Expert Services

ProRealCode - Trading & Coding with ProRealTime™

ProRealCode - Trading & Coding with ProRealTime™

No recent search

Discussion re Pure Renko strategy

- Forums

- ProRealTime English Forum

- ProOrder: Automated Strategies & Backtesting

- Discussion re Pure Renko strategy

-

AuthorPosts

-

@MAKSIDE yes I tried that, but it didn’t go anywhere. I will’ve a look again.

I’ve been trying to apply ATR code to dynamically adjust the boxsize with little success. I tried optimising the strategy to 500 ticks (on the 10s version) and it prooved to be succesful in the short term with a very small box size.

So I tried to apply the Volatility Breakout Indicator (https://www.prorealcode.com/prorealtime-indicators/volatility-breakout-indicator/) to enter long only when it’s above the upper channel in timeframe 100seconds and vice verca for short conditions.

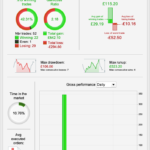

It seems to be that a small box size doesn’t work most of times as the price quickly retraces and gest stopped out, however from my backtest it looks like it could work when applying this indicator. Maybe this is a way to always use a small box size and having minimum drawdown? Although the % of winning trades are lower than 50% it seems that the losses are small (as momentum is no our side) and the gains are high.

I will test this on demo tomorrow – it would be amazing if we could have a set box size that worked all the time!

