Paul

PaulParticipant

Master

@zilliq probably yes. Using long & short at the same time, each with in part optimised parameters and a big stoploss, have a greater chance of being more curvefitted? Long/short separate have its benefits. I’am testing both a.t.m.

@BobFlynn : i have best profit factor and less draw down with my ATR values. I found these values with the optimisation tools of PRT.

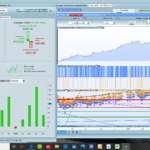

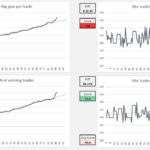

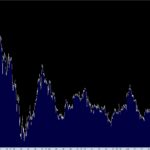

hi guys this is my optimization for version DJA 3 minutes only 1 contract long and short and small stop loss

The denominated vectorial “account destructor” for other persons, go Up again on backtest.

This is the best bot un this forum, think.

Dear Fran, if you are referring to me and nonetheless, if we called it “account burner” it’s because after nice performances, suddenly they dropped into deep red. This, joint with a poor robustness test results led us to use the forum as what is intended to be used: a place to discuss strategies and take action to make them better, not a race for those who find the most performing system or who is better than the others.

That said, I invite you not to use your tone of arrogance as you have done in the past, and respect both those who created the code and those who try to contribute to the community; also be grateful to the moderators who are very kind and still keep you here after numerous warnings.

I go back to the sea, have a good day.

Paul

PaulParticipant

Master

@Fran55

Yes it’s a very good bot. If you intend to sell or rent your modified code of the original vectorial dax using the marketplace, don’t forget to pay royalties to Balmora74 as he is the original creator!

Really i think buy robots.

@Andrea.1981, thanks for reviving the DJ 3m. Here’s another version using your vectorial values, I changed the hours and the stop, added @Paul’s ATR trail.

WF is good, final values are from the last 70/30 period so showing good OOS performance before and after. Unfortunately robustness is rather poor though, I’m posting it anyway in case someone cleverer than me can find other improvements. Seems it ‘might’ have potential…

Hi Guys,

You have always the same error.

Use this code

ONCE PeriodeB = 29

ONCE nbChandelierB= 40

MMB = Exponentialaverage[PeriodeB](close)

pente = (MMB-MMB[nbchandelierB]*pipsize) / nbchandelierB

pentecorrecte=((MMB-MMB[nbchandelierB])*pipsize) / nbchandelierB

return pente, pentecorrecte

And you will see that pente can NEVER be negative and so the CondBuy2 = (pente > trigger) AND (pente < 0) can’t be exist

Cheers

Hi @Zilliq, I assure you I have tried to incorporate your changes. In your message #130588 you suggested this:

ADJASUROPPO = ((MMA-MMA[nbchandelierA])/pipsize) / nbChandelierA

ANGLE = (ATAN(ADJASUROPPO))

trigger = exponentialaverage[PeriodeA+lag](ANGLE)

Then in #130842 you suggested changing pente to:

pente = ((MMB-MMB[nbchandelierB])/pipsize)/nbchandelierB

Now you seem to have changed your mind and want it to be

pentecorrecte=((MMB-MMB[nbchandelierB])*pipsize) / nbchandelierB

This gets a wee bit confusing. If I make all your suggested changes the result is zero trades. If I change just pente to either of your preferred lines, the result is no change at all —identical to the original.

Do please post a complete version of the code as you think it should be so we can test it, thanks for your input!

Sorry @ I write the post to fast, the first is the correct correction

pente = ((MMB–MMB[nbchandelierB])/pipsize)/nbchandelierB

not pentecorrecte=((MMB–MMB[nbchandelierB])*pipsize) / nbchandelierB

But in your itf file there is still the error

Cheers

Thanks for that Zilliq. Maybe for you it is ‘technically’ an error … but it makes no difference to the results in back test. Exactly the same, your way or the original.

I don’t understand because in the cond2buy “pente” need to ne negative but with this “error” it never can be…Strange..