Paul

PaulParticipant

Master

I couldn’t find improvements on the code, so I wondered should I be trading all from 8-18h.

First of the bat found that the first two hours are not very good. Having adjusted start-time, I ran it again and found further improvements in i.e.14-16h.

It just got rid of poor performance trades, average gain, win-chance and payout went up.

Not a popular method for a a strategy and not a solid one perhaps, but the results improved so much it’s hard to ignore.

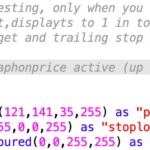

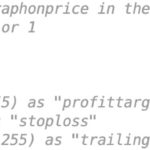

Added the holiday, no position in the weekend, added to limit the number of positions a day, displaying lines to see in a backtest where the stoploss actually is or how the trailing stop is working.

Paul

PaulParticipant

Master

// ROBOT VECTORIAL DAX v4

// M5

// SPREAD = 1

Hi,

I try to improve it with a new money managemt that I used in other my strategy. Do you have also the version for Nasdaq ?

thanks

AE

AEParticipant

Senior

Paul thanks so much! It looks really good.

One question: On your code I see April 2019, but we are on July. It means that the backtesting optimice is until April 2019 and since April 2019 it’s like real (out of sample) ?

Thanks again

Paul

PaulParticipant

Master

Hi AE,

Although I didn’t touch the basic parameters of the original code, I made other changes. So it’s no clean OOS!

@volpiemanuele. plz post your full other strategy. Perhaps that management could be used here.

AE

AEParticipant

Senior

Sorry Paul but I´m new here and I don’t know what do you mean with OOS. Could you please explain what do you mean with “it’s no clean OOS” ?

When you did your other changes, do you used all data to do backtesting or only until April 2019? I just see the backtesting from April to July and profits are incredible. This results maybe are overfitting?

Thanks!!

Thank you for sharing. Can you help me ? Thank you

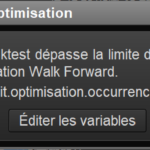

Second image: Instead of 6 occurrences, try with 5 or less (first put actif mode on, change the parameter & turn it off again)

and for live trading? (instrcution “graph” is forbidden)…

Paul

PaulParticipant

Master

@AE you mentioned out of sample, that’s OOS and it’s not clean. I used the data up till today when filtering the hours. That with the basic parameters setting which were found in april I guess. It’s curve-fitted and perhaps too much. I leave that open for discussion

@Ted21 Too much optimisation / combinations it seems. Try to have it less

@winnie37 I didn’t focus on a WFE score, so that’s something others could pick up. The daystraddle v3 is finished in my view. Time-schedules are not in play there, because it only takes a position in the first hour.

Also added a pic attached to show what to do when you go live with this code (the (un)comment question) and if you want lines for backtesting purpose.

With lines it’s nicely visible i.e. the stoploss of first trade of day.

Short at 12372 with a stoploss at 12620.

It’s big, especially when you have it visual in stead a percentage number.

I made a small update in which you can see what happens if you switch the extra time schedules on/off

last note; It is possible to still have interesting results with a 1% stoploss & an exit with the trailingstop.

Hi,

I add to the last version my MM. You can set 4 type of MM. You can set 1 instead of 0 and change some parameters. The risult attached is related to 1 lot, increasing of 0.25 of each gain for max 9 trade. The are many possibility to combinate the parameters. I have explained in the code the function (in italian Language). Thanks Emanuele

AE

AEParticipant

Senior

Paul, could you please send us the same strategy but modified to be used on Nasdaq (US Tech 100 cash) and another one (maybe the same?) for SP500 (EEUU 500 Cash)??

Thanks you in advance for your amazing work.

Paul

PaulParticipant

Master

@volpiemanuele Thanks for sharing that money management layout.

I’ve not worked on a version of SP500 & Nasdaq. Hope someone else will post some settings to work with.

Made a few small changes and I believe “reset at start” wasn’t working good, with MM and max 3 positions. This also because you could ‘ve a position overnight.

If countofshort/long shares was set to 1, it still went up to 3 cumulative positions.

So the reset counter is adjusted and that had impact with or without MM.

It’s not working as it’s supposed to work but results increased.