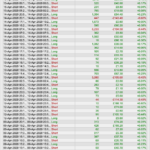

The screenshot was from Demo Live £1 lot size, however since this morning I am now running it “Real Live” with £0.2 lot size. So far 2 winning trades which matches my demo live test.

I am also testing since this morning a daily optmisation but letting each strategy run for 1 week. So splitting the strategy into 5, mon-fri, and running daily optmisation the evening before the day it goes live. So Renko-Tuesday.itf will be optimised on Monday evening and reoptimised 7 days later. Tuesday evening I’ll optimise Renko-Wednesday.itf and so on. I’ll let you know how that goes..

Daily optimsation has shown better results with different box sizes but the fixed settings has proven to work better for me (so far)

I use box size 50 and renko type 1, run in 5 seconds (not 10s as mentioned above)

No changes to the original code (I think) but posting my verison here for reference.

@GraHal

Yesterday wasn’t too bad 😉 but there was a big loss there too.

Applied machine learning on 2.3pR version, and results are AWESOME.

I will try today to apply it on every version and on every timeframe in order to find the best one 🙂

I’ll let you know how that goes..

Yes please … that will be well interesting an useful.

I got the S10 TF version going good now … backtest attached.

PS

Even better (2nd image) with the settings shown for Renko Type = 2 and Box size = 95.

First good version, 10sec.

Position size: 0.2

It only works between 8.00 to 21.00 in order to use just the lowest spreads available for DOW.

As you can see from the equity curve, the first day the system took a lot of trades in order to better optimize the machine learning algorithm values following my istructions; then, the system started to work normally with costant gains and trades.

So in a live trading optic, should be better to run it before 8am and not during the day, that could bring to losses.

I confirm that ML could be the best thing to fit into these short TF systems.

In addiction, still thinking in a live trading optic, I’d run a new system every Sunday evening: “sacrifice” the Monday in order to let the system better optimize itself, and taking gains the rest of the week; closing it Friday evening and starting a new one on Sunday again.

Paul

PaulParticipant

Master

maybe simulated trading between certain times or the first day to let the heuristic engine determine the values and then go live.

First good version, 10sec.

Will you be sharing your first good version?

Is there no way to avoid the ‘first day sacrifice’!? Poor System! 🙂

Why not optimise the settings before you set it going?

Above is what I did when I got a few ML Systems working. We could even do a walk forward and use the settings for starting value etc from the latest IS period … least then the System kicks off with a fighting chance? Or even just use settings from a normal 10k bars optimisation?

Is above what you do or do you guess / finger in the air for starting value etc?

Just asking / just saying! 🙂

Paul

PaulParticipant

Master

probably you had so many trades the first day, because the start values are way off the ideal ones.

What about taking the last values of your backtest, and put them in as starting values, or only slightly less.

I just talked about some random ideas in order to stimulate brainstorming, sacrificing some systems 🙂

Heres the valuex (renko type) and valuey (boxsize) that i’ve used on the 2.3pr 10sec.

P.S.: Reset periods are just randoms

// Heuristics Algorithm Start

If onmarket[1] = 1 and onmarket = 0 Then

optimize = optimize + 1

EnDif

StartingValue = 1

ResetPeriod = 0.5 //Specify no of months after which to reset optimization

Increment = 1

MaxIncrement = 1 //Limit of no of increments either up or down

Reps = 6 //Number of trades to use for analysis

MaxValue = 3 //Maximum allowed value

MinValue = increment //Minimum allowed value

once monthinit = month

once yearinit = year

If (year = yearinit and month = (monthinit + ResetPeriod)) or (year = (yearinit + 1) and ((12 - monthinit) + month = ResetPeriod)) Then

ValueX = StartingValue

WinCountB = 0

StratAvgB = 0

BestA = 0

BestB = 0

monthinit = month

yearinit = year

EndIf

once ValueX = StartingValue

once PIncPos = 1 //Positive Increment Position

once NIncPos = 1 //Neative Increment Position

once Optimize = 0 ////Initialize Heuristicks Engine Counter (Must be Incremented at Position Start or Exit)

once Mode = 1 //Switches between negative and positive increments

//once WinCountB = 3 //Initialize Best Win Count

//GRAPH WinCountB coloured (0,0,0) AS "WinCountB"

//once StratAvgB = 4353 //Initialize Best Avg Strategy Profit

//GRAPH StratAvgB coloured (0,0,0) AS "StratAvgB"

