Weekly Seasonality Analysis

Forums › ProRealTime English forum › General trading discussions › Weekly Seasonality Analysis

- This topic has 23 replies, 3 voices, and was last updated 5 years ago by

Vonasi.

-

-

11/15/2018 at 10:50 PM #84958

I have been testing weekly seasonality to try to prove if it gives an edge or not. So far with various tests with various settings this has currently made me less confident that seasonality is a very important part of our filtering – but I continue to test and I would be happy to be proven wrong.

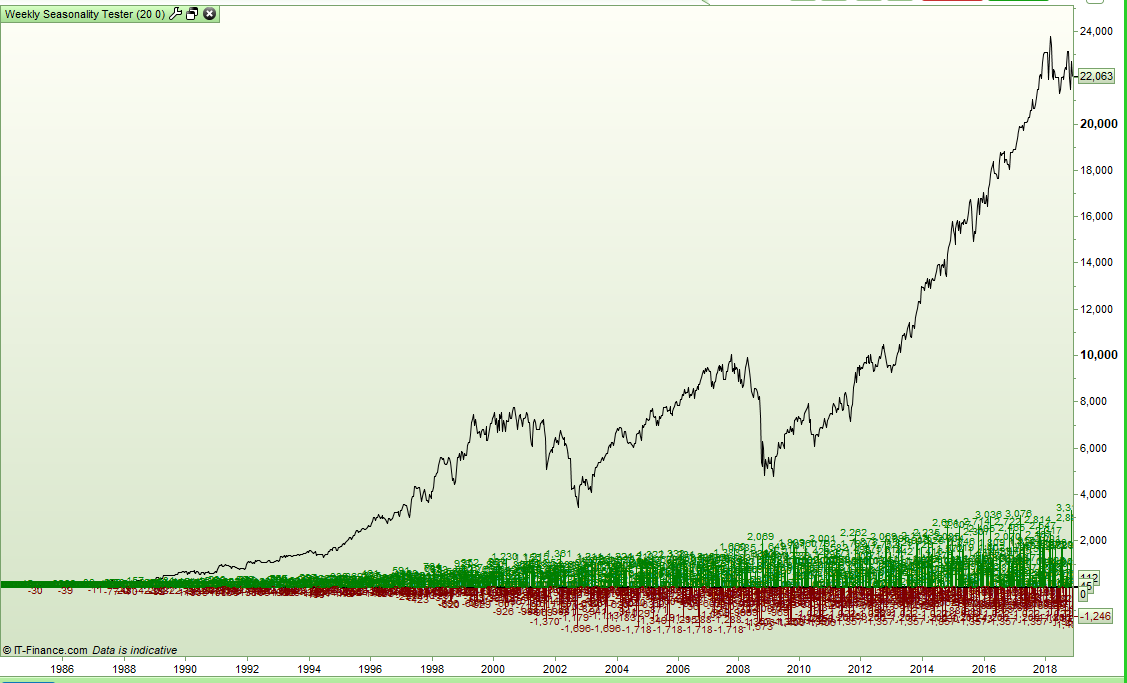

I decided to take my weekly seasonality indicator and convert it into a test bed to see what happened if you bought in any week where the rolling look back period showed that it had historically been a good week to buy and then sold at the end of the week. Here are the results on the DJI with 20 year look back period and buying on any week that has historically been profitable 50% or more of the time:

As I expected this simple strategy struggled during market recessions especially with long look back periods as it is a slow to respond lagging indicator. So I decided to add the simple filter that you did not buy if the close was less than the low of the same week one year ago.

