Expert Services

ProRealCode - Trading & Coding with ProRealTime™

ProRealCode - Trading & Coding with ProRealTime™

No recent search

Mother of Dragons trading strategy…

- Forums

- ProRealTime English Forum

- ProOrder: Automated Strategies & Backtesting

- Mother of Dragons trading strategy…

-

AuthorPosts

-

The backtests seem fine to me but could be an issue with positionsize. Minimum for demo is 1, minimum live is .5

But didn’t obtain same variables as you

Probably because mine is optimized with 200k of data. But also, I don’t necessarily choose variables for max profit, sometimes I think it’s better to go for a higher %win esp if it gives higher number of trades. Sometimes it’s based on VRT results.

As for adapting to other instruments, you really just have to go through all the variables for each timeframe top to bottom. You’ll have to do this 2 or 3 times as one change effects another. I have tried versions for DAX, CAC, SP500, FTSE, ASX – cant remember what else. Some of them are still limping along in demo but the DJ and NAS are the only ones I have faith in. If anything else might work, I would start with the DAX and try to bang that into shape, using DJ v5 as a template.

@nonetheless It is the same time as in Spain that comes in “NAS 5m MoD v4S” On November 1 the time changes in the US and then it will be necessary to put if not onmarket or (time <= 153000 – USDLS and time> = 220000 – USDLS) and it keeps giving me the same failure with the MM activated and I have 1 lotti in demo. Doesn’t it give you an error?

once longStep = 0 once openStrongShort = 0 if not onmarket or (time <= 143000 - USDLS and time >= 210000 - USDLS) then longStep = 0 openStrongShort = 0 endif //detect strong direction for market open once rangeOK = 50 once tradeMin = 500 IF (time >= 144000 - USDLS) AND (time <= 144000 + tradeMin - USDLS) THEN openStrongShort = close < open AND open - close > rangeOK ENDIF

It tests fine for me, both with or without MM. If the problem only occurs with MM you could try using a higher factor, like 5 0r 10, or try it with volpiemanuele’s MM

josef1604 thanked this postYou are right, putting a factor of 5 does not give an error. Could you put what result gives you in 200k of candles with factor 3, please? thanks

I really wouldn’t worry about it, any factor below 10 will give a result in the millions – it’s only something to dream about. But if factor 3 blows up over the past 100k then that can also happen over the coming 100k. I will change mine to 5; if the algo succeeds then positionsize will increase dramatically enough.

josef1604 thanked this post@volpiemanuele @nonetheless (ps. still searching for you)

Can you think of any reason why MM v5 and V.5a would be giving me these blank results. I am literally using the code that you both posted.

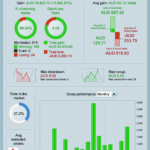

DJI MOD v5 works perfectly (see attached). It’s really strange.