If Optimize = Reps Then

WinCountA = 0 //Initialize current Win Count

StratAvgA = 0 //Initialize current Avg Strategy Profit

For i = 1 to Reps Do

If positionperf(i) > 0 Then

WinCountA = WinCountA + 1 //Increment Current WinCount

EndIf

StratAvgA = StratAvgA + (((PositionPerf(i)*countofposition[i]*100000)*-1)*-1)

Next

StratAvgA = StratAvgA/Reps //Calculate Current Avg Strategy Profit

//Graph (PositionPerf(1)*countofposition[1]*100000)*-1 as "PosPerf1"

//Graph (PositionPerf(2)*countofposition[2]*100000)*-1 as "PosPerf2"

//Graph StratAvgA*-1 as "StratAvgA"

//once BestA = 300

//GRAPH BestA coloured (0,0,0) AS "BestA"

If StratAvgA >= StratAvgB Then

StratAvgB = StratAvgA //Update Best Strategy Profit

BestA = ValueX

EndIf

//once BestB = 300

//GRAPH BestB coloured (0,0,0) AS "BestB"

If WinCountA >= WinCountB Then

WinCountB = WinCountA //Update Best Win Count

BestB = ValueX

EndIf

If WinCountA > WinCountB and StratAvgA > StratAvgB Then

Mode = 0

ElsIf WinCountA < WinCountB and StratAvgA < StratAvgB and Mode = 1 Then

ValueX = ValueX - (Increment*NIncPos)

NIncPos = NIncPos + 1

Mode = 2

ElsIf WinCountA >= WinCountB or StratAvgA >= StratAvgB and Mode = 1 Then

ValueX = ValueX + (Increment*PIncPos)

PIncPos = PIncPos + 1

Mode = 1

ElsIf WinCountA < WinCountB and StratAvgA < StratAvgB and Mode = 2 Then

ValueX = ValueX + (Increment*PIncPos)

PIncPos = PIncPos + 1

Mode = 1

ElsIf WinCountA >= WinCountB or StratAvgA >= StratAvgB and Mode = 2 Then

ValueX = ValueX - (Increment*NIncPos)

NIncPos = NIncPos + 1

Mode = 2

EndIf

If NIncPos > MaxIncrement or PIncPos > MaxIncrement Then

If BestA = BestB Then

ValueX = BestA

Else

If reps >= 10 Then

WeightedScore = 10

Else

WeightedScore = round((reps/100)*100)

EndIf

ValueX = round(((BestA*(20-WeightedScore)) + (BestB*WeightedScore))/20) //Lower Reps = Less weight assigned to Win%

EndIf

NIncPos = 1

PIncPos = 1

ElsIf ValueX > MaxValue Then

ValueX = MaxValue

ElsIf ValueX < MinValue Then

ValueX = MinValue

EndIF

Optimize = 0

EndIf

// Heuristics Algorithm End

// Heuristics Algorithm 2 Start

If onmarket[1] = 1 and onmarket = 0 Then

optimize2 = optimize2 + 1

Endif

StartingValue2 = 20

ResetPeriod2 = 12 //Specify no of months after which to reset optimization

Increment2 = 5

MaxIncrement2 = 5 //Limit of no of increments either up or down

Reps2 = 1 //Number of trades to use for analysis

MaxValue2 = 100 //Maximum allowed value

MinValue2 = increment //Minimum allowed value

once monthinit2 = month

once yearinit2 = year

If (year = yearinit2 and month = (monthinit2 + ResetPeriod2)) or (year = (yearinit2 + 1) and ((12 - monthinit2) + month = ResetPeriod2)) Then

ValueY = StartingValue2

WinCountB2 = 0

StratAvgB2 = 0

BestA2 = 0

BestB2 = 0

monthinit2 = month

yearinit2 = year

EndIf

once ValueY = StartingValue2

once PIncPos2 = 1 //Positive Increment Position

once NIncPos2 = 1 //Neative Increment Position

once Optimize2 = 0 ////Initialize Heuristicks Engine Counter (Must be Incremented at Position Start or Exit)

once Mode2 = 1 //Switches between negative and positive increments

//once WinCountB2 = 3 //Initialize Best Win Count

//GRAPH WinCountB2 coloured (0,0,0) AS "WinCountB2"

//once StratAvgB2 = 4353 //Initialize Best Avg Strategy Profit

//GRAPH StratAvgB2 coloured (0,0,0) AS "StratAvgB2"

If Optimize2 = Reps2 Then

WinCountA2 = 0 //Initialize current Win Count

StratAvgA2 = 0 //Initialize current Avg Strategy Profit

For i2 = 1 to Reps2 Do

If positionperf(i) > 0 Then

WinCountA2 = WinCountA2 + 1 //Increment Current WinCount

EndIf

StratAvgA2 = StratAvgA2 + (((PositionPerf(i)*countofposition[i]*100000)*-1)*-1)

