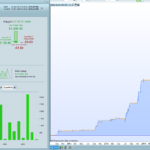

This version is DJI 1H and 24H.

The graph is good, but it can’t run in live.

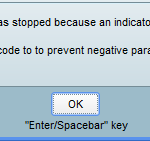

The stop notice said negative or zero parameter and attached.

Anyone can help?

Thanks.

Line 241:

tsatr=averagetruerange[tsatrperiod]((close/4.8))/1000

tsatrperiod is equal to 0 at line 204:

once tsatrperiod = 0 // ts atr parameter

You should set a period of calculation for this indicator 🙂

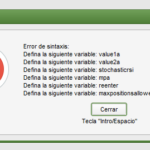

I integrate the ML code and open this error… Paul

I integrate the ML code and open this error… Paul

It’s not an error, you just have to define those variables.

Yes, i see.

But, what define this variables??

Paul

PaulParticipant

Master

Fran55, better use the code posted in the Machine Learning topic on page one for one variable and see how that works.

https://www.prorealcode.com/topic/machine-learning-in-proorder/#post-121059

Hi, All

Recently the result is not good in DAX, DJI market 🙁

how about you?

Hi, All

Recently the result is not good in DAX, DJI market 🙁

how about you?

I’m still testing it in demo but the results in DJ are very good last 10 days

I think this is normal as the price is in full bullish divergence.

Hello guys,

Lets’ make this discussion active again! 😀

As I now have 1M candles available for the backtest I’ve optimised it and changes few settings and here is where I am currently.

I am trying to get the curve as clean as possible since mid-june 2016 as it is (in my opinion) enough to optimise and represents well enough the market conditions with the volumes that we have nowadays.

Here is the code where it stand at the moment, could you test it on your side and tell me what you think that could be change / improve / optimise? I ran out of idea and I’ve worked quite a long time on it so I need an exterior opinion I guess 😉

Feel free to tell what you think and what’s you have in mind! It could be a good path to explore! 😀

PS. I am working on another code that I’ll released when it’ll be ready in my opinion based on ichimoku quite only 😉

THANKS GUYS! 😀

//-------------------------------------------------------------------------

// Code principal : DJI Tanou V13

//-------------------------------------------------------------------------

DEFPARAM CumulateOrders = false

DEFPARAM Preloadbars = 50000

//--------------------------------------------------------------------------------------------------------------------------------------------------

//Money Management

positionsize=1

//--------------------------------------------------------------------------------------------------------------------------------------------------

//HORAIRES DE TRADING

Ctime = time >= 153000 and time < 220000

//--------------------------------------------------------------------------------------------------------------------------------------------------

//STRATEGIE

//VECTEUR = CALCUL DE L'ANGLE

//i1 = HistoricVolatility[10](close)

//c1 = (i1 >= 0.06)

ONCE PeriodeA = 3

ONCE nbChandelierA= 30

MMA = Exponentialaverage[PeriodeA](close)

ADJASUROPPO = (MMA-MMA[nbchandelierA]) / nbChandelierA

ANGLE = (ATAN(ADJASUROPPO)) //FONCTION ARC TANGENTE

CB1 = ANGLE >= 37

CS1 = ANGLE <= - 47

//VECTEUR = CALCUL DE LA PENTE ET SA MOYENNE MOBILE

ONCE PeriodeB = 30

ONCE nbChandelierB= 35

lag = 0

MMB = Exponentialaverage[PeriodeB](close)

pente = (MMB-MMB[nbchandelierB]) / nbchandelierB

trigger = Exponentialaverage[PeriodeB+lag](pente)

CB2 = (pente > trigger) AND (pente < 0.4)

CS2 = (pente CROSSES UNDER trigger) AND (pente > -0.9)

mx = average[41,0](close)

CB3 = mx > mx[1]

mx2 = average[58,0](close)

CS3 = mx2 < mx2[1]

// ichimoku

//Tenkan = (highest[9](high)+lowest[9](low))/2

Kijun = (highest[26](high)+lowest[26](low))/2

SSpanB = (highest[52](high[26])+lowest[52](low[26]))/2

////chikou=close

If Kijun[1] = Kijun then

Condichi2 = 0

Else

Condichi2 = 1

Endif

//--------------------------------------------------------------------------------------------------------------------------------------------------

