edit : new topic from https://www.prorealcode.com/topic/why-is-backtesting-so-unreliable/

According to IG Status Page … all trading platforms are now sorted!! See attached.

This Renko code is the only code I am still getting Rejects / Stoppages on (up to now anyway!?).

Only major difference I can see between this System and my others is the use of While, Wend? Maybe While. Wend has recently become a non-approved term anymore??

@Nonetheless would it be easy for you to re-code without While, Wend? I know the code is a DocTrading code so maybe it not easy for you either?

If one of our coding wizards might be able to help it would be much appreciated?

Below is the code of the System that is showing +£1.8K profit since October (see attached).

//-------------------------------------------------------------------------

// Main code : Nneless Renko DJI 1M v1

//-------------------------------------------------------------------------

//https://www.prorealcode.com/topic/why-is-backtesting-so-unreliable/#post-110889

// Definition of code parameters

DEFPARAM CumulateOrders = False // Cumulating positions deactivated

// The system will cancel all pending orders and close all positions at 0:00. No new ones will be allowed until after the "FLATBEFORE" time.

//DEFPARAM FLATBEFORE = 143000

// Cancel all pending orders and close all positions at the "FLATAFTER" time

//DEFPARAM FLATAFTER = 210000

boxSize = 110 //50

once renkoMax = ROUND(close / boxSize) * boxSize

once renkoMin = renkoMax - boxSize

IF high > renkoMax + boxSize THEN

WHILE high > renkoMax + boxSize

renkoMax = renkoMax + boxSize

renkoMin = renkoMin + boxSize

WEND

ELSIF low < renkoMin - boxSize THEN

WHILE low < renkoMin - boxSize

renkoMax = renkoMax - boxSize

renkoMin = renkoMin - boxSize

WEND

ENDIF

buy 1 CONTRACT at renkoMax + boxSize stop

sellshort 1 CONTRACT at renkoMin - boxSize stop

// Stops and targets

SET STOP PLOSS 75

SET TARGET PPROFIT 150

Paul

PaulParticipant

Master

maybe this?

IF high > renkoMax + boxSize THEN

renkoMax = renkoMax + boxSize

renkoMin = renkoMin + boxSize

ELSIF low < renkoMin - boxSize THEN

renkoMax = renkoMax - boxSize

renkoMin = renkoMin - boxSize

ENDIF

Hahaha … nice one Paul!

Your change works (same profits etc) and System has NOT been rejected!

Feeling guilty now that I didn’t persevere with the code.

I had heard others on here mention While, Wend and the terms are on here under approved probuilder language documentation and so I doubted this would be the Issue, but seems it is!

Now I can try my other forks piling up ready to be Forward Tested!

Onward and Upward!

Thank You

Grahal

showing +£1.8K profit since October

That is not too shabby at all, thanks to DocTrading (and also to Paul!) who did the heavy lifting…

Paul

PaulParticipant

Master

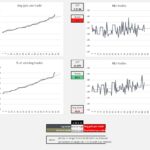

now wondering if it could be used on a higher timeframe. Couldn’t resist! 100k tested so far on 15 min dow, spread 3.1

//-------------------------------------------------------------------------

// main code : nneless renko dji 1m v1

//-------------------------------------------------------------------------

//https://www.prorealcode.com/topic/why-is-backtesting-so-unreliable/#post-110889

defparam cumulateorders = false

defparam preloadbars = 1000

timeframe (default)

boxsize = 100

once renkomax = round(close / boxsize) * boxsize

once renkomin = renkomax - boxsize

if high > renkomax + boxsize then

renkomax = renkomax + boxsize

renkomin = renkomin + boxsize

elsif low < renkomin - boxsize then

renkomax = renkomax - boxsize

renkomin = renkomin - boxsize

endif

ctime=hour>=4

if ctime then

buy 1 contract at renkomax + boxsize stop

sellshort 1 contract at renkomin - boxsize stop

else

exitshort 1 contract at renkomax + boxsize stop

sell 1 contract at renkomin - boxsize stop

endif

// trailingstop splitsed so it can run on higher timeframe

timeframe (15 minutes,updateonclose)

// trailing atr stop

once trailingstoptype = 1 // trailing stop - 0 off, 1 on

once trailingstoplong = 7 // trailing stop atr relative distance

once trailingstopshort = 4 // trailing stop atr relative distance

once atrtrailingperiod = 14 // atr parameter value

once minstop = 10 // minimum trailing stop distance

// trailingstop

//----------------------------------------------

atrtrail = averagetruerange[atrtrailingperiod]((close/10)*pipsize)/1000

trailingstartl = round(atrtrail*trailingstoplong)

trailingstarts = round(atrtrail*trailingstopshort)

