Have not read the entire thread ( i will ) but enough to get the gist of it . Seems to be a lot of optimization of optomization which rarely ends well . The mother of all curve fits BUT . With just a brief look at the logic of the OP i think he has something and i would like to explore it .

Will clean up the code and get into the nuts and bolts of it , seems to be a bit of a regime filter base to it and i like that aspect . His initial curve is still pretty rocksolid and thats a decent positive after many months of OOS . Could be a good thing imo . I will be back

Thank you for all your enthusiasm and sharing around the original version of the code proposed by Balmora! Forks versions are inevitable and I encourage them, even if over-optimization is very often the cause of the abandonment of a project, it also allows to educate the nice programmers of automatic trading systems on this aspect which is the more important in this discipline! 😉

Hi everyone. Many thanks for sharing this amazing code. The v1 is running in test with very few changes and seems to work good. Indeed, seems very powerful with Dax M5. Not yet read the 39 pages…

Paul

PaulParticipant

Master

Hi

i’am looking at a variation on the trailing stop used in v2.

This modification has its upside (closing in on gains & quicker profit taking) and downside (missing out on a bigger ride because took profit to quick in hindsight) .

Didn’t test it yet live and don’t know if it’s 100% correct.

This is the part which is change on the top of the trailing stop code.

once steps=0.05

once minatrdist=3

once atrtrailingperiod = 14 // atr parameter value

once minstop = 10 // minimum trailing stop distance

if barindex=tradeindex then

trailingstoplong = 4 // trailing stop atr relative distance

trailingstopshort = 4 // trailing stop atr relative distance

elsif prezzouscita>0 then

if longonmarket then

if trailingstoplong>minatrdist then

if prezzouscita>prezzouscita[1] then

trailingstoplong=trailingstoplong

else

trailingstoplong=trailingstoplong-steps

endif

else

trailingstoplong=minatrdist

endif

endif

if shortonmarket then

if trailingstopshort>minatrdist then

if prezzouscita<prezzouscita[1] then

trailingstopshort=trailingstopshort

else

trailingstopshort=trailingstopshort-steps

endif

else

trailingstopshort=minatrdist

endif

endif

endif

Paul

PaulParticipant

Master

here’s it complete

// trailing stop atr [adjusted reset]

once enablets=1

once displayts=1

if enablets then

//

once steps=0.05

once minatrdist=3

once atrtrailingperiod = 14 // atr parameter value

once minstop = 10 // minimum trailing stop distance

if barindex=tradeindex then

trailingstoplong = 5 // trailing stop atr relative distance

trailingstopshort = 5 // trailing stop atr relative distance

elsif prezzouscita>0 then

if longonmarket then

if trailingstoplong>minatrdist then

if prezzouscita>prezzouscita[1] then

trailingstoplong=trailingstoplong

else

trailingstoplong=trailingstoplong-steps

endif

else

trailingstoplong=minatrdist

endif

endif

if shortonmarket then

if trailingstopshort>minatrdist then

if prezzouscita<prezzouscita[1] then

trailingstopshort=trailingstopshort

else

trailingstopshort=trailingstopshort-steps

endif

else

trailingstopshort=minatrdist

endif

endif

endif

//

atrtrail=averagetruerange[atrtrailingperiod]((close/10)*pipsize)/1000

trailingstartl=round(atrtrail*trailingstoplong)

trailingstarts=round(atrtrail*trailingstopshort)

tgl=trailingstartl

tgs=trailingstarts

//

if not onmarket or ((longonmarket and shortonmarket[1]) or (longonmarket[1] and shortonmarket)) then//or (longonmarket and condsell) or (shortonmarket and condbuy) then

maxprice=0

minprice=close

prezzouscita=0

endif

//

if longonmarket then//and not condsell then

maxprice=max(maxprice,close)

if maxprice-tradeprice(1)>=tgl*pointsize then

if maxprice-tradeprice(1)>=minstop then

prezzouscita=maxprice-tgl*pointsize

else

prezzouscita=maxprice-minstop*pointsize

endif

endif

endif

//

if shortonmarket then//and not condbuy then

minprice=min(minprice,close)

if tradeprice(1)-minprice>=tgs*pointsize then

if tradeprice(1)-minprice>=minstop then

prezzouscita=minprice+tgs*pointsize

else

prezzouscita=minprice+minstop*pointsize

endif

endif

endif

//

if onmarket and prezzouscita>0 then

exitshort at prezzouscita stop

sell at prezzouscita stop

endif

if displayts then

graphonprice prezzouscita coloured(0,0,255,255) as "trailingstop atr"

endif

endif

Above added as Log 191 to here …

Snippet Link Library

Does anyone use US100 V5 live?

I myself haven’t looked at it since September but see that it has been stable since then.

Hi all, with my broker (IG) on CFD, after several days of optimization in demo, at the moment where i wanted to push it to live, ProOrder tells me it needs a stop… The ‘customized’ trailing stop musn’t be well recognized. Has this subjet ever been evoked through the 39 pages ? Many thanks

That happen if you are on a limited risk account. All orders must have stoploss attached. I suggest you add a SET STOP PLOSS instruction at the end of the code.

That happen if you are on a limited risk account. All orders must have stoploss attached. I suggest you add a SET STOP PLOSS instruction at the end of the code.

Indeed thank you, i only added this instruction SET STOP PLOSS 100 at the end and my code is online. But a warning (cf. attached snapshot) tells me trailing stop are not allowed with risk limited contracts. Impossible to simulate with the proback test which gives me the same result with and without the final instruction SET STOP PLOSS 100. Only live could give me the answer… I push it live.

Have you asked IG to lighten the restrictions? The first and hardest limit forces guarantued stops but there is an inbetween level. Not sure what each level is referred as here.

ALZ

ALZParticipant

Average

Juju,

limited risk account..

Ask IG by phone to change your current account by “Standard Account”…

Then, 😉

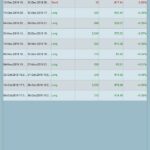

Good afternoon, I update the evolution of the strategy in the Nasdaq, it is working in real account, I am waiting for it to do 2 bad operations to increase a position, but it does not fail, I only carry a losing operation. Regarding the results of Strategy 6.1 on the Dax in November, I think it was an accident, a robot that has been making good numbers in a period of 32 months that is what gives the backtest does not stop working at night In the morning, I understand that if the market changes, it should progressively have worse results, but not always start losing. This month of December is in positive and the last operations are very good …. Good weekend and Merry Christmas!

Thanks Gubben and ALZ fit your replies. It seems to work with only adding a ploss at the end ! Which doesn’t prevent the custom trailing to work. A good week on DAX. I’m going to push US 100 v5 to live too.

Balmora, Many thanks for the geometric philosophy of your first idea of this bot, which is very “pure”.

Been running the us100 v5.0p and dax v5.0p since aug 14th.

The us100 has been doing really good. But DAX is still at a loss.

Are there any new versions of DAX that work better?