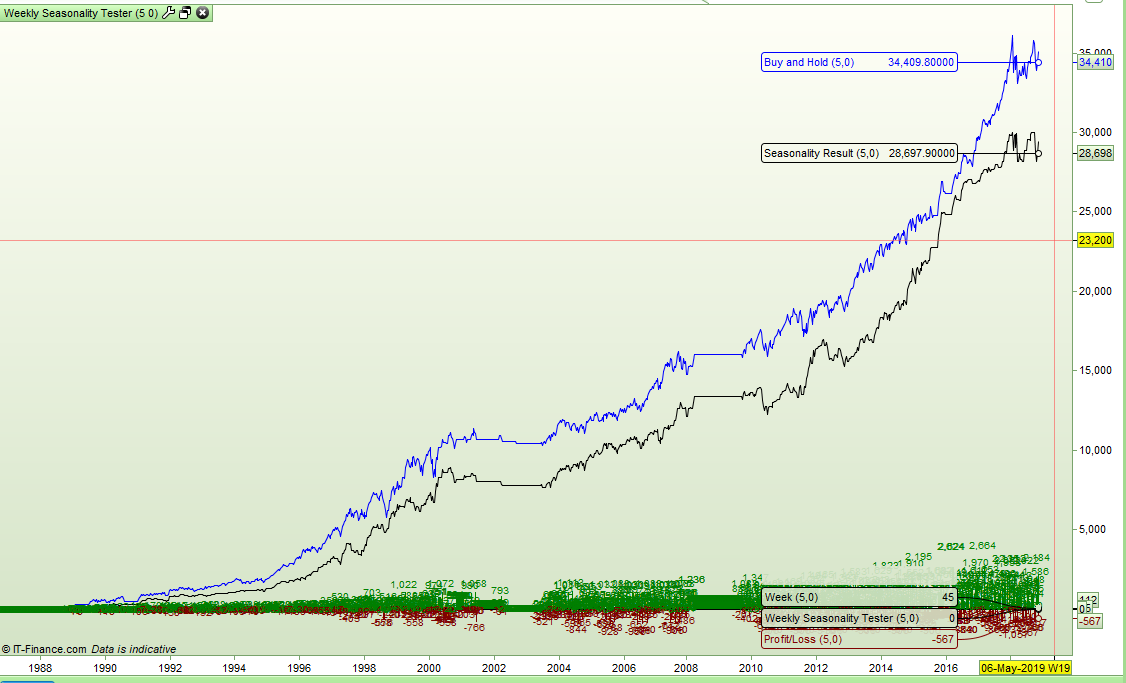

That is quite a nice equity curve but then it is not difficult to get a nice equity curve from the DJI. What I found interesting was the most recent results:

Basically since Trump and Brexit the market has lost direction and is going sideways in a volatile manner. It seems similar activity has happened before looking at the equity curve but it confirms that this is probably a tough time to forward test strategies if even a simple buy in historically good weeks and sell a week later – but stay out of the market if it is lower than a year ago strategy is going sideways right now on the DJI weekly.

1 user thanked author for this post.

