Expert Services

ProRealCode - Trading & Coding with ProRealTime™

ProRealCode - Trading & Coding with ProRealTime™

No recent search

Discussing the strategy VECTORIAL DAX (M5)

- Forums

- ProRealTime English Forum

- ProOrder: Automated Strategies & Backtesting

- Discussing the strategy VECTORIAL DAX (M5)

-

AuthorPosts

-

Here is my version, with a different angle (WF).

Improvments and suggestions are welcome!

// ROBOT VECTORIAL DAX V.3 // M5 // SPREAD 1.5 // by BALMORA 74 - FEBRUARY 2019 /// winnie version 10/04/12019 DEFPARAM CumulateOrders = false DEFPARAM Preloadbars = 50000 //VARIABLES CtimeA = time >= 080000 and time <= 180000 CtimeB = time >= 080000 and time <= 180000 ONCE BarLong = 950 //EXIT ZOMBIE TRADE LONG ONCE BarShort = 650 //EXIT ZOMBIE TRADE SHORT MoneyManagement = 2 //MoneyManagement = Set to 0 for level stakes. Set to 1 for increasing stake size as profits increase and decreasing stake size as profits decrease. Set to 2 for increasing stake size as profits increase with stake size never being decreased. RiskManagement = 1 //RiskManagement = 0 = risk management off and 1 = risk management on. I do not recommend using this it can blow up your account very easily! Capital = 10000 MinBetSize = 1 //MinBetSize = The minimum bet size allowed for the instrument. RiskLevel = 10 //RiskLevel =A factor that changes how fast position size increases as profit increases. Only relevant if Risk Management is turned on. Equity = Capital + StrategyProfit IF MoneyManagement = 1 THEN PositionSize = Max(MinBetSize, Equity * (MinBetSize/Capital)) ENDIF IF MoneyManagement = 2 THEN PositionSize = Max(LastSize, Equity * (MinBetSize/Capital)) LastSize = PositionSize ENDIF IF MoneyManagement <> 1 and MoneyManagement <> 2 THEN PositionSize = MinBetSize ENDIF IF RiskManagement THEN IF Equity > Capital THEN RiskMultiple = ((Equity/Capital) / RiskLevel) PositionSize = PositionSize * (1 + RiskMultiple) ENDIF ENDIF PositionSize = Round(PositionSize) // TAILLE DES POSITIONS PositionSizeLong = 1 * positionsize PositionSizeShort = 1 * positionsize //STRATEGIE //VECTEUR = CALCUL DE L'ANGLE ONCE PeriodeA = 10 ONCE nbChandelierA= 15 MMA = Exponentialaverage[PeriodeA](close) ADJASUROPPO = (MMA-MMA[nbchandelierA]*pipsize) / nbChandelierA ANGLE = (ATAN(ADJASUROPPO)) //FONCTION ARC