//

if trailingstoptype then

tgl =trailingstartl

tgs=trailingstarts

if not onmarket or ((longonmarket and shortonmarket[1]) or (longonmarket[1] and shortonmarket)) then

maxprice = 0

minprice = close

newsl = 0

endif

if longonmarket then

maxprice = max(maxprice,close)

if maxprice-tradeprice(1)>=tgl*pointsize then

if maxprice-tradeprice(1)>=minstop then

newsl = maxprice-tgl*pointsize

else

newsl = maxprice - minstop*pointsize

endif

endif

endif

if shortonmarket then

minprice = min(minprice,close)

if tradeprice(1)-minprice>=tgs*pointsize then

if tradeprice(1)-minprice>=minstop then

newsl = minprice+tgs*pointsize

else

newsl = minprice + minstop*pointsize

endif

endif

endif

endif

timeframe (default)

if trailingstoptype then

if longonmarket then

if newsl>0 then

sell at newsl stop

endif

endif

if shortonmarket then

if newsl>0 then

exitshort at newsl stop

endif

endif

endif

// stops and targets

set stop %loss 2

set target %profit 2

graphonprice renkomax + boxsize

graphonprice renkomin - boxsize

it would make sense / logical to ask the Mods to change the name of this Topic to … Discussion re Pure Renko strategy

Yes, absolutely … how do I go about that? I’m waving my arms but guess they can’t see me.

wondering if it could be used on a higher timeframe

Hey, my thoughts exactly! The 1m TF always seemed wrong. Now it’s really starting to look interesting…

Make a statue to Paul thanks

how do I go about that?

@Vonasi or

@RobertoGozzi might check out all the action on this Topic and now – as OP – you are asking for the title to be changed, they may sort it for us?

Now Paul is onboard I can see us having all sorts Renko versions in this Topic so Mods please …

New Topic Required …

Renko Systems

Paul

PaulParticipant

Master

there’s a bug at monday 00.00.00 where there shouldn’t be an entry. With the bug the results are better though.

pics are with spread 100k & 200k

//-------------------------------------------------------------------------

// main code : nneless renko dji 15min v1

//-------------------------------------------------------------------------

//https://www.prorealcode.com/topic/why-is-backtesting-so-unreliable/#post-110889

defparam cumulateorders = false

defparam preloadbars = 1000

timeframe (default)

once bugfix=0 // [1] activate bugfix monday time 00.00.00

once boxsize = 100

once renkomax = round(close / boxsize) * boxsize

once renkomin = renkomax - boxsize

if high > renkomax + boxsize then

renkomax = renkomax + boxsize

renkomin = renkomin + boxsize

elsif low < renkomin - boxsize then

renkomax = renkomax - boxsize

renkomin = renkomin - boxsize

endif

condbuy=1

condsell=1

ctime=hour>=3

if bugfix then

if dayofweek=5[1] and (hour[1]=22 or hour[1]=21) then

skipmondayfirsthour=0

else

skipmondayfirsthour=1

endif

else

skipmondayfirsthour=1

endif

if ctime then

if skipmondayfirsthour then

if condbuy then

buy 1 contract at renkomax + boxsize stop

endif

if condsell then

sellshort 1 contract at renkomin - boxsize stop

endif

endif

endif

// trailingstop splitsed so it can run on higher timeframe

timeframe (15 minutes,updateonclose)

// trailing atr stop

once trailingstoptype = 1 // trailing stop - 0 off, 1 on

once trailingstoplong = 7 // trailing stop atr relative distance

once trailingstopshort = 4 // trailing stop atr relative distance

once atrtrailingperiod = 14 // atr parameter value

once minstop = 10 // minimum trailing stop distance

// trailingstop

//----------------------------------------------

atrtrail = averagetruerange[atrtrailingperiod]((close/10)*pipsize)/1000

trailingstartl = round(atrtrail*trailingstoplong)

trailingstarts = round(atrtrail*trailingstopshort)

//

if trailingstoptype then

tgl =trailingstartl

tgs=trailingstarts

if not onmarket or ((longonmarket and shortonmarket[1]) or (longonmarket[1] and shortonmarket)) then

maxprice = 0

minprice = close

newsl = 0

endif

if longonmarket then

maxprice = max(maxprice,close)

if maxprice-tradeprice(1)>=tgl*pointsize then

if maxprice-tradeprice(1)>=minstop then

newsl = maxprice-tgl*pointsize

else

newsl = maxprice - minstop*pointsize

endif

endif

endif

if shortonmarket then

minprice = min(minprice,close)

if tradeprice(1)-minprice>=tgs*pointsize then

if tradeprice(1)-minprice>=minstop then

newsl = minprice+tgs*pointsize

else

newsl = minprice + minstop*pointsize

endif

endif

endif

endif

timeframe (default)

if trailingstoptype then

if longonmarket then

if newsl>0 then

sell at newsl stop

endif

endif

if shortonmarket then

if newsl>0 then

exitshort at newsl stop

endif

endif

endif

// stops and targets

set stop %loss 2

set target %profit 2

graphonprice renkomax + boxsize

graphonprice renkomin - boxsize

Sadly the robustness test is a bust for this one. Odd because I had thought that Renko bars were time independent and that it might perform better than most. 🤔

Would be worth putting a link to your post above on Vonasi Robustness Tester Topic … he might have some useful observation re Renko and Robustness tests?

Here’s an interesting development. Starting with the 1m version that @Grahal was running I added a trailing stop, tweaked the boxsize, stop and TP — ran it on daily TF for a 20 year back test.

Very low % win but the stop loss is just .1% so it works even with lots of small losses. WF is as good as it gets, robustness checks out…

Can you also do the 21 5 and the 20 5 in order to look at the total average?