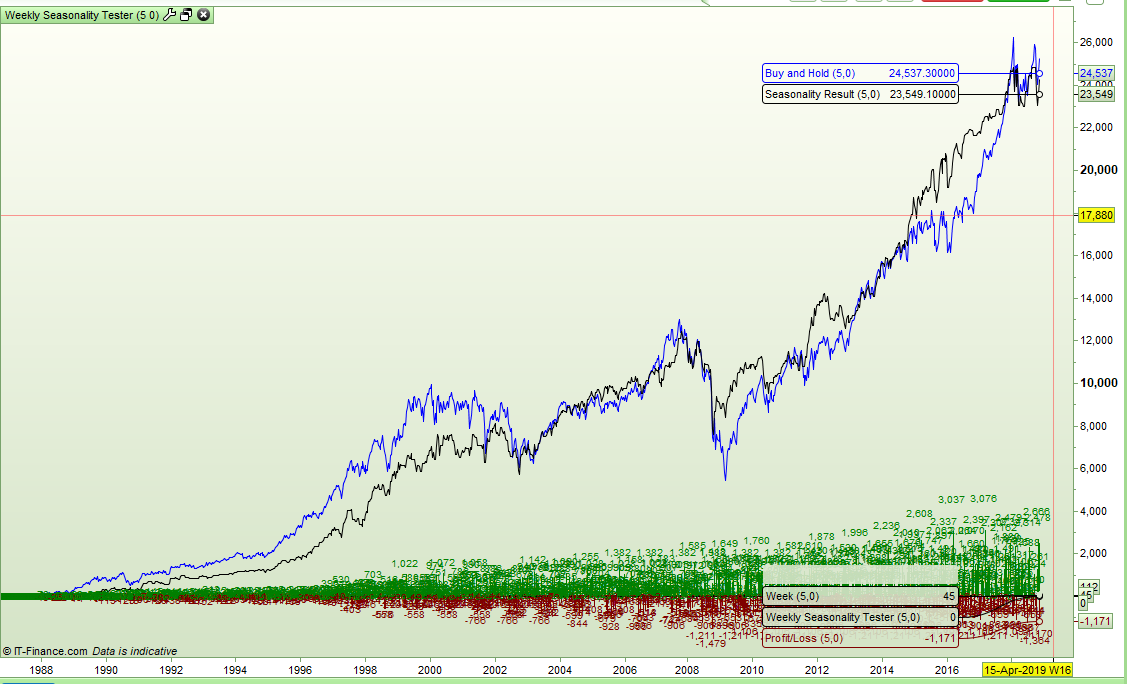

11/15/2018 at 11:28 PM #84968Here is the same tests without the close above 1 year low filter and then with the close above 1 year low filter for a rolling look back period of just 5 years. It seems the 20 year look back has only a little advantage over the 5 year look back period.

I am still undecided about the importance of seasonality but I will test a bit further. I have done some limited testing of a combined filter of 5, 10, 15 and 20 rolling year look backs as a filter but fear that it may limit trades quantities massively for maybe little benefit.

11/16/2018 at 6:55 AM #84981Great information we recieve from you. Thanks a lot for sharing all this information.

I am have the opinion that the world of trading is so different nowdays that I do not know if it ia trustwortly to look back in data ao many years ago.

I read your post becase maybe I am wrong. Now you have the tool to prove it.