TANGENTE CondBuy1 = ANGLE >= 20 CondSell1 = ANGLE <= - 24 //VECTEUR = CALCUL DE LA PENTE ET SA MOYENNE MOBILE ONCE PeriodeB = 20 ONCE nbChandelierB= 35 lag = 1.5 MMB = Exponentialaverage[PeriodeB](close) pente = (MMB-MMB[nbchandelierB]*pipsize) / nbchandelierB trigger = Exponentialaverage[PeriodeB+lag](pente) CondBuy2 = (pente > trigger) AND (pente < 0) CondSell2 = (pente CROSSES UNDER trigger) AND (pente > -1) //ENTREES EN POSITION CONDBUY = CondBuy1 and CondBuy2 and CTimeA CONDSELL = CondSell1 and CondSell2 and CtimeB //POSITION LONGUE IF CONDBUY THEN buy PositionSizeLong contract at market SET STOP %LOSS 2 ENDIF //POSITION COURTE IF CONDSELL THEN Sellshort PositionSizeShort contract at market SET STOP %LOSS 2 ENDIF //VARIABLES STOP SUIVEUR ONCE trailingStopType = 1 // Trailing Stop - 0 OFF, 1 ON ONCE trailingstoplong = 4 // Trailing Stop Atr Relative Distance ONCE trailingstopshort = 4 // Trailing Stop Atr Relative Distance ONCE atrtrailingperiod = 14 // Atr parameter Value ONCE minstop = 0 // Minimum Trailing Stop Distance // TRAILINGSTOP //---------------------------------------------- atrtrail = AverageTrueRange[atrtrailingperiod]((close/10)*pipsize)/1000 trailingstartl = round(atrtrail*trailingstoplong) trailingstartS = round(atrtrail*trailingstopshort) if trailingStopType = 1 THEN TGL =trailingstartl TGS=trailingstarts if not onmarket then MAXPRICE = 0 MINPRICE = close PREZZOUSCITA = 0 ENDIF if longonmarket then MAXPRICE = MAX(MAXPRICE,close) if MAXPRICE-tradeprice(1)>=TGL*pointsize then if MAXPRICE-tradeprice(1)>=MINSTOP then PREZZOUSCITA = MAXPRICE-TGL*pointsize ELSE PREZZOUSCITA = MAXPRICE - MINSTOP*pointsize ENDIF ENDIF ENDIF if shortonmarket then MINPRICE = MIN(MINPRICE,close) if tradeprice(1)-MINPRICE>=TGS*pointsize then if tradeprice(1)-MINPRICE>=MINSTOP then PREZZOUSCITA = MINPRICE+TGS*pointsize ELSE PREZZOUSCITA = MINPRICE + MINSTOP*pointsize ENDIF ENDIF ENDIF if onmarket and PREZZOUSCITA>0 then EXITSHORT AT PREZZOUSCITA STOP SELL AT PREZZOUSCITA STOP ENDIF ENDIF //EXIT ZOMBIE TRADE IF POSITIONPERF<0 THEN IF shortOnMarket AND BARINDEX-TRADEINDEX(1)>= barshort THEN EXITSHORT AT MARKET ENDIF ENDIF IF POSITIONPERF<0 THEN IF LongOnMarket AND BARINDEX-TRADEINDEX(1)>= barlong THEN SELL AT MARKET ENDIF ENDIFHi Winnie. Thanks for sharing your researchs

