Are we all deluded?

Forums › ProRealTime English forum › General trading discussions › Are we all deluded?

- This topic has 54 replies, 13 voices, and was last updated 5 years ago by

Vonasi.

-

-

06/30/2018 at 10:35 AM #74907

I think the market will revert again to its ‘normality’ as regards trends

I guess that depends on what normality you are talking about. On the DAX chart since the early 90’s I see at least 19 normalities varying from rising steadily, rising rapidly, falling rapidly, going sideways etc – you get the idea. 🙂

06/30/2018 at 11:57 AM #74921Hi All

Very interesting comments, I think you certainly have to back test to 3 – 4 years, 6 months is no where near enough. But saying that I have an automated system in operation now for nearly 3 months which certainly is not performing as per my back tests. Typical really and that’s what makes trading so difficult : We do not know what tomorrow holds.

I was very interested in Vonasi’s comments about trend following major indices (which I do – the DAX to be precise) and the change in market structure. He was saying that his EStop got hit and he decided to wait on the sidelines. I also have noticed this, when I back tested my ES was hit just over once a month this was over a nearly 2 year period. And what happened when I started live trading ? It is getting hit 4 times a month, sometimes 5 ! The market is in a very bad sideways and volatile state at present (the DAX index) …trend following right now is very difficult. But you cannot ‘come out’ of your system and wait on the sidelines, because if you do when that big trend comes along that pays off all your losses, guess what ? you are NOT on it ! Now you have a problem. Psychologically its huge.

My opinion is that the market is like this because of geo-politics but that cannot affect my system which must be left to ‘run’. I think the market will revert again to its ‘normality’ as regards trends but for now it s what it is. Difficult game, trading.

If you trade long only

try to avoid the summer

this is dax daily long only (june,july,august)

06/30/2018 at 12:36 PM #74925try to avoid the summer

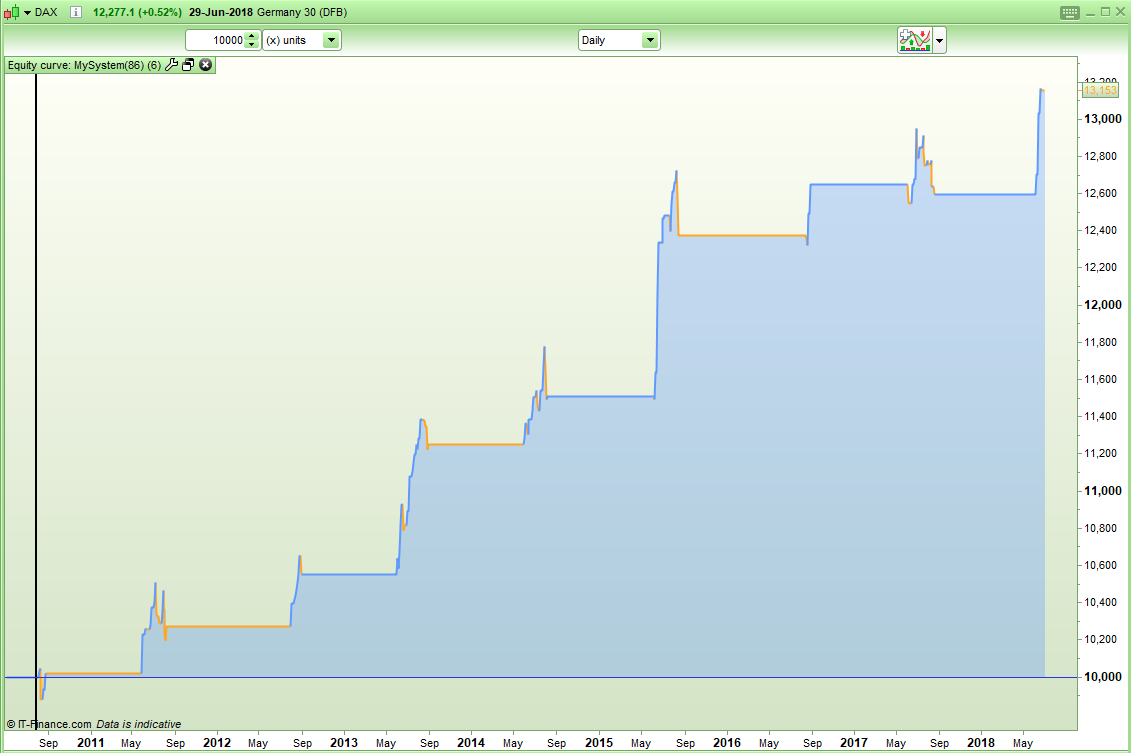

I guess that all depends on the strategy you are trading. Here is one of mine on the DAX and trading only June, July and August. It was actually coded for a different market but I thought I would try it on the DAX today. Seems to be all right in those months.

06/30/2018 at 3:14 PM #74939@chrisnye – Don’t lose heart, but do take a long hard look at what you expect from automated trading and how you go about it. It is possible to be profitable, but forward testing on Demo is essential. I lost enough money manual trading for it to hurt both my bank account and my pride. I realised it was my psychology getting in the way so now I’ve switched to 100% auto trading on PRT and started to think very differently about trading and what I expect. Since doing so about a month ago my account has grown by about 5%, so nothing special, BUT a profit and with only 3 strategies live. I did this by testing out about 10 or so different strategies, from the simplest MA cross over to more complex ones with multiple indicators. All went through some optimisation and then went into the demo account to trade live for some time. Nothing went live until it could demonstrate at least 20 live trades that showed a win/loss ratio about the same as backtest and produced a reasonable level of profitability. It takes a lot of time coding strategies and testing, but I see it as time well spent if I can find good quality strategies that work in the live markets. I’m treating this as a business, putting in the time, keeping records and progressing only when its objectively right to do so. Its nowhere near making me an income right now, but it will. I absolutely agree with those who say ‘take a break from live trading’, so you can get some confidence and some perspective. Stick with it.

06/30/2018 at 3:50 PM #74944This thread has brought up an interesting point about backtesting. The prevailing wisdom is very much test and optimise over long periods or a strategy cannot be seen as robust. But if market structure changes to the point where it makes sense to withdraw from the market because the strategy cannot cope, is this the best tactic?

Testing my strategies its become obvious there has been a big change in the indices, and to a lesser extent Forex, since the end of 2017. If I optimise a variable on a 1H TF from mid 2016 to now two outcomes are more likely than others: either the period from mid 2016 to end 2017 is somewhere close to break even and all the strategy profit is in 2018, or the profit occurs mainly in 2016/17 and 2018 shows break even or a loss. To my simplistic view this leads me to conclude that optimising for how the market is now is better than having a strategy that’s a compromise in all market conditions. So all my strategies have been tested and optimised for 2018 only (all are on 1H TF or smaller so I don’t see it as a major issue given they all generate at least 60-100 trades this year).

This does mean a strategy is not something to set up once and forget. It will need monitoring and re-optimising as the market evolves. To me that’s a price worth paying for a strategy that makes a good profit now.

Note – I don’t believe this would be the case if I were trying to put together strategies on the 4H TF or bigger. These longer TF strategies would need to work over months and years, whereas my short term strategies can rely on weeks and months of trading to get a good set of data.

What does everyone think? Does it make sense to work with the prevailing market structure on the smaller time frames?

06/30/2018 at 4:03 PM #74946These longer TF strategies would need to work over months and years

No they don’t. Just because you are using a daily chart does not mean you have to be in the market for months. You can be in for seconds if your stop and limit orders and the market decides that that is what is going to happen.

The danger of your idea of testing on only recent data is that you have no idea how your strategy will behave when the market changes and you can only tell that the market has changed once some time has passed by and you have some data to show you that it has changed. By then your strategy has drained your account.

Markets really only do three things – they go up, they go down or they go sideways and today’s candle could be the last one in any of those market structures and you will never know that until it is too late.

Trending/momentum strategies only work in two of the market types whereas mean reversal can be made to work in all three – in fact it absolutely loves a sideways market. Just my humble opinion.

06/30/2018 at 4:11 PM #74948Nick TheTall Guy – I do agree with you that more recent data has much more relevance than data from the extreme past. My own tests have repeatedly confirmed that data prior to the invention of the computer is not very relevant to today’s data. I like my strategies to work from 2000 to the present day. If they happen to work before that then that is nice but if they don’t then it is not a reason to bin a strategy. I also like them to work well or stay off market through any major downturns. If you just test on last years data then your strategy may not be prepared for one of these when it next comes along.

06/30/2018 at 6:46 PM #74955Hi Vonasi and all,

When I say ‘normality’ on the DAX for me that means the trends continuing as they have for the last say 5 years – that’s enough data for me. I cannot see the point in going back to the 90’s…of course all indexes go up, down and sideways – that’s a given. The DAX has been very volatile when compared to the past, just since Feb of this year. I do believe this is likely a ‘blip’ but how long that blip will last is the big question. I am still catching the trends but gains are eroded by the volatility being there, causing my stop to get hit constantly, even though it is ‘far away’. I personally do not pick months of the year to trade or for that matter ‘long’ only positions. I am not saying it cant work, but its too ‘picky’ for me and not traditional trend following as it were. For example what happens if you go long only and the market tanks, like Feb 6-7th 2018 (where the DAX fell by nearly 1000 pts in under 24 hours) ? Again you are not on that massive move !

As for the comments above about trading how the market is ‘now’ – I mean when is it a ‘now’ ? Tell me ….When you react to the ‘now’ / recent only events you must by definition of missed the change, then what happens if you change then the market reverts back to how it was !? For me you must look at historical data to put the probabilities on your side otherwise you are curve fitting and will ‘system hop’ ..

take care all.

06/30/2018 at 7:03 PM #74956I do believe this is likely a ‘blip’ but how long that blip will last is the big question.

For example what happens if you go long only and the market tanks

Answer to the first question: Until someone shoots Donald Trump – or until the effects of untangling from QE have played out – or until Brexit has been binned as the bad idea that it is. Not sure which will come first. I’m hoping for the former and the latter.

Answer to the second question: Your ‘we are in a recession filter’ stops your long only strategy trading and starts your short only strategy trading.

Hint: Recessions are not difficult to spot – they normally mention them in the news! 🙂

07/01/2018 at 12:53 AM #74967Firstly i know i am not deluded , now thats out the way 😉 . Reading the talk about changing market condition making some systems redundant has me thinking most systems here are NOT adapative . IN my opinion the biggest change in markets that throws static systems out of synch with market conditions is Volatility . Having set stops/profit targets etc etc , whether they be points or percent will always lose efficacy in radical changes in volatility . If you want a system that stands the test of time you need volatility adjusted inputs and outputs . Adapatable dynamic systems . The key point i make here is that markets are dynamic and so should be your systems . Just putting it out there . Sure there are more things that change that affect system performance than volatility and we should also address these but Volatility is the major culprit . If you cant see the problem you will rarely find the solution

07/01/2018 at 1:02 AM #74968I know I am anewbie and compared to most here a little fish in a big tank. But istillcannot comprehend having a system back tested for 10+ years. Markets change as to conditions and volatility. You just need to look at the atr over 10yrs and thing moves more than mick Jagger. My way of developing a system over a few years may not stand the test of time BUT maybe I need to review every 6 months. The downside is it may clear my account balance out so to stop this from happening maybe after my account balance drops x % or I have x losses in a row I pull the plug on it. I remember reading Richard donchian would reduce his % loss per trade every time his account balance dropped by an amount. I have this thing in my head that backtesting for several years is not the right thing for me. Having said this if you have hundreds of trades per year in a smaller time frame that is enough of a data sample for me than trading daily tf and only have 20 trades per annum. Like I said I am a newbie so am ready to be shot down now 🙁

07/01/2018 at 1:12 AM #7497007/01/2018 at 8:13 AM #74976If you want a system that stands the test of time you need volatility adjusted inputs and outputs

This is a tricky one to achieve. Like all indicators your measure of volatility is a lagging one. One massive candle yesterday does not mean that we should suddenly have wide stops and limits today or different position size today as today’s candle can just as easily be the first candle in a run of low volatility after a one off candle of high volatility. If you extend your measure of volatility further back then you end up taking an average over a period and so you then have an indicator on an indicator and even more lag.

I have not found a good way to use volatility yet to adjust inputs and outputs. I have one strategy running on one index in demo for a few months now that is profitable and working as the back test did. It adjusts position size according to ATRP. I am loath to put it live as it is very market specific and fails badly on every other market.

07/01/2018 at 8:47 AM #74981Hi All

Very interesting comments, I think you certainly have to back test to 3 – 4 years, 6 months is no where near enough. But saying that I have an automated system in operation now for nearly 3 months which certainly is not performing as per my back tests. Typical really and that’s what makes trading so difficult : We do not know what tomorrow holds.

I was very interested in Vonasi’s comments about trend following major indices (which I do – the DAX to be precise) and the change in market structure. He was saying that his EStop got hit and he decided to wait on the sidelines. I also have noticed this, when I back tested my ES was hit just over once a month this was over a nearly 2 year period. And what happened when I started live trading ? It is getting hit 4 times a month, sometimes 5 ! The market is in a very bad sideways and volatile state at present (the DAX index) …trend following right now is very difficult. But you cannot ‘come out’ of your system and wait on the sidelines, because if you do when that big trend comes along that pays off all your losses, guess what ? you are NOT on it ! Now you have a problem. Psychologically its huge.

My opinion is that the market is like this because of geo-politics but that cannot affect my system which must be left to ‘run’. I think the market will revert again to its ‘normality’ as regards trends but for now it s what it is. Difficult game, trading.

If you trade long only

try to avoid the summer

this is dax daily long only (june,july,august)

Just to be clear

this is buy and hold (buy at open first day in june and hold for three months every year, thats 25% of time)

a version of this https://www.theguardian.com/business/2018/apr/29/sell-in-may-go-away-global-tensions-city-summer-break

07/01/2018 at 9:20 AM #74983This is a tricky one to achieve. Like all indicators your measure of volatility is a lagging one.

Stick at it , you will get there .

-

AuthorPosts

Find exclusive trading pro-tools on