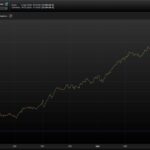

Here is a one for Dax 15m thats been live since February 2024 and has worked good for me.

//————————————————————————-

// Main code : DAX_15M_VECTORIAL_LIVE

//————————————————————————-

// M15

// SPREAD 3

// Optimize date – FEB 2024

DEFPARAM CumulateOrders = false

DEFPARAM Preloadbars = 50000

// Variabler för handelstid

ONCE zz = 36.0

ONCE dd = 64.0

ONCE bb = 41.0

ONCE xx = 8.0

CtimeA = time >= 080000 and time <= 220000

CtimeB = time >= 080000 and time <= 220000

ONCE BarLong = 350 // Avslutar lång position efter detta antal barer

ONCE BarShort = 350 // Avslutar kort position efter detta antal barer

// Positionstorlek

ONCE PositionSizeLong = 0.5 // Storlek på lång position

ONCE PositionSizeShort = 1 // Storlek på kort position

// Strategi – Vektorberäkning av vinkel

ONCE PeriodeA = xx // Period för exponentiellt glidande medelvärde (öka för mer stabilitet) (kortsiktig trend)

ONCE nbChandelierA = zz // Antal ljus för vinkelberäkning (öka för att jämna ut beräkningen)

MMA = Exponentialaverage[PeriodeA](close)

ADJASUROPPO = (MMA – MMA[nbChandelierA] * pipsize) / nbChandelierA

ANGLE = (ATAN(ADJASUROPPO)) // Beräkning av vinkel

CondBuy1 = ANGLE >= 20 // Köpvillkor baserat på vinkel

CondSell1 = ANGLE <= -45 // Säljvillkor baserat på vinkel

// Vektorberäkning av lutning och dess glidande medelvärde

ONCE PeriodeB = dd // Period för exponentiellt glidande medelvärde av lutning (öka för att fånga längre trender)

ONCE nbChandelierB = bb // Antal ljus för lutningsberäkning (öka för att jämna ut beräkningen)

lag = 6 // Fördröjning av signalen (öka för att fördröja signalen)

MMB = Exponentialaverage[PeriodeB](close)

pente = (MMB – MMB[nbChandelierB] * pipsize) / nbChandelierB

trigger = Exponentialaverage[PeriodeB + lag](pente)

CondBuy2 = (pente > trigger) AND (pente < 0) // Köpvillkor baserat på lutning

CondSell2 = (pente CROSSES UNDER trigger) AND (pente > -1) // Säljvillkor baserat på lutning

// Ingångar i position

CONDBUY = CondBuy1 and CondBuy2 and CTimeA // Villkor för köp

CONDSELL = CondSell1 and CondSell2 and CtimeB // Villkor för sälj

// Lång position

IF CONDBUY THEN

buy PositionSizeLong contract at market

SET TARGET %PROFIT 5.0 // Mål för vinst i procent

ENDIF

// Kort position

IF CONDSELL THEN

Sellshort PositionSizeShort contract at market

SET TARGET %PROFIT 1.5 // Mål för vinst i procent

ENDIF

// Variabler för trailing stop

ONCE trailingStopType = 1 // Trailing stop – 0 AV, 1 PÅ

ONCE trailingstoplong = 10 // Trailing stop för lång position (öka för att skydda vinst)

ONCE trailingstopshort = 7 // Trailing stop för kort position (öka för att skydda vinst)

ONCE atrtrailingperiod = 30 // Period för ATR (justera för marknadsvolatilitet)

ONCE minstop = 0.8 // Minsta avstånd för trailing stop (öka för större avstånd)

// Trailing stop-logik

atrtrail = AverageTrueRange[atrtrailingperiod]((close / 10) * pipsize) / 1000

trailingstartl = round(atrtrail * trailingstoplong)

trailingstartS = round(atrtrail * trailingstopshort)

if trailingStopType = 1 THEN

TGL = trailingstartl

TGS = trailingstartS

if not onmarket then

MAXPRICE = 0

MINPRICE = close

PREZZOUSCITA = 0

ENDIF

if longonmarket then

MAXPRICE = MAX(MAXPRICE, close)

if MAXPRICE – tradeprice(1) >= TGL * pointsize then

if MAXPRICE – tradeprice(1) >= minstop then

PREZZOUSCITA = MAXPRICE – TGL * pointsize

ELSE

PREZZOUSCITA = MAXPRICE – minstop * pointsize

ENDIF

ENDIF

ENDIF

if shortonmarket then

MINPRICE = MIN(MINPRICE, close)

if tradeprice(1) – MINPRICE >= TGS * pointsize then

if tradeprice(1) – MINPRICE >= minstop then

PREZZOUSCITA = MINPRICE + TGS * pointsize

ELSE

PREZZOUSCITA = MINPRICE + minstop * pointsize

ENDIF

ENDIF

ENDIF

if onmarket and PREZZOUSCITA > 0 then

EXITSHORT AT PREZZOUSCITA STOP

SELL AT PREZZOUSCITA STOP

ENDIF

ENDIF

// Exit zombie trade

IF POSITIONPERF < 0 THEN

IF shortOnMarket AND BARINDEX – TRADEINDEX(1) >= barshort THEN

EXITSHORT AT MARKET

ENDIF

ENDIF

IF POSITIONPERF < 0 THEN

IF LongOnMarket AND BARINDEX – TRADEINDEX(1) >= barlong THEN

SELL AT MARKET

ENDIF

ENDIF