As you already spotted what is not correct, make it easier for us 🙂 … which of the conditions for a Buy have not been met correctly?

Marc

MarcParticipant

Average

As you can see in my attachment the low of third candle is deeper than candle before…Ths condition wasn’t met for a sell order..

Marc

MarcParticipant

Average

Please ignore above post and find another pic which shows two example orders…both lost…and I do not really know why

I’m sorry, but I’m a little slow on the uptake. To me that little bit of the Chart you show looks like a Buy Order with the trigger being the high of the 3rd candle??

the low of third candle is deeper than candle before…Ths condition wasn’t met for a sell order..

So for a sell order you don’t want the low of the third candle lower than the candle before … is that what you are saying? I’m confused by … Ths condition wasn’t met for a sell order.

Somebody else will probably pop in who can see exactly what you are saying? 🙂

Idea – it be good if you copied the bit of the code you are referring to?

Marc

MarcParticipant

Average

Hi GraHal,

here’s the code and a screenshot.

DEFPARAM CumulateOrders = true

//Buy-Condition l1: Kerze vor 3 Perioden muss bullish sein und es müssen 3 Kerzen mit tieferen Hochs und tieferen Tiefs folgen und der Schlusskurs der vorherigen Kerze muss größer sein als der Schlusskurs der ersten Kerze

l1 = OPEN[3] < CLOSE[3] AND High[3] > High [2] AND High[2] > High[1] AND Low[3] > Low[2] AND Low[2] > Low[1] AND Close[1] >= Close[3]

//Buy-Condition l2: Kerze vor 3 Perioden muss bearish sein und es müssen 3 Kerzen mit tieferen Hochs und tieferen Tiefs folgen und der Schlusskurs der vorherigen Kerze ist größer als das Open der ersten Kerze

l2 = OPEN[3] > CLOSE[3] AND High[3] > High [2] AND High[2] > High[1] AND Low[3] > Low[2] AND Low[2] > Low[1] AND Close[1] >= Open[3]

//Sell-Condition s1: Kerze vor 3 Perioden muss bullish sein und es müssen 3 Kerzen mit höheren Hochs und höheren Tiefs und der SK der vorherigen Kerze ist kleiner als der SK's der ersten Kerze, wenn der SK von Kerze 1 kleiner als das Close ist

s1 = OPEN[3] < CLOSE[3] AND High[3] < High [2] AND High[2] < High[1] AND Low[3] < Low[2] AND Low[2] < Low[1] AND Close[1] <= Close[3]

//Sell-Condition s2: Kerze vor 3 Perioden muss bearish sein und es müssen 3 Kerzen mit höheren hoch und hheren Tiefs und der SK der vorherigen Kerze ist kleiner als der SK's der ersten Kerze, wenn der SK von Kerze 1 kleiner als das Close ist

s2 =OPEN[3] > CLOSE[3] AND High[3] < High [2] AND High[2] < High[1] AND Low[3] < Low[2] AND Low[2] < Low[1] AND Close[1] <= Open[3]

//Kauforder zur Eröffnung der nächsten Kerze wenn Konditionen l1 oder l2 erfüllt sind

IF l1 OR l2 THEN

BUY 1 SHARES AT MARKET NextBarOpen

ENDIF

//Verkauforder zur Eröffnung der nächsten Kerze wenn Konditionen s1 oder s2 erfüllt sind

IF s1 OR s2 THEN

SELLSHORT 1 SHARE AT MARKET NextBarOpen

ENDIF

//For LONG trades:

IF LongOnMarket THEN

SET STOP LOSS (close - low[1]) //difference betwee current price and LOW of candle 3

SET TARGET PROFIT (high[3] - close) //difference between the HIGH of candle 1 and current price (a lower current price is assumed)

EndIF

//For SHORT trades:

IF ShortOnMarket THEN

SET STOP LOSS (high[1] - close) //difference betwee current price and HIGHof candle 3

SET TARGET PROFIT (close - low[3]) //difference between the LOW of candle 1 and current price (a higher current price is assumed)

EndIf

If anybody else can see / understand what is wrong / not happening here then feel free to step in and help Marc.

The last image appears to meet your condition l2.

Are you aware that the candles are indexed like this?

