen every day in every market and have done since those markets were traded electronically. Of course, some of them are false signals but on the whole they are not. It’s how you go about weeding out the false signals and that’s where the MTF could be very useful but I haven’t tested it yet.

Are you willing to divulge anything about your exit conditions?

Not really off topic as using multiple time frames is just another added way to curve fit.

For me it is not about false signals and true signals it is more about future probability based on historical probability. Find something that has a high probability of repeatedly happening and ends in profit more than it ends in losses and just trade it.

As for exits. One is a simple RSI level being achieved and the other is based on something that trading longer time frames such as daily and weekly has taught me. Sometimes you have to be patient and wait for the profit to come to you – especially on indices. Obviously your account and mind need to be able to deal with possible larger draw downs and maybe the odd larger than you’d like loss but your probability study will give you some idea of the likely hood of this. At the end of the day it is called spread BETTING for a reason so we have to accept a certain level of risk.

08/23/2018 at 6:44 PM #78878I’ll let you into a little secret. All of our codes are a curve fit.

very probably you are right Vonasi… even simpliest defintion of the rules for entry and exit is kind of curve fitting, based on the knowledge or at least idea about how profiting from buying/selling works/might work. so there is really basically only one big answer to be figured out: what is “bad” and what is “good” curve fitting. and of course – I don’t know the answer. I can just tell that I did not come accross any commonly known indicator which would convince me that working with it would result in “good” curve fitting, so I try to eliminate all of them. and still I can tell, that I “like” curve fitting (seting rules for entries and exits) which is linked to volatility, while still avoiding using all of the commonly known volatility “indicators”.

and then it came to my mind the code which is probably most known, least used – but also least curve fitted:

BUY & HOLD

…will not work for currencies, but for major stock indices, commodities, bonds, over very long time period 😉

08/23/2018 at 7:06 PM #78879and then it came to my mind the code which is probably most known, least used – but also least curve fitted: BUY & HOLD

Absolutely – BUY AND HOLD is the one we all dream about beating – but spread betting or trading CFD’s is not the tool to do that with. So we have to ask ourselves ‘what do I want from spread betting’ and the answer is a reasonable profit that makes the risk seem worthwhile. We can only look at the past and say ‘if I’d done this then it would have worked out like this – now how likely do I think it is to carry on doing this?’ To make this work we need to be as lightly curve fitted as possible.

Personally I think that beating buy and hold using spread betting is a pretty tough ask as the spread and the fees make it a very tough game. So I see my job as taking some of the buy and hold profit chunk by chunk and avoiding the massive draw downs that come with buy and hold. If a strategy is profitable and the equity curve has no big dips then that is a good spread betting strategy IMHO.

Yesterday I tested a strategy that quite simply bought every week a major index and sold a week later whether in profit or loss. There was one simple filter that stopped it buying if a down turn was evident. It was very profitable but as a downturn approached you can sense that just one massive down week could wipe out a lot of profit or our account if we had just started trading with a small capital. This is the risk to reward that we have to work out whether we can live with.

08/24/2018 at 5:36 AM #78884Talking to the beaten here but there is plenty of evidence out there buy and hold can be beaten handsomely . Of course you need to be in the top 5% but that goes for any pursuit . Someone pulls out an alledgely #figjam minimally curve fitted >90% WR with profit factor of the scale and now declares buy and hold the holy grail … WTF . The key to this game is pattern recognition in price action and defining maths to ascertain an accurate definition of said price action . Fitting a said pair of RSI with a filter to turn of in a hindsite period of stormy weather is not the path to do this … That is 100% curve fitting PERIOD . There i have said it … Jog on

1 user thanked author for this post.

-

AuthorPosts

Find exclusive trading pro-tools on