//variation of renko strategy with volatility cycle indicator to filter. This allows for a smaller box size to be used with high accuracy. //————————————————————————- // Hoofd code : renko v3.2 dji 10 sec(V2) //————————————————————————- // see notes for spread defparam cumulateorders = false defparam preloadbars = 1000 defparam flatbefore = 130000 defparam flatafter = 211500 timeframe (100 seconds) myupperchannel, mylowerchannel = CALL “PRC_Volatility Cycle Breakout”[18, 2, 10, 0.1] timeframe (default) once spreadmode = 1 // [1]dji;[2]us500;[3]us100;[4]dax;[5]saf;[6]ftse;[7]cac40 once orderhandling = 1 // [0] default; [1] based on open v/d market order once orderoffset = 1 // % average slippage & spread points if above=[1] once trailingstoptype = 2 // [0]off [1]original [2]modified(faster) once positionsize = 1 once tradetype = 1 // [1]long&short;[2]long;[3]short once closeonreversal = 1 // break renko other side once closeonbreak = 1 // close on breaking previous x high / low once periodr = 1 //0all;1day;2week;3month;4year once maxprofit = 100 //set high to make it useless, or to i.e. 2 % once maxloss = 100 //set high to make it useless, or to i.e. 2 % // boxsize settings boxsize = 1.3 once renkomax = round(close / boxsize) * boxsize once renkomin = renkomax – boxsize if close > renkomax + boxsize and not (close < renkomin – boxsize) then renkomax = renkomax + boxsize renkomin = renkomin + boxsize endif if close < renkomin – boxsize and not (close > renkomax + boxsize) then renkomax = renkomax – boxsize renkomin = renkomin – boxsize endif //================================ // limit losses & secure profit if periodr=0 then if barindex=0 then longperf=0 shortperf=0 tradecounter=0 tradecounterlong=0 tradecountershort=0 endif elsif periodr=1 then if day<>day[1] then longperf=0 shortperf=0 tradecounter=0 tradecounterlong=0 tradecountershort=0 endif elsif periodr=2 then if dayofweek=0 then longperf=0 shortperf=0 tradecounter=0 tradecounterlong=0 tradecountershort=0 endif elsif periodr=3 then if month<>month[1] then longperf=0 shortperf=0 tradecounter=0 tradecounterlong=0 tradecountershort=0 endif elsif periodr=4 then if year<>year[1] then longperf=0 shortperf=0 tradecounter=0 tradecounterlong=0 tradecountershort=0 endif endif if longonmarket[1] and (not onmarket or shortonmarket) then if strategyprofit[1]>=strategyprofit[2] then longperf=longperf+positionperf(1)*100 else longperf=longperf-positionperf(1)*100 endif endif if shortonmarket[1] and (not onmarket or longonmarket) then if strategyprofit[1]>=strategyprofit[2] then shortperf=shortperf+positionperf(1)*100 else shortperf=shortperf-positionperf(1)*100 endif endif if longperf>maxprofit or longperf<-maxloss then tradelong=0 else tradelong=1 endif if shortperf>maxprofit or shortperf<-maxloss then tradeshort=0 else tradeshort=1 endif //================================= // strategy once periodeb = 15 once nbchandelierb = 30 mmb = exponentialaverage[periodeb](totalprice) pente = (mmb-mmb[nbchandelierb]*pipsize) / nbchandelierb //buy conditions condbuy = (pente > -0.5) //short conditions condsell = (pente < -1) if range<>0 then spreadOC=abs(open-close) coeff=spreadOC/highest[6](spreadOC)*100 else coeff=0 endif // conditions condbuy=condbuy and high > (renkomax + boxsize) condbuy=condbuy and coeff<15 condsell=condsell and low < (renkomin – boxsize) condsell=condsell and coeff<15 // entry If (tradetype=1 or tradetype=2) and tradelong and close > myupperchannel then if condbuy and not longonmarket then buy positionsize contract at market tradecounter=tradecounter+1 tradecounterlong=tradecounterlong+1 endif endif if (tradetype=1 or tradetype=3) and tradeshort and close < mylowerchannel then if condsell and not shortonmarket then sellshort positionsize contract at market tradecounter=tradecounter+1 tradecountershort=tradecountershort+1 endif endif // closeonreversal if closeonreversal then if longonmarket then sell at (renkomin – boxsize) stop endif if shortonmarket then exitshort at (renkomax + boxsize) stop endif endif // close on break previous high/low if closeonbreak then if longonmarket and (shortonmarket[1] or not onmarket[1]) then breakvaluelow=lowest[10](low) endif if longonmarket then sell at breakvaluelow stop endif if shortonmarket and (longonmarket[1] or not onmarket[1]) then breakvaluehigh=highest[10](high) endif if shortonmarket then exitshort at breakvaluehigh stop endif endif // spread has to be set in the backtest-engine too // spread if spreadmode=1 then // wallstreet if time > 090000 and time <= 153000 then spread=2.4 elsif time > 153000 and time <= 220000 then spread=1.6 elsif time > 221500 and time <= 223000 then spread=9.8 elsif time > 230000 and time <= 235959 then spread=9.8 elsif time = 000000 then spread=9.8 else spread=3.8 endif elsif spreadmode=2 then // us500 if time > 090000 and time <= 220000 then spread=0.4 elsif time > 221500 and time <= 223000 then spread=1.5 elsif time > 223000 and time <= 235959 then spread=1.5 elsif time = 000000 then spread=1.5 else spread=0.6 endif elsif spreadmode=3 then // us100 if time > 153000 and time <= 220000 then spread=1 elsif time > 221500 and time <= 223000 then spread=5 elsif time > 230000 and time <= 235959 then spread=5 elsif time = 000000 then spread=5 else spread=2 endif elsif spreadmode=4 then // dax if time > 090000 and time <= 173000 then spread=1 elsif time > 173000 and time <= 220000 then spread=2 elsif time > 220000 and time <= 235959 then spread=7 elsif time >= 000000 and time <= 080000 then spread=7 elsif time > 080000 and time <= 090000 then spread=2 endif elsif