From my side I worked on an improved version based on Paul’s suggestions

I kept the values of original angles but I did a backtest using Walk Forward to optimize the variable “lag” and I’m OK like you for lag = 1.5.

Otherwise I added a 3rd condition for LONG and SHORT based on the orientation of a medium-term moving average :

CondBuy3 = average[100](close) > average[100](close)[1]

CondSell3 = average[20](close) < average[20](close)[1]

It gives less number of positions / less drawdown and a better profit factor.

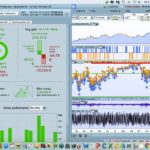

Below are the results and the .ITF file.

It is quite possible that the algorithm is over fitted and over optimized. Reason why I put the code in account demo to observe its behavior over 6 months to 1 year…

I will it share it after….

// ROBOT VECTORIAL DAX v2 // M5 // SPREAD = 1 // by BALMORA 74 - APRIL 2019 DEFPARAM CumulateOrders = false DEFPARAM Preloadbars = 50000 //TRADING TIME CtimeA = time >= 080000 and time <= 180000 CtimeB = time >= 080000 and time <= 180000 //POSITION SIZE PositionSize = 1 //STRATEGY ONCE PeriodeA = 10 ONCE nbChandelierA= 15 ONCE PeriodeB = 20 ONCE nbChandelierB= 35 ONCE lag = 1.5 MMA = Exponentialaverage[PeriodeA](close) ADJASUROPPO = (MMA-MMA[nbchandelierA]*pipsize) / nbChandelierA ANGLE = (ATAN(ADJASUROPPO)) CondBuy1 = ANGLE >= 35 CondSell1 = ANGLE <= - 40 MMB = Exponentialaverage[PeriodeB](close) pente = (MMB-MMB[nbchandelierB]*pipsize) / nbchandelierB trigger = Exponentialaverage[PeriodeB+lag](pente) //BUY CONDITIONS CondBuy1 = ANGLE >= 35 CondBuy2 = (pente > trigger) AND (pente < 0) CondBuy3 = average[100](close) > average[100](close)[1] CONDBUY = CondBuy1 and CondBuy2 and CondBuy3 and CTimeA //SHORT CONDITIONS CondSell1 = ANGLE <= - 40 CondSell2 = (pente CROSSES UNDER trigger) AND (pente > -1) CondSell3 = average[20](close) < average[20](close)[1] CONDSELL = CondSell1 and CondSell2 and CondSell3 and CtimeB //POSITION LONGUE IF CONDBUY THEN buy PositionSize contract at market SET STOP %LOSS 2 ENDIF //POSITION COURTE IF CONDSELL THEN Sellshort PositionSize contract at market SET STOP %LOSS 2 ENDIF //TRAILING STOP ONCE trailingStopType = 1 // Trailing Stop - 0 OFF, 1 ON ONCE trailingstoplong = 4 // Trailing Stop Atr Relative Distance ONCE trailingstopshort = 4 // Trailing Stop Atr Relative Distance ONCE atrtrailingperiod = 14 // Atr parameter Value ONCE minstop = 0 // Minimum Trailing Stop Distance // TRAILINGSTOP //---------------------------------------------- atrtrail = AverageTrueRange[atrtrailingperiod]((close/10)*pipsize)/1000 trailingstartl = round(atrtrail*trailingstoplong) trailingstartS = round(atrtrail*trailingstopshort) if trailingStopType = 1 THEN TGL =trailingstartl TGS=trailingstarts if not onmarket then MAXPRICE = 0 MINPRICE = close PREZZOUSCITA = 0 ENDIF if longonmarket then MAXPRICE = MAX(MAXPRICE,close) if MAXPRICE-tradeprice(1)>=TGL*pointsize then if MAXPRICE-tradeprice(1)>=MINSTOP then PREZZOUSCITA = MAXPRICE-TGL*pointsize ELSE PREZZOUSCITA = MAXPRICE - MINSTOP*pointsize ENDIF ENDIF ENDIF if shortonmarket then MINPRICE = MIN(MINPRICE,close) if tradeprice(1)-MINPRICE>=TGS*pointsize then if tradeprice(1)-MINPRICE>=MINSTOP then PREZZOUSCITA = MINPRICE+TGS*pointsize ELSE PREZZOUSCITA = MINPRICE + MINSTOP*pointsize ENDIF ENDIF ENDIF if onmarket and PREZZOUSCITA>0 then EXITSHORT AT PREZZOUSCITA STOP SELL AT PREZZOUSCITA STOP ENDIF ENDIFIs there redundant code in this strategy or can anybody offer a reason for the following please?