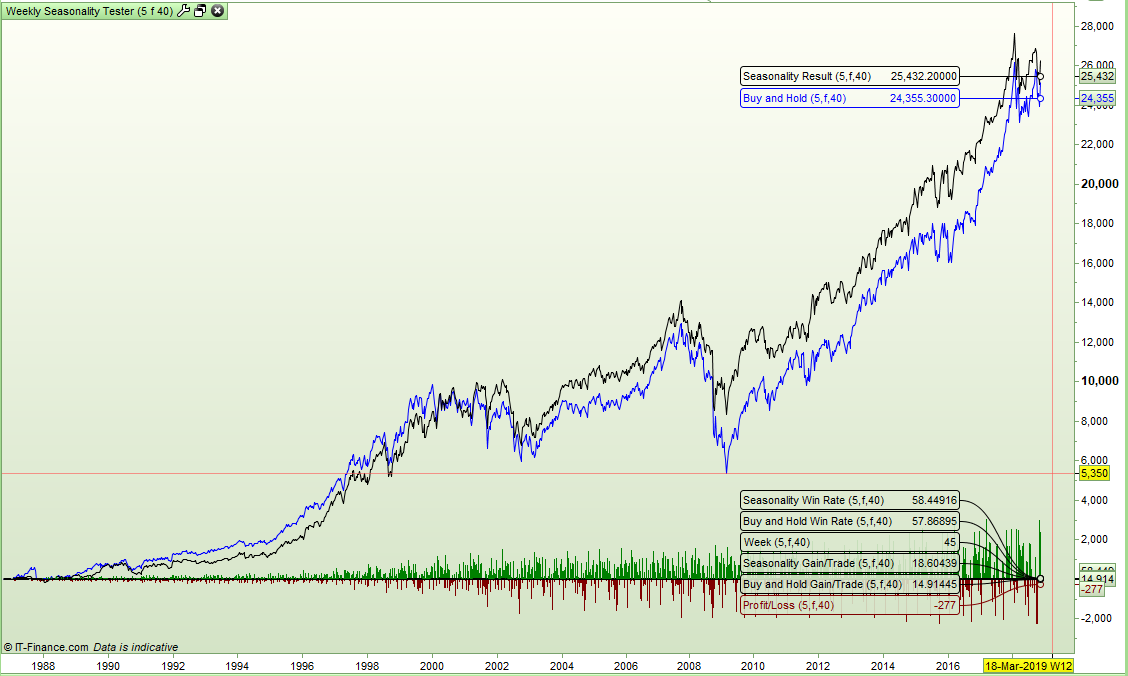

11/16/2018 at 10:21 AM #84991I thought we needed a buy and hold equity curve to compare against so I added this. Here is the results for a 5 year rolling look back on the DJI. First without the close > low[51] filter and then with the filter. Blue line is buy and hold:

It seems in the first image that trading only in seasonally good weeks has smoothed the equity curve a little and resulted in pretty much the same profit for less trades. Also of interest is that in the 2008 recession the seasonality filter meant that the draw down was far lower as I guess as more weeks went bad fewer and fewer trades were opened so the seasonality filter should be reducing trade quantities as we head to the bottom.

11/16/2018 at 10:29 AM #8499611/16/2018 at 10:42 AM #8500311/16/2018 at 11:16 AM #85011If seasonality as a filter is worth anything then as we increase our entry threshold we should see an improvement in the quality of trades. So I went back to the 20 year look back period and then set the Insignificance Range so that trades were only opened if any week had been an up week 60% or more of the time in the look back sample tested. Obviously this results in lower quantity of trades but they should be higher quality if seasonality is helping us. Here are the results:

What is interesting is the fact that the filter reduces draw down in the 2008 recession but then once the markets start recovering the filter is slow to respond. It clearly takes a while for the newly successful weeks to bring their score back up above our 60% threshold. This is one clear downside of seasonality filtering especially with longer look back periods.

