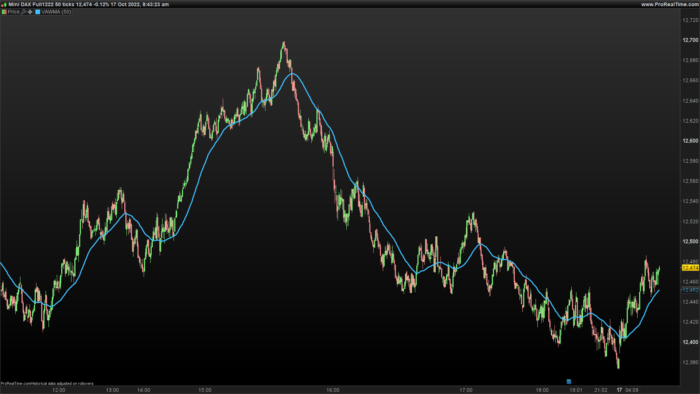

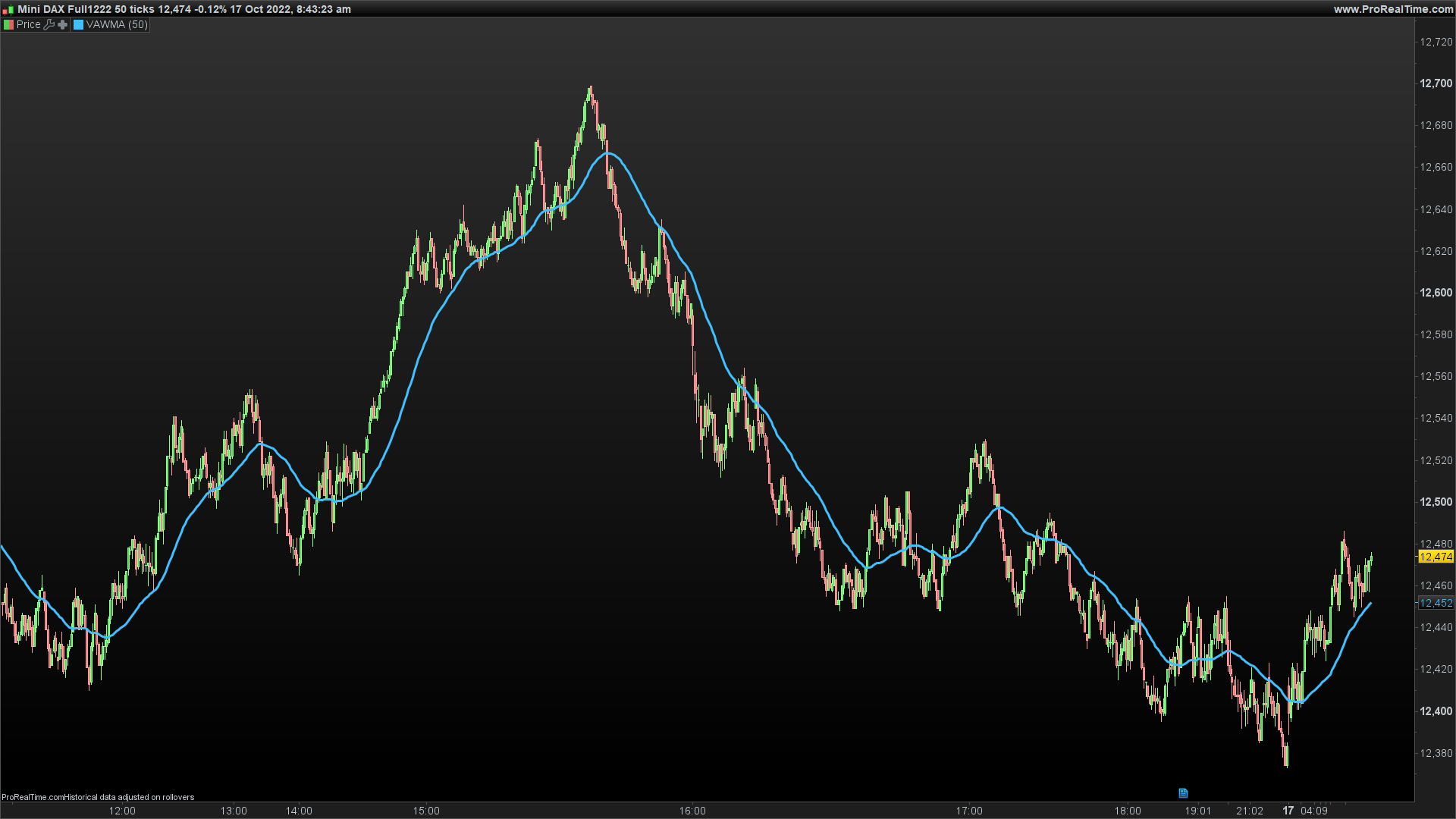

VAWMA = VWMA and WMA combined.

Simply put, this attempts to determine the average price per share over time, weighted heavier for recent values.

Uses triangular algorithm to taper off values in the past (same as WMA does).

Why use this?

Let’s say the earliest bar of the VWMA has a huge amount of volume . That means that when the next bar arrives, there will be an abrupt change in the moving average that doesn’t represent the current value properly. VAWMA eliminates this problem by triangular weighting each bar.

(description from original author: Electrified, all credits to him).

|

1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 |

//PRC_VAWMA | indicator //17.10.2022 //Nicolas @ www.prorealcode.com //Sharing ProRealTime knowledge //converted from pinescript // --- settings len = 50 //Length // --- end of settings src = medianprice sum = 0.0 vol = 0.0 for m = 1 to len // m = triangular multiple i = len - m v = volume[i] * m vol = vol + v sum = sum + src[i] * v next return sum/vol as "VAWMA" |

Share this

No information on this site is investment advice or a solicitation to buy or sell any financial instrument. Past performance is not indicative of future results. Trading may expose you to risk of loss greater than your deposits and is only suitable for experienced investors who have sufficient financial means to bear such risk.

ProRealTime ITF files and other attachments :PRC is also on YouTube, subscribe to our channel for exclusive content and tutorials

Hi Nicolas!

I can´t install this indicator. it installs in a separate window not as an average on the price.

How can i make it work?

Thanks

Add it on the price, see how: https://www.prorealcode.com/blog/video-tutorials/how-to-add-an-indicator-on-price-prorealtime/

No consigo instalarlo en el precio en PRL-version 10