spreadmode=5 then // south african 40 if time > 073000 and time <= 163000 then spread=8 else spread=30 endif elsif spreadmode=6 then // ftse100 if time > 080000 and time <= 163000 then spread=1 elsif time > 163000 and time <= 210000 then spread=2 elsif time > 070000 and time <= 075000 then spread=2 else spread=5 endif elsif spreadmode=7 then // cac40 if time > 090000 and time <= 173000 then spread=1 elsif time > 173000 and time <= 220000 then spread=2 elsif time > 220000 and time <= 235959 then spread=5 elsif time > 000000 and time <= 080000 then spread=5 elsif time > 080000 and time <= 090000 then spread=2 endif endif spread=spread/2 // orderhandling if orderhandling then once orderprice=close // prevent graph orderprice at 0 at start chart offsetvalue=((close/10000)*orderoffset)*pointsize // adjustment spread & slippage if longonmarket and not longonmarket[1] then orderprice=open+offsetvalue+spread elsif shortonmarket and not shortonmarket[1] then orderprice=open-offsetvalue-spread endif if longonmarket then pp=((close/orderprice)-1)*100 elsif shortonmarket then pp=((orderprice/close)-1)*100 elsif not onmarket then pp=0 endif else once orderprice=close // prevent graph orderprice at 0 at start chart orderprice=tradeprice(1) if longonmarket then pp=((close/orderprice)-1)*100 elsif shortonmarket then pp=((orderprice/close)-1)*100 elsif not onmarket then pp=0 endif endif pp=pp // to use variable //graphonprice orderprice //graph spread // trailing atr stop //———————————————- if trailingstoptype=1 then once trailingstoplong = 2 once trailingstopshort = 2 once atrtrailingperiod = 14 once minstop = 10 atrtrail=averagetruerange[atrtrailingperiod]((close/10)*pipsize)/1000 //i.e. dow //atrtrail=averagetruerange[atrtrailingperiod]((close/1)*pipsize) //i.e. forex tgl = round(atrtrail*trailingstoplong) tgs = round(atrtrail*trailingstopshort) if not onmarket or ((longonmarket and shortonmarket[1]) or (longonmarket[1] and shortonmarket)) then maxprice = 0 minprice = close newsl = 0 endif if longonmarket then maxprice = max(maxprice,close) // original “close” if maxprice-orderprice>=tgl*pointsize then if maxprice-orderprice>=minstop then newsl = maxprice-tgl*pointsize else newsl = maxprice – minstop*pointsize endif endif endif if shortonmarket then minprice = min(minprice,close) // original “close” if orderprice-minprice>=tgs*pointsize then if orderprice-minprice>=minstop then newsl = minprice+tgs*pointsize else newsl = minprice + minstop*pointsize endif endif endif if longonmarket then if newsl>0 then sell at newsl stop endif endif if shortonmarket then if newsl>0 then exitshort at newsl stop endif endif endif // trailing stop atr //———————————————- if trailingstoptype=2 then once steps=0.05 // set to 0 to ignore steps once minatrdist=1 once atrtrailingperiod = 14 // atr parameter value once minstop = 10 // minimum trailing stop distance if barindex=tradeindex then once trailingstoplong = 2 // trailing stop atr relative distance once trailingstopshort = 2 // trailing stop atr relative distance else if longonmarket then if newsl>0 then if trailingstoplong>minatrdist then if newsl>newsl[1] then trailingstoplong=trailingstoplong else trailingstoplong=trailingstoplong-steps endif else trailingstoplong=minatrdist endif endif endif if shortonmarket then if newsl>0 then if trailingstopshort>minatrdist then if newsl<newsl[1] then trailingstopshort=trailingstopshort else trailingstopshort=trailingstopshort-steps endif else trailingstopshort=minatrdist endif endif endif endif // atrtrail=averagetruerange[atrtrailingperiod]((close/10)*pipsize)/1000 //i.e. dow //atrtrail=averagetruerange[atrtrailingperiod]((close/1)*pipsize) //i.e. forex // tgl=round(atrtrail*trailingstoplong) tgs=round(atrtrail*trailingstopshort) if not onmarket or ((longonmarket and shortonmarket[1]) or (longonmarket[1] and shortonmarket)) then maxprice=0 minprice=close newsl=0 endif // if longonmarket then maxprice=max(maxprice,high) if maxprice-orderprice>=tgl*pointsize then if maxprice-orderprice>=minstop then newsl=maxprice-tgl*pointsize else newsl=maxprice-minstop*pointsize endif endif endif // if shortonmarket then minprice=min(minprice,low) if orderprice-minprice>=tgs*pointsize then if orderprice-minprice>=minstop then newsl=minprice+tgs*pointsize else newsl=minprice+minstop*pointsize endif endif endif // if longonmarket then if newsl>0 then sell at newsl stop endif endif if shortonmarket then if newsl>0 then exitshort at newsl stop endif endif if longonmarket then if newsl>0 then sell at newsl stop endif endif if shortonmarket then if newsl>0 then exitshort at newsl stop endif endif endif // if onmarket then once sl=0.5 once pt=0.5 if longonmarket then slvalue=orderprice-(sl*(orderprice/100)) sell at slvalue stop endif if shortonmarket then slvalue=orderprice+(sl*(orderprice/100)) exitshort at slvalue stop endif if longonmarket then ptvalue=orderprice+(pt*(orderprice/100)) sell at ptvalue limit endif if shortonmarket then ptvalue=orderprice-(pt*(orderprice/100)) exitshort at ptvalue limit endif endif set stop %loss 1 //set target %profit 0.25 //graph longperf coloured(0,0,255,255) as “long performance” //graph shortperf coloured(255,0,0,255) as “short performance” //graphonprice renkomax + boxsize coloured(0,200,0) as “renkomax” //graphonprice renkomin – boxsize coloured(200,0,0) as “renkomin” //graphonprice newsl coloured(0,0,255,255) as “trailingstop atr” //graphonprice avg coloured(0,0,255,255) as “average renko”Sorry first time posting code here.. I clicked the insert prt function but it appears to have been entered incorrectly.

