Hi,

I tried to make a strategy based on Volatility Scalper Indicator of Nicolas. As a reminder, this indicator detects the high volatility of market places. It’s the reflect when the market is making big move on the same bar.

This strategy is based on this indicator.

- When the value of the upside volume is considered as good, value > treshold and close > long MM, -> buy position is taken.

- When the value of the downside volume is considered as good, value > treshold and close < long MM, -> sell position is taken.

- Stop according to traling stop

- time 1530 – 2200, everyday

- option / reversal position size (possibility to activate or not)

- option for buy, sell or both

all suggestions are open…

- maybe specify more precise time ranges according to the volatility of DJI, same thing for different days… ?

- others ?

- …

- others.. ?

//VOLATILITY SCALPER STRATEGY

//@MAKSIDE - 2020

//V0.1

// Définition des paramètres du code

DEFPARAM CumulateOrders = False // Cumul des positions désactivé

//$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$ Volatility Scalper

//@Nicolas/PRT

// Variables

threshATRPeriod = 40

smoothing = 2

verticalShiftPercent = 0

// --

threshATRPeriod = max(1, threshATRPeriod)

smoothing = max(1, smoothing)

diff = averagetruerange[1] - averagetruerange[2]

if(close-close[1])>0 THEN

upsidevol = averagetruerange[1] + diff * 0.5

upsideVol = max(upsideVol, 0)

downsidevol = 0

ELSE

upsidevol = 0

downsidevol = averagetruerange[1] + diff * 0.5

downsideVol = max(downsideVol, 0)

ENDIF

t = DEMA[smoothing](AverageTrueRange[threshATRPeriod])

t = t + (t*(verticalShiftPercent/100))

//$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$

//PARAMETERS OF STRATEGY **************************************

//level of volatility indicator / bull market

Cupsidevol = 10

//level of volatility indicator / bear market

CdownsideVol = 20

//buy conditions

Cdatetimebuy = (CurrentTime > 153000) and currenttime < 220000

//sell conditions

Cdatetimesell = (CurrentTime > 153000) and currenttime < 220000

Cbuy = upsidevol>Cupsidevol and upsidevol > t and Cdatetimebuy

Csell = downsidevol>CdownsideVol and downsidevol > t and Cdatetimesell

// Strategy - 1 : buy, 2 : sell, 3 : both

Cchoice = 2

//Reverse martingale 1 : ON, 0 : OFF

levier = 1

n = 1

reversemartingale = 0

//$$$$$$$$$$$$$$ REVERSE MARTINGALE

// in case of loss, back to initial value 1

// in case of winning, increase by one unit

// in case of 4 consecutive wins, back to initial value 1

if reversemartingale = 1 then

ONCE n = levier

IF Strategyprofit<Strategyprofit[1] THEN

n = levier

ENDIF

IF Strategyprofit>Strategyprofit[1] THEN

n = n + levier

ENDIF

IF n >= 6 * levier THEN // modifier la valeur selon vos préférences

n = levier

ENDIF

endif

//STRATEGY **************************************

//

if Cchoice = 1 or 3 then

if close > Average[4800](close) then

IF not longonmarket and Cbuy THEN

BUY n CONTRACT AT MARKET

ENDIF

SET STOP pLOSS 5

endif

endif

if Cchoice = 2 or 3 then

if close < Average[4800](close) then

IF not shortonmarket and Csell THEN

sellshort n CONTRACT AT MARKET

ENDIF

SET STOP pLOSS 5

endif

endif

//TRAILING STOP **************************************

trailingstart = 15 //trailing will start @trailinstart points profit

trailingstep = 5 //trailing step to move the "stoploss"

//reset the stoploss value

IF NOT ONMARKET THEN

newSL=0

ENDIF

//manage long positions

IF LONGONMARKET THEN

//first move (breakeven)

IF newSL=0 AND close-tradeprice(1)>=trailingstart*pipsize THEN

newSL = tradeprice(1)+trailingstep*pipsize

ENDIF

//next moves

IF newSL>0 AND close-newSL>=trailingstep*pipsize THEN

newSL = newSL+trailingstep*pipsize

ENDIF

ENDIF

//manage short positions

IF SHORTONMARKET THEN

//first move (breakeven)

IF newSL=0 AND tradeprice(1)-close>=trailingstart*pipsize THEN

newSL = tradeprice(1)-trailingstep*pipsize

ENDIF

//next moves

IF newSL>0 AND newSL-close>=trailingstep*pipsize THEN

newSL = newSL-trailingstep*pipsize

ENDIF

ENDIF

//stop order to exit the positions

IF newSL>0 THEN

SELL AT newSL STOP

EXITSHORT AT newSL STOP

ENDIF

//************************************************************************

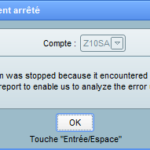

For the moment, that doesn’t work with proorder..

I have that systematically..

Hi and thank you for your code!

Really like the stratergy. I was trying to put it live on my demo but gets an error just after I start it? Have checked the code and the only thing I changed was the ploss to 6 because that’s the min stopploss? But also tried with higher without succes.

Are you sure about the ploss set to 6 with IG account/DJI ?

please note, the gain is more important.. 862$ for my sample.. it’s 1.6 for the spread between 1530 – 2200 with IG.

In my example, i took 2 for the spread.

But you are right… i modified and try with different values for ploss and that the same thing.. bot rejected immediately

When you try to start the bot this comes up (see picture)

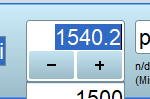

I got no near your gain with 1 contract with 100k units. (see picture of my backtest)

For the spread normally its 1,6 but nowdays its going up and down like crazy.

@MrCool

It’s not DJI 1€ .. but DJI 2$ used.

814$ with reversemartingale = 0

838$ with reversemartingale = 1

when this bot will work, be careful, please check this value because it’s not the value 1 which will be given to proorder but more if reversemartingale is on… (position size is increased in this case)

Ah my bad! Now I get the same results and it’s doing good today 🙂

Yes I’m aware of that, thank you!

Do you think its wrong with the code or ptr?

I don’t know.. I open a ticket through held desk center of PRT

i’m waiting and sure, i will come back soon 😉

Try to add a a defparam preloadbards = 1000 at the top of the code.

You should also calculate your position size only before entering a new order, because now the “n” variable is calculating on each bar, even if you don’t meet the requirement to open a new position at market. So move the martingale code before line 79 and 91.

@Nicolas

you are right, but i just tested. as soon as i start prorder, the strategy is rejected…

Sorry, I forgot a zero:

defparam preloadbars = 10000

Good morning,

The minimum stop this morning is 1095 point see attached picture