//ENTREES EN POSITION

VarDistIchiBuy = 14

VarDistIchiSell = 1

DistIchiSSB = Open - SSpanB

If DistIchiSSB >= VarDistIchiBuy then

CondDistIchil = 1

Else

CondDistIchil = 0

Endif

If DistIchiSSB <= VarDistIchiSell then

CondDistIchis = 1

Else

CondDistIchis = 0

Endif

//RSI Dynamic

//RSIDyna1 = RSI[14](close)

//RSIDyna2 = DynamicZoneRSIUp[14,20](close)

//RSIDyna3 = DynamicZoneRSIDown[14,20](close)

//RSIDL1 = RSIDyna1 <= 61.5

//RSIDL2 = RSIDyna2 <=58

//RSIDL3 = RSIDyna3 <= 53.8

//RSIDL4 = RSIDyna1>RSIDyna2

//RSIDL5 = RSIDyna2>RSIDyna3

//RSIDL = RSIDL3

//RSIDS1 = RSIDyna1 <= 30.15

//RSIDS2 = RSIDyna2 >=49

//RSIDS3 = RSIDyna3 >= 38

//RSIDS4 = RSIDyna2>RSIDyna3

//RSIDS5 = RSIDyna3>RSIDyna1

//RSIDS = RSIDS4 and RSIDS5

CONDBUY = CB1 and CB2 and CB3 and CTime and CondDistIchil and condichi2

CONDSELL = CS1 and CS2 and CS3 and Ctime and CondDistIchis and condichi2

//--------------------------------------------------------------------------------------------------------------------------------------------------

//Entrée en position

//POSITION LONGUE

IF CONDBUY THEN

buy positionsize contract at market

SET STOP %LOSS 2.4

ENDIF

//POSITION COURTE

IF CONDSELL THEN

Sellshort positionsize contract at market

SET STOP %LOSS 0.8

ENDIF

//--------------------------------------------------------------------------------------------------------------------------------------------------

//SET TARGET %PROFIT 2

//Break even

breakevenPercent = 0.19

PointsToKeep = 4

startBreakeven = tradeprice(1)*(breakevenpercent/100)

once breakeven = 1//1 on - 0 off

//reset the breakevenLevel when no trade are on market

if breakeven>0 then

IF NOT ONMARKET THEN

breakevenLevel=0

ENDIF

// --- BUY SIDE ---

//test if the price have moved favourably of "startBreakeven" points already

IF LONGONMARKET AND close-tradeprice(1)>=startBreakeven THEN

//calculate the breakevenLevel

breakevenLevel = tradeprice(1)+PointsToKeep

ENDIF

//place the new stop orders on market at breakevenLevel

IF breakevenLevel>0 THEN

SELL AT breakevenLevel STOP

ENDIF

// --- end of BUY SIDE ---

IF SHORTONMARKET AND tradeprice(1)-close>startBreakeven THEN

//calculate the breakevenLevel

breakevenLevel = tradeprice(1)-PointsToKeep

ENDIF

//place the new stop orders on market at breakevenLevel

IF breakevenLevel>0 THEN

EXITSHORT AT breakevenLevel STOP

ENDIF

endif

//--------------------------------------------------------------------------------------------------------------------------------------------------

//SL above 0 if more than X hours and positive

//if longonmarket and barindex-tradeindex>60 then

//if close-tradeprice(1)>=2 then

//sell at tradeprice(1) STOP

//endif

//endif

//

//if shortonmarket and barindex-tradeindex>40 then

//if tradeprice(1)-close>=2 then

//EXITSHORT at tradeprice(1) STOP

//endif

//endif

//--------------------------------------------------------------------------------------------------------------------------------------------------