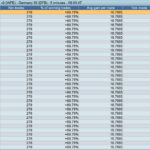

When I optimise the angles, it seems that almost any value gives the same figure for Gain … see attached.

Attached is related to the code version immediately above this post.

Balmora74 thanked this postHi Balmara74,

thanks for your improvment. I run it too. Another idea to improve tue strategy would be to include and test this part of code, very interesting…

https://www.prorealcode.com/blog/learning/how-to-improve-a-strategy-with-simulated-trades-1/

I tried to do it yesterday but i’m not a professionnal coder ;), so some difficulties and errors to do it. Could you try?

Did you test the strategy on 200K?

Balmora74 thanked this post@Grahal

Maybe because you use a negative angle value for variable A28.

It could be interesting to use a value between 0 and +90 (knowing that the more one deviates from 45 and less positions we have).

EDIT POST – ERROR FOUND !!

I found a error on the code above !! Yes it’s redudant because LINES 27 and 28 are the same than LINES 34 and 40

So this is the good version of the code below (i have delete lines 27 and 28) :

// ROBOT VECTORIAL DAX v2 // M5 // SPREAD = 1 // by BALMORA 74 - APRIL 2019 DEFPARAM CumulateOrders = false DEFPARAM Preloadbars = 50000 //TRADING TIME CtimeA = time >= 080000 and time <= 180000 CtimeB = time >= 080000 and time <= 180000 //POSITION SIZE PositionSize = 1 //STRATEGY ONCE PeriodeA = 10 ONCE nbChandelierA= 15 ONCE PeriodeB = 20 ONCE nbChandelierB= 35 ONCE lag = 1.5 MMA = Exponentialaverage[PeriodeA](close) ADJASUROPPO = (MMA-MMA[nbchandelierA]*pipsize) / nbChandelierA ANGLE = (ATAN(ADJASUROPPO)) MMB = Exponentialaverage[PeriodeB](close) pente = (MMB-MMB[nbchandelierB]*pipsize) / nbchandelierB trigger = Exponentialaverage[PeriodeB+lag](pente) //BUY CONDITIONS CondBuy1 = ANGLE >= 35 CondBuy2 = (pente > trigger) AND (pente < 0) CondBuy3 = average[100](close) > average[100](close)[1] CONDBUY = CondBuy1 and CondBuy2 and CondBuy3 and CTimeA //SHORT CONDITIONS CondSell1 = ANGLE <= - 40 CondSell2 = (pente CROSSES UNDER trigger) AND (pente > -1) CondSell3 = average[20](close) < average[20](close)[1] CONDSELL = CondSell1 and CondSell2 and CondSell3 and CtimeB //POSITION LONGUE IF CONDBUY THEN buy PositionSize contract at market SET STOP %LOSS 2 ENDIF //POSITION COURTE IF CONDSELL THEN Sellshort PositionSize contract at market SET STOP %LOSS 2 ENDIF //TRAILING STOP ONCE trailingStopType = 1 // Trailing Stop - 0 OFF, 1 ON ONCE trailingstoplong = 4 // Trailing Stop Atr Relative Distance ONCE trailingstopshort = 4 // Trailing Stop Atr Relative Distance ONCE atrtrailingperiod = 14 // Atr parameter Value ONCE minstop = 0 // Minimum Trailing Stop Distance // TRAILINGSTOP //---------------------------------------------- atrtrail = AverageTrueRange[atrtrailingperiod]((close/10)*pipsize)/1000 trailingstartl = round(atrtrail*trailingstoplong) trailingstartS = round(atrtrail*trailingstopshort) if trailingStopType = 1 THEN TGL =trailingstartl TGS=trailingstarts if not onmarket then MAXPRICE = 0 MINPRICE = close PREZZOUSCITA = 0 ENDIF if longonmarket then MAXPRICE = MAX(MAXPRICE,close) if MAXPRICE-tradeprice(1)>=TGL*pointsize then if MAXPRICE-tradeprice(1)>=MINSTOP then PREZZOUSCITA = MAXPRICE-TGL*pointsize ELSE PREZZOUSCITA = MAXPRICE - MINSTOP*pointsize ENDIF ENDIF ENDIF if shortonmarket then MINPRICE = MIN(MINPRICE,close) if tradeprice(1)-MINPRICE>=TGS*pointsize then if tradeprice(1)-MINPRICE>=MINSTOP then PREZZOUSCITA = MINPRICE+TGS*pointsize ELSE PREZZOUSCITA = MINPRICE + MINSTOP*pointsize ENDIF ENDIF ENDIF if onmarket and PREZZOUSCITA>0 then EXITSHORT AT PREZZOUSCITA STOP SELL AT PREZZOUSCITA STOP ENDIF ENDIFI am going to run this code live.

A little more fun then 🙂

In order for the losses not to be too large you can sell ex.. 0.5 contracts directly after a position is taken.

It will be lower DD as well.

How do you code this?

Vonasi Sad to hear that.I currently have 5 algo live on dax.

Unfortunately, they have gone bad at the same time and it is expensive.

I am going to run them on demo now instead.I currently have 5 algo live on dax. Unfortunately, they have gone bad at the same time and it is expensive. I am going to run them on demo now instead.

I would suggest always running any strategies in a lengthy live forward test in demo to confirm that they are not curve fitted. Yes it is a bit boring and not as exciting as going live but your patience will save you from losing an awful lot of money in the long run. I have strategies that have had on test for a year or more now. They are very profitable but the draw down was bigger than in the in sample test and would have sucked my real account dry if I had just gone live with them. Patience pays!winnie37 thanked this postvonsai True!!I tested your code on nasdaq.

changed sl and tp and time.

