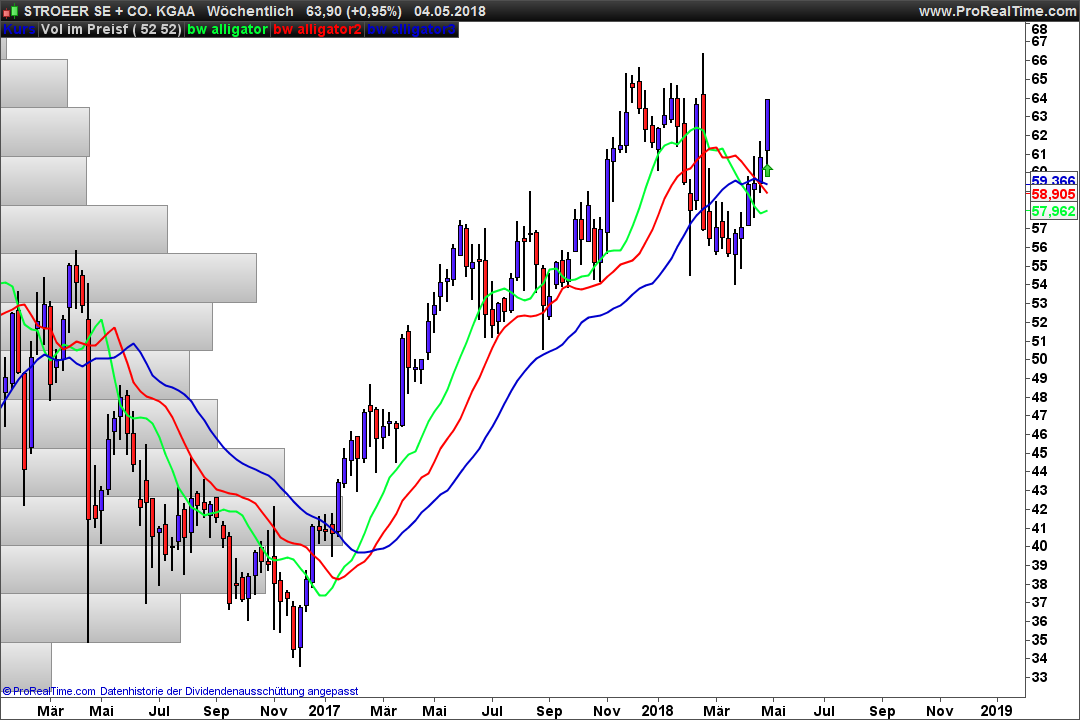

i use it on weekly chart for lower noise

the trend is measured with the bill williams alligator

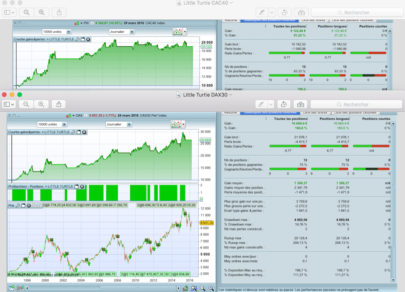

i used it to trade german xetra stocks

i only wanna stocks with a total traded volume (close * volume) of 3 mio euro (you can change this value)

no optimization needed

give every week a lot of stocks – cherry pick the beauties with your eye

stop loss is the red alligator linie – often nice upswings are found

|

1 2 3 4 5 6 7 8 9 |

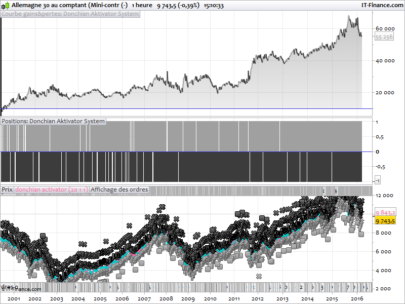

c2 = WilderAverage[8]((high+low)/2)[5] c3 = WilderAverage[13]((high+low)/2)[8] c4 = average[52](close*volume) > 3000000 c5 = average[52](close*volume) c6 = c3 > c2 c7 = close > c3 and close[1] < c3[1] c8 = c7 or c7[1] or c7[2] or c7[3] c9 = close > c2 SCREENER[c4 and c6 and c8 and c9](c5 as "traded volume") |

Share this

No information on this site is investment advice or a solicitation to buy or sell any financial instrument. Past performance is not indicative of future results. Trading may expose you to risk of loss greater than your deposits and is only suitable for experienced investors who have sufficient financial means to bear such risk.

ProRealTime ITF files and other attachments :PRC is also on YouTube, subscribe to our channel for exclusive content and tutorials

Voici une version améliorée qui tient compte de plus de critères, notamment l’intégration des volumes récents et du RSI qui réduit les faux positifs.

// Calcul des moyennes de Wilder et du volume moyen

c2 = WilderAverage[8]((high+low)/2)[5]

c3 = WilderAverage[13]((high+low)/2)[8]

c4 = Average[52](close*volume) > 3000000 // Volume moyen sur 52 périodes > 3M

c5 = Average[52](close*volume)

// Vérification des tendances et cassures

c6 = c3 > c2 // Tendance haussière sur les moyennes

c7 = close > c3 and close[1] c2 // Confirmation au-dessus de la moyenne courte

// Ajout d’un filtre de volumes récents (pic de volume)

recentVolumeSpike = volume > 0.5 * Average[10](volume) // Volume > 50% de la moyenne

// Ajout d’un filtre RSI pour éviter les zones de surachat

r = RSI[14](close)

c10 = r Average[200](close) // Estimation de tendance haussière

// SCREENER final avec toutes les conditions améliorées

SCREENER[c4 and c6 and c8 and c9 and recentVolumeSpike and c10 and marketTrendEstimate](c5 as “Traded Volume”, rsi as “RSI”)