// trailing atr stop

once trailingstoptype = 1 // trailing stop - 0 off, 1 on

once tsincrements = 0.19 // set to 0 to ignore tsincrements

once tsminatrdist = 5

once tsatrperiod = 14 // ts atr parameter

once tsminstop = 12 // ts minimum stop distance

once tssensitivity = 1 // [0]close;[1]high/low

if trailingstoptype then

if barindex=tradeindex then

trailingstoplong = 3 // ts atr distance

trailingstopshort = 3 // ts atr distance

else

if longonmarket then

if tsnewsl>0 then

if trailingstoplong>tsminatrdist then

if tsnewsl>tsnewsl[1] then

trailingstoplong=trailingstoplong

else

trailingstoplong=trailingstoplong-tsincrements

endif

else

trailingstoplong=tsminatrdist

endif

endif

endif

if shortonmarket then

if tsnewsl>0 then

if trailingstopshort>tsminatrdist then

if tsnewsl<tsnewsl[1] then

trailingstopshort=trailingstopshort

else

trailingstopshort=trailingstopshort-tsincrements

endif

else

trailingstopshort=tsminatrdist

endif

endif

endif

endif

tsatr=averagetruerange[tsatrperiod]((close/10))/1000

//tsatr=averagetruerange[tsatrperiod]((close/1)) // (forex)

tgl=round(tsatr*trailingstoplong)

tgs=round(tsatr*trailingstopshort)

if not onmarket or ((longonmarket and shortonmarket[1]) or (longonmarket[1] and shortonmarket)) then

tsmaxprice=0

tsminprice=close

tsnewsl=0

endif

if tssensitivity then

tssensitivitylong=high

tssensitivityshort=low

else

tssensitivitylong=close

tssensitivityshort=close

endif

if longonmarket then

tsmaxprice=max(tsmaxprice,tssensitivitylong)

if tsmaxprice-tradeprice(1)>=tgl*pointsize then

if tsmaxprice-tradeprice(1)>=tsminstop then

tsnewsl=tsmaxprice-tgl*pointsize

else

tsnewsl=tsmaxprice-tsminstop*pointsize

endif

endif

endif

if shortonmarket then

tsminprice=min(tsminprice,tssensitivityshort)

if tradeprice(1)-tsminprice>=tgs*pointsize then

if tradeprice(1)-tsminprice>=tsminstop then

tsnewsl=tsminprice+tgs*pointsize

else

tsnewsl=tsminprice+tsminstop*pointsize

endif

endif

endif

if longonmarket then

if tsnewsl>0 then

sell at tsnewsl stop

endif

if tsnewsl>0 then

if low crosses under tsnewsl then

sell at market // when stop is rejected

endif

endif

endif

if shortonmarket then

if tsnewsl>0 then

exitshort at tsnewsl stop

endif

if tsnewsl>0 then

if high crosses over tsnewsl then

exitshort at market // when stop is rejected

endif

endif

endif

endif

if onmarket then

if dayofweek=0 and (hour=0 and minute>=57) and abs(dopen(0)-dclose(1))>50 and positionperf(0)>0 then

if shortonmarket and close>dopen(0) then

exitshort at market

endif

if longonmarket and close<dopen(0) then

sell at market

endif

endif

endif

Is that with walk forward testing?

I feel having distance variables on top of angle and slope variables(which are already prone to cruve fitting) are too many entry variables.

Hello @mononochrome, it’s not forward testing, you can do it if you’d like to!

I don’t get what you mean the rest of your message sorry…

If you look at most of the trades they dont follow the immediate direction of the entries, esp since this is a short time frame.

Having a wide stoploss in an upward trending market you could potentially enter anywhere with the same exit strategy and seem profitable on a backtest.

Maybe using volume couldhelp to catch those short term direction movements?

I thank balmora for the angle code. I know its very useful but i just dont know yet how to use it!

I’ve worked quite a long time on it

Nice one Tanou, thank you for sharing!

I’ve set your version going on Demo Forward Test.

I will report back with any improvements.

Nice one re your Dashboard layout! 🙂

I’m going to try out your layout in place of mine as yours looks easier / quicker to adapt from the standard PRT PreDefined settings.

Paul

PaulParticipant

Master

hi Tanou thnx for sharing.

Maybe there is some gain to be made when the breakeven is never triggered. Because then, the market could reverse and hit a big stoploss. It’s something i’am testing. Maybe channels.

There’s an unbalance for long & short trades, as long is hit more that short.

I”ve mentioned it before somewhere,

CB2 = (pente > trigger) AND (pente < 0.4)

replaced with, similar as to short,

CB2 = (pente crosses over trigger) AND (pente < 0.4)

winratio goes over 90%(100k) but total results go down a bit, equitycurve looks sweet 500k bars.