This is DJI v5a + MM

// Definition of code parameters DEFPARAM CumulateOrders = false // Cumulating positions deactivated DEFPARAM preloadbars = 5000 //Money Management DOW MM = 1 // = 0 for optimization if mm = 1 then prof = 0 ddpp = 212// max dd per point ddm = 2 // multiples of max drawdowns to factor into positionsize capital = 350 //starting bank dpct = 5 //% margin for deposit deposit = (open/100)*dpct //margin per point pri = 1 // percent to reinvest as a decimal positionsize = (capital +((strategyprofit + prof)*pri))/((ddm*ddpp)+deposit) if positionsize < 0.25 then positionsize = 0.2 endif else once positionsize = 0.2 endif TIMEFRAME(2 hours,updateonclose) Period= 495 inner = 2*weightedaverage[round( Period/2)](typicalprice)-weightedaverage[Period](typicalprice) HULLa = weightedaverage[round(sqrt(Period))](inner) c1 = HULLa > HULLa[1] c2 = HULLa < HULLa[1] indicator1 = SuperTrend[8,4] c3 = (close > indicator1) c4 = (close < indicator1) ma = average[60,3](close) c11 = ma > ma[1] c12 = ma < ma[1] //Stochastic RSI | indicator lengthRSI = 15 //RSI period lengthStoch = 9 //Stochastic period smoothK = 10 //Smooth signal of stochastic RSI smoothD = 5 //Smooth signal of smoothed stochastic RSI myRSI = RSI[lengthRSI](close) MinRSI = lowest[lengthStoch](myrsi) MaxRSI = highest[lengthStoch](myrsi) StochRSI = (myRSI-MinRSI) / (MaxRSI-MinRSI) K = average[smoothK](stochrsi)*100 D = average[smoothD](K) c13 = K>D c14 = K<D TIMEFRAME(30 minutes,updateonclose) indicator5 = Average[2](typicalPrice) indicator6 = Average[7](typicalPrice) c15 = (indicator5 > indicator6) c16 = (indicator5 < indicator6) TIMEFRAME(15 minutes,updateonclose) indicator2 = Average[4](typicalPrice) indicator3 = Average[8](typicalPrice) c7 = (indicator2 > indicator3) c8 = (indicator2 < indicator3) Periodc= 22 innerc = 2*weightedaverage[round( Periodc/2)](typicalprice)-weightedaverage[Periodc](typicalprice) HULLc = weightedaverage[round(sqrt(Periodc))](innerc) c9 = HULLc > HULLc[1] c10 = HULLc < HULLc[1] TIMEFRAME(10 minutes) indicator4 = SuperTrend[2,6] indicator4a = SAR[0.025,0.025,0.1] c19 = (close > indicator4) or (close > indicator4a) c20 = (close < indicator4) or (close < indicator4a) TIMEFRAME(5 minutes) //Stochastic RSI | indicator lengthRSIa = 3 //RSI period lengthStocha = 6 //Stochastic period smoothKa = 9 //Smooth signal of stochastic RSI smoothDa = 3 //Smooth signal of smoothed stochastic RSI myRSIa = RSI[lengthRSIa](close) MinRSIa = lowest[lengthStocha](myrsia) MaxRSIa = highest[lengthStocha](myrsia) StochRSIa = (myRSIa-MinRSIa) / (MaxRSIa-MinRSIa) Ka = average[smoothKa](stochrsia)*100 Da = average[smoothDa](Ka) c23 = Ka>Da c24 = Ka<Da ma3 = average[15,3](typicalPrice) c21 = ma3 > ma3[1] c22 = ma3 < ma3[1] Periodb= 15 innerb = 2*weightedaverage[round( Periodb/2)](typicalprice)-weightedaverage[Periodb](typicalprice) HULLb = weightedaverage[round(sqrt(Periodb))](innerb) c5 = HULLb > HULLb[1]and HULLb[1]<HULLb[2] c6 = HULLb < HULLb[1]and HULLb[1]>HULLb[2] // Conditions to enter long positions IF dhigh(0)-high<300 and c1 AND C3 AND C5 and c7 and c9 and c11 and c13 and c15 and c19 and c21 and c23 THEN BUY positionsize CONTRACT AT MARKET SET STOP %LOSS 1.5 SET TARGET %PROFIT 2.5 ENDIF // Conditions to enter short positions IF low-dlow(0)<600 and c2 AND C4 AND C6 and c8 and c10 and c12 and c14 and c16 and c20 and c22 and c24 THEN SELLSHORT positionsize CONTRACT AT MARKET SET STOP %LOSS 2 SET TARGET %PROFIT 2.2 ENDIF //================== exit in profit if longonmarket and C6 and c8 and close>positionprice then sell at market endif If shortonmarket and C5 and c7 and close<positionprice then exitshort at market endif //==============exit at loss if longonmarket AND c2 and c6 and close<positionprice then sell at market endif If shortonmarket and c1 and c5 and close>positionprice then exitshort at market endif //%trailing stop function once trailingpercentlong = 0.21 // % once trailingpercentshort = 0.24 // % once accelerator = 0.05 // 1 = default; always > 0 (i.e. 0.5-3) once accelerator2 = 0.01 // 1 = default; always > 0 (i.e. 0.5-3) once ts2sensitivity = 2 // [0]close;[1]high/low;[2]low;high //==================== once steppercentlong = (trailingpercentlong/10)*accelerator once steppercentshort = (trailingpercentshort/10)*accelerator2 if onmarket then trailingstartlong = tradeprice(1)*(trailingpercentlong/100) trailingstartshort = tradeprice(1)*(trailingpercentshort/100) trailingsteplong = tradeprice(1)*(steppercentlong/100) trailingstepshort = tradeprice(1)*(steppercentshort/100) endif if not onmarket or ((longonmarket and shortonmarket[1]) or (longonmarket[1] and shortonmarket)) then newsl=0 endif if ts2sensitivity=1 then ts2sensitivitylong=high ts2sensitivityshort=low elsif ts2sensitivity=2 then ts2sensitivitylong=low ts2sensitivityshort=high else ts2sensitivitylong=close ts2sensitivityshort=close endif if longonmarket then if newsl=0 and ts2sensitivitylong-tradeprice(1)>=trailingstartlong then newsl = tradeprice(1)+trailingsteplong endif if newsl>0 and ts2sensitivitylong-newsl>trailingsteplong then newsl = newsl+trailingsteplong endif endif if shortonmarket then if newsl=0 and tradeprice(1)-ts2sensitivityshort>=trailingstartshort then newsl = tradeprice(1)-trailingstepshort endif if newsl>0 and newsl-ts2sensitivityshort>trailingstepshort then newsl = newsl-trailingstepshort endif endif if barindex-tradeindex>1 then if longonmarket then if newsl>0 then sell at newsl stop endif if newsl>0 then if low crosses under newsl then sell at market endif endif endif if shortonmarket then if newsl>0 then exitshort at newsl stop endif if newsl>0 then if high crosses over newsl then exitshort at market endif endif endif endif //************************************************************************ IF longonmarket and barindex-tradeindex>1900 and close<positionprice then sell at market endif IF shortonmarket and barindex-tradeindex>580 and close>positionprice then exitshort at market endif //============================================= if longonmarket and abs(open-close)<1 and high[1]>high and close>positionprice and high-close>13 then sell at market endif if shortonmarket and abs(open-close)<1 and low[1]>low and close-low>9 and close<positionprice then exitshort at market endif //=================================== myrsiM5=rsi[14](close) // if myrsiM5<20 and barindex-tradeindex>1 and longonmarket and close>positionprice then sell at market endif if myrsiM5>70 and barindex-tradeindex>1 and shortonmarket and close<positionprice then exitshort at market endif // --------- US DAY LIGHT SAVINGS MONTHS ---------------- // mar = month = 3 // MONTH START nov = month = 11 // MONTH END IF (month > 3 AND month < 11) OR (mar AND day>14) OR (mar AND day-dayofweek>7) OR (nov AND day<=dayofweek AND day<7) THEN USDLS=010000 ELSE USDLS=0 ENDIF once shortStep = 0 once longStep = 0 once openStrongLong = 0 once openStrongShort = 0 if not onmarket or (time <= 143000 - USDLS and time >= 210000 - USDLS) then shortStep = 0 longStep = 0 openStrongLong = 0 openStrongShort = 0 endif //detect strong direction for market open once rangeOK = 45 once tradeMin = 500 IF (time >= 144000 - USDLS) AND (time <= 144000 + tradeMin - USDLS) THEN openStrongLong = close > open AND close - open > rangeOK openStrongShort = close < open AND open - close > rangeOK ENDIF once bollperiod = 20 once bollMAType = 1 once s = 2 once BollLevel = 90 once BollSR = 50 bollMA = average[bollperiod, bollMAType](close) STDDEV = STD[bollperiod] bollUP = bollMA + s * STDDEV bollDOWN = bollMA - s * STDDEV IF bollUP = bollDOWN THEN bollPercent = 50 ELSE bollPercent = 100 * (close - bollDOWN) / (bollUP - bollDOWN) ENDIF //Market spike up IF shortonmarket AND shortStep = 0 AND bollPercent > BollLevel THEN shortStep = 1 ENDIF //Market slowly come down IF shortonmarket AND shortStep = 1 AND bollPercent < 100 - BollLevel THEN shortStep = 2 ENDIF //Market still go back to bullish and supported after strong bull open, exit IF shortonmarket AND shortStep = 2 AND bollPercent > BollSR AND openStrongLong THEN exitshort at market ENDIF //Market shoot down IF longonmarket AND longStep = 0 AND bollPercent < 100 - BollLevel THEN longStep = 1 ENDIF //Market slowly go back up IF longonmarket AND longStep = 1 AND bollPercent > BollLevel THEN longStep = 2 ENDIF //Market still go back to bearish and resisted after strong bear open, exit IF longonmarket AND longStep = 2 AND bollPercent < 100 - BollSR AND openStrongShort THEN sell at market ENDIF once trendPeriod = 70 once trendPeriodResume = 30 once trendGap = 3 once trendResumeGap = 6 if not onmarket then fullySupported = 0 fullyResisteded = 0 endif //Market supported in the wrong direction IF shortonmarket AND fullySupported = 0 AND summation[trendPeriod](bollPercent > 50) >= trendPeriod - trendGap THEN fullySupported = 1 ENDIF //Market pull back but continue to be supported IF shortonmarket AND fullySupported = 1 AND bollPercent[trendPeriodResume + 1] < 0 AND summation[trendPeriodResume](bollPercent > 50) >= trendPeriodResume - trendResumeGap THEN exitshort at market ENDIF //Market resisted in wrong direction IF longonmarket AND fullyResisteded = 0 AND summation[trendPeriod](bollPercent < 50) >= trendPeriod - trendGap THEN fullyResisteded = 1 ENDIF //Market pull back but continue to be resisted IF longonmarket AND fullyResisteded = 1 AND bollPercent[trendPeriodResume + 1] > 100 AND summation[trendPeriodResume](bollPercent < 50) >= trendPeriodResume - trendResumeGap THEN sell at market ENDIF //Started real wrong direction once strongTrend = 70 once strongPeriod = 6 IF shortonmarket and openStrongLong and barindex - tradeindex < 12 and summation[strongPeriod](bollPercent > strongTrend) = strongPeriod then exitshort at market ENDIF IF longonmarket and openStrongShort and barindex - tradeindex < 12 and summation[strongPeriod](bollPercent < 100 - strongTrend) = strongPeriod then sell at market ENDIFThis is DJI MOD v5a code that I am using:

