When does spread actually change?

Forums › ProRealTime English forum › ProOrder support › When does spread actually change?

- This topic has 17 replies, 5 voices, and was last updated 4 years ago by

Mike.

-

-

07/24/2018 at 10:01 AM #76581

I’m working on a bit of MTF code so that with a daily or weekly strategy trades can be taken when the spread is more favourable rather than at midnight – which for most US and EU markets is when the spread is at its largest. My question is that on this IG page times are shown for when the spread changes:

…but do they change exactly at the time shown? If I use the 1 Hour chart as my shortest time frame and open the trade at the open of the 0800 candle for example will I actually get the better spread or should I wait a bit? It is very difficult to eyeball on the markets at the times shown. Yes I could just switch down to a five minute or 1 minute chart but I would like to use the 1 hour chart or even four hour chart if it ties in with the earliest time to get the best spread so as I get more back test data.

Has anybody seen any issues with their strategies when opening on the exact hour of the spread change? Does anyone ever see a delay in the spread change?

I don’t really spend much time watching the markets at the opening as I am more of a daily/weekly trader so maybe the market open is not the best time to get in to the markets anyway – any intra-day traders got some advise on this?

2 users thanked author for this post.

07/24/2018 at 10:10 AM #7658307/24/2018 at 10:20 AM #76584I just did a quick test on a 1 minute chart and opened a long and a short using two strategies like this:

1234567if opentime = 121500 thenbuy 1 contract at marketendifif onmarket thensell at marketendifand this:

1234567if opentime = 121500 thensellshort 1 contract at marketendifif onmarket thenexitshort at marketendif…and on the DJI one position was opened long at 25138.1 and one position short at 25135.7 which is a spread of 2.4 which exactly matches what IG say it should be at this time. So now I just need to set strategies running with the open time of each market and gather my own data on what spread I get.

I think I just answered my own question!

07/24/2018 at 11:26 AM #76594I have set up 12 long and 12 short strategies to run at the open of 12 different markets opening times at minimum stake. They are US and EU markets. So hopefully tomorrow just after 0800 I will have a good survey of what spread trades are actually opened at.

07/24/2018 at 2:22 PM #76614The first results are in. It seems that if you set a strategy to open a position at the market open time then it fails to get you the better spread that IG say starts at that time.

Wall Street spread was 2.4 and should have been 1.6

US Tech 100 spread was 2.0 and should have been 1.0

SP500 spread was 0.6 and should have been 0.4

The spread that they opened at exactly matches what the spread for each market should be in the time period prior to the open.

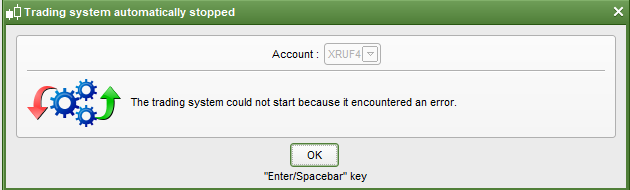

Strangely four of the strategies stopped themselves. One on the SP500 after it had traded and three on EU markets that had not needed to trade yet. I have restarted them. The error given was:

07/25/2018 at 8:34 AM #76666The full results are in and they are very conclusive. I ended up testing the opening time of 11 major indices in the US and EU and every single one when opening trades at the market open time opened them with the pre-market open rate of spread. This means that if your strategy opens a position for you using the market open time then your trade will start off at a disadvantage.

Interestingly there was absolutely no slippage at all on any of the markets.

I will now set a few identical strategies on one of the US markets with second intervals and see if I can work out when the spread actually changes.

07/25/2018 at 1:41 PM #76711So my little test on the opening of the DJI to test when the spread changed has now run itself. I opened long and short positions for every second of the first 10 seconds then at 20 second and 1 minute after 1430. For some reason the positions at 2 seconds and 4 second strategies did not open positions and I made an error and forgot to put one of the 6 second strategies on test. In the end this did not matter as every result returned a spread of 2.4 exactly. 2.4 is what IG list as the out of hours pre-market spread and I now notice that even though the market has been open for quite some time the spread is still 2.4. I did not check what the spread was pre-market opening so cannot say if it changed at all. This is a test for tomorrow! It would seem that IG are not telling the truth about what their spreads are on either of these pages where they list the current spread as supposedly 1.6 when in fact it is 2.4:

Here is an image confirming that the trades were opened just after the market open:

07/26/2018 at 8:17 AM #7676307/26/2018 at 11:54 AM #76793I have set two strategies running that buy long and sell short on every half hour on the DJI so I can gather data on what the actual spread is compared to what IG are telling us it should be.

Although even if IG are telling us it should be one thing and it isn’t they will always have this get out clause:

Spreads are subject to variation, especially in volatile market conditions. On 24 hour index markets, our spreads depend on whether the underlying futures market is open (in-hours) or closed (out-of-hours). Other index markets are only quoted when the underlying futures market is open. Our dealing spreads may change to reflect the available liquidity during different times of day. Our normal spread during each time period is shown in the table.

From this page:

07/26/2018 at 1:22 PM #76798My above tests appear to be invalid. I have been a 42 carat plonker. I ran the strategies on a little used PRT account that I have and I just realised that the time zone was set differently to my other platforms so when I thought that it had opened trades at the market open it was actually 2 hour earlier! The chart image above fooled me into thinking that it was the open but actually there was just a weird bit of volatility at 1230 UK time. I have corrected the time zone on the platform and will start again…. doh!

07/26/2018 at 3:07 PM #76816Now that I have corrected my 42 carat plonker time zone error my results are correct.

The trade that opened on the dot of the DJI market open at 1430 British Summer Time got the 1.6 pip spread that IG say it should – so we can open trades at exactly the market open and know we are getting the better spread. No need to wait a few seconds or a minute. This is good because it means we can use the 30 minute and 1 hour charts to time entries and exits at market open to get a better spread.

I guess everyone already knew this but I like to prove things for my own confidence that a strategy will actually do what it is meant to do. I will leave the test strategies running to check the spread change over the full 24 hour period just for interest.

07/27/2018 at 11:49 AM #76880thank you vonasi!!!!

07/28/2018 at 3:07 PM #76982The test was a relative success and for all the trades opened it proved that spread was what the broker said it should be and that it changed exactly at the time they said it should so buying at exactly the market open time gets the lower spread.

However there were some issues of non opening trades and that is now being discussed here:

07/31/2018 at 5:42 PM #77206@Vonasi which Thread was it that I agreed to run a Long and a Short version of Roberto code as a double check against your findings re Spread?? 🙂

Anyway I use Google Sheets and it wont accept a drag and drop of results into Sheets.

You probably have an Excel Template all set up and a macro you run and out pop the results?? 🙂

Can you use attached and import into your Template ?

07/31/2018 at 6:45 PM #77209You probably have an Excel Template all set up and a macro you run and out pop the results??

I used pen and paper and a calculator, sometimes I even used my brain to work out the difference – but then again I am quite old (school). 🙂

This was the thread:

-

AuthorPosts

Find exclusive trading pro-tools on