Sorry for the Mission Drift – I actually thought we were in the Pure Renko strategy thread…

It is selected in the screenshot. If you’re seeing that unselected somewhere else, it was probably 2am…

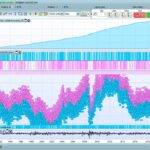

Maybe you did a lot of tests and posting of results at 2 am (?) because to reproduce your results on coffee I have to disable tick by tick mode.

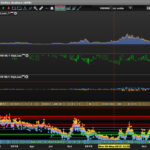

However, the Daily TF on DJI (I think?) that I posted was with tick by tick enabled.

We need to get the bottom of this anyway … I’m glad a few of us are now looking at it!? 🙂

Vonasi’s keeping quiet, now I know why … he’s already bought his new yacht complete with onboard tropical island!!!! 🙂

Attached is what I get on coffee with tick by tick enabled … too much caffeine for me .. I’ll never sleep!! 🙂

Forgot to click on tick by tick before-done that… even with daily bars this is a problem.

Bard

BardParticipant

Master

Thanks for clarifying @Nonetheless. In your opinion, because I have not read through all of that forum thread, was that a mistake using version 1 because v2 performed better than the very first Renko algo?

I actually couldn’t get v1 to work on the 1 minute TF, hence me thinking maybe it was meant to be 1 month (which I never usually backtest on) and then discovering it worked really well with that TF, I decided to add the ML code to see what would happen… the rest, as they say is a “happy accident.”

Bard

BardParticipant

Master

I’ve been going back through Juanj’s original code carefully: https://www.prorealcode.com/topic/machine-learning-in-proorder/page/3/#post-121130

Is line 166 and 169 (now lines 2 and 5) correct?

For i2 = 1 to Reps2 Do

If positionperf(i) > 0 Then

WinCountA2 = WinCountA2 + 1 //Increment Current WinCount

EndIf

StratAvgA2 = StratAvgA2 + (((PositionPerf(i)*countofposition[i]*100000)*-1)*-1)

Next

Perhaps a little mistake, because surely it should read “(i2)” not (i), right? :

For i2 = 1 to Reps2 Do

If positionperf(i2) > 0 Then

WinCountA2 = WinCountA2 + 1 //Increment Current WinCount

EndIf

StratAvgA2 = StratAvgA2 + (((PositionPerf(i2)*countofposition[i]*100000)*-1)*-1)

Bard

BardParticipant

Master

** and should countofposition also be “(i2)?”

was that a mistake using version 1

The subsequent versions were far more sophisticated, for sure, and some have ML applied, for example #126632

1m in the original was def 1 minute but I never kept it on forward testing for that long. @Grahal had a lot of success with it

then discovering it worked really well

Glad you did!

I’ve often found new and better ways through life by doing something wrong in the first place! 🙂

Perhaps a little mistake, because surely it should read “(i2)” not (i), right? :

I agree! well spotted!

Also the 100000 should read Close or a value related to the Price of instrument under test.

Bard

BardParticipant

Master

Thanks very much for the clarification @Nonetheless. Do you know what the “ha” stands for in front of the high in Renko3?

So that’s 2 more different versions to test and apply ML1 and ML2 too. I’m going to be here for years…

Bard

BardParticipant

Master

Sorry for the Mission Drift..

I’m just waiting for my brother to tell me it’s okay, that I can leave my computer…

** and should countofposition also be “(i2)?”

Yes I would say so.

It’s a pity @Juanj hasn’t dropped by for a while? He also may be working with these errors.

One way I noticed errors early on in my trialling the HAlgos is … I used Halgo2 as stand alone / on it’s own in a System. When I tried to backtest it told me about 3 or 4 variables were not defined. I then realised that HAlgo2 had been using values from HAlgo1.

You could try above as a check on your HAlgo2 and also HAlgo3.

what the “ha” stands for

HA = heikin ashi, an alternative Japanese candle-type

Bard

BardParticipant

Master

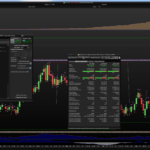

It’s giving me the same kind of results (in the millions with 30x capital). In fact it seems to have picked up a “spare £13 million”… Not sure @GraHal, is anyone else able to replicate these results?