// Definition of code parameters DEFPARAM CumulateOrders = false // Cumulating positions deactivated DEFPARAM preloadbars = 5000 //Money Management DOW MM = 1 // = 0 for optimization if MM = 0 then positionsize=15 ENDIF if MM = 1 then ONCE startpositionsize = .4 ONCE factor = 5 // factor of 10 means margin will increase/decrease @ 10% of strategy profit; factor 20 = 5% etc ONCE margin = (close*.005) // tier 1 margin value of 1 contract in instrument currency; change decimal according to available leverage ONCE margin2 = (close*.01)// tier 2 margin value of 1 contract in instrument currency; change decimal according to available leverage ONCE tier1 = 55 // DOW €1 IG first tier margin limit ONCE maxpositionsize = 550 // DOW €1 IG tier 2 margin limit ONCE minpositionsize = .2 // enter minimum position allowed IF Not OnMarket THEN positionsize = startpositionsize + Strategyprofit/(factor*margin) ENDIF IF Not OnMarket THEN IF startpositionsize + Strategyprofit/(factor*margin) > tier1 then positionsize = (((startpositionsize + (Strategyprofit/(factor*margin))-tier1)*(factor*margin))/(factor*margin2)) + tier1 //incorporating tier 2 margin ENDIF IF Not OnMarket THEN if startpositionsize + Strategyprofit/(factor*margin) < minpositionsize THEN positionsize = minpositionsize //keeps positionsize from going below allowed minimum ENDIF IF (((startpositionsize + (Strategyprofit/(factor*margin))-tier1)*(factor*margin))/(factor*margin2)) + tier1 > maxpositionsize then positionsize = maxpositionsize// keeps positionsize from going above IG tier 2 margin limit ENDIF ENDIF ENDIF ENDIF TIMEFRAME(2 hours,updateonclose) Period= 495 inner = 2*weightedaverage[round( Period/2)](typicalprice)-weightedaverage[Period](typicalprice) HULLa = weightedaverage[round(sqrt(Period))](inner) c1 = HULLa > HULLa[1] c2 = HULLa < HULLa[1] indicator1 = SuperTrend[8,4] c3 = (close > indicator1) c4 = (close < indicator1) ma = average[60,3](close) c11 = ma > ma[1] c12 = ma < ma[1] //Stochastic RSI | indicator lengthRSI = 15 //RSI period lengthStoch = 9 //Stochastic period smoothK = 10 //Smooth signal of stochastic RSI smoothD = 5 //Smooth signal of smoothed stochastic RSI myRSI = RSI[lengthRSI](close) MinRSI = lowest[lengthStoch](myrsi) MaxRSI = highest[lengthStoch](myrsi) StochRSI = (myRSI-MinRSI) / (MaxRSI-MinRSI) K = average[smoothK](stochrsi)*100 D = average[smoothD](K) c13 = K>D c14 = K<D TIMEFRAME(30 minutes,updateonclose) indicator5 = Average[2](typicalPrice) indicator6 = Average[7](typicalPrice) c15 = (indicator5 > indicator6) c16 = (indicator5 < indicator6) TIMEFRAME(15 minutes,updateonclose) indicator2 = Average[4](typicalPrice) indicator3 = Average[8](typicalPrice) c7 = (indicator2 > indicator3) c8 = (indicator2 < indicator3) Periodc= 22 innerc = 2*weightedaverage[round( Periodc/2)](typicalprice)-weightedaverage[Periodc](typicalprice) HULLc = weightedaverage[round(sqrt(Periodc))](innerc) c9 = HULLc > HULLc[1] c10 = HULLc < HULLc[1] TIMEFRAME(10 minutes) indicator4 = SuperTrend[2,6] indicator4a = SAR[0.025,0.025,0.1] c19 = (close > indicator4) or (close > indicator4a) c20 = (close < indicator4) or (close < indicator4a) TIMEFRAME(5 minutes) //Stochastic RSI | indicator lengthRSIa = 3 //RSI period lengthStocha = 6 //Stochastic period smoothKa = 9 //Smooth signal of stochastic RSI smoothDa = 3 //Smooth signal of smoothed stochastic RSI myRSIa = RSI[lengthRSIa](close) MinRSIa = lowest[lengthStocha](myrsia) MaxRSIa = highest[lengthStocha](myrsia) StochRSIa = (myRSIa-MinRSIa) / (MaxRSIa-MinRSIa) Ka = average[smoothKa](stochrsia)*100 Da = average[smoothDa](Ka) c23 = Ka>Da c24 = Ka<Da ma3 = average[15,3](typicalPrice) c21 = ma3 > ma3[1] c22 = ma3 < ma3[1] Periodb= 15 innerb = 2*weightedaverage[round( Periodb/2)](typicalprice)-weightedaverage[Periodb](typicalprice) HULLb = weightedaverage[round(sqrt(Periodb))](innerb) c5 = HULLb > HULLb[1]and HULLb[1]<HULLb[2] c6 = HULLb < HULLb[1]and HULLb[1]>HULLb[2] // Conditions to enter long positions IF dhigh(0)-high<300 and c1 AND C3 AND C5 and c7 and c9 and c11 and c13 and c15 and c19 and c21 and c23 THEN BUY positionsize CONTRACT AT MARKET SET STOP %LOSS 1.5 SET TARGET %PROFIT 2.5 ENDIF // Conditions to enter short positions IF low-dlow(0)<600 and c2 AND C4 AND C6 and c8 and c10 and c12 and c14 and c16 and c20 and c22 and c24 THEN SELLSHORT positionsize CONTRACT AT MARKET SET STOP %LOSS 2 SET TARGET %PROFIT 2.2 ENDIF //================== exit in profit if longonmarket and C6 and c8 and close>positionprice then sell at market endif If shortonmarket and C5 and c7 and close<positionprice then exitshort at market endif //==============exit at loss if longonmarket AND c2 and c6 and close<positionprice then sell at market endif If shortonmarket and c1 and c5 and close>positionprice then exitshort at market endif //%trailing stop function trailingpercentlong = 0.21 // % trailingpercentshort = 0.24 // % once acceleratorlong = 0.05 // [1] default; always > 0 (i.e. 0.5-3) once acceleratorshort= 0.01 // 1 = default; always > 0 (i.e. 0.5-3) ts2sensitivity = 3 // [1] default [2] hl [3] lh (not use once) //==================== once steppercentlong = (trailingpercentlong/10)*acceleratorlong once steppercentshort = (trailingpercentshort/10)*acceleratorshort if onmarket then trailingstartlong = positionprice*(trailingpercentlong/100) trailingstartshort = positionprice*(trailingpercentshort/100) trailingsteplong = positionprice*(steppercentlong/100) trailingstepshort = positionprice*(steppercentshort/100) endif if not onmarket or ((longonmarket and shortonmarket[1]) or (longonmarket[1] and shortonmarket)) then newsl = 0 mypositionprice = 0 endif positioncount = abs(countofposition) if newsl > 0 then if positioncount > positioncount[1] then if longonmarket then newsl = max(newsl,positionprice * newsl / mypositionprice) else newsl = min(newsl,positionprice * newsl / mypositionprice) endif endif endif if ts2sensitivity=1 then ts2sensitivitylong=close ts2sensitivityshort=close elsif ts2sensitivity=2 then ts2sensitivitylong=high ts2sensitivityshort=low elsif ts2sensitivity=3 then ts2sensitivitylong=low ts2sensitivityshort=high endif if longonmarket then if newsl=0 and ts2sensitivitylong-positionprice>=trailingstartlong*pipsize then newsl = positionprice+trailingsteplong*pipsize endif if newsl>0 and ts2sensitivitylong-newsl>=trailingsteplong*pipsize then newsl = newsl+trailingsteplong*pipsize endif endif if shortonmarket then if newsl=0 and positionprice-ts2sensitivityshort>=trailingstartshort*pipsize then newsl = positionprice-trailingstepshort*pipsize endif if newsl>0 and newsl-ts2sensitivityshort>=trailingstepshort*pipsize then newsl = newsl-trailingstepshort*pipsize endif endif if barindex-tradeindex>1 then if longonmarket then if newsl>0 then sell at newsl stop endif if newsl>0 then if low crosses under newsl then sell at market endif endif endif if shortonmarket then if newsl>0 then exitshort at newsl stop endif if newsl>0 then if high crosses over newsl then exitshort at market endif endif endif endif mypositionprice = positionprice //************************************************************************ IF longonmarket and barindex-tradeindex>1900 and close<positionprice then sell at market endif IF shortonmarket and barindex-tradeindex>580 and close>positionprice then exitshort at market endif //============================================= if longonmarket and abs(open-close)<1 and high[1]>high and close>positionprice and high-close>13 then sell at market endif if shortonmarket and abs(open-close)<1 and low[1]>low and close-low>9 and