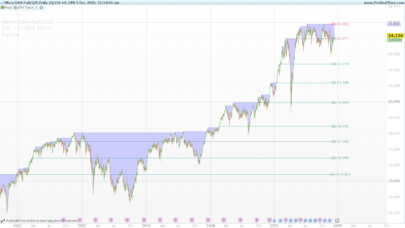

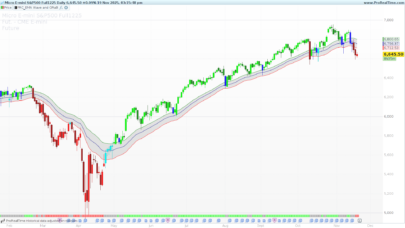

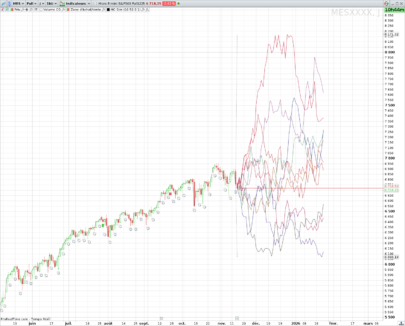

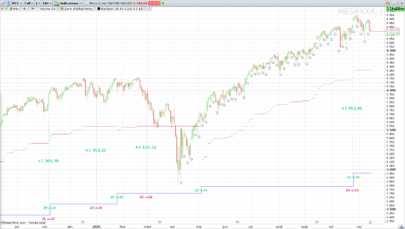

Bollinger oscillator

This is an extension of Bollinger bands. It shows the relative position of the closing price of the candle relative to the bands.

Zero value equals to a close on the lower bound. 50 value equals to a close on the Bollinger moving average. Finally, 100 value equals to a close on the upper bound.

This is an oscillator that provides overbought / oversold signals over 100 and under 0 levels. Divergences with price levels may be profited upon.

|

1 2 3 4 5 6 7 8 |

REM Calculation of Bollinger oscillator delta = CLOSE - BOLLINGERDOWN width = 4 * STD BBO = delta * 100 / width RETURN BBO AS"Bollinger Band Oscillator" |

Share this

No information on this site is investment advice or a solicitation to buy or sell any financial instrument. Past performance is not indicative of future results. Trading may expose you to risk of loss greater than your deposits and is only suitable for experienced investors who have sufficient financial means to bear such risk.

ProRealTime ITF files and other attachments :PRC is also on YouTube, subscribe to our channel for exclusive content and tutorials

Hi

I don’t understand the maths of the width calculation in the above does it represent 2 above the average and 2 below the average. I was trying to amend the code for a 2.3 std but don’t come up with the same answer as provided by %b in standard indicators. Can anyone help please?

For information I attach my attempt

// Bollinger Band Oscillator

delta = close-bollingerdown

width = 4.6*std

BBO = delta*100/width

RETURN BBO AS \"bb Oscillator 2.3

i also have same question. pls advise on how can have Bollinger B%(50,3)?

Hi Nicolas

There’s a problem to download file (400 Bad Request)

Thanks for the indicator and have a nice day

Hi, I fixed this issue. You can now download the file without any error.

Thanks a lot

Bonjour le %bollinger est protégé sur Prorealtime. Le code ci-dessus est paramétré par défaut à 20 périodes. Je souhaiterais le paramétré en 200 périodes. quel paramètre faudrait il mettre pour avoir le même que prorealtime en 200 périodes. Merci

Le code dans ce post répond à cette demande d’adaptation de la période du %Bollinger: https://www.prorealcode.com/topic/bollinger-b/#post-41519