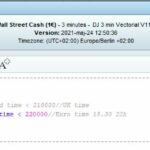

I never got DJ 3 min Vectorial V11.1 going:

Maybe there is something wrong withe timezone? Help pls

what do you mean that you can’t get it going? it doesn’t open any trades? or you get an error message?

time setting should be correct for Sverige.

what do you mean that you can’t get it going? it doesn’t open any trades? or you get an error message?

time setting should be correct for Sverige.

No trades since start 25/5

that’s only 1 week so the conditions probably haven’t occurred yet. do any trades show in backtest for that period?

yes backtrade says trades.

what does the relationship between these 2 pictures look?

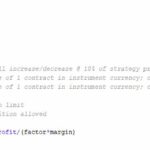

In the Max Positions box (2nd pic) you can put anything you want, it’s up to you.

The maxpositionsize in the Money Management refers to the IG tier2 margin limit, after which the margin requirement is much higher. But you’d be a millionaire by the time it got that high so you probably wouldn’t worry too much.

The settings you have there are actually all mixed up; tier1 / tier2 max for the DJ should be 55 / 550 (not that it matters).

The minimum positionsize for the DJ is supposedly 0.2 but recently (in Demo) I got error messages saying the minimum was 1 – not sure if that has changed or just a glitch.

There is an error in the V11.1.

Line 158

startBreakeven = tradeprice(1)*(breakevenpercent/100)

should be changed to

startBreakeven = close * (breakevenpercent/100)

The problem is that the last trade is used to calculate the value of startBreakeven. If there is no previous trade at the start of the program the value is 0.

close should be a good replacement for calculation of the stop parameters.

I’ve used that Breakeven code in lots of algos, never had a problem with it. It’s a variation on a code by Nicolas, this is the original:

https://www.prorealcode.com/blog/learning/breakeven-code-automated-trading-strategy/

Have you tested it with

startBreakeven = close * (breakevenpercent/100) ?

Seems to me that you could only reach startBreakeven if it happened in 1 candle – otherwise it will start a new measurement from each new close.

The original code uses a fixed value and does not calculate the value from any price.

After looking closer at the code I agree that the code is correct, the value is only used when tradeprice(1) is not 0 and the startBreakeven value is calculated for every candle.

I tested the code and it did work. startBreakeven is used as the minimum difference between close and tradeprice(1), in v11.1 0.26% is used. (88 points for dow 34000)

//test if the price have moved favourably of "startBreakeven" points already

IF LONGONMARKET AND close-tradeprice(1)>=startBreakeven THEN

//calculate the breakevenLevel

breakevenLevel = tradeprice(1)+PointsToKeep

ENDIF

In a different program a similar stop parameter calculation was inside an IF NOT ONMARKET, and the first trade was wrong. That is why I check all programs for that problem.

Hello everybody,

I would like to know if every body tried a vectorial strategy on NAS ?

@

LaurentBZH35

Do not double post. Ask your question only once and only in one forum. All double posts will be deleted anyway so posting the same question multiple times will just be wasting your own time and will not get you an answer any quicker. Double posting just creates confusion in the forums.

Thank you 🙂

You are already in a discussion about VECTORIAL strategy, there’s no need to open a new one to scatter info and making it more difficult to retrieve.

See pic to know how you can find attachments concerning NASDAQ.

It is better not to backtest the entire period, but to not include at least 3 to 4 of the last months in the backtest. Otherwise, it is impossible to determine whether the system works in real life.

All vector systems run very poorly in real life in the last few months.

@Vinzentvega

The markets, especially the DAX, have been in a sideways range since the end of May. Which is not ideal for trend following strategies. The trick is to lose as little as possible in such phases without a clear direction.

For consideration: Since I have just run a test where my base system is running in 10 different versions with different trend filters in demo … I have found that as long as there is a trend, the differences between the systems are not particularly great live when there is a sideways phase gives my basic system without a filter performs best. Some trend systems even go into a large drawdown. Even if the back test curve looks so nice. I already got this food for thought with my KISS-EMA-RSI system (see topic). The more you filter on trades, the more unstable it runs live. Because you also filter out a lot of good trades. Let’s take this DAX Vectorial … let’s say it has 2000 unfiltered trades in 200000bars … if we filter the best trades, we might get 500-1000 trades that are doing really well. But then we still have 1000 trades that are unpredictable. Partly good, partly bad. But due to this high uncertainty factor, we run the risk of having a great backtest but live … a drawdown. So let’s take about 1500 trades unfiltered, only with a flat angle and TP / SL in a ratio of 1: 1.5 … we have a stable system that should run live. I sat down and did some rough calculations last night. I get about 45% hit rate and about 1.3 … not great, but I think stable. Unfortunately, I don’t have time for the weekend, but I think I’ll be able to finish it here next week.

Unfortunately, my translator spun the last sentences. I think you know what I mean. Does anyone share my view? Mediocre trades that happen often should be the target, not the huge moves that seem unpredictable.