close<positionprice then exitshort at market endif //=================================== myrsiM5=rsi[14](close) // if myrsiM5<20 and barindex-tradeindex>1 and longonmarket and close>positionprice then sell at market endif if myrsiM5>70 and barindex-tradeindex>1 and shortonmarket and close<positionprice then exitshort at market endif // --------- US DAY LIGHT SAVINGS MONTHS ---------------- // mar = month = 3 // MONTH START nov = month = 11 // MONTH END IF (month > 3 AND month < 11) OR (mar AND day>14) OR (mar AND day-dayofweek>7) OR (nov AND day<=dayofweek AND day<7) THEN USDLS=010000 ELSE USDLS=0 ENDIF once shortStep = 0 once longStep = 0 once openStrongLong = 0 once openStrongShort = 0 if not onmarket or (time <= 143000 - USDLS and time >= 210000 - USDLS) then shortStep = 0 longStep = 0 openStrongLong = 0 openStrongShort = 0 endif //detect strong direction for market open once rangeOK = 45 once tradeMin = 500 IF (time >= 144000 - USDLS) AND (time <= 144000 + tradeMin - USDLS) THEN openStrongLong = close > open AND close - open > rangeOK openStrongShort = close < open AND open - close > rangeOK ENDIF once bollperiod = 20 once bollMAType = 1 once s = 2 once BollLevel = 90 once BollSR = 50 bollMA = average[bollperiod, bollMAType](close) STDDEV = STD[bollperiod] bollUP = bollMA + s * STDDEV bollDOWN = bollMA - s * STDDEV IF bollUP = bollDOWN THEN bollPercent = 50 ELSE bollPercent = 100 * (close - bollDOWN) / (bollUP - bollDOWN) ENDIF //Market spike up IF shortonmarket AND shortStep = 0 AND bollPercent > BollLevel THEN shortStep = 1 ENDIF //Market slowly come down IF shortonmarket AND shortStep = 1 AND bollPercent < 100 - BollLevel THEN shortStep = 2 ENDIF //Market still go back to bullish and supported after strong bull open, exit IF shortonmarket AND shortStep = 2 AND bollPercent > BollSR AND openStrongLong THEN exitshort at market ENDIF //Market shoot down IF longonmarket AND longStep = 0 AND bollPercent < 100 - BollLevel THEN longStep = 1 ENDIF //Market slowly go back up IF longonmarket AND longStep = 1 AND bollPercent > BollLevel THEN longStep = 2 ENDIF //Market still go back to bearish and resisted after strong bear open, exit IF longonmarket AND longStep = 2 AND bollPercent < 100 - BollSR AND openStrongShort THEN sell at market ENDIF once trendPeriod = 70 once trendPeriodResume = 30 once trendGap = 3 once trendResumeGap = 6 if not onmarket then fullySupported = 0 fullyResisteded = 0 endif //Market supported in the wrong direction IF shortonmarket AND fullySupported = 0 AND summation[trendPeriod](bollPercent > 50) >= trendPeriod - trendGap THEN fullySupported = 1 ENDIF //Market pull back but continue to be supported IF shortonmarket AND fullySupported = 1 AND bollPercent[trendPeriodResume + 1] < 0 AND summation[trendPeriodResume](bollPercent > 50) >= trendPeriodResume - trendResumeGap THEN exitshort at market ENDIF //Market resisted in wrong direction IF longonmarket AND fullyResisteded = 0 AND summation[trendPeriod](bollPercent < 50) >= trendPeriod - trendGap THEN fullyResisteded = 1 ENDIF //Market pull back but continue to be resisted IF longonmarket AND fullyResisteded = 1 AND bollPercent[trendPeriodResume + 1] > 100 AND summation[trendPeriodResume](bollPercent < 50) >= trendPeriodResume - trendResumeGap THEN sell at market ENDIF //Started real wrong direction once strongTrend = 70 once strongPeriod = 6 IF shortonmarket and openStrongLong and barindex - tradeindex < 12 and summation[strongPeriod](bollPercent > strongTrend) = strongPeriod then exitshort at market ENDIF IF longonmarket and openStrongShort and barindex - tradeindex < 12 and summation[strongPeriod](bollPercent < 100 - strongTrend) = strongPeriod then sell at market ENDIF@nonetheless – I just realized that in v5a you have MM switched on for some reason?