[attachment file=77368]

Marc

MarcParticipant

Average

Hi Vonasi,

I thought that the code works the following way:

candle 1, candle 2 and candle 3 meet the conditions. If they are in line with the strategy candle 0 shall be executing market order candle. TP and SL shall be linked with highs or lows of candle 1-3.

Du you understand what I mean?

Regards Marc

Candle zero is the last closed candle. It is at the close of this candle that all decisions are made based on your code. The trade is opened at the open of the next candle.

It is as I showed in the image that I posted. Your strategy ignores the most recently closed candle and bases all its decisions on the three candles before. Subtract 1 from all your candle index numbers and maybe the strategy will trade how you think it should.

You must save your SL and TP and set them only once, otherwise they might change at any future bar, as Vonasi explained:

DEFPARAM CumulateOrders = true

//Buy-Condition l1: Kerze vor 3 Perioden muss bullish sein und es müssen 3 Kerzen mit tieferen Hochs und tieferen Tiefs folgen und der Schlusskurs der vorherigen Kerze muss größer sein als der Schlusskurs der ersten Kerze

l1 = OPEN[3] < CLOSE[3] AND High[3] > High [2] AND High[2] > High[1] AND Low[3] > Low[2] AND Low[2] > Low[1] AND Close[1] >= Close[3]

//Buy-Condition l2: Kerze vor 3 Perioden muss bearish sein und es müssen 3 Kerzen mit tieferen Hochs und tieferen Tiefs folgen und der Schlusskurs der vorherigen Kerze ist größer als das Open der ersten Kerze

l2 = OPEN[3] > CLOSE[3] AND High[3] > High [2] AND High[2] > High[1] AND Low[3] > Low[2] AND Low[2] > Low[1] AND Close[1] >= Open[3]

//Sell-Condition s1: Kerze vor 3 Perioden muss bullish sein und es müssen 3 Kerzen mit höheren Hochs und höheren Tiefs und der SK der vorherigen Kerze ist kleiner als der SK's der ersten Kerze, wenn der SK von Kerze 1 kleiner als das Close ist

s1 = OPEN[3] < CLOSE[3] AND High[3] < High [2] AND High[2] < High[1] AND Low[3] < Low[2] AND Low[2] < Low[1] AND Close[1] <= Close[3]

//Sell-Condition s2: Kerze vor 3 Perioden muss bearish sein und es müssen 3 Kerzen mit höheren hoch und hheren Tiefs und der SK der vorherigen Kerze ist kleiner als der SK's der ersten Kerze, wenn der SK von Kerze 1 kleiner als das Close ist

s2 =OPEN[3] > CLOSE[3] AND High[3] < High [2] AND High[2] < High[1] AND Low[3] < Low[2] AND Low[2] < Low[1] AND Close[1] <= Open[3]

//Kauforder zur Eröffnung der nächsten Kerze wenn Konditionen l1 oder l2 erfüllt sind

IF l1 OR l2 AND Not OnMarket THEN //Not OnMarket will prevent SL & TP to be recalculated

SL = (close - low[1]) //difference between current price and LOW of candle 1

TP = (high[3] - close) //difference between the HIGH of candle 3 and current price (a lower current price is assumed)

BUY 1 SHARES AT MARKET //NextBarOpen

SET STOP LOSS SL

SET TARGET PROFIT TP

ENDIF

//Verkauforder zur Eröffnung der nächsten Kerze wenn Konditionen s1 oder s2 erfüllt sind

IF s1 OR s2 AND Not OnMarket THEN //Not OnMarket will prevent SL & TP to be recalculated

SL = (high[1] - close) //difference between current price and HIGH of candle 1

TP = (close - low[3]) //difference between the LOW of candle 3 and current price (a higher current price is assumed)

SELLSHORT 1 SHARE AT MARKET //NextBarOpen

SET STOP LOSS SL

SET TARGET PROFIT TP

ENDIF

Marc

MarcParticipant

Average

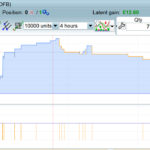

It still looks mad -.-

Perhaps the strategy is not really that good

l1

My mistake – I got my open[3] < or > close[3] condition mixed up as I always write it the other way round – close before open!

It still looks mad -.-

Perhaps the strategy is not really that good

Or maybe it is better on a different market and a different time frame? But usually if it feels like a failure straight out of the box it usually is!

@Marc looks like maybe you should work on it on 4H TF on DJI?

Attached are results for Roberto version code