Maybe there is a caching issue and even though it shows tick by tick it’s not doing tick by tick, although I have started a fresh session in PRT this morning and get the same high results.

Maybe the other day I had other backtests running in the same chart and when I changed the TF of coffee it would show me a warning saying that tick by tick wasn’t available for the date range for another system (and I did click for it to test the new TF without tick by tick, but perhaps it was also unticking my Renko ML1 StpLoss system, (although it’s not visually removing my tick in the tick by tick backtest box)?

Here’s the code instead of the itf: The only change is with:

StratAvgA = StratAvgA + (((PositionPerf(i)*countofposition[i]*100000)*-1)*-1)

where I replaced 100,000 with Close. Oddly no difference in profit on Coffee although it did make a big difference when I made that change for the Ehlers’ Univ Osc ML2 system with coffee?

//-------------------------------------------------------------------------

// Main code : Nneless Renko DJI 1M v1 ML1 Cycle Limit Reset -

// Orig a 1 Min system (no ML), then 1 Month (no ML) and then 1 Month with ML and now Daily with ML

// The 30 x capital was a test to break the system.

//-------------------------------------------------------------------------

//https://www.prorealcode.com/topic/why-is-backtesting-so-unreliable/#post-110889

// Definition of code parameters

DEFPARAM CumulateOrders = False // Cumulating positions deactivated

// The system will cancel all pending orders and close all positions at 0:00. No new ones will be allowed until after the "FLATBEFORE" time.

//DEFPARAM FLATBEFORE = 143000

// Cancel all pending orders and close all positions at the "FLATAFTER" time

//DEFPARAM FLATAFTER = 210000

Capital = 10000 + strategyprofit //Current profit made by the closed trades of the running strategy.

N = 30*Capital / Close //30

//ValueX for the Renko Stop Loss.

//Heuristics Algorithm 1 Start

If (onmarket[1] = 1 and onmarket = 0) or (longonmarket[1] = 1 and longonmarket and countoflongshares < countoflongshares[1]) or (longonmarket[1] = 1 and longonmarket and countoflongshares > countoflongshares[1]) or (shortonmarket[1] = 1 and shortonmarket and countofshortshares < countofshortshares[1]) or (shortonmarket[1] = 1 and shortonmarket and countofshortshares > countofshortshares[1]) or (longonmarket[1] and shortonmarket) or (shortonmarket[1] and longonmarket) Then

optimise = optimise + 1

EndIf

//Settings 1

StartingValue = 10 //10 Stop Loss

ResetPeriod = 0.5 //0.5 Specify no of months after which to reset optimisation

Increment = 5 //20

MaxIncrement = 10 //10 Limit of no of increments either up or down

Reps = 2 //Number of trades to use for analysis //2

MaxValue = 150 //150 //Maximum allowed value

MinValue = increment //Minimum allowed value

once monthinit = month

once yearinit = year

If (year = yearinit and month = (monthinit + ResetPeriod)) or (year = (yearinit + 1) and ((12 - monthinit) + month = ResetPeriod)) Then

ValueX = StartingValue

WinCountB = 0

StratAvgB = 0

BestA = 0

BestB = 0

monthinit = month

yearinit = year

EndIf

once ValueX = StartingValue

once PIncPos = 1 //Positive Increment Position

once NIncPos = 1 //Negative Increment Position

once optimise = 0 ////Initialize Heuristicks Engine Counter (Must be Incremented at Position Start or Exit)

once Mode1 = 1 //Switches between negative and positive increments

//once WinCountB = 3 //Initialize Best Win Count

//GRAPH WinCountB coloured (0,0,0) AS "WinCountB"

//once StratAvgB = 4353 //Initialize Best Avg Strategy Profit

//GRAPH StratAvgB coloured (0,0,0) AS "StratAvgB"

If optimise = Reps Then

WinCountA = 0 //Initialize current Win Count

StratAvgA = 0 //Initialize current Avg Strategy Profit

HeuristicsCycle = HeuristicsCycle + 1

For i = 1 to Reps Do

If positionperf(i) > 0 Then

WinCountA = WinCountA + 1 //Increment Current WinCount

EndIf

StratAvgA = StratAvgA + (((PositionPerf(i)*countofposition[i]*Close)*-1)*-1)