That’s what seems to be breaking it for me. Is there any variables in MM that would be tied to the instrument or currency?

As soon as I switch MM off it works again, which would also explain why the MM version is not working.

// Definition of code parameters DEFPARAM CumulateOrders = false // Cumulating positions deactivated DEFPARAM preloadbars = 5000 //Money Management DOW MM = 1 // = 0 for optimization if MM = 0 then positionsize=1 ENDIF if MM = 1 then ONCE startpositionsize = .4 ONCE factor = 5 // factor of 10 means margin will increase/decrease @ 10% of strategy profit; factor 20 = 5% etc ONCE margin = (close*.005) // tier 1 margin value of 1 contract in instrument currency; change decimal according to available leverage ONCE margin2 = (close*.01)// tier 2 margin value of 1 contract in instrument currency; change decimal according to available leverage ONCE tier1 = 55 // DOW €1 IG first tier margin limit ONCE maxpositionsize = 550 // DOW €1 IG tier 2 margin limit ONCE minpositionsize = .2 // enter minimum position allowed IF Not OnMarket THEN positionsize = startpositionsize + Strategyprofit/(factor*margin) ENDIF IF Not OnMarket THEN IF startpositionsize + Strategyprofit/(factor*margin) > tier1 then positionsize = (((startpositionsize + (Strategyprofit/(factor*margin))-tier1)*(factor*margin))/(factor*margin2)) + tier1 //incorporating tier 2 margin ENDIF IF Not OnMarket THEN if startpositionsize + Strategyprofit/(factor*margin) < minpositionsize THEN positionsize = minpositionsize //keeps positionsize from going below allowed minimum ENDIF IF (((startpositionsize + (Strategyprofit/(factor*margin))-tier1)*(factor*margin))/(factor*margin2)) + tier1 > maxpositionsize then positionsize = maxpositionsize// keeps positionsize from going above IG tier 2 margin limit ENDIF ENDIF ENDIF ENDIFbertholomeo thanked this postMM = 0 // = 0 for optimization if mm = 1 then prof = 0 ddpp = 212// max dd per point ddm = 2 // multiples of max drawdowns to factor into positionsize capital = 350 //starting bank dpct = 5 //% margin for deposit deposit = (open/100)*dpct //margin per point pri = 1 // percent to reinvest as a decimal positionsize = (capital +((strategyprofit + prof)*pri))/((ddm*ddpp)+deposit) if positionsize < 0.25 then positionsize = 0.2 endif endif if mm = 0 then positionsize = 0.2 endif@StingeRe My code run ok in my PRT (demo or live version). Try to change MM inserting this code. If MM = 0 you have fixed position and if MM = 1 you have the MM. I see that your currency is AUD. You can insert the correct value in AUD in this variable “ddpp” and “capital”. My currency is EURO. Thanks