I tidied it up. Sometimes that happens.

I added hourly optimised renko boxsizes. Good idea?

// boxsize settings IF (CurrentHour = 08) THEN boxsize = 11.5 ENDIF IF (CurrentHour = 09) THEN boxsize = 21.4 ENDIF IF (CurrentHour = 10) THEN boxsize = 25 ENDIF IF (CurrentHour = 11) THEN boxsize = 33.7 ENDIF IF (CurrentHour = 12) THEN boxsize = 12.5 ENDIF IF (CurrentHour = 13) THEN boxsize = 11.6 ENDIF IF (CurrentHour = 14) THEN boxsize = 2.8 ENDIF IF (CurrentHour = 15) THEN boxsize = 24.7 ENDIF IF (CurrentHour = 16) THEN boxsize = 27.8 ENDIF IF (CurrentHour = 17) THEN boxsize = 14.5 ENDIF IF (CurrentHour = 18) THEN boxsize = 25.8 ENDIF IF (CurrentHour = 19) THEN boxsize = 6.5 ENDIF IF (CurrentHour = 20) THEN boxsize = 12.5 ENDIF IF (CurrentHour = 21) THEN boxsize = 28.9 ENDIFhourly optimised renko boxsizes. Good idea?

Only time will tell? 🙂

We need to Forward Test 2 Systems side by side … one with hourly box opti and one without … I’ve done just that! 🙂

Is box size that critical that we need the value after the decimal point? (curve fitting to the extreme?? 🙂 Also be easier and quicker for opti without decimal values?

@GraHal

Yes indeed! It’s probably over optimised. I wonder also if it’s better to optimise only from yesterdays price action or if it’s good to take a 4 day period. Whilst the maket is so volatile it might be better to optimise against a shorter period? What’s your thougths on this?

I reckon best to use maximum data available (4 days) but to optimise every day at 14:00 ish UK time (before DJI open) .

Then optimised values will be up with latest price action, but also will take into account the last 4 days price action

@eckaw interesting, curious how it performs today!

My focus is on less parameters.

I.e. below

Still it gave me parameters long and/or short and period. That period I use range*10 now.

Maybe it doesn’t make sense, but it can work for the dax too.

if barindex>1 and range>0 then spread = max(abs(open - close), 0.000000001) coeff=spread/highest[range*10](spread)*100 trendup = coeff<cf trenddown= coeff<cf endifOne thing for sure. No point optimising with 1.6/2.4 spread. If it’s gonna be profitable, it has to be at 6!

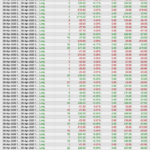

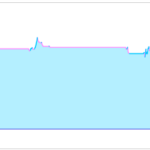

during the test with renko / TF 1s, i saw difference between backtest and demo this afternoon

do you have an idea about the huge difference in the numbers of late candles regarding the last exit ? orange cross/backtest , red cross/demo IG

thanks

Yes, probably the entryprice is worse in the live demo that you had in the backtest. Did you have it with spread 6?

@ Paul

thanks

yes, probably the entryprice. For spread it was set to 6

2nd cause could be the trailing stop, if using the fast one. While it works good overall, sometimes it behaves inconsistent, regardless of entryprice.

MAKSIDE thanked this posthere’s an inconsistency today.

short at the same time, backtest sells lower and gets out on trailing stop with small profit.

live demo short sells higher=better and no trailingstop is activated and results in a small loss.

Especially because the entryprice is better in the live demo makes it hard to understand why no ts is activated.

edit; Switched trailing-stops. Same results hopefully better consistency.

I’m having very bad results on every version of the strategy. What about you guys?

-

AuthorPosts

- You must be logged in to reply to this topic.

Discussion re Pure Renko strategy

ProOrder: Automated Strategies & Backtesting

Author

Summary

This topic contains 345 replies,

has 24 voices, and was last updated by bertrandpinoy

5 years, 7 months ago.

Topic Details

| Forum: | ProOrder: Automated Strategies & Backtesting |

| Language: | English |

| Started: | 02/25/2020 |

| Status: | Active |

| Attachments: | 149 files |

About personal data collected

The information collected on this form is stored in a computer file by ProRealCode to create and access your ProRealCode profile. This data is kept in a secure database for the duration of the member's membership. They will be kept as long as you use our services and will be automatically deleted after 3 years of inactivity. Your personal data is used to create your private profile on ProRealCode. This data is maintained by SAS ProRealCode, 407 rue Freycinet, 59151 Arleux, France. If you subscribe to our newsletters, your email address is provided to our service provider "MailChimp" located in the United States, with whom we have signed a confidentiality agreement. This company is also compliant with the EU/Swiss Privacy Shield, and the GDPR. For any request for correction or deletion concerning your data, you can directly contact the ProRealCode team by email at privacy@prorealcode.com If you would like to lodge a complaint regarding the use of your personal data, you can contact your data protection supervisory authority.