Next

StratAvgA = StratAvgA/Reps //Calculate Current Avg Strategy Profit

//Graph (PositionPerf(1)*countofposition[1]*100000)*-1 as "PosPerf1"

//Graph (PositionPerf(2)*countofposition[2]*100000)*-1 as "PosPerf2"

//Graph StratAvgA*-1 as "StratAvgA"

//once BestA = 300

//GRAPH BestA coloured (0,0,0) AS "BestA"

If StratAvgA >= StratAvgB Then

StratAvgB = StratAvgA //Update Best Strategy Profit

BestA = ValueX

EndIf

//once BestB = 300

//GRAPH BestB coloured (0,0,0) AS "BestB"

If WinCountA >= WinCountB Then

WinCountB = WinCountA //Update Best Win Count

BestB = ValueX

EndIf

If WinCountA > WinCountB and StratAvgA > StratAvgB Then

Mode1 = 0

ElsIf WinCountA < WinCountB and StratAvgA < StratAvgB and Mode1 = 1 Then

ValueX = ValueX - (Increment*NIncPos)

NIncPos = NIncPos + 1

Mode1 = 2

ElsIf WinCountA >= WinCountB or StratAvgA >= StratAvgB and Mode1 = 1 Then

ValueX = ValueX + (Increment*PIncPos)

PIncPos = PIncPos + 1

Mode1 = 1

ElsIf WinCountA < WinCountB and StratAvgA < StratAvgB and Mode1 = 2 Then

ValueX = ValueX + (Increment*PIncPos)

PIncPos = PIncPos + 1

Mode1 = 1

ElsIf WinCountA >= WinCountB or StratAvgA >= StratAvgB and Mode1 = 2 Then

ValueX = ValueX - (Increment*NIncPos)

NIncPos = NIncPos + 1

Mode1 = 2

EndIf

If NIncPos > MaxIncrement or PIncPos > MaxIncrement Then

If BestA = BestB Then

ValueX = BestA

Else

If reps >= 10 Then

WeightedScore = 10

Else

WeightedScore = round((reps/100)*100)

EndIf

ValueX = round(((BestA*(20-WeightedScore)) + (BestB*WeightedScore))/20) //Lower Reps = Less weight assigned to Win%

EndIf

NIncPos = 1

PIncPos = 1

ElsIf ValueX > MaxValue Then

ValueX = MaxValue

ElsIf ValueX < MinValue Then

ValueX = MinValue

EndIF

optimise = 0

EndIf

// Heuristics Algorithm 1 End

//Renko Definitions

boxSize = 100 // Orig 110

//StartingValue = 10 //10 Stop Loss

//ResetPeriod = 0.5 //0.5 Specify no of months after which to reset optimisation

//Increment = 5 //20

//MaxIncrement = 10 //10 Limit of no of increments either up or down

//Reps = 2 //Number of trades to use for analysis //2

//MaxValue = 150 //150 //Maximum allowed value

//MinValue = increment //Minimum allowed value

once renkoMax = ROUND(close / boxSize) * boxSize

once renkoMin = renkoMax - boxSize

IF high > renkoMax + boxSize THEN

WHILE high > renkoMax + boxSize

renkoMax = renkoMax + boxSize

renkoMin = renkoMin + boxSize

WEND

ELSIF low < renkoMin - boxSize THEN

WHILE low < renkoMin - boxSize

renkoMax = renkoMax - boxSize

renkoMin = renkoMin - boxSize

WEND

ENDIF

c1 = renkoMax + boxSize

c2 = renkoMin - boxSize

// Conditions to enter long positions

If c1 then

Buy N CONTRACT at renkoMax + boxSize stop

EndIf

// Conditions to enter short positions

If c2 then

Sellshort N CONTRACT at renkoMin - boxSize stop

EndIf

// Stops and targets

//SET STOP PLOSS ValueX //Orig 75

Set stop trailing ValueX//100

SET TARGET PPROFIT 500 //Orig 150

GRAPH ValueX coloured(0,255,0)

Bard

BardParticipant

Master

Maybe Vonasi’s hard to reach because he bought a nuclear sub instead!? 😀