@SitngeRe…first change the value in AUD….for me the problem is this….the code is correct….

I just realized that in v5a you have MM switched on for some reason?

MM is entirely optional, for me it tests correctly both with or without. If yours wont run with MM=1 you can try altering the positionsize, the factor or both.

@nonetheless, I have some issues with the TS, it just adjusts to BE but does not follow the price forward to cover the open positions. Do you have any idea why? Thanks in advance!

Yeah, I just noticed that as well, I’ll look into it.

josef1604 thanked this postHopefully this fixes the TS problem. NAS to follow…

Thanks @nonetheless, I noticed this last night as well when I was forward testing 4.xx vs 5.

Interesting they both ended up taking similar profits in the end though.

Thanks kindly for the fix.

-

AuthorPosts

- You must be logged in to reply to this topic.

Mother of Dragons trading strategy…

ProOrder: Automated Strategies & Backtesting

Author

Summary

This topic contains 522 replies,

has 50 voices, and was last updated by LaurentBZH35

4 years, 10 months ago.

Topic Details

| Forum: | ProOrder: Automated Strategies & Backtesting |

| Language: | English |

| Started: | 01/21/2020 |

| Status: | Active |

| Attachments: | 195 files |

About personal data collected

The information collected on this form is stored in a computer file by ProRealCode to create and access your ProRealCode profile. This data is kept in a secure database for the duration of the member's membership. They will be kept as long as you use our services and will be automatically deleted after 3 years of inactivity. Your personal data is used to create your private profile on ProRealCode. This data is maintained by SAS ProRealCode, 407 rue Freycinet, 59151 Arleux, France. If you subscribe to our newsletters, your email address is provided to our service provider "MailChimp" located in the United States, with whom we have signed a confidentiality agreement. This company is also compliant with the EU/Swiss Privacy Shield, and the GDPR. For any request for correction or deletion concerning your data, you can directly contact the ProRealCode team by email at privacy@prorealcode.com If you would like to lodge a complaint regarding the use of your personal data, you can contact your data protection supervisory authority.