// ROBOT VECTORIAL DAX v2 // M5 // SPREAD = 1 // by BALMORA 74 - APRIL 2019 DEFPARAM CumulateOrders = false DEFPARAM Preloadbars = 50000 //TRADING TIME CtimeA = time >= 150000 and time <= 220000 CtimeB = time >= 150000 and time <= 220000 //POSITION SIZE PositionSize = 1 //STRATEGY ONCE PeriodeA = 10 ONCE nbChandelierA= 15 ONCE PeriodeB = 20 ONCE nbChandelierB= 35 ONCE lag = 1.5 MMA = Exponentialaverage[PeriodeA](close) ADJASUROPPO = (MMA-MMA[nbchandelierA]*pipsize) / nbChandelierA ANGLE = (ATAN(ADJASUROPPO)) MMB = Exponentialaverage[PeriodeB](close) pente = (MMB-MMB[nbchandelierB]*pipsize) / nbchandelierB trigger = Exponentialaverage[PeriodeB+lag](pente) //BUY CONDITIONS CondBuy1 = ANGLE >= 35 CondBuy2 = (pente > trigger) AND (pente < 0) CondBuy3 = average[100](close) > average[100](close)[1] CONDBUY = CondBuy1 and CondBuy2 and CondBuy3 and CTimeA //SHORT CONDITIONS CondSell1 = ANGLE <= - 40 CondSell2 = (pente CROSSES UNDER trigger) AND (pente > -1) CondSell3 = average[20](close) < average[20](close)[1] CONDSELL = CondSell1 and CondSell2 and CondSell3 and CtimeB //POSITION LONGUE IF CONDBUY THEN buy PositionSize contract at market SET STOP %LOSS 2 ENDIF //POSITION COURTE IF CONDSELL THEN Sellshort PositionSize contract at market SET STOP %LOSS 2 ENDIF //TRAILING STOP ONCE trailingStopType = 1 // Trailing Stop - 0 OFF, 1 ON ONCE trailingstoplong = 8 // Trailing Stop Atr Relative Distance ONCE trailingstopshort = 5 // Trailing Stop Atr Relative Distance ONCE atrtrailingperiod = 30 // Atr parameter Value ONCE minstop = 0 // Minimum Trailing Stop Distance // TRAILINGSTOP //---------------------------------------------- atrtrail = AverageTrueRange[atrtrailingperiod]((close/10)*pipsize)/1000 trailingstartl = round(atrtrail*trailingstoplong) trailingstartS = round(atrtrail*trailingstopshort) if trailingStopType = 1 THEN TGL =trailingstartl TGS=trailingstarts if not onmarket then MAXPRICE = 0 MINPRICE = close PREZZOUSCITA = 0 ENDIF if longonmarket then MAXPRICE = MAX(MAXPRICE,close) if MAXPRICE-tradeprice(1)>=TGL*pointsize then if MAXPRICE-tradeprice(1)>=MINSTOP then PREZZOUSCITA = MAXPRICE-TGL*pointsize ELSE PREZZOUSCITA = MAXPRICE - MINSTOP*pointsize ENDIF ENDIF ENDIF if shortonmarket then MINPRICE = MIN(MINPRICE,close) if tradeprice(1)-MINPRICE>=TGS*pointsize then if tradeprice(1)-MINPRICE>=MINSTOP then PREZZOUSCITA = MINPRICE+TGS*pointsize ELSE PREZZOUSCITA = MINPRICE + MINSTOP*pointsize ENDIF ENDIF ENDIF if onmarket and PREZZOUSCITA>0 then EXITSHORT AT PREZZOUSCITA STOP SELL AT PREZZOUSCITA STOP ENDIF ENDIFI tested your code on nasdaq.

Not my code!Sorry Vonsai. Wrong of me there. It´s Balmora´s code 🙂Balmora74, Vonasi and the others, Could someone do this? Thanks 🙂 Another idea to improve tue strategy would be to include and test this part of code, very interesting… https://www.prorealcode.com/blog/learning/how-to-improve-a-strategy-with-simulated-trades-1/ I tried to do it yesterday but i’m not a professionnal coder 😉I’ve done a lot of coding with simulated trading ideas in the past but my conclusion after a lot of effort was that it wasn’t really worth the effort. Others may have a different point of view. At the moment I am a bit busy with other projects and I don’t really enjoy converting other people’s codes (especially if a lot of the variable names are Italian!) so I’ll leave this one for someone else if that is OK.winnie37 thanked this postNot my code!

Not even your name! 🙂 Couldn’t resist sorry … as you said Vonasi trading can be lonely and I do enjoy a laugh even if it me making myself laugh!winnie37 thanked this post -

AuthorPosts

- You must be logged in to reply to this topic.

Discussing the strategy VECTORIAL DAX (M5)

ProOrder: Automated Strategies & Backtesting

Author

Summary

This topic contains 1,263 replies,

has 125 voices, and was last updated by VinzentVega

1 year ago.

Topic Details

| Forum: | ProOrder: Automated Strategies & Backtesting |

| Language: | English |

| Started: | 02/24/2019 |

| Status: | Active |

| Attachments: | 470 files |

About personal data collected

The information collected on this form is stored in a computer file by ProRealCode to create and access your ProRealCode profile. This data is kept in a secure database for the duration of the member's membership. They will be kept as long as you use our services and will be automatically deleted after 3 years of inactivity. Your personal data is used to create your private profile on ProRealCode. This data is maintained by SAS ProRealCode, 407 rue Freycinet, 59151 Arleux, France. If you subscribe to our newsletters, your email address is provided to our service provider "MailChimp" located in the United States, with whom we have signed a confidentiality agreement. This company is also compliant with the EU/Swiss Privacy Shield, and the GDPR. For any request for correction or deletion concerning your data, you can directly contact the ProRealCode team by email at privacy@prorealcode.com If you would like to lodge a complaint regarding the use of your personal data, you can contact your data protection supervisory authority.