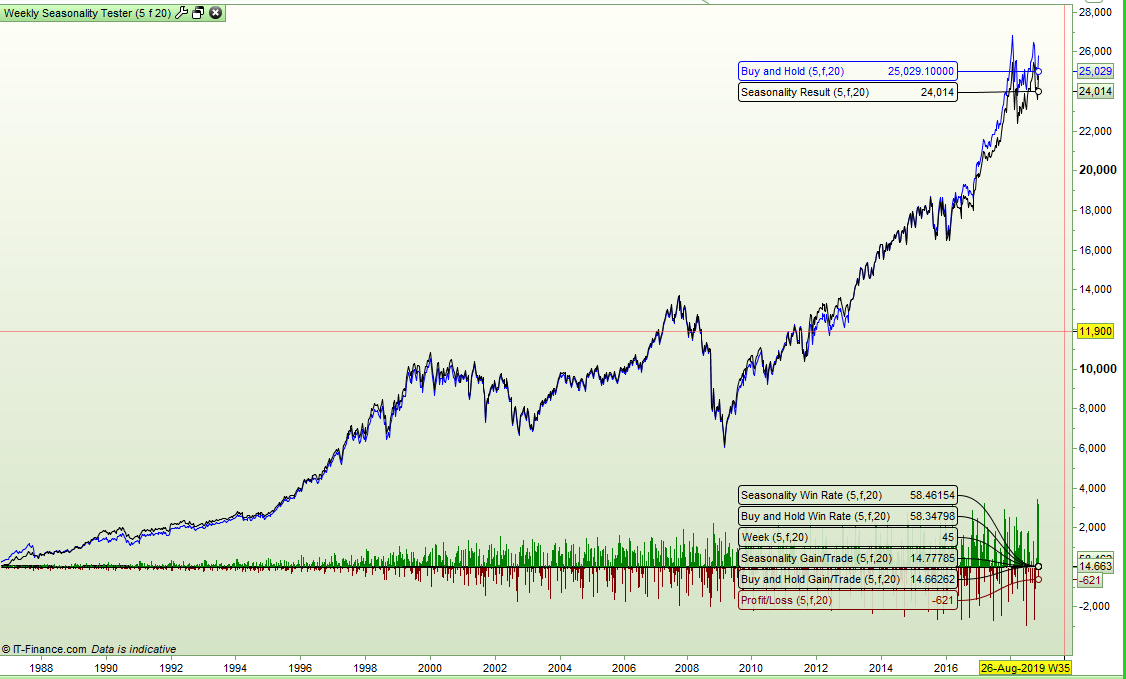

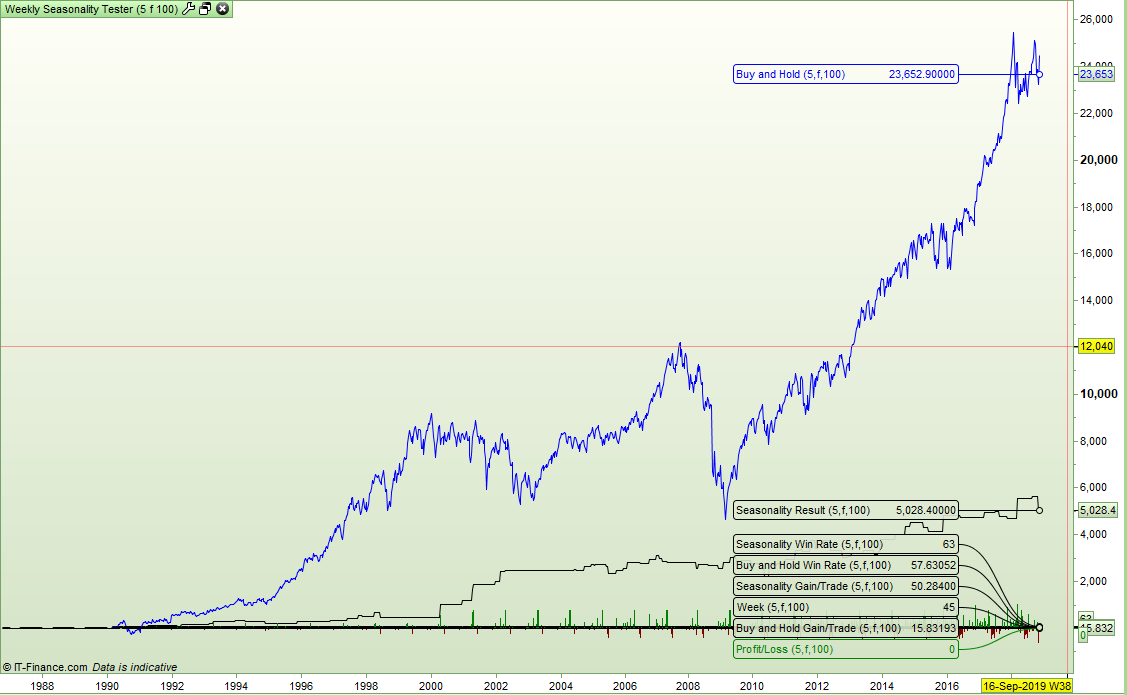

11/16/2018 at 11:22 AM #8501511/16/2018 at 2:00 PM #85030So if the conclusion is that a long period rolling look back seasonality filter is too slow to react I decided to test the 5 year look back period with entry thresholds of 20%, 40%, 60%, 80% and 100%. So either 1 year in the last 5 years has been profitable through to 5 in the last 5 years. I also added calculations to work out the win rate and gain per trade for both the buy and hold and the seasonality results.

Here are the charts (20% first and 100% last):

It is interesting that by just only buying in weeks where at least 2 (40%) of the last 5 years have been profitable the equity curve beats buy and hold for most of the time. Also if limiting trades to weeks where 4 or 5 of the last years have been profitable then the win rate increases. Also the gain per trade is improved with every application of the seasonality filter – the higher the entry threshold the higher the gain per trade is.

-

AuthorPosts

Find exclusive trading pro-tools on