Next

StratAvgA2 = StratAvgA2/Reps2 //Calculate Current Avg Strategy Profit

//Graph (PositionPerf(1)*countofposition[1]*100000)*-1 as "PosPerf1-2"

//Graph (PositionPerf(2)*countofposition[2]*100000)*-1 as "PosPerf2-2"

//Graph StratAvgA2*-1 as "StratAvgA2"

//once BestA2 = 300

//GRAPH BestA2 coloured (0,0,0) AS "BestA2"

If StratAvgA2 >= StratAvgB2 Then

StratAvgB2 = StratAvgA2 //Update Best Strategy Profit

BestA2 = ValueY

EndIf

//once BestB2 = 300

//GRAPH BestB2 coloured (0,0,0) AS "BestB2"

If WinCountA2 >= WinCountB2 Then

WinCountB2 = WinCountA2 //Update Best Win Count

BestB2 = ValueY

EndIf

If WinCountA2 > WinCountB2 and StratAvgA2 > StratAvgB2 Then

Mode = 0

ElsIf WinCountA2 < WinCountB2 and StratAvgA2 < StratAvgB2 and Mode2 = 1 Then

ValueY = ValueY - (Increment2*NIncPos2)

NIncPos2 = NIncPos2 + 1

Mode2 = 2

ElsIf WinCountA2 >= WinCountB2 or StratAvgA2 >= StratAvgB2 and Mode2 = 1 Then

ValueY = ValueY + (Increment2*PIncPos2)

PIncPos2 = PIncPos2 + 1

Mode = 1

ElsIf WinCountA2 < WinCountB2 and StratAvgA2 < StratAvgB2 and Mode2 = 2 Then

ValueY = ValueY + (Increment2*PIncPos2)

PIncPos2 = PIncPos2 + 1

Mode2 = 1

ElsIf WinCountA2 >= WinCountB2 or StratAvgA2 >= StratAvgB2 and Mode2 = 2 Then

ValueY = ValueY - (Increment2*NIncPos2)

NIncPos2 = NIncPos2 + 1

Mode2 = 2

EndIf

If NIncPos2 > MaxIncrement2 or PIncPos2 > MaxIncrement2 Then

If BestA2 = BestB2 Then

ValueY = BestA

Else

If reps2 >= 10 Then

WeightedScore2 = 10

Else

WeightedScore2 = round((reps2/100)*100)

EndIf

ValueY = round(((BestA2*(20-WeightedScore2)) + (BestB2*WeightedScore2))/20) //Lower Reps = Less weight assigned to Win%

EndIf

NIncPos2 = 1

PIncPos2 = 1

ElsIf ValueY > MaxValue2 Then

ValueY = MaxValue2

ElsIf ValueY < MinValue2 Then

ValueY = MinValue2

EndIF

Optimize2 = 0

EndIf

// Heuristics Algorithm 2 End

Sorry for my newbie-question but how do i implement Francescos mashinelearning Valuex and ValueY in to the 2.3 version of the system?

So exciting following these threads with your genius codes, hope to someday be able to contribute with something as well. Wish you all a nice weekend!

I’m everything but not a genius coder 🙂

I’m still a newbie but reading everyday the forum since months and doing hundreds of tests on the platform i’m starting learing something. It becomes fun and fascinating especially when you are surrounded by the people of this section that works everyday for new challenges with strong motivations.

Btw, if you want the answer to your question and start learning something, you can study this topic https://www.prorealcode.com/topic/machine-learning-in-proorder/ and you will easily understand in few pages how to implement the ML in the code.

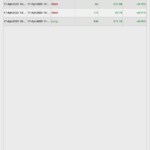

Today “Real Live” results. Positionsize 0.2.

Paul

PaulParticipant

Master

nice! how many % or points did you set the stoploss?

Maxloss was set to 1 – does this part of the code act as a stop loss? I didn’t add a ‘set stop loss x’ code and wasn’t sure so I was watching the screen when the trades were on 🙂

It seems to be the entry is not perfect, but it’s probably very difficult to achieve that on this timeframe. However, it has a high win rate so it often ends up in profit as can be seen in my previous demo forward-test.

A tight stop loss will definatly see less wins. I don’t know how we can resolve this without adding too many parameters to the strategy. I was looking into oscillators on different timeframes, and voss predictive filter, but haven’t